Managing finances can be a daunting task for small business owners. At Sager CPA, we understand the challenges you face in keeping your books accurate and up-to-date.

Outsourced accounting services for small businesses offer a powerful solution to streamline your financial management. By leveraging expert knowledge and advanced technology, you can focus on growing your business while leaving the numbers to professionals.

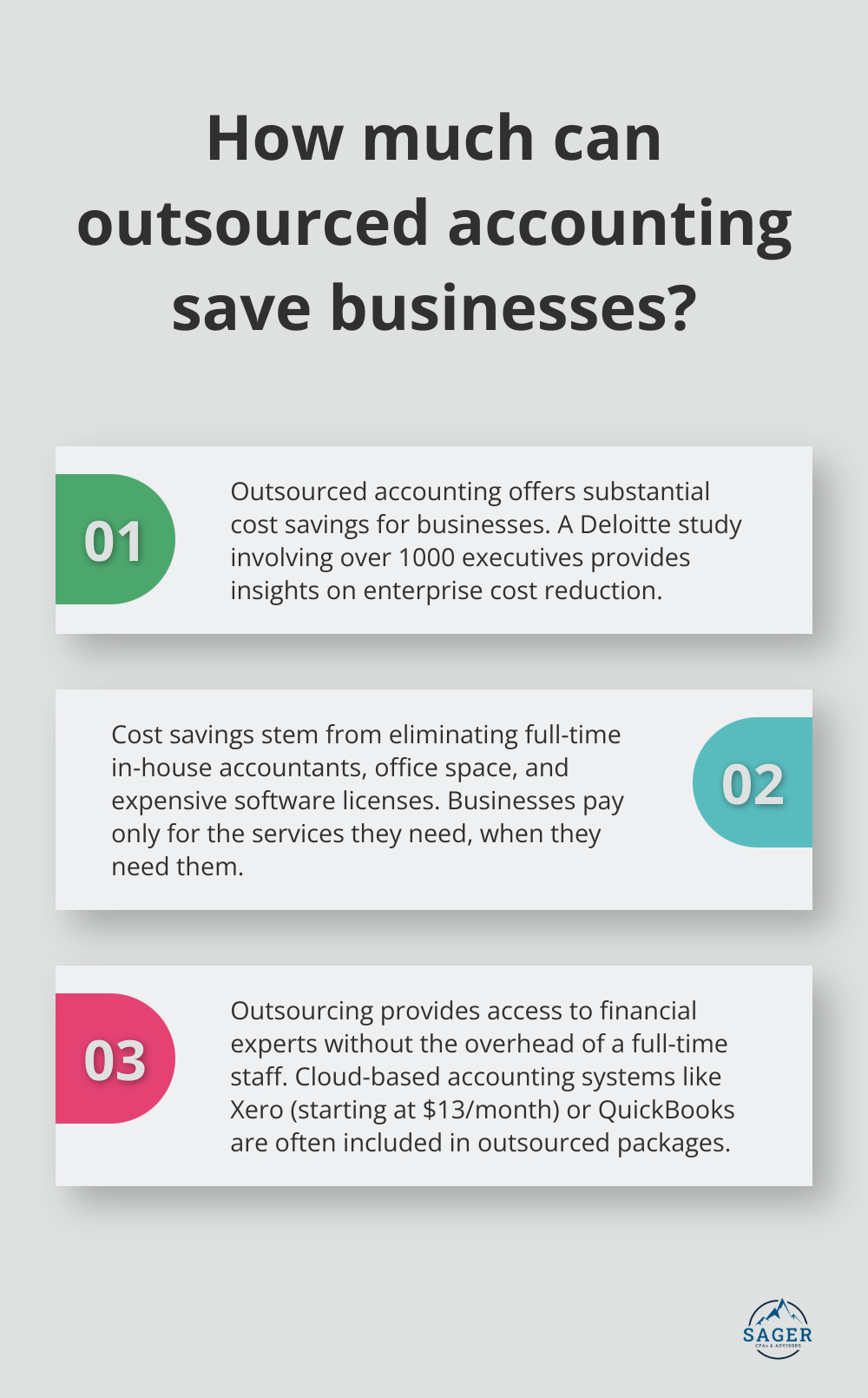

Outsourced accounting offers substantial cost savings for businesses. A Deloitte study involving more than 1000 executive survey participants provides in-depth insights on enterprise cost reduction. This reduction stems from eliminating the need for full-time in-house accountants, office space, and expensive accounting software licenses. Instead, businesses pay only for the services they need, when they need them.

Outsourcing provides access to a team of financial experts without the overhead of maintaining a full-time staff. These professionals stay current with the latest accounting standards and tax laws, ensuring financial compliance. For instance, when the Tax Cuts and Jobs Act was introduced in 2017, businesses with outsourced accounting teams quickly adapted to the new regulations without disruption.

