The 2024 tax planning tables are out, and they bring significant changes for taxpayers. At Sager CPA, we’ve analyzed these updates to help you navigate the evolving tax landscape.

Understanding these changes is key to optimizing your financial strategy and minimizing your tax burden in the coming year. Let’s explore the major shifts in tax brackets, deductions, and credits that will impact your 2024 tax planning.

The 2024 tax planning tables introduce significant changes that will affect your financial strategy. These updates require careful consideration to optimize your tax planning for the coming year.

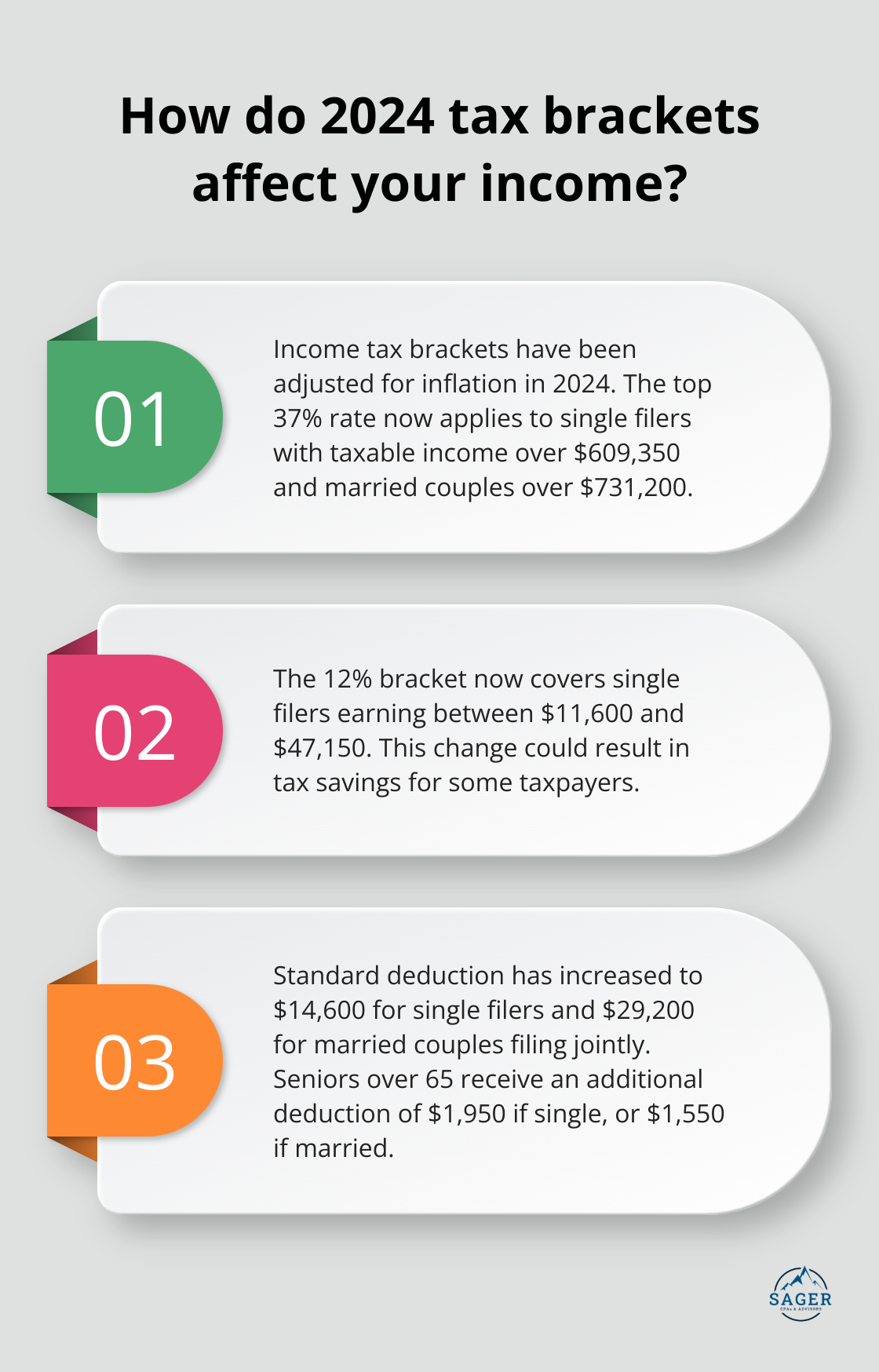

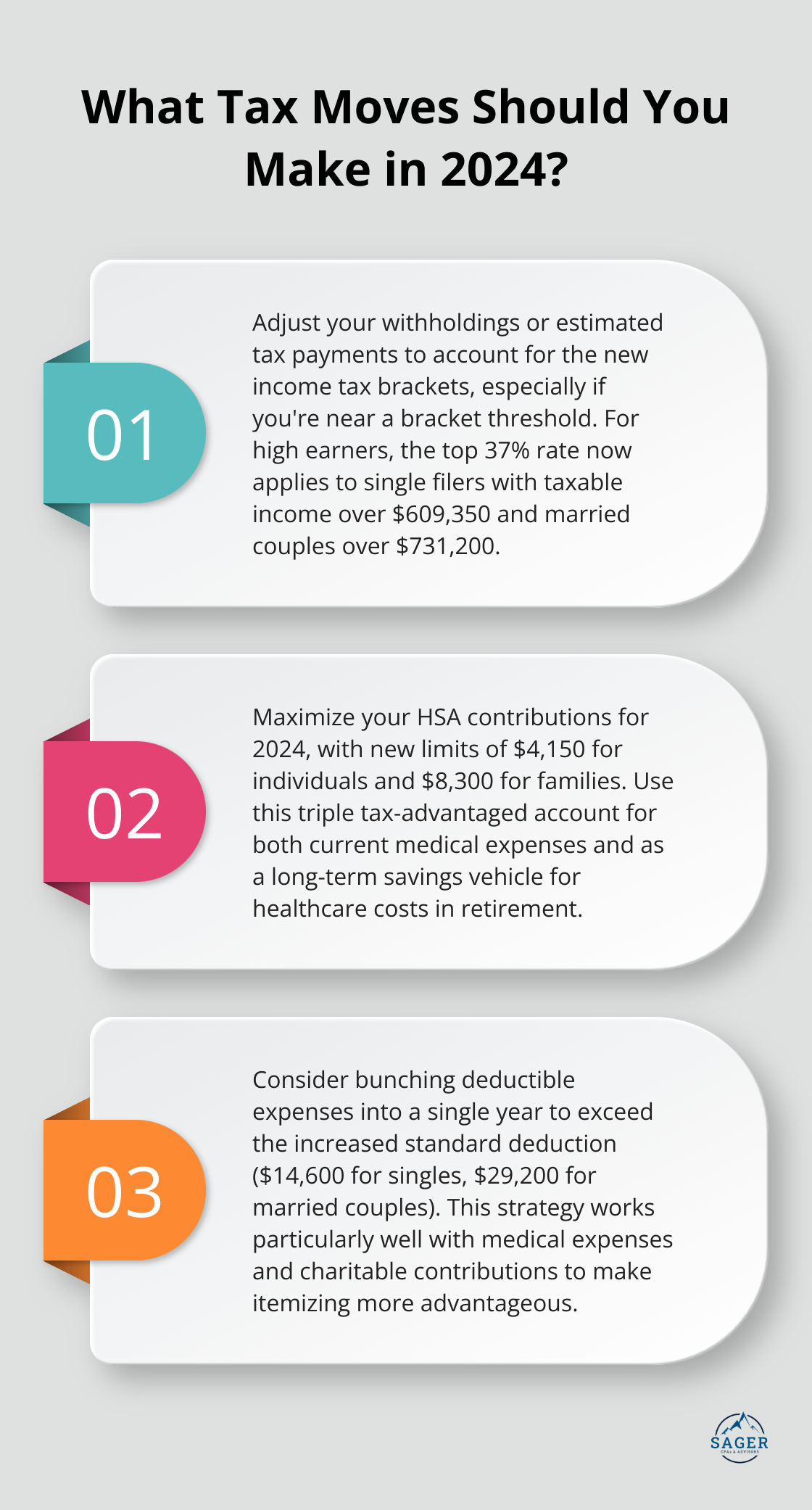

For 2024, the IRS has adjusted income tax brackets for inflation. The top marginal tax rate of 37% now applies to single filers with taxable income over $609,350 and married couples over $731,200. This increase from 2023 will potentially affect high-income earners.

Lower brackets also see substantial changes. The 12% bracket now covers single filers earning between $11,600 and $47,150 (up from the previous year). This adjustment could result in tax savings for taxpayers who now fall into a lower bracket.

The standard deduction has received a significant boost for 2024. Single filers can now claim $14,600, while married couples filing jointly will see a deduction of $29,200. This $750 increase for singles and $1,500 for couples could lead to substantial tax savings for those who don’t itemize deductions.

Seniors over 65 receive an additional benefit, with an extra deduction of $1,950 if single, or $1,550 if married. This change acknowledges the unique financial challenges faced by older taxpayers.

The capital gains tax rates for 2024 have also changed. The 0% rate now applies to single filers with taxable income up to $47,025, while the 20% rate kicks in for income over $518,900. This change could impact investment strategies, particularly for those near these thresholds.

