Small businesses face unique financial challenges that can make or break their success. At Sager CPA, we understand the critical role a small business CPA plays in navigating these complexities.

From tax compliance to strategic growth planning, the right CPA can be a game-changer for your company’s financial health. In this post, we’ll explore how partnering with a skilled CPA can boost your small business’s financial success and set you on the path to long-term prosperity.

The tax code changes frequently, presenting a challenge for small businesses. Small business owners who attempt to navigate this alone often miss deductions or make costly mistakes. A CPA stays current with these changes, ensures compliance, and maximizes tax benefits. Professional tax planning can lead to significant savings (often thousands of dollars annually) for businesses.

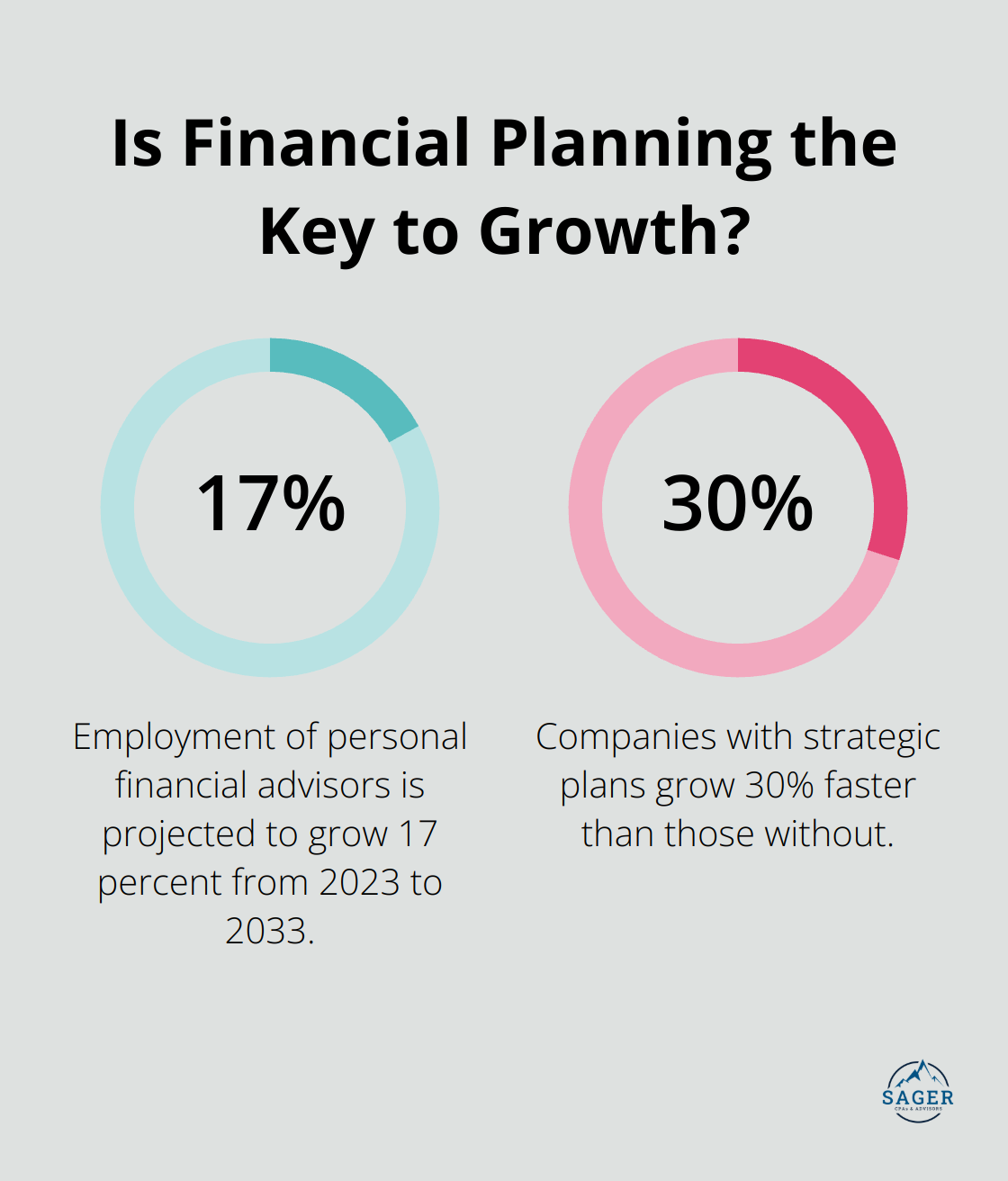

Raw financial data requires proper interpretation to become valuable. CPAs transform numbers into actionable insights. Employment of personal financial advisors is projected to grow 17 percent from 2023 to 2033, much faster than the average for all occupations. Advanced analytics tools provide clients with clear financial pictures, which inform decisions about inventory management, pricing strategies, and growth opportunities.