Outsourced accounting firms invest in state-of-the-art financial software and tools. This means businesses benefit from advanced technology without the hefty price tag. Cloud-based accounting systems like Xero or QuickBooks are often included in outsourced accounting packages. Xero’s starting price is $13 per month, while QuickBooks offers additional features like document scanning.

As businesses grow, their accounting needs change. Outsourced accounting services easily scale with business growth. Whether a company expands into new markets or experiences seasonal fluctuations, accounting support adjusts accordingly. This flexibility proves particularly valuable for startups and small businesses that may experience rapid growth or changes in their financial needs.

Outsourcing accounting functions allows business owners and managers to concentrate on their core competencies. Instead of spending time on complex financial tasks, they can dedicate their energy to strategic planning, product development, and customer service. This shift in focus often leads to improved overall business performance and growth.

The combination of cost savings, expertise, technology, and flexibility offered by outsourced accounting services positions businesses for smarter financial management and sustainable growth. As we move forward, let’s explore how the outsourced accounting process works in practice and what businesses can expect when they partner with a professional accounting service.

Outsourced accounting starts with a thorough evaluation of your business’s financial needs. We examine your current accounting practices, financial goals, and challenges. This assessment allows us to customize our services to your specific requirements.

After understanding your needs, we establish a robust financial infrastructure. This process involves the setup of cloud-based accounting software (such as QuickBooks Online or Xero), which enables real-time collaboration and data access. We also implement secure data transfer protocols to safeguard your financial information.

Once the foundation is in place, our team takes charge of your daily financial tasks. These include:

A key advantage of outsourced accounting is access to up-to-date financial data. We produce regular financial reports, including:

These reports offer valuable insights into your business’s financial health and performance. Our team can identify revenue stream trends or highlight areas for cost reduction.

Outsourced accounting extends beyond number-crunching. Based on your business data, we provide proactive financial advice. This might include strategies to improve cash flow, such as sending invoices immediately after delivery or considering technologies like Enterprise Resource Planning (ERP). We also keep you informed about tax law changes that could impact your business, helping you make informed decisions.

Regular communication is essential for successful outsourced accounting. We schedule periodic check-ins to review your financial reports, address concerns, and plan for upcoming financial events. Our team remains available to answer questions and provide support as needed. This ongoing dialogue ensures that your financial management aligns with your business goals and adapts to changing circumstances.

Outsourced accounting is a dynamic process that evolves with your business. As your company grows or faces new challenges, we adjust our services accordingly. This flexibility allows you to scale your financial management without hiring additional in-house staff or investing in new accounting systems. Now, let’s explore how to choose the right outsourced accounting partner for your business.

Your ideal accounting partner should possess a proven track record in your specific industry. When seeking outsourced accounting support, evaluate firms’ industry experience, security measures, and whether you’d own your own data or not. Ask potential partners about their experience with businesses similar to yours and request specific examples of how they’ve helped clients in your industry.

In today’s digital landscape, your accounting partner must be tech-savvy. Inquire about the software they use and its compatibility with your existing systems. For example, if you use Salesforce for CRM, ask if the accounting firm has experience with Salesforce-compatible financial tools.

Security is paramount for financial data. The Cost of a Data Breach Report 2024 by IBM revealed that the global average cost of a data breach in 2024 was $4.88 million. Question potential partners about their cybersecurity measures, including encryption methods, multi-factor authentication, and regular security audits.

Understand the exact services included in the partnership. Some firms offer basic bookkeeping, while others provide full-service CFO support. Consider your future growth plans and ensure the accounting firm can scale its services as your business expands. For instance, if you plan to expand internationally, verify that the firm has expertise in international tax law and currency conversions.

Accounting firms typically offer various pricing models, such as hourly rates, fixed monthly fees, or value-based pricing. Request a detailed breakdown of costs and confirm there are no hidden fees. Some firms might charge extra for year-end tax preparation or financial statement audits, so it’s essential to understand the full scope of services included in your agreement.

Effective communication forms the foundation of a successful accounting partnership. Inquire about the firm’s communication protocols, including the frequency of financial reports, availability of a dedicated account manager, and average response time to client queries.

Some firms (like Sager CPA) offer regular check-ins and real-time access to financial data through cloud-based platforms. This level of transparency and accessibility can prove invaluable for making timely business decisions.

Outsourced accounting services for small businesses offer powerful solutions to streamline financial management and drive growth. These services leverage expert knowledge, advanced technology, and cost-effective solutions, allowing businesses to focus on their core competencies. The benefits include significant cost savings, access to expertise on demand, cutting-edge technology without hefty investments, and scalability to meet changing business needs.

Selecting the right accounting partner maximizes these benefits. Companies should look for a firm with industry-specific experience, robust security measures, and a commitment to clear communication. The ideal partner should offer scalable services that can grow with the business and provide transparent pricing structures.

Sager CPA understands the unique financial challenges faced by small businesses. We offer tailored accounting solutions, strategic business advisory services, and comprehensive tax planning to reduce liabilities. Our team provides proactive strategies, customized action plans, and enhanced financial clarity to support informed decision-making and long-term financial stability.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.