Clear financial reporting is the backbone of a company’s financial health and reputation. At Sager CPA, we’ve seen firsthand how clarity in financial statements can make or break business relationships.

Transparency in financial reporting builds trust, aids decision-making, and ensures regulatory compliance. This post will explore why clarity matters and how businesses can achieve it in their financial reporting practices.

Clear financial reports build trust with stakeholders, including investors, lenders, and partners. When financial statements are easy to understand and free from ambiguity, it demonstrates a company’s commitment to transparency. This openness can lead to stronger relationships and increased confidence in the business’s management.

Clarity in financial reporting facilitates better decision-making at all levels of an organization. When financial data is presented clearly, executives can quickly identify trends, spot potential issues, and capitalize on opportunities.

For example, a clear presentation of cash flow statements can help businesses anticipate liquidity issues before they become critical. This foresight allows companies to take proactive measures, such as adjusting inventory levels or negotiating better terms with suppliers.

Compliance with regulatory standards is essential for avoiding penalties and maintaining a good reputation. Clear financial reports make it easier for auditors and regulatory bodies to verify compliance, reducing the risk of costly fines or legal issues.

To improve the clarity of your financial reports, consider these strategies:

Clear financial reporting goes beyond meeting regulatory requirements; it provides a true and fair view of your company’s financial position. As we move forward, we’ll explore the key elements that contribute to clear and effective financial reporting.

Clear financial reports rely on consistent data presentation. Use the same format, terminology, and measurement methods across all financial statements and reporting periods. This approach allows stakeholders to compare performance over time and across different entities, facilitating accurate trend analysis and benchmarking. For example, maintain a uniform revenue recognition method throughout your reports to enable effective comparisons.

Financial reports should be accessible to all stakeholders, not just financial experts. Use plain language and avoid industry jargon whenever possible. When technical terms are necessary, provide clear definitions. Instead of simply stating “EBITDA increased,” explain that “Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) – a measure of a company’s overall financial performance – increased by 15% compared to last year.”

Today’s business world often involves complex financial transactions. Whether it’s a merger, acquisition, or intricate financial instrument, these need thorough explanations in your reports. Break down complex transactions into simpler components and explain their impact on the company’s financial position. This approach helps stakeholders understand the full picture of your company’s financial health.

Visual aids significantly enhance the clarity of financial reports. Graphs and charts present complex data in an easily digestible format. A line graph showing revenue trends over the past five years can instantly communicate information that might take paragraphs to explain in text. However, choose the right type of visual aid for each set of data. Bar charts work well for comparing categories, while pie charts effectively show proportions of a whole.

Clear financial reports go beyond presenting numbers; they provide context and explanations. Include narrative sections that explain significant changes, unusual events, or important trends. This additional information helps readers understand the “why” behind the numbers and makes the report more valuable for decision-making.

The next chapter will explore strategies to improve financial reporting clarity, building on these fundamental elements. These strategies will help you create reports that not only meet regulatory requirements but also provide a true and fair view of your company’s financial position.

Implementing robust internal controls ensures the accuracy and reliability of financial data. Define clear roles and responsibilities within your finance team. Establish a system of checks and balances, where team members review each other’s work. This approach catches errors early and prevents misstatements in financial reports.

Implement a multi-step approval process for significant transactions. Require two signatures for purchases above a certain threshold. This extra layer of scrutiny prevents unauthorized transactions and ensures proper recording and reporting of all major financial activities.

