Small business owners face unique challenges when it comes to taxes. At Sager CPA, we understand the importance of effective tax planning strategies for small businesses.

Implementing the right approach can significantly reduce your tax burden and boost your bottom line. This guide will explore practical small business tax planning strategies to help you navigate the complex world of business taxation and maximize your financial success.

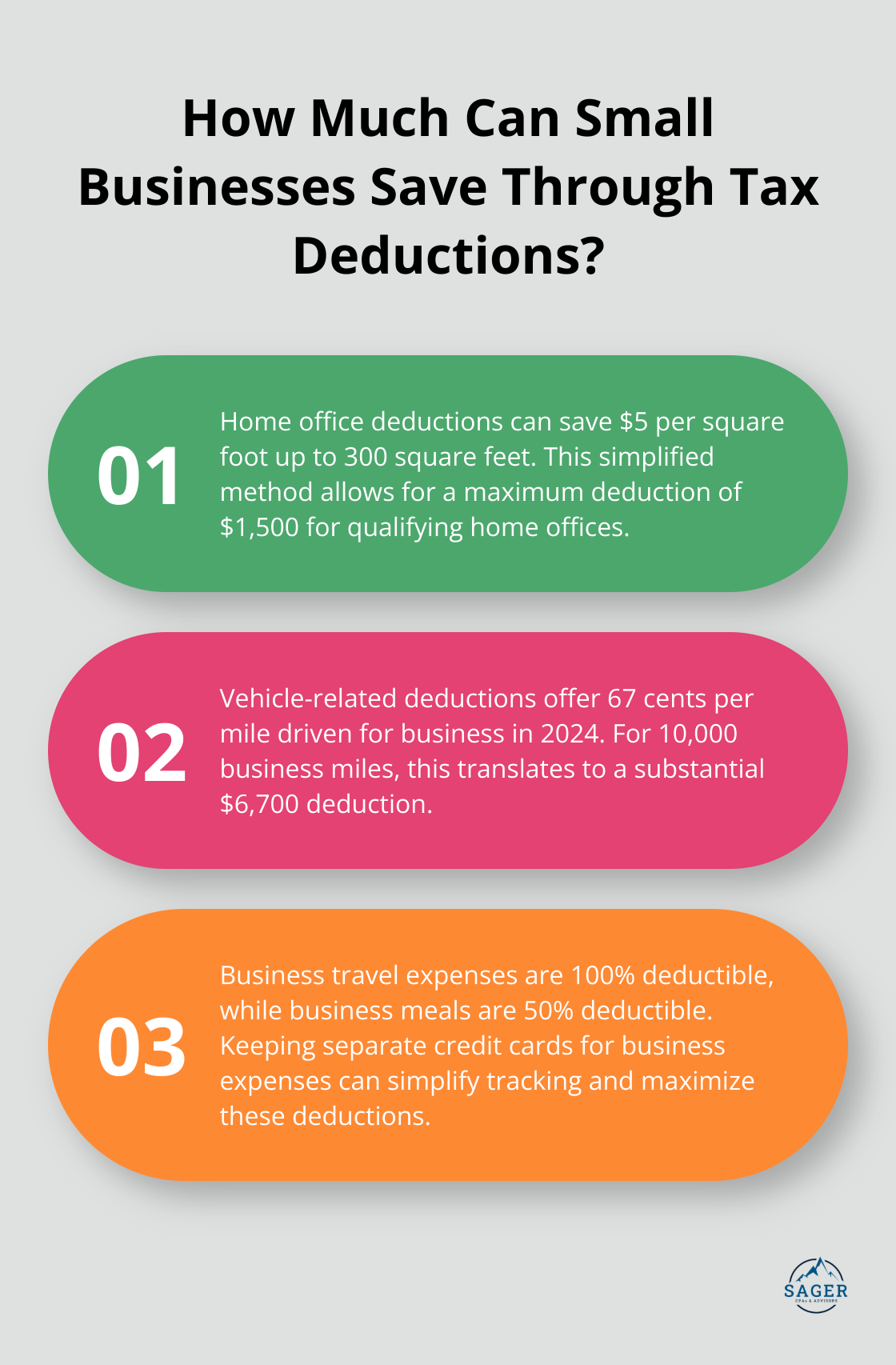

Small business owners must understand tax deductions to minimize their tax burden. Proper knowledge and application of deductions can significantly impact a company’s bottom line.