Growth requires careful planning and execution. A study by the Small Business Administration found that companies with strategic plans grow 30% faster than those without. CPAs play a vital role in developing these plans. They create financial forecasts, budget for expansion, and identify potential funding sources. This proactive approach often results in double-digit growth rates for businesses.

Cash flow management stands as a cornerstone of business success. A CPA helps businesses track income and expenses, identify trends, and make informed decisions about spending and investments. This expertise proves particularly valuable during economic downturns or seasonal fluctuations (which many industries face).

Small business owners often find themselves too close to their operations to make objective financial decisions. A CPA offers an outside perspective, grounded in financial expertise and industry knowledge. This objectivity proves invaluable when considering major financial decisions (such as expansions, mergers, or significant equipment purchases).

As we move forward, let’s explore the specific services that small business CPAs offer to drive financial success.

Small business CPAs offer a range of critical services that can significantly impact your company’s financial health. These services drive growth and stability for businesses across various industries.

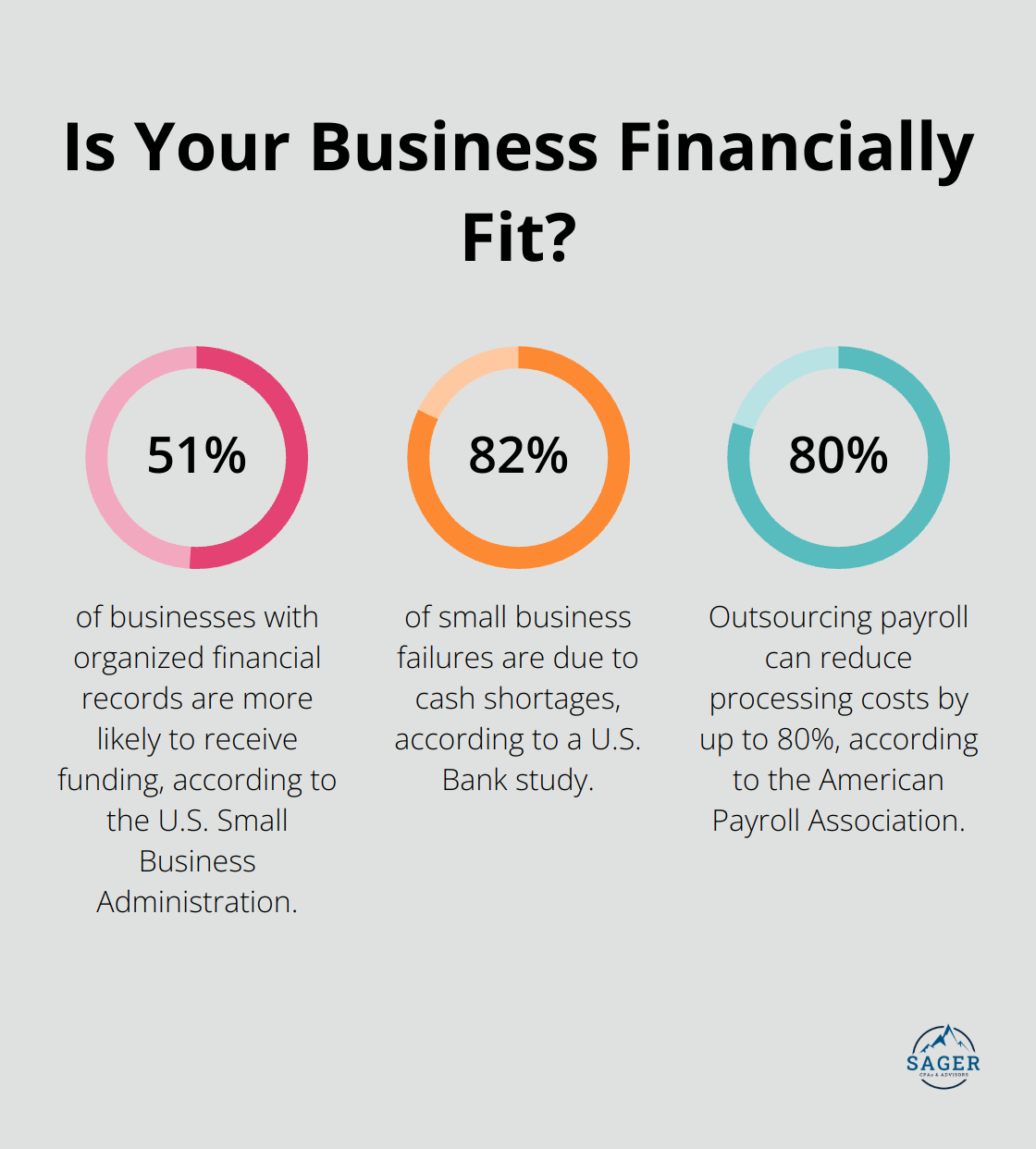

Accurate financial statements form the foundation of sound business decisions. CPAs prepare detailed balance sheets, income statements, and cash flow statements that provide a clear picture of your company’s financial position. The U.S. Small Business Administration reports that businesses with organized financial records are 51% more likely to receive funding. This level of detail allows you to spot trends, identify areas for improvement, and make data-driven decisions.

Effective tax planning extends beyond annual filings. It’s an ongoing process that can lead to lower taxes owed and improved cash flow. CPAs streamline this process and implement strategies to minimize your tax burden. They might advise on the timing of major purchases to maximize deductions or help structure your business to take advantage of favorable tax treatments (which can result in significant savings).

CPAs serve as trusted advisors, offering insights that extend beyond numbers. They analyze industry trends, assess risk factors, and provide guidance on major financial decisions. This proactive approach can make the difference between stagnation and growth. A CPA might identify opportunities for cost-cutting that could increase your profit margins by 5-10% (a significant boost for any small business).

