High net worth financial planning strategies are essential for preserving and growing substantial wealth. At Sager CPA, we understand the unique challenges faced by high-net-worth individuals in managing their complex financial landscapes.

This blog post explores top strategies for comprehensive asset management, advanced tax planning, and wealth transfer. We’ll provide insights into how these approaches can help secure your financial future and leave a lasting legacy.

At Sager CPA, we recognize that comprehensive asset management forms the foundation of wealth preservation and growth for high net worth individuals. Our approach centers on three key areas: strategic diversification, dynamic rebalancing, and robust risk management.

Diversification extends beyond spreading investments across different asset classes. For high net worth clients, we implement sophisticated diversification strategies that transcend traditional stocks and bonds. This includes capital allocation to alternative investments such as private equity, real estate investment trusts (REITs), and hedge funds. Alternative investments can provide diversification and potentially higher returns, making them an important component of a well-rounded portfolio.

We also prioritize geographic diversification. The MSCI World Index, which tracks developed markets, demonstrates that international exposure can substantially reduce portfolio volatility. Our clients benefit from carefully selected international investments that strike a balance between risk and reward across global markets.

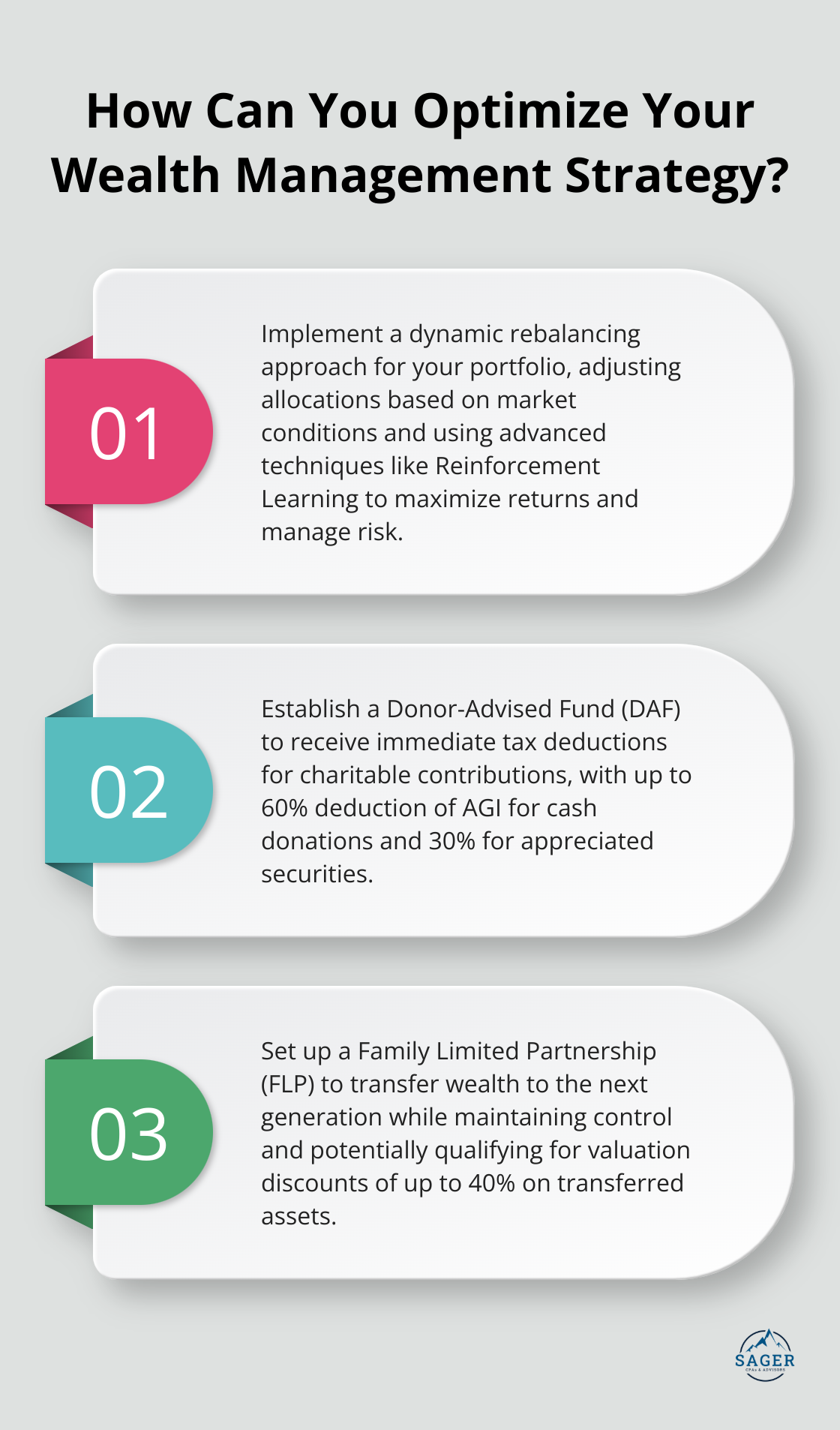

Regular portfolio rebalancing plays a vital role, but timing and execution are paramount. We employ a dynamic rebalancing approach, which adjusts portfolio allocations based on market conditions and individual client goals. This method considers dynamic risks and aims to maximize portfolio returns using advanced techniques such as Reinforcement Learning (RL).

Our rebalancing strategy extends beyond maintaining target allocations. We continuously assess market trends, economic indicators, and geopolitical events to make informed decisions about when and how to rebalance. This proactive approach helps safeguard wealth during market downturns and capitalize on emerging opportunities.

