Tax planning for 2024 is more important than ever. With new tax laws and economic shifts on the horizon, staying ahead of the curve is essential for your financial well-being.

At Sager CPA, we’ve compiled a comprehensive guide to help you navigate the complexities of the upcoming tax year. Our expert tips will empower you to make informed decisions and potentially reduce your tax liability.

The tax landscape will shift in 2024, and taxpayers must understand the changes that will impact their financial planning. This chapter explores the key updates you need to know.

The IRS has announced inflation adjustments for 2025 that will affect tax brackets and standard deductions. For heads of households, the standard deduction will be $22,500 for tax year 2025, an increase of $600 from the amount for tax year 2024. These adjustments can significantly impact your tax liability, potentially pushing you into a lower tax bracket or making the standard deduction more beneficial than itemizing.

Retirement savers will benefit from increased contribution limits for various accounts. The contribution limit for 401(k), 403(b), and most 457 plans will rise to $23,000 for 2024 (up from $22,500 in 2023). Individuals 50 or older can make an additional catch-up contribution of $7,500, bringing their total potential contribution to $30,500. For Individual Retirement Accounts (IRAs), the limit will increase to $7,000, with an extra $1,000 catch-up contribution for those 50 and older.

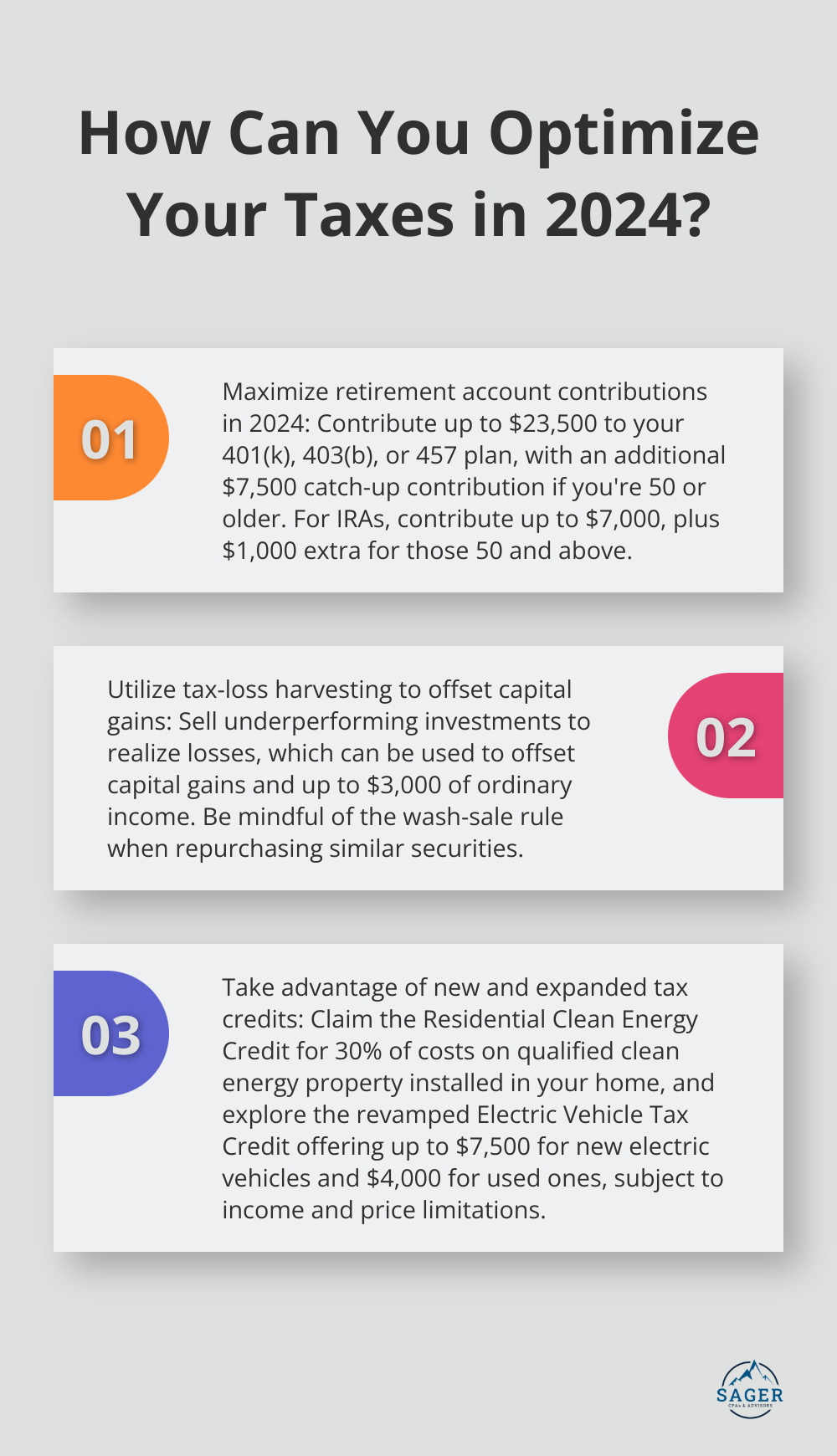

Several new tax credits and deductions will be introduced or modified for 2024. The Inflation Reduction Act has extended and expanded various energy-related tax credits. For instance, the Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. Additionally, the Electric Vehicle Tax Credit has been revamped, potentially offering up to $7,500 for qualifying new electric vehicles and $4,000 for used ones (subject to income limitations and vehicle price caps).