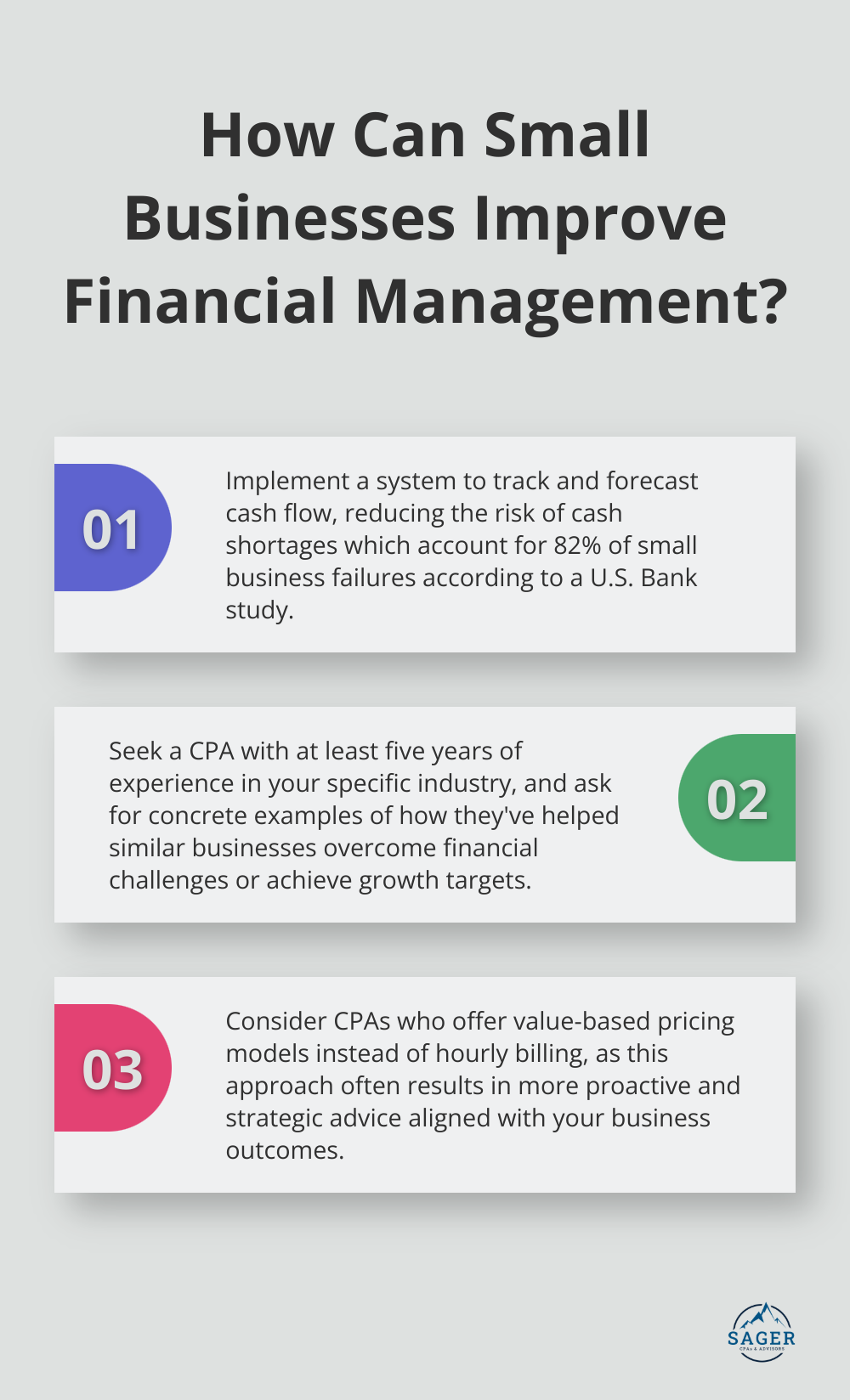

Maintaining healthy cash flow is essential for small business survival. CPAs implement systems to track and forecast cash flow, ensuring you have the liquidity to cover expenses and invest in growth opportunities. Cash flow management for small businesses is crucial for growth and sustainability. These efforts can reduce the risk of cash shortages, which account for 82% of small business failures according to a U.S. Bank study.

Payroll errors can prove costly and time-consuming to correct. CPAs ensure accurate and timely payroll processing, compliance with tax regulations, and proper record-keeping. The American Payroll Association estimates that outsourcing payroll can reduce processing costs by up to 80%. This not only saves money but also frees up valuable time for you to focus on core business activities.

The expertise provided by a skilled CPA is an investment that pays dividends in improved financial performance and peace of mind. As we move forward, let’s explore how to choose the right CPA for your small business needs.

When you evaluate potential CPAs, look beyond basic certifications. A CPA license is essential, but professionals with additional credentials such as Certified Management Accountant (CMA) or Certified Financial Planner (CFP) can boost your salary, knowledge, job security, and promotion chances. They also allow for specialization in areas like tax and other financial domains.

Experience plays a vital role. A CPA with at least five years of experience working with small businesses in your industry will likely have encountered and solved similar challenges to those you face. Ask for specific examples of how they’ve helped businesses like yours overcome financial hurdles or achieve growth targets.

Your CPA should understand your industry’s unique challenges. For instance, a CPA experienced in the restaurant industry will understand the nuances of food cost management and tip reporting, while one specializing in e-commerce will know sales tax complexities across different states.

Ask potential CPAs about their familiarity with industry-specific software, regulations, and benchmarks. Their answers will reveal the depth of their relevant experience and how quickly they can add value to your business.