Effective risk management surpasses diversification. We implement sophisticated hedging strategies using options and other derivatives to protect against downside risk. Collar strategies, for instance, prove particularly effective for high net worth individuals with concentrated stock positions, providing downside protection while allowing for some upside potential.

Asset protection constitutes another critical component of our risk management approach. We collaborate closely with legal experts to establish appropriate structures (such as trusts and limited liability companies) to shield assets from potential creditors and lawsuits. The importance of this cannot be overstated, as inadequate protection strategies can lead to significant wealth loss across generations.

Each high net worth individual possesses unique needs and goals. Our comprehensive asset management strategies adapt to each client’s specific situation, ensuring that their wealth not only remains preserved but also positioned for long-term growth. The combination of strategic diversification, dynamic rebalancing, and robust risk management provides our clients with a solid foundation for financial success in an ever-changing economic landscape.

As we move forward, we’ll explore advanced tax planning techniques that complement these asset management strategies, further optimizing your financial position and preserving your hard-earned wealth.

At Sager CPA, we recognize that advanced tax planning is a cornerstone of wealth preservation for high net worth individuals. Our approach extends beyond basic tax compliance, focusing on proactive strategies that minimize tax liabilities and maximize wealth retention.

Tax-loss harvesting serves as a potent strategy in our arsenal. This technique involves selling investments to lower your taxable income and free up cash to reinvest in more promising opportunities. Not only does this strategy help you save on taxes, but it also allows for portfolio optimization.

Timing plays a critical role in this strategy. The wash-sale rule prohibits claiming a loss on a security if you purchase the same or a “substantially identical” security within 30 days before or after the sale. We navigate these rules meticulously, often replacing sold securities with similar (but not identical) investments to maintain your desired market exposure.

