Choosing the right outsourced accounting services can be a game-changer for your business. At Sager CPA, we’ve seen firsthand how proper financial management can drive growth and success.

This guide will walk you through the key factors to consider when selecting an accounting partner, ensuring you make an informed decision that aligns with your business goals.

Outsourced accounting services provide a strategic solution for businesses to streamline their financial operations. This approach involves hiring external professionals to manage various financial tasks traditionally handled in-house. The global finance and accounting business process outsourcing market size was estimated at USD 60.31 billion in 2023 and is expected to grow at a CAGR of 9.3%, highlighting its growing importance.

These services encompass a wide range of financial functions, including bookkeeping, financial statement preparation, payroll processing, and tax compliance. More advanced offerings may include financial analysis, budgeting, and CFO-level advisory. The scope can be tailored to fit the specific needs of businesses, from small startups to large corporations.

Businesses can choose from a variety of outsourced accounting services to best fit their needs:

Outsourcing accounting functions offers numerous advantages:

Small businesses particularly benefit from the scalability of outsourced services. As they grow, their accounting support can easily adapt without the need to hire and train new staff. This flexibility proves invaluable in today’s fast-paced business environment.

Outsourced accounting services often leverage cutting-edge technology and software to improve efficiency and accuracy. This technological advantage (which might be cost-prohibitive for individual businesses to implement) includes:

These technological solutions not only streamline processes but also provide businesses with more timely and accurate financial insights.

As we move forward, it’s important to consider the key factors that will help you choose the best outsourced accounting service for your specific needs. Let’s explore these factors in detail to ensure you make an informed decision that aligns with your business goals.

The foundation of any exceptional accounting service is its team’s expertise. You should select firms with professionals who have experience in your specific industry. For example, if you operate in the tech sector, an accounting team well-versed in software revenue recognition rules will prove invaluable. Ask potential providers about their team’s qualifications and ongoing training programs to ensure they stay current with evolving financial regulations.

While basic bookkeeping might suffice for some, many businesses require a more extensive range of services. A study by Accounting Today found that 68% of small businesses prefer a one-stop-shop for their financial needs. You should seek out providers that offer a full spectrum of services, from daily transaction recording to complex financial analysis and strategic planning. This approach not only streamlines your operations but also ensures consistency across all financial aspects of your business.

In today’s digital age, the technology used by your accounting service can significantly impact efficiency and accuracy. By 2023, 31% of organizations expect to run 75% of their workloads in the cloud. You should inquire about the software platforms potential providers use and how they integrate with your existing systems. Advanced features like real-time reporting, automated bank feeds, and AI-powered analytics can provide you with more timely and actionable financial insights.

With financial data being a prime target for cybercriminals, robust security measures are non-negotiable. The 2021 Cost of a Data Breach Report by IBM found that the average cost of a data breach in the financial sector was $5.72 million. You must ensure your chosen provider employs state-of-the-art encryption, multi-factor authentication, and regular security audits. Don’t hesitate to ask for their data breach response plan and compliance certifications like SOC 2.

Pricing transparency is essential for building trust and avoiding unexpected costs. You should look for providers that offer clear, itemized pricing structures. Some may charge a flat monthly fee, while others might use a tiered system based on transaction volume. According to a survey by Bill.com, 78% of small businesses prefer fixed monthly pricing for accounting services. However, what’s most important is finding a pricing model that aligns with your business’s cash flow and growth trajectory.

The right outsourced accounting service should feel like an extension of your team, not just a vendor. As you evaluate potential providers, consider how their expertise, service offerings, technology, security measures, and pricing align with your specific needs. These factors will play a significant role in determining the success of your outsourced accounting partnership. Now, let’s explore the steps you can take to evaluate and select the right provider for your business.

