Financial clarity is the cornerstone of successful business management. Without it, companies risk making uninformed decisions that can lead to costly mistakes and missed opportunities.

At Sager CPA, we’ve seen firsthand how clarity in financial management can transform businesses. This post will explore practical strategies and tools to help you achieve greater financial transparency and control in your organization.

Financial management forms the backbone of any successful business. It extends beyond mere money tracking; it involves making informed decisions that drive growth and profitability. At its core, financial management encompasses the planning, organization, direction, and control of financial activities to achieve organizational goals.

The key components of financial management include budgeting, financial reporting, and analysis. Budgeting helps businesses plan for future expenses and income, while financial reporting provides a snapshot of the company’s current financial health. Analysis of these reports allows for informed decision-making and strategy adjustments.

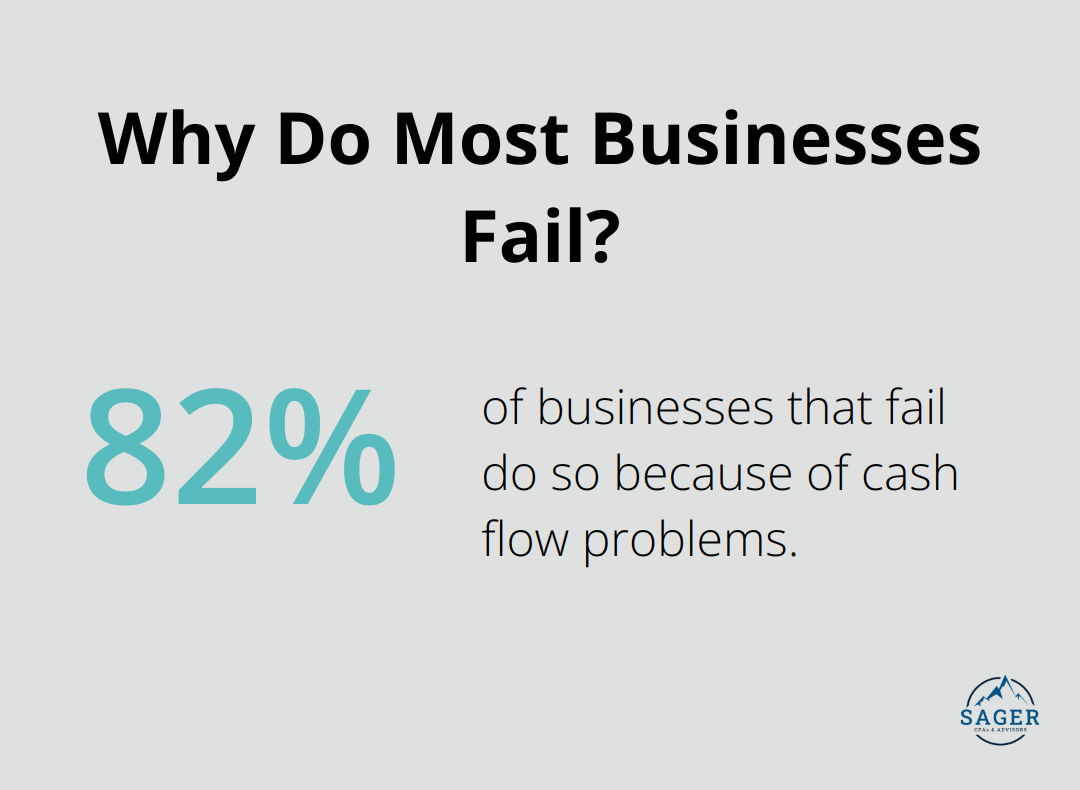

Cash flow management often gets overlooked, yet it’s a critical aspect. A study by U.S. Bank found that 82% of businesses that fail do so because of cash flow problems. This statistic highlights the importance of maintaining a healthy cash flow to cover operational expenses and invest in growth opportunities.

Achieving clarity in financial management presents challenges. Many businesses struggle with incomplete or inaccurate data, which can lead to misguided decisions. A survey by BlackLine revealed that over half of global executives surveyed are not confident in identifying financial data inaccuracies.

The absence of real-time financial information poses another challenge. Traditional monthly or quarterly reports can become outdated by the time of review, leaving businesses unable to respond quickly to market changes or internal issues.

To improve financial clarity, businesses should implement a robust accounting system. This doesn’t necessarily mean expensive software; even small businesses can benefit from cloud-based solutions that offer real-time data access and automated reporting.

Regular financial health check-ups prove invaluable. Monthly reviews of key financial metrics (such as profit margins, accounts receivable turnover, and inventory levels) can help identify trends and potential issues before they escalate into significant problems.

Investing in financial education for key team members can yield substantial returns. When more people in the organization understand financial concepts and reports, it leads to better decision-making at all levels.

While internal efforts to improve financial clarity are essential, professional guidance can provide invaluable insights. Certified Public Accountants (CPAs) offer expertise in financial management, tax planning, and strategic advisory services. For instance, Sager CPA and Advisors provides tailored financial management services that help businesses enhance their financial clarity and make informed decisions.