The IRS allows businesses to deduct ordinary and necessary expenses incurred during the tax year. These include office supplies, advertising costs, and professional fees. Don’t overlook smaller expenses like software subscriptions or professional development courses – they accumulate quickly.

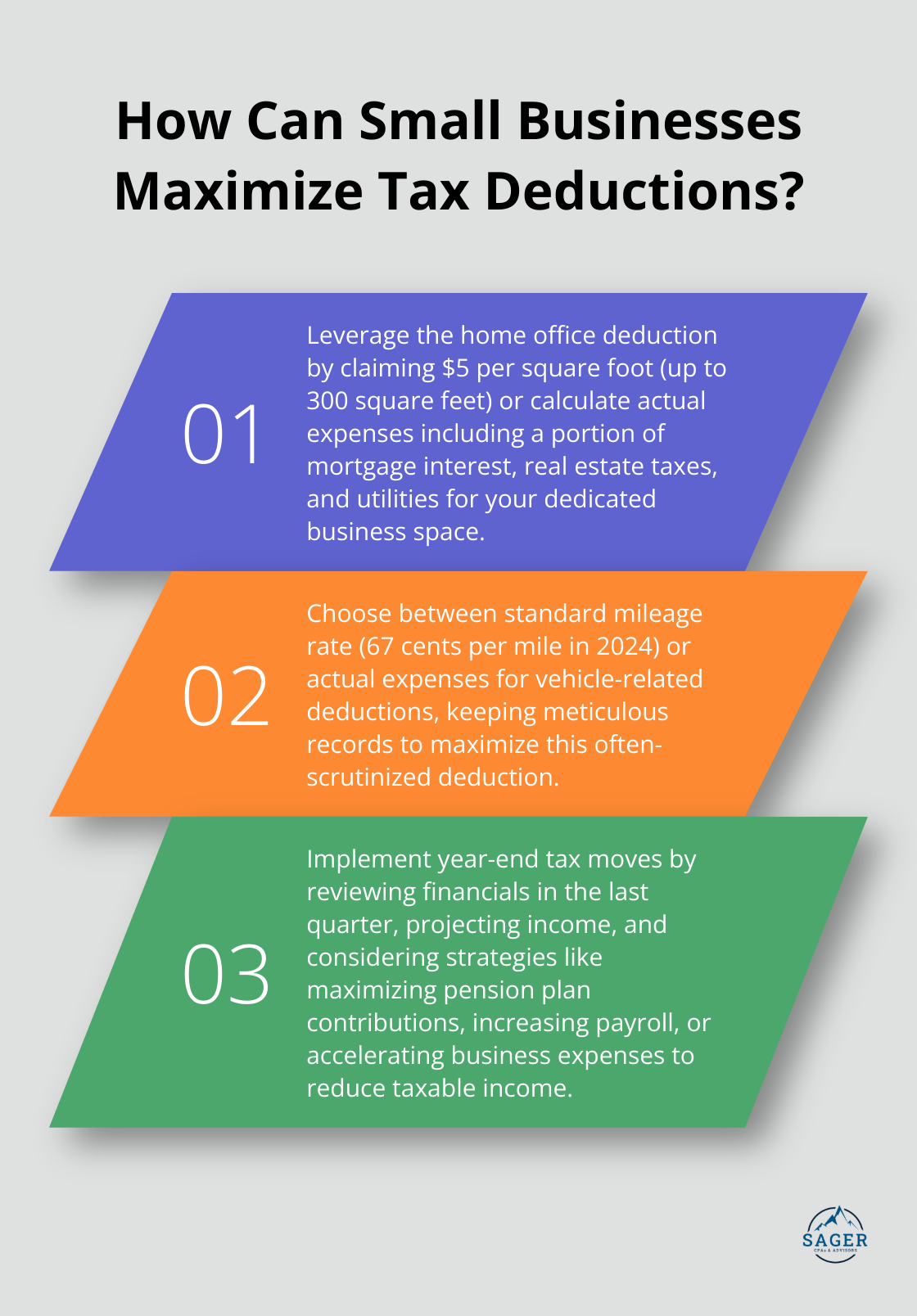

If you use part of your home exclusively for business, you may qualify for the home office deduction. The IRS offers a simplified method where you can deduct $5 per square foot of your home office (up to 300 square feet). Alternatively, you can calculate the actual expenses, which might include a portion of your mortgage interest, real estate taxes, and utilities.