Long-term investors should pay close attention to these new limits. Strategic timing of asset sales could result in significant tax savings. For instance, realizing gains in a year when your income is lower might allow you to take advantage of the 0% rate.

The changes in tax brackets and deductions will also affect retirement planning strategies. The increased standard deduction might influence decisions about traditional versus Roth IRA contributions. Higher-income earners might need to reassess their retirement savings approach in light of the new top tax bracket threshold.

Business owners (especially those with pass-through entities) will need to review their tax strategies in light of these changes. The adjustments to individual tax brackets can affect decisions about business structure, profit distribution, and personal income management.

These updates to the 2024 tax planning tables present both challenges and opportunities. A thorough review of your financial situation in light of these changes will help you make informed decisions to optimize your tax strategy for the coming year. The next section will explore how these changes interact with various tax credits and deductions, providing a more comprehensive picture of your 2024 tax landscape.

The 2024 tax year introduces significant updates to credits and deductions that will affect your tax strategy. These changes can impact your overall tax burden and provide opportunities for tax planning.

The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return.

The CTC phases out for single filers with modified adjusted gross income (MAGI) exceeding $200,000 and for married couples filing jointly with MAGI over $400,000. Planning your income around these thresholds can help maximize your credit eligibility.

The Earned Income Tax Credit (EITC) receives a boost in 2024. Use the EITC tables to look up maximum credit amounts by tax year. If you are unsure if you can claim the EITC, use the EITC Qualification Assistant.

The increased standard deduction for 2024 may lead more taxpayers to choose this option. However, itemizing deductions can still benefit some taxpayers. The state and local tax (SALT) deduction remains capped at $10,000, but other itemized deductions have seen adjustments.

The medical expense deduction threshold stays at 7.5% of adjusted gross income (AGI). You can deduct medical expenses that exceed 7.5% of your AGI, potentially providing significant tax savings for those with high healthcare costs.

Charitable contributions continue to reduce taxable income for those who itemize. While the temporary above-the-line deduction for cash donations (available even to those who don’t itemize) has expired, strategic charitable giving can still yield tax benefits.

The mortgage interest deduction limit remains at $750,000 of acquisition indebtedness for homes purchased after December 15, 2017. Interest on home equity loans is only deductible if the loan is used to buy, build, or substantially improve the home that secures the loan.

These updates to tax credits and deductions for 2024 create opportunities for strategic tax planning. Understanding how these changes apply to your specific financial situation allows you to make informed decisions to optimize your tax position. The next section will explore strategies to maximize these tax benefits and minimize your overall tax burden in 2024.