Businesses will also see changes in 2024. The corporate tax rate will remain at 21%, but there will be modifications to deductions and credits. For example, the Research and Development (R&D) tax credit will become more generous, allowing businesses to claim up to $500,000 in credit (up from $250,000 in previous years). Small businesses (those with gross receipts of $5 million or less) will be able to use the credit against payroll taxes.

These changes present both opportunities and challenges for taxpayers. A proactive approach to tax planning can help you take full advantage of these new provisions while navigating potential pitfalls. As we move into the next section, we’ll explore specific strategies to reduce your tax liability and optimize your financial position for the coming year.

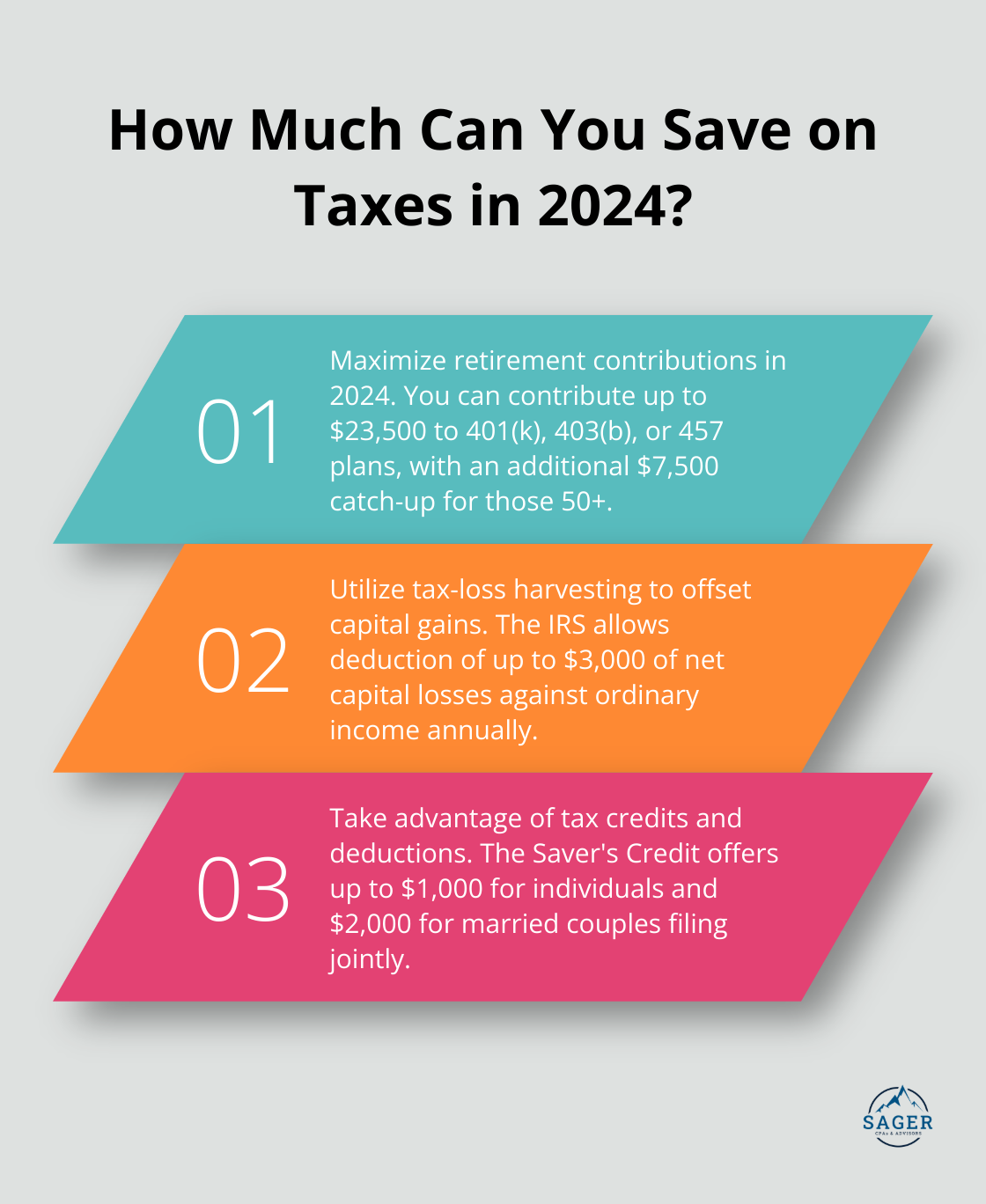

Tax planning involves making smart financial moves that can significantly reduce your tax burden. We’ve identified several powerful strategies that can help you keep more money in your pocket this year.