For business-related driving, you have two options: the standard mileage rate or actual expenses. In 2024, the standard mileage rate is 67 cents per mile. If you drove 10,000 miles for business, that’s a $6,700 deduction. However, if you use a vehicle primarily for business, tracking actual expenses like gas, maintenance, and depreciation might yield a higher deduction. Keep meticulous records – the IRS scrutinizes vehicle deductions closely.

Business travel expenses are fully deductible, including airfare, lodging, and ground transportation. Meals during business travel or with clients are 50% deductible. Try to use a separate credit card for business expenses to simplify tracking. Also, save digital copies of receipts – they tend to fade over time.

Tax laws change frequently. What was deductible last year might not be this year. Working with a professional tax advisor (like those at Sager CPA) is essential to stay up-to-date with the latest tax code changes. This ensures you never miss out on potential deductions.

The next step in effective tax planning involves choosing the right business structure. Different structures offer various tax benefits and implications, which can significantly affect your overall tax strategy.

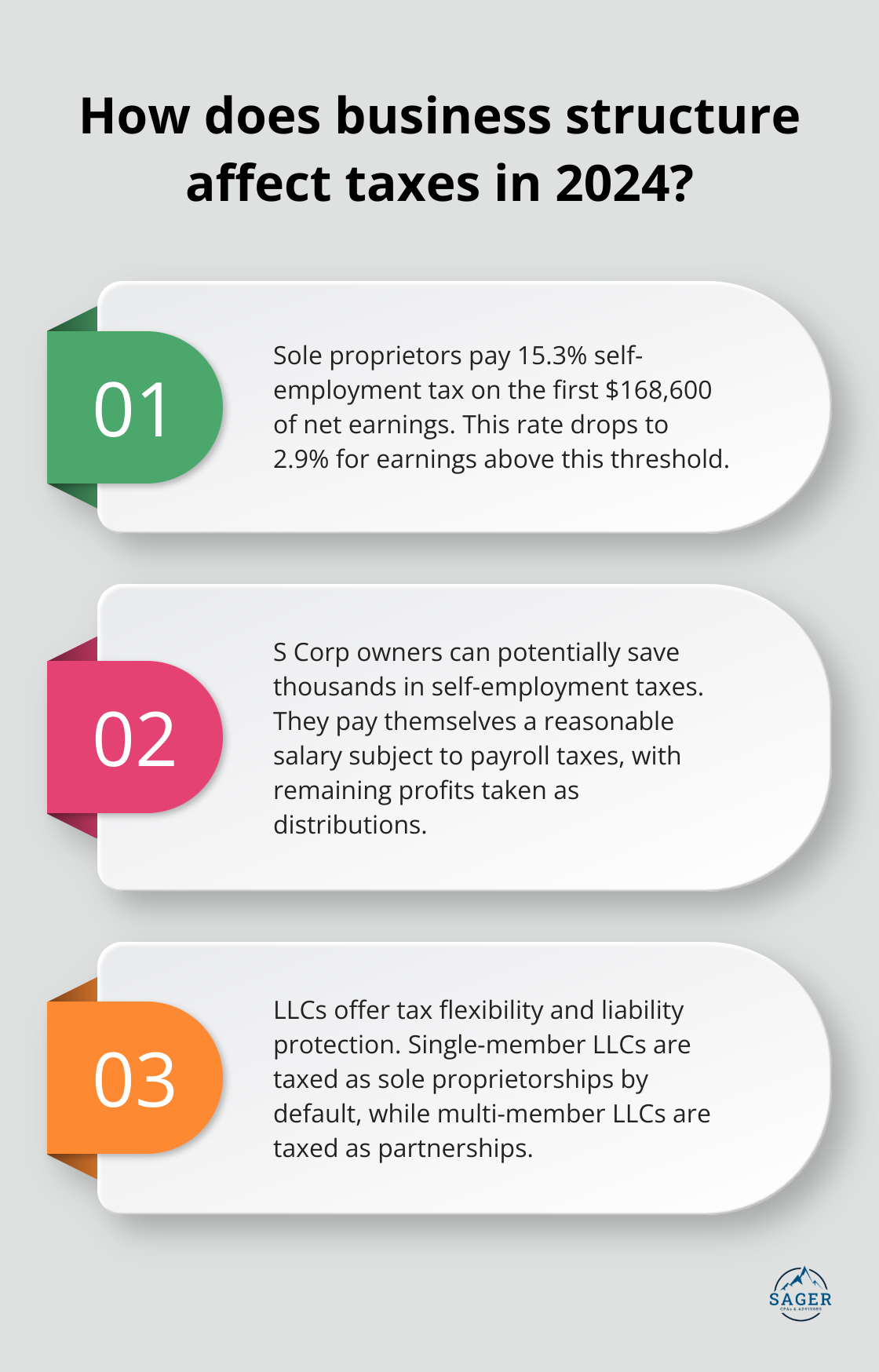

Sole proprietorships offer the most straightforward tax structure. Business owners report income and expenses on their personal tax returns using Schedule C. This simplicity, however, comes at a price. Sole proprietors pay self-employment tax on all business profits. In 2024, this tax amounts to 15.3% on the first $168,600 of net earnings, and 2.9% on earnings above that threshold.

Partnerships provide tax flexibility but require careful planning. Each partner reports their share of business income on their personal tax return, regardless of profit distribution. This can result in “phantom income,” where partners owe taxes on profits they haven’t received. Partnership agreements should clearly outline profit distribution policies to avoid potential issues.

S corps and LLCs both offer unique advantages and limitations. S Corp owners can pay themselves a reasonable salary and take the remaining profits as distributions. Only the salary is subject to payroll taxes, which can potentially save thousands in self-employment taxes. The IRS closely scrutinizes S Corp salary levels, so working with a tax professional to determine an appropriate salary is essential.

