At Sager CPA, we know that smart tax strategies for business owners can significantly boost profits. Many companies overlook opportunities to reduce their tax burden and increase their bottom line.

This blog post will reveal powerful tactics to maximize deductions, time your income and expenses strategically, and choose the right business structure. By implementing these strategies, you’ll be well-positioned to keep more of your hard-earned money and fuel your business growth.

At Sager CPA, we’ve observed numerous businesses miss out on valuable tax deductions and credits. Let’s explore effective strategies to maximize your tax savings and increase your bottom line.

Many business owners fail to claim all eligible expenses. Common overlooked deductions include home office expenses, vehicle mileage, and professional development costs. The IRS allows deductions for a wide range of business-related expenses, so it’s important to maintain meticulous records of all your spending.

For example, if you use your personal vehicle for business purposes, tracking your mileage can lead to significant deductions. The IRS standard mileage rate for 2023 is 65.5 cents per mile driven for business use. This can add up quickly, especially for businesses with frequent client visits or deliveries.

Every industry has unique tax incentives designed to promote growth and innovation. Restaurants can benefit from the FICA Tip Credit, which offers a tax credit for the Social Security and Medicare taxes paid on employees’ tip income. Manufacturing companies might qualify for the Domestic Production Activities Deduction, which can reduce taxable income by up to 9% of qualified production activities income.

It’s essential to stay informed about the tax credits specific to your industry. At Sager CPA, we prioritize keeping our clients updated on these opportunities, ensuring they don’t miss out on valuable tax savings.

Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This provision can significantly reduce your tax liability and free up cash flow for further investments in your business.

For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000. This limit is reduced by the amount by which the cost of section 179 property placed in service exceeds a certain threshold. You can potentially write off the entire cost of new equipment in the year it’s purchased, rather than depreciating it over several years. This serves as a powerful tool for businesses looking to upgrade their technology or machinery while minimizing their tax burden.

If your business engages in research and development activities, you might qualify for the Research Credit. This credit applies not only to scientific research but also to technological advancements in products, processes, software, and more.

The R&D Tax Credit provides a dollar-for-dollar reduction in your tax liability. Guidelines and audit technique guide are provided for field examiners on the examination of Research Credit cases.

These strategies can substantially reduce your tax liability and increase your business profits. However, tax laws are complex and ever-changing. Working with experienced professionals (like those at Sager CPA) helps you navigate these opportunities and ensures you maximize your tax savings while staying compliant with all regulations. Now, let’s move on to another critical aspect of tax strategy: the strategic timing of income and expenses.

At Sager CPA, we observe businesses that miss significant tax savings by not timing their income and expenses strategically. One effective strategy involves deferring income to the next tax year when beneficial. If you expect to fall into a lower tax bracket next year, you can push some income into that year to potentially pay less tax overall. This might involve delaying billing for services rendered in December until January or postponing the sale of appreciated assets.

The Tax Foundation reports that top marginal tax rates for businesses can vary significantly based on income levels. Careful management of income recognition can potentially save thousands in taxes.

In contrast, accelerating expenses into the current tax year can reduce your immediate tax liability. This strategy might include prepaying some expenses (such as rent or insurance premiums) or making planned purchases before year-end.

For instance, if you plan to upgrade your office equipment, doing so in December rather than January could allow you to claim the deduction a full year earlier. The Section 179 deduction allows business taxpayers to deduct the cost of certain property as an expense when the property is first placed in service.