Effective communication forms the foundation of a successful client-CPA relationship. During initial consultations, assess how well the CPA explains complex financial concepts. Do they use clear language? Do they answer your questions patiently?

Availability also matters significantly. Determine how quickly they respond to emails or calls, and whether they offer virtual meetings for convenience. Some CPAs now use client portals for secure document sharing and real-time financial updates (which can greatly enhance collaboration).

While cost matters, it shouldn’t be the deciding factor. Focus on the value a CPA brings to your business. Many CPAs now move away from hourly billing towards value-based pricing models. This approach aligns the CPA’s incentives with your business outcomes, often resulting in more proactive and strategic advice.

Ask potential CPAs to outline their fee structure and what services they include. Some may offer tiered packages tailored to different business sizes and needs.

When you evaluate CPAs, consider Sager CPA and Advisors. Their approach to tailored financial management and proactive tax planning aligns with the needs of growing small businesses. They offer customized action plans and regular communication, ensuring that clients receive not just accounting services, but a true financial partnership focused on long-term stability and growth.

A small business CPA can transform your company’s financial health and long-term success. These professionals navigate complex tax landscapes, unlock financial insights, and fuel growth through strategic planning. From comprehensive financial reporting to proactive business advisory, the right CPA brings invaluable expertise to your business.

The impact of a skilled CPA extends far beyond annual tax filings. It creates a solid financial foundation that supports your business goals year-round. With their guidance, you can optimize cash flow, make informed decisions, and seize growth opportunities that might otherwise go unnoticed.

Don’t let financial complexities hold your business back. Take action today to secure your financial future. Schedule a consultation with Sager CPA to discuss your unique needs and create a personalized strategy for success.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.