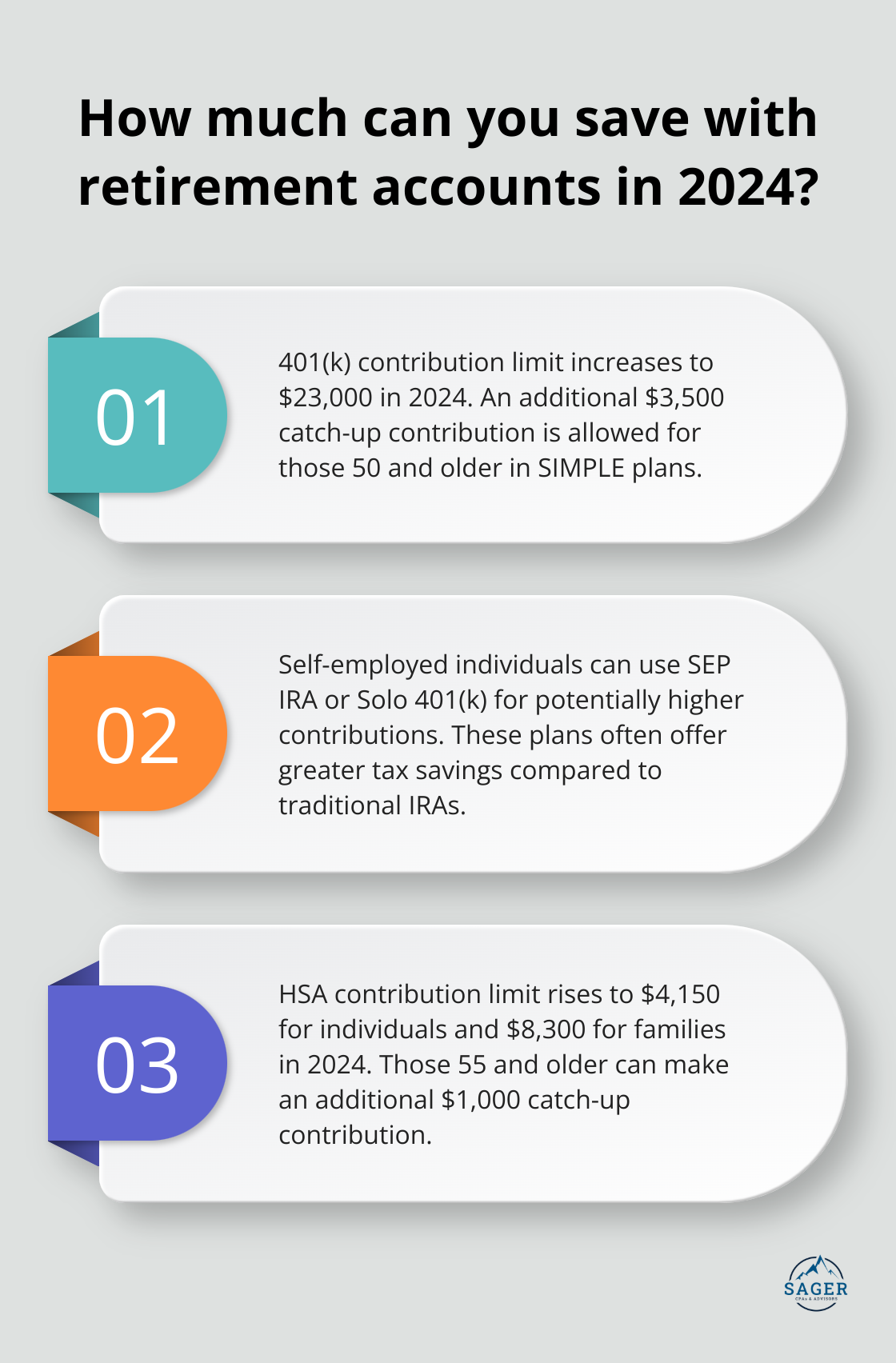

The 2024 tax year offers new opportunities to reduce your tax burden through retirement account contributions. The 401(k) contribution limit increases to $23,000, with an additional $3,500 catch-up contribution for those 50 and older participating in SIMPLE plans. This change allows you to significantly lower your taxable income.

Self-employed individuals or small business owners should consider a Simplified Employee Pension (SEP) IRA or a Solo 401(k). These plans often permit higher contribution limits compared to traditional IRAs, potentially resulting in greater tax savings.

Health Savings Accounts (HSAs) provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2024, the HSA contribution limit rises to $4,150 for individuals and $8,300 for families (with an additional $1,000 catch-up contribution for those 55 and older).

HSAs don’t have a “use it or lose it” policy, unlike Flexible Spending Accounts (FSAs). Unused funds roll over year to year, making HSAs an excellent tool for long-term healthcare cost planning and potential retirement savings.

Your tax liability can be significantly impacted by the strategic timing of income and expenses. Self-employed individuals or those with control over income receipt should consider deferring income to the following year if they expect to be in a lower tax bracket.

Conversely, accelerating income into the current year might benefit those who anticipate being in a higher tax bracket next year. This could involve earlier client invoicing or taking distributions from retirement accounts (if over 59½).

For expenses, try to bunch deductible items into a single year to exceed the standard deduction threshold, making itemizing more advantageous. This strategy works particularly well with medical expenses and charitable contributions.

If you’re close to the medical expense deduction threshold (7.5% of your AGI), schedule and pay for elective procedures before year-end to maximize your deduction.

Implement tax-efficient investment strategies to minimize your tax burden. Consider holding investments for more than a year to qualify for long-term capital gains rates, which are typically lower than short-term rates.

Tax-loss harvesting can offset capital gains and reduce your taxable income. This involves selling underperforming investments to realize losses, which can then be used to offset gains in other areas of your portfolio.

Tax planning is not a one-size-fits-all approach. Your specific financial situation, income level, and long-term goals all play a role in determining the most effective strategies for you. A professional tax advisor can create personalized tax strategies that align with your unique circumstances and objectives.

The 2024 tax planning tables introduce significant changes that impact taxpayers across various income levels. These updates create new opportunities for strategic financial planning, from adjusted income tax brackets to increased standard deductions. The shifts in tax credits and deductions underscore the importance of staying informed about the evolving tax landscape.

Proactive tax planning becomes more important in light of these changes. Understanding how the new tax tables affect your specific financial situation allows you to make informed decisions to optimize your tax position. This may involve maximizing retirement account contributions, leveraging Health Savings Accounts, or timing income and expenses strategically.

Sager CPA specializes in providing expert financial management and tax planning services tailored to both individuals and businesses. Our team offers comprehensive tax planning strategies to reduce liabilities, precise accounting, and strategic advisory services. We work closely with our clients to develop customized action plans, ensuring they make the most of the new tax landscape while fostering long-term financial stability and growth.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.