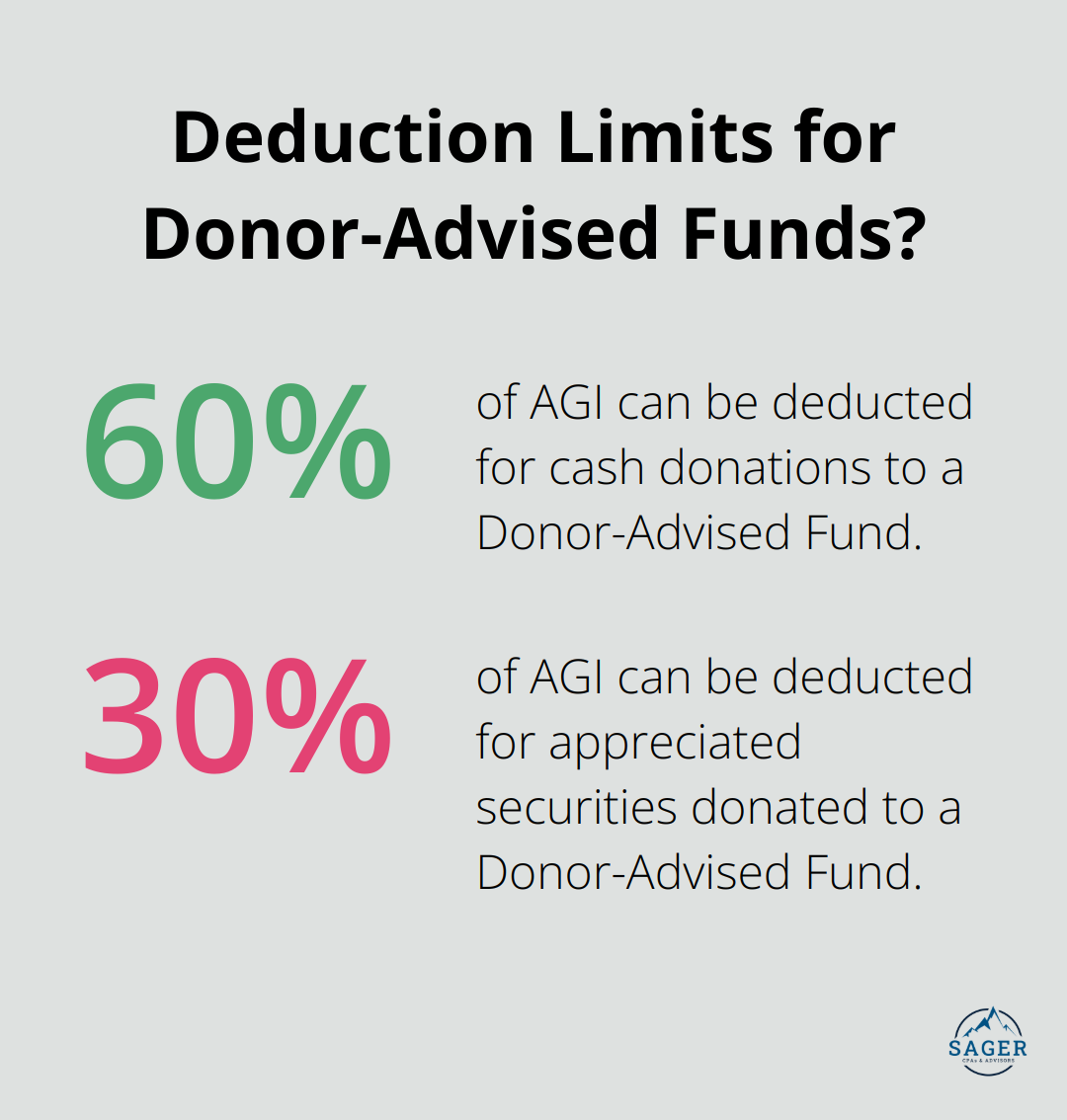

Charitable giving not only supports causes you care about but also yields significant tax benefits. We often recommend the establishment of a Donor-Advised Fund (DAF) for our high net worth clients. A DAF allows you to receive an immediate income tax deduction for your contribution, with up to 60% deduction of AGI for cash donations and up to 30% of AGI for appreciated securities.

For clients with highly appreciated assets, we suggest donating these directly to charity. This strategy allows you to avoid capital gains taxes while still claiming a deduction for the full market value of the asset.