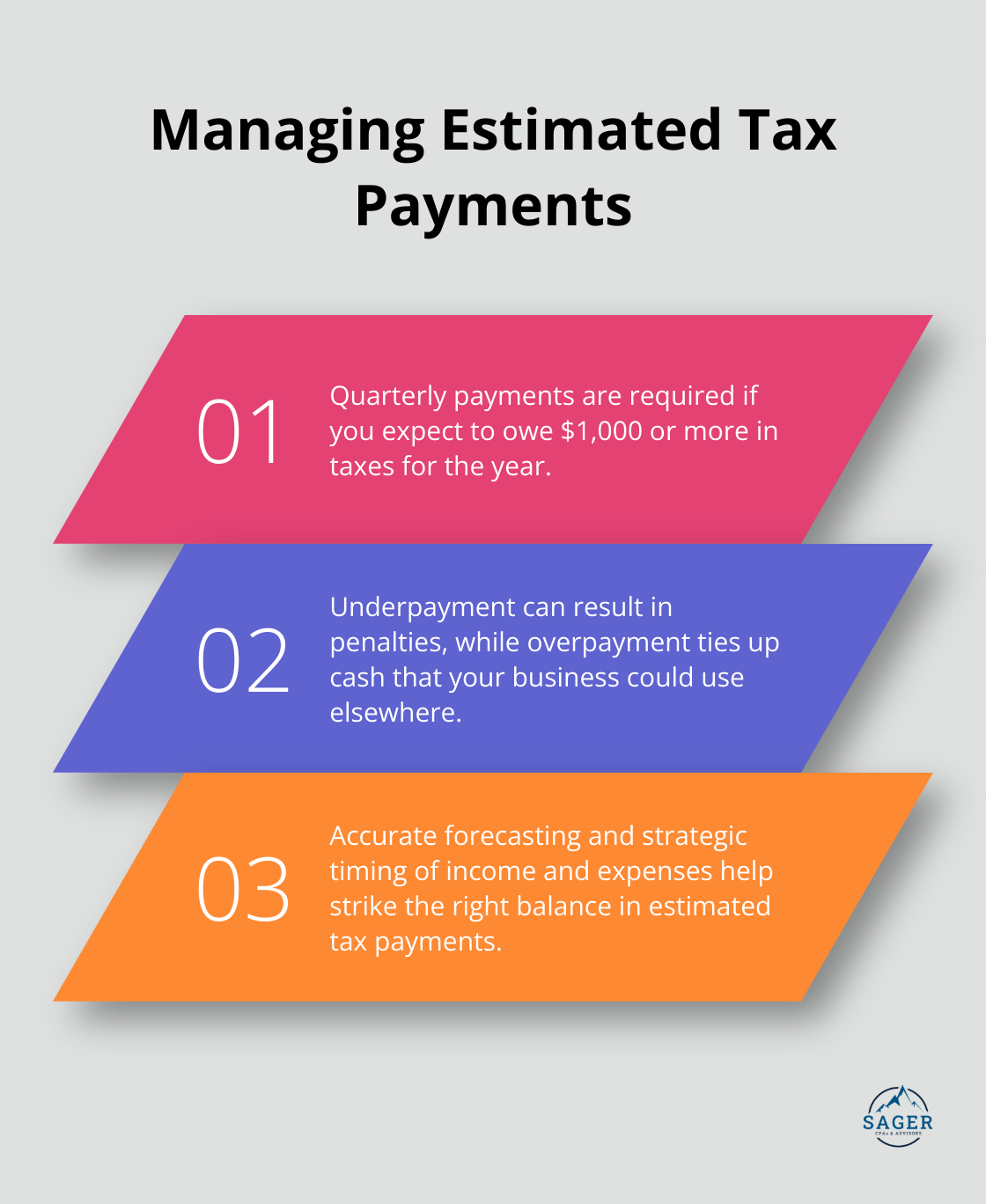

For many businesses, especially pass-through entities like S corporations and partnerships, estimated tax payments require careful consideration. The IRS mandates these payments quarterly if you expect to owe $1,000 or more in taxes for the year.

Underpayment of estimated taxes can result in penalties, while overpayment ties up cash that your business could use elsewhere. Accurate forecasting and strategic timing of income and expenses help strike the right balance.

Business income often fluctuates, which creates challenges in tax planning but also presents opportunities. In high-income years, you might focus more on accelerating deductions and deferring income. In leaner years, the opposite approach might prove more beneficial.

Some businesses use a cash reserve strategy. This approach involves creating cash flow forecasts to predict future income and expenses, and reviewing bank statements and financial reports monthly to spot trends.

Effective timing of income and expenses requires a deep understanding of tax law and your business’s financial situation. While these strategies can lead to significant savings, you must implement them carefully to ensure compliance with IRS regulations. The next chapter will explore how choosing the right business structure can further optimize your tax strategy and boost your profits.

At Sager CPA, we often see businesses struggle with tax implications due to their chosen entity type. Your business structure significantly influences your tax obligations, liability protection, and operational flexibility.