Limited Liability Companies (LLCs) provide flexibility in tax treatment. Single-member LLCs are taxed as sole proprietorships by default, while multi-member LLCs are taxed as partnerships. However, LLCs can elect to be taxed as S Corporations, potentially combining liability protection with tax savings. Unlike corporations, LLCs do not pay income tax on their profits, which can be advantageous for some businesses.

Selecting the right business structure is not a one-time decision. As businesses grow and change, it’s important to reassess the structure periodically. An annual review of your business structure ensures it still aligns with your financial goals and tax strategy. Changing your business structure can have significant tax implications (which is why consulting with a tax professional before making any changes is crucial).

The next step in effective tax planning involves implementing timing strategies to optimize tax savings. These strategies can help businesses manage their cash flow and minimize their tax burden throughout the year.

If you expect to be in a lower tax bracket next year, consider income deferral to reduce your current year’s tax burden. Cash-basis businesses can delay invoicing for December work until January. Accrual-basis businesses might postpone shipments or service completion until the new year. However, avoid artificial income manipulation, as this could alert the IRS.

If you anticipate a higher tax bracket this year, accelerate expenses for beneficial deductions. Purchase necessary equipment or supplies before year-end. For instance, buy new computers in December instead of January to secure valuable deductions for the current tax year. (Remember, these must be legitimate business expenses to qualify for deductions.)

The last quarter is critical for tax planning. Review your financials and project your income for the year. During a profitable year, consider maximizing deductions by making pension plan contributions, increasing payroll, or accelerating business expenses. These strategies can help reduce your taxable income.