The next chapter will explore specific strategies that can further enhance financial clarity and drive informed decision-making. These strategies will build upon the fundamental aspects of financial management discussed here, providing a comprehensive approach to achieving financial transparency and control in your organization.

Your accounting system powers your financial operations. Outdated systems can cause errors, delays, and missed opportunities. Upgrade to a cloud-based accounting solution for real-time data access and automated reporting. QuickBooks Online provides excellent inventory management, time tracking, and in-depth contact records and transaction forms. It’s also considered the best option for multiple users. These features enable quicker, more informed decisions.

When you select a new system, focus on features like bank feed integration, customizable reporting, and multi-user access. These features will save time, reduce errors, and improve collaboration across your team.

Comprehensive financial reporting extends beyond basic profit and loss statements. It should offer a 360-degree view of your financial health. Start by identifying the key performance indicators (KPIs) that matter most to your business (e.g., cash flow, accounts receivable turnover, or gross profit margin).

Create a dashboard that displays these KPIs in an easy-to-understand format. Tools like Tableau or Microsoft Power BI help visualize your data, making it easier to spot trends and anomalies. Try to review this dashboard weekly and adjust your strategies based on the insights you gain.

Financial forecasting allows you to anticipate cash flow issues, plan for growth, and make proactive decisions. Master Financial Forecasting by following these steps: 1. Identify the objectives, 2. Consider the time frame, 3. Determine the level of detail, and 4. Identify the contributors. This approach keeps your projections current and relevant.

Use historical data as a starting point, but don’t rely on it exclusively. Factor in market trends, planned initiatives, and potential risks. Tools like PlanGuru or Jirav streamline the forecasting process, allowing you to create multiple scenarios and test different assumptions.

Compare your actual results to your forecasts regularly, analyzing any variances. This practice will help refine your forecasting accuracy over time and provide valuable insights into your business operations.

Financial management is a complex field. Many businesses benefit from professional guidance to fully optimize their financial processes. Expert advisors can provide the expertise needed to elevate your financial management, ensuring you have the insights needed to make informed decisions and drive your business forward.

The next chapter will explore how technology can further enhance your financial clarity, providing deeper insights and more efficient processes.

Technology transforms financial management, offering real-time insights and automating tedious tasks. This chapter explores how you can use technology to gain a clearer picture of your finances.

Cloud-based accounting systems revolutionize financial management. These platforms allow multi-user access and safe online or remote server storage. This accessibility proves essential for timely decision-making and maintaining financial health.

Popular solutions like QuickBooks Online, Xero, and FreshBooks offer features such as automated bank feeds, invoice generation, and expense tracking. These features save time and reduce manual errors.

When you select a cloud-based solution, consider factors like ease of use, integration capabilities with other business tools, and scalability. The platform should grow with your business and provide the specific features you need.

Data analytics tools transform raw financial data into actionable insights. Integration of these tools with your accounting system uncovers trends, identifies potential issues, and enables data-driven decisions.

Tools like ThoughtSpot help visualize your financial data. This visualization makes it easier to spot patterns and anomalies that might not appear in traditional spreadsheets.

You might use analytics to track cash flow trends over time, identifying seasonal fluctuations or unexpected dips. This insight could improve your working capital management or adjust your business strategies.

Automation changes the game in financial management. It saves time, improves accuracy, and provides real-time updates to your financial picture.

Implement automation in areas like accounts payable and receivable, payroll processing, and expense management. Tools like Bill.com for accounts payable or Expensify for expense management streamline these processes, reducing manual work and potential errors.

Automated systems also provide real-time updates to your financial reports. This means you always work with the most current data, allowing for more accurate forecasting and decision-making.

An integrated financial ecosystem connects various financial tools and processes. This integration creates a seamless flow of information, reducing data silos and improving overall financial clarity.

Try to create an ecosystem where your accounting software, payment processing systems, inventory management tools, and customer relationship management (CRM) platforms all communicate with each other. This integration provides a holistic view of your financial health and business operations.

For example, when a sale occurs, it automatically updates your inventory levels, records the revenue in your accounting system, and updates the customer’s information in your CRM. This real-time, interconnected approach enhances financial clarity and operational efficiency.

Clarity in financial management requires dedication, the right tools, and expert guidance. Businesses must implement robust accounting systems, develop comprehensive financial reporting, and leverage technology to gain a clear picture of their financial health. Ongoing financial education proves essential as the business landscape evolves, helping companies adapt and thrive in changing market conditions.

Professional advice plays a key role in enhancing financial clarity. Sager CPA and Advisors offers expert financial management and tax planning services tailored for individuals and businesses. Their proactive strategies and customized action plans help clients achieve enhanced financial clarity and make informed decisions.

To implement clearer financial management practices, assess your current financial processes and identify areas for improvement. Invest in cloud-based accounting solutions and data analytics tools to streamline operations and gain deeper insights. Create a culture of financial awareness within your organization to foster a sense of ownership and alignment across the team.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.