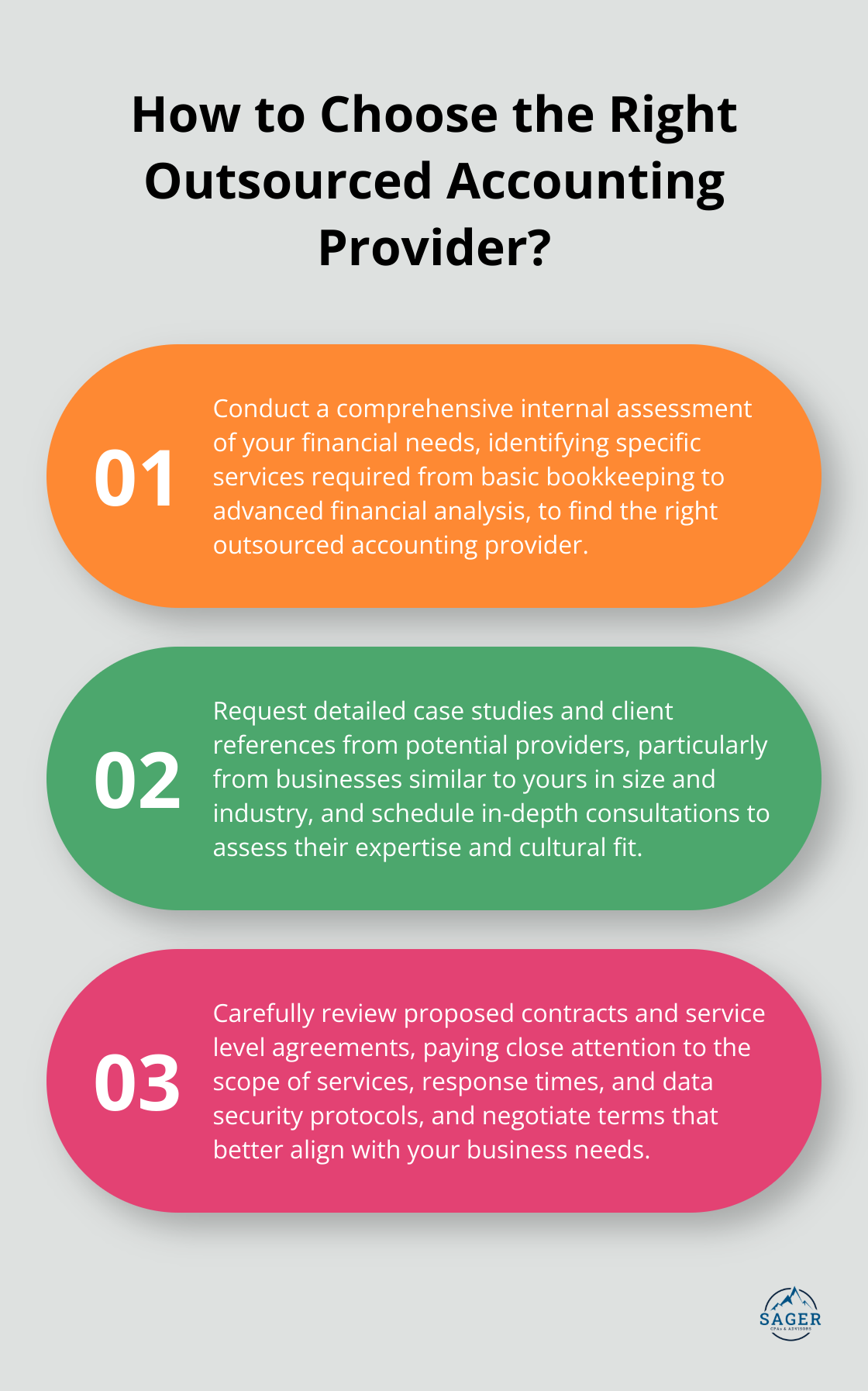

Start with a thorough internal assessment of your financial needs. This step will help you identify the specific services you require, from basic bookkeeping to advanced financial analysis. Understanding your requirements is crucial for finding the right outsourced finance and accounting services provider.

Use industry directories, peer recommendations, and online reviews to identify firms with strong reputations. This approach will help you narrow down your options to the most qualified candidates.

Don’t rely solely on marketing materials when evaluating candidates. Request detailed case studies and client references, particularly from businesses similar to yours in size and industry.

Schedule in-depth consultations with your top candidates. These meetings provide an opportunity to assess their expertise, communication style, and cultural fit with your organization. Prepare a list of specific questions about their processes, technology, and how they’ve helped similar businesses overcome financial challenges.

Carefully review the proposed contracts and service level agreements (SLAs) before making a final decision. Pay close attention to the scope of services, response times, and data security protocols.

Don’t hesitate to negotiate terms that better align with your business needs.

After thorough evaluation, select the provider that best matches your needs, budget, and company culture.

Selecting the right outsourced accounting services will significantly impact your business’s financial health and growth trajectory. You must consider factors such as expertise, service range, technology integration, data security, and pricing transparency. The ideal provider should meet your current needs and support your future aspirations.

The benefits of choosing the right accounting partner extend far beyond mere number crunching. You’ll gain a strategic ally who can provide valuable insights, help you navigate complex financial landscapes, and contribute to your business’s success. With the right outsourced accounting team, you can focus on your core competencies while your finances remain in capable hands.

Sager CPA understands the intricacies of outsourced accounting services and provides tailored solutions that drive businesses forward. Our team offers comprehensive financial management and tax planning services (designed to reduce liabilities and enhance financial clarity). Don’t let financial complexities hold your business back; schedule a consultation with Sager CPA today to create a personalized strategy for long-term financial stability and success.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.