One of the most effective ways to lower your taxable income is to maximize contributions to tax-advantaged retirement accounts. For 2024, you can contribute up to $23,500 to your 401(k), 403(b), or 457 plan. If you’re 50 or older, you can add an extra $7,500 as a catch-up contribution. Don’t overlook IRAs either – you can put away $7,000, plus an additional $1,000 if you’re 50+. These contributions not only secure your future but also provide immediate tax benefits by reducing your taxable income.

Timing is everything when it comes to tax planning. If you’re self-employed or have control over when you receive income, consider deferring some earnings to 2025 if you expect to be in a lower tax bracket next year. Conversely, if you anticipate being in a higher bracket in 2025, accelerating income into 2024 might be wise. The same principle applies to deductible expenses – group them in the year when they’ll provide the most tax benefit. For example, if you’re close to the threshold for itemizing deductions, consider making your January 2025 mortgage payment in December 2024 to boost your mortgage interest deduction for the current year.

Tax-loss harvesting is a sophisticated strategy that can save you thousands in taxes. This involves offsetting capital gains with capital losses to lower your tax bill and better position your portfolio going forward. The IRS allows you to deduct up to $3,000 of net capital losses against your ordinary income each year (with any excess carried forward to future years). Be cautious of the wash-sale rule, which disallows the loss if you repurchase the same or a substantially identical security within 30 days before or after the sale.

Take full advantage of available tax credits and deductions. Some often-overlooked opportunities include:

Strategic charitable giving can reduce your tax bill while supporting causes you care about. Consider:

Implementing these strategies requires careful planning and execution. While the potential tax savings are substantial, it’s crucial to consider your overall financial picture and long-term goals. Working with experienced professionals can help you navigate the complexities of tax law and make informed decisions that optimize your financial position for years to come.

As we move forward, let’s explore how these tax planning strategies can be tailored to different life stages and financial situations.

Tax planning evolves as you progress through different life stages. Young professionals should prioritize early contributions to retirement accounts. Even small contributions to a 401(k) or IRA can reduce taxable income significantly. The power of compound interest means early starts lead to substantial long-term gains.

Families with children should take advantage of the Child Tax Credit (up to $2,000 per qualifying child under 17). The Child and Dependent Care Credit offers relief for working parents who pay for childcare. These credits directly reduce your tax bill and may result in a larger refund.

First-time homebuyers should consider potential tax deductions for mortgage interest and property taxes. However, the increased standard deduction requires careful calculation to determine if itemizing these deductions will benefit you.

As careers advance and incomes rise, tax planning becomes more complex. High-income earners often face the Alternative Minimum Tax (AMT), which can limit certain deductions. It’s important to work with a tax professional to navigate this complexity and explore strategies like timing income recognition or accelerating deductions.

Business owners have unique opportunities for tax planning. The choice of business structure (sole proprietorship, LLC, S-Corp, etc.) can impact your tax liability significantly. Each structure has different rules for income recognition, deductions, and self-employment taxes. S-Corps can potentially reduce self-employment taxes by paying owners a reasonable salary and taking additional income as distributions.

Maximizing retirement contributions becomes even more important in this stage. High-income earners who max out their 401(k) contributions should consider a backdoor Roth IRA strategy to further reduce taxable income in retirement.

As retirement nears, tax planning shifts focus to managing distributions and preserving wealth. One key strategy is Roth conversions. Converting traditional IRA funds to a Roth IRA can benefit you if you expect to be in a higher tax bracket in retirement. While you’ll pay taxes on the converted amount now, future withdrawals will be tax-free.

It’s important to understand Required Minimum Distributions (RMDs). Once you reach age 73, you must start taking distributions from most retirement accounts. Failure to take RMDs can result in hefty penalties. However, if you’re still working, you may delay RMDs from your current employer’s 401(k) plan.

Estate planning becomes increasingly important at this stage. The current estate tax exemption is historically high, but it’s set to decrease in 2026. Try strategies like gifting assets to family members or setting up trusts to minimize potential estate taxes.

Tax planning is a dynamic process that should adapt to your life circumstances. While these strategies provide a starting point, individual situations vary greatly. Consulting with a qualified tax professional can help you develop a customized plan of action that aligns with your specific goals and life stage.

Tax planning for 2024 requires a proactive and informed approach. The strategies we discussed can significantly reduce your tax liability, but they must align with your unique financial situation and goals. Your life stage, income level, and long-term objectives all influence the most effective tax planning methods for you.

Sager CPA offers comprehensive tax planning services tailored to individual needs. We help you navigate the complexities of tax law, ensuring you maximize available deductions and credits. Our team of experts works closely with you to create a customized action plan for long-term financial success.

Professional tax planning can transform tax season from a stressful obligation into an opportunity for financial optimization. Don’t leave money on the table in 2024 (and beyond). Take control of your tax situation and set yourself up for success with expert guidance from Sager CPA.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.