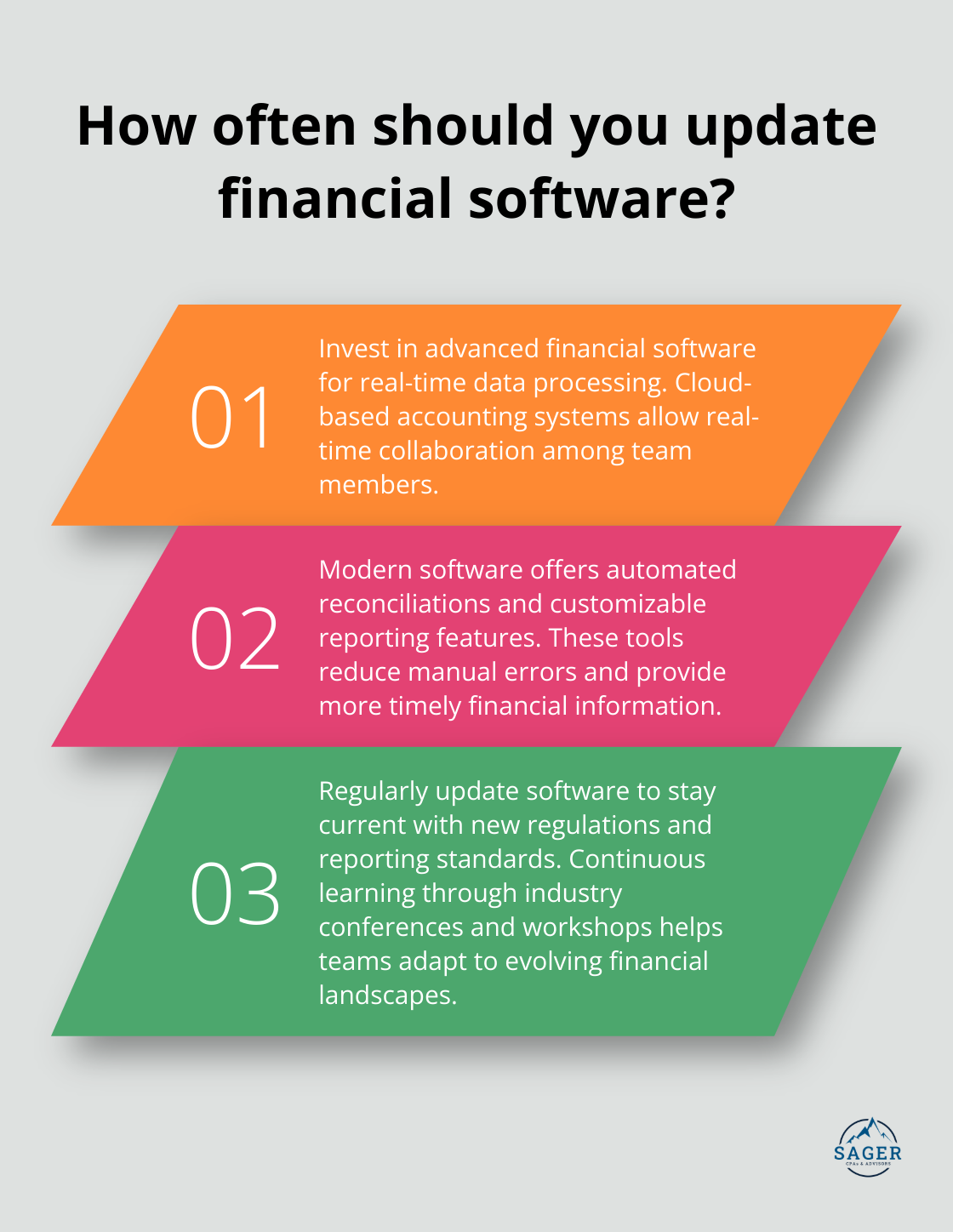

Invest in advanced financial software to revolutionize your reporting process. Modern accounting systems offer real-time data processing, automated reconciliations, and customizable reporting features. These tools reduce manual errors and provide more timely financial information.

Cloud-based accounting software allows real-time collaboration among team members, ensuring everyone works with the most up-to-date financial data. Many of these systems also offer built-in analytics tools, helping you identify trends and anomalies quickly.

The financial landscape evolves constantly, with new regulations and reporting standards emerging regularly. Invest in ongoing training for your finance team to stay ahead. Send team members to industry conferences, workshops, or online courses focused on financial reporting best practices.

Implement monthly “lunch and learn” sessions where team members share insights from recent training or discuss new accounting standards. This practice leads to more consistent and accurate financial reporting across your organization.

While internal reviews provide value, external audits and feedback offer fresh insights and identify blind spots in your reporting processes. Engage an independent auditor to review your financial statements periodically. Their objective perspective highlights areas for improvement that you might overlook internally.

Ask for feedback from key stakeholders (board members, investors, or lenders) on your financial reports. Inquire if they find your reports clear and informative. Their input guides you in refining your reporting to better meet their needs.

Tailor your financial reports to suit different stakeholders’ needs. Create separate versions of your reports for internal management, board members, and external investors. Each version should focus on the key metrics and information most relevant to that specific audience.

For example, internal management reports might include detailed operational metrics, while investor reports focus more on high-level financial performance and growth indicators. This customization ensures that each stakeholder group receives the most pertinent information in a format they can easily understand and act upon.

Keeping a backup set of records — including bank statements, tax returns, and insurance policies — is easier than ever now that many financial documents are available digitally. This practice enhances financial reporting clarity by ensuring all necessary information is readily accessible when needed.

Clear financial reporting forms the foundation of business success, building trust and enabling informed decision-making. Companies that prioritize transparency in their financial statements often experience improved stakeholder relationships and enhanced marketplace credibility. Advanced financial software, robust internal controls, and ongoing training for finance teams significantly improve clarity in financial reporting.

The benefits of clarity in financial reporting extend beyond regulatory compliance, leading to better access to capital and improved operational efficiency. Companies should take proactive steps to enhance their financial reporting practices, creating reports that provide genuine value to all stakeholders. Sager CPA encourages businesses to assess their current reporting methods and identify areas for improvement.

Clarity in financial reporting requires commitment and continuous improvement. Companies can start by simplifying complex transactions, improving data visualization, or seeking external audits (each step contributes to financial health). These efforts position businesses for long-term growth and success in today’s competitive environment.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.