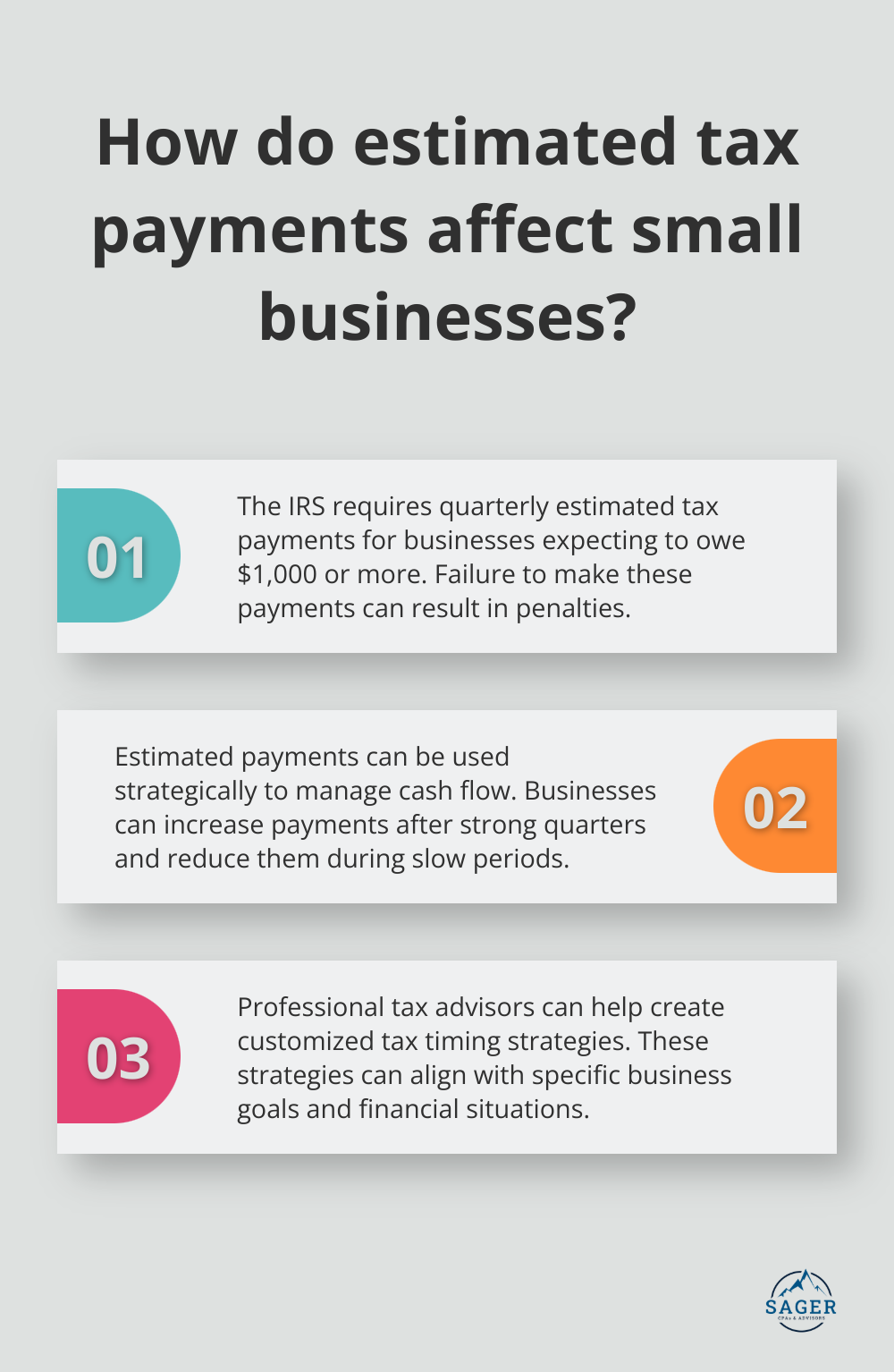

Many small business owners must make estimated tax payments. The IRS requires these quarterly payments if you expect to owe $1,000 or more in taxes when you file your return. Failure to make these payments can result in penalties. Use estimated payments strategically. Increase your payment after a strong quarter to avoid a large tax bill (and potential penalties) at year-end. Reduce your payment during slow periods to preserve cash flow.

Effective tax timing requires careful planning and execution. Many small business owners turn to professional tax advisors for customized tax timing strategies that align with their business goals and financial situation. (Sager CPA specializes in creating such strategies tailored to each client’s unique needs.)

Effective tax planning forms the foundation of financial success for small businesses. Small business tax planning strategies should adapt to changing regulations and business goals. Professional tax advisors provide invaluable benefits, offering expertise to navigate complex tax laws and develop customized strategies.

Sager CPA offers expert financial management and tax planning services tailored to specific needs. Our team helps businesses reduce tax liabilities and maintain financial stability. We provide ongoing support to position businesses for growth and success.

Tax planning transforms from a daunting task into a powerful tool for business success with the right approach. Professional guidance leads to informed decision-making and enhanced financial clarity. Small business owners should take control of their financial destiny by implementing effective strategies and seeking expert advice.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.