With the current estate tax exemption set to potentially decrease from $12.92 million per individual in 2023 to approximately half that amount in 2026, proactive estate planning is essential. We work closely with estate attorneys to implement strategies such as irrevocable life insurance trusts (ILITs) and grantor retained annuity trusts (GRATs) to minimize estate tax exposure.

Annual gifting serves as another key strategy. In 2023, you can give up to $17,000 per recipient without incurring gift tax. For married couples, this means potentially transferring $34,000 per recipient annually, tax-free. Over time, this can significantly reduce your taxable estate.

We also explore more advanced techniques like family limited partnerships (FLPs) or limited liability companies (LLCs). These structures facilitate the transfer of wealth to the next generation while maintaining control and potentially qualifying for valuation discounts.

At Sager CPA, we understand that tax planning requires a tailored approach. We customize our strategies to each client’s unique financial situation, goals, and risk tolerance. The integration of these advanced tax planning techniques with comprehensive asset management forms a solid foundation for effective wealth preservation and growth.

As we move forward, we’ll explore wealth transfer and legacy planning strategies that complement these tax optimization techniques, ensuring a comprehensive approach to your financial future.

Trusts offer flexibility, control, and tax advantages in wealth transfer. Irrevocable trusts also avoid the probate process, which both protects from taxes and unwanted scrutiny, but also speeds up the estate process. Grantor Retained Annuity Trusts (GRATs) transfer appreciating assets to beneficiaries with minimal gift tax consequences.

A study by Wealth-X reveals that 68% of ultra-high-net-worth individuals use trusts in their wealth transfer strategy. Trust attorneys design and implement trust structures tailored to each client’s unique needs and goals.

Family Limited Partnerships enable you to pass on wealth to your heirs while shielding them from high estate taxes, allowing you to transfer wealth for generations. FLPs allow gifting of limited partnership interests to family members at a discounted value for gift tax purposes, resulting in potential tax savings.

The American Institute of CPAs found that FLPs can achieve valuation discounts of up to 40% on transferred assets. Correct structuring and operation of FLPs withstand IRS scrutiny. Experienced professionals set up and manage FLPs to meet wealth transfer goals and regulatory requirements.

Philanthropic planning supports causes and reduces tax burdens. Private foundations provide the highest level of control and flexibility in charitable giving. The National Center for Family Philanthropy reports that family foundations donate an average of $454,000 annually to charitable causes.

Donor-Advised Funds (DAFs) offer a hands-off approach with immediate tax benefits. DAFs allow grant recommendations to charities over time. Fidelity Charitable reports that the average DAF account makes 10 grants per year, with an average grant size of $4,200.

Effective wealth transfer and legacy planning require a comprehensive, long-term approach. The combination of trusts, family limited partnerships, and strategic philanthropic planning ensures that wealth benefits families and communities for generations. Staying informed about legal and tax developments provides cutting-edge strategies that protect and grow legacies.

Each high-net-worth individual has unique goals and circumstances. Tailored strategies (incorporating trusts, FLPs, and philanthropic planning) address specific needs and preferences. This personalized approach maximizes the effectiveness of wealth transfer and legacy planning efforts.

High net worth financial planning strategies form the cornerstone of effective wealth management. We at Sager CPA have explored key approaches that include comprehensive asset management, advanced tax planning techniques, and strategic wealth transfer methods. These strategies provide a solid foundation for long-term financial success, minimizing tax liabilities and ensuring your legacy benefits future generations.

The complexities of high net worth planning demand personalized advice tailored to your unique circumstances and goals. At Sager CPA, we specialize in providing expert financial management and tax planning services designed for high-net-worth individuals and businesses. Our proactive approach and customized action plans support informed financial decisions.

We invite you to schedule a consultation with Sager CPA to create a personalized financial strategy (aligned with your long-term objectives). Our expertise and tailored solutions can help optimize your financial position, minimize risks, and secure a lasting legacy. Partner with professionals who understand the nuances of high net worth planning to navigate the intricate landscape of wealth management effectively.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.