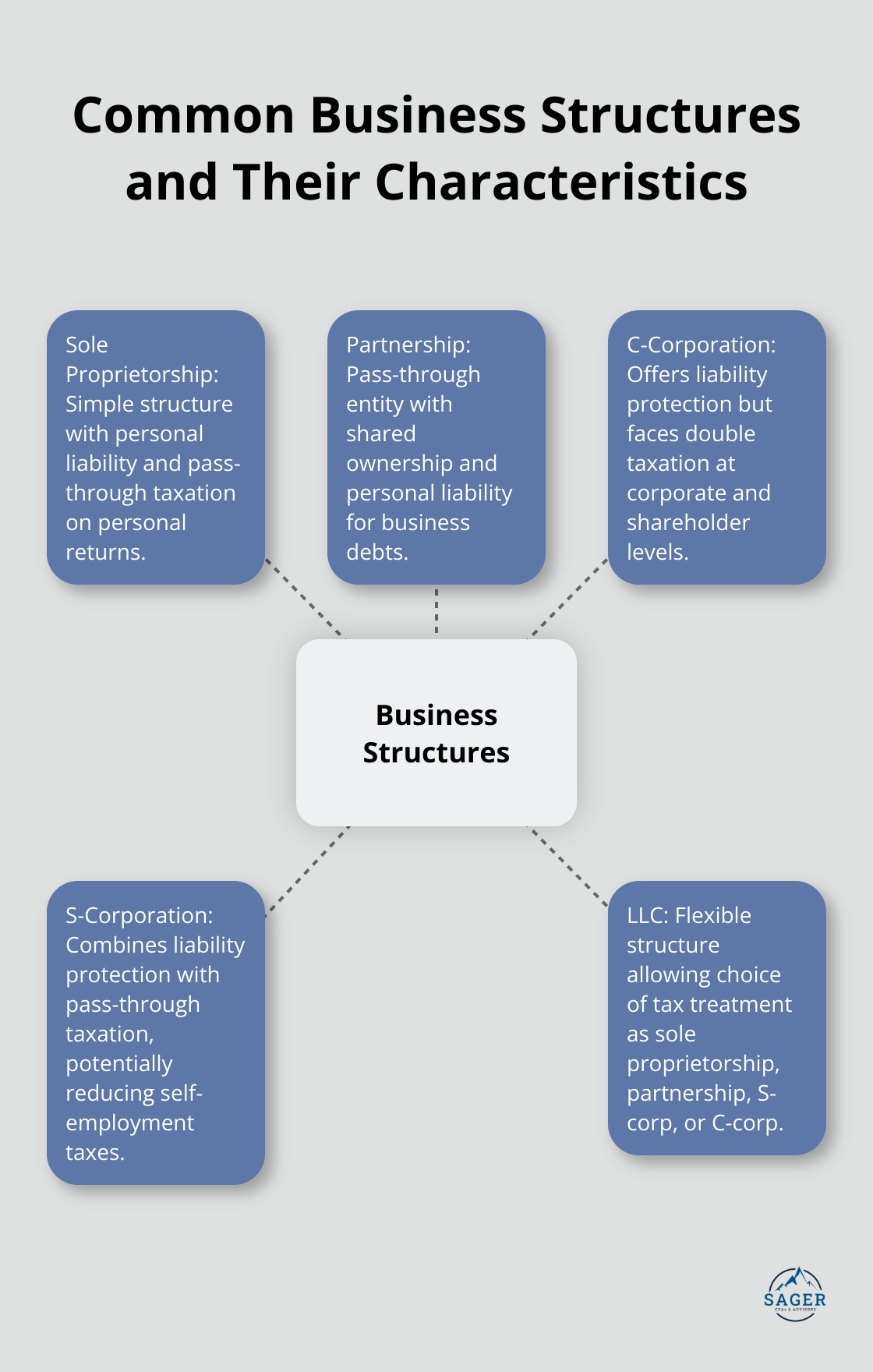

Sole proprietorships and partnerships offer simplicity but leave owners personally liable for business debts. These pass-through entities report business income on personal tax returns, potentially pushing individuals into higher tax brackets. C-corporations face double taxation – once at the corporate level and again when dividends are distributed to shareholders. However, they offer robust liability protection and easier access to capital.

S-corporations provide a middle ground, combining liability protection with pass-through taxation. This structure can reduce self-employment taxes. The National Association of Tax Professionals reports that S-corporation owners can save thousands in self-employment taxes annually by paying themselves a reasonable salary and taking the rest as distributions.

Limited Liability Companies (LLCs) offer remarkable flexibility in taxation. Single-member LLCs are treated as sole proprietorships for tax purposes by default, while multi-member LLCs are taxed as partnerships. However, LLCs can elect to be taxed as S-corporations or C-corporations, allowing owners to optimize their tax strategy as the business evolves. Members of an LLC are considered self-employed and must pay self-employment tax contributions towards Medicare and Social Security.

The Small Business Administration found that LLCs are the fastest-growing business structure in the U.S. (with a 120% increase over the past decade). This popularity stems from their adaptability and potential tax benefits.

As your business grows and changes, your business structure should too. We recommend an annual review of your entity type to ensure it still aligns with your financial goals and tax strategy. Factors to consider include:

Changing your business structure can have significant tax implications. Converting from an LLC to an S-corporation could reduce self-employment taxes, but it also introduces more stringent operational requirements. The IRS reports that improper conversions are a common audit trigger, underscoring the importance of professional guidance in this process.

Your chosen business structure plays a pivotal role in your overall tax strategy. It affects not only how much you pay in taxes but also when and how you pay them. For example, C-corporations can deduct 100% of health insurance premiums for employees (including owner-employees), while sole proprietors can only deduct these costs as an adjustment to income on their personal tax returns.

S-corporations offer unique tax-saving opportunities. Owners can receive both salary and distributions, potentially reducing their overall tax burden. However, the IRS scrutinizes S-corporations to ensure that owner-employees receive “reasonable compensation” before taking distributions.

Effective tax strategies for business owners boost profits and fuel growth. Maximizing deductions, timing income and expenses, and selecting the right business structure reduce tax burdens significantly. Proactive tax planning integrates these considerations into year-round financial decisions, resulting in substantial savings and increased flexibility.

Expert guidance proves invaluable in navigating complex tax laws. We at Sager CPA offer tailored financial management and tax planning services for individuals and businesses. Our team stays current with the latest regulations to help clients minimize tax liabilities and optimize financial performance.

Don’t leave money on the table. Take action now to implement these tax strategies for business owners and enhance your company’s financial stability. Schedule a consultation with Sager CPA today to create a personalized strategy that aligns with your business goals and maximizes tax savings.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.