Financial clarity is the cornerstone of successful business management. Without it, companies risk making uninformed decisions that can lead to costly mistakes and missed opportunities.

At Sager CPA, we’ve seen how clarity in financial management can transform businesses, enabling them to make strategic choices with confidence and precision.

This guide will explore the key components of financial clarity and provide practical strategies to achieve it in your organization.

Financial clarity enables businesses to identify the strengths and weaknesses of their financial position and build a clear picture of their financial status. It empowers you to make informed decisions that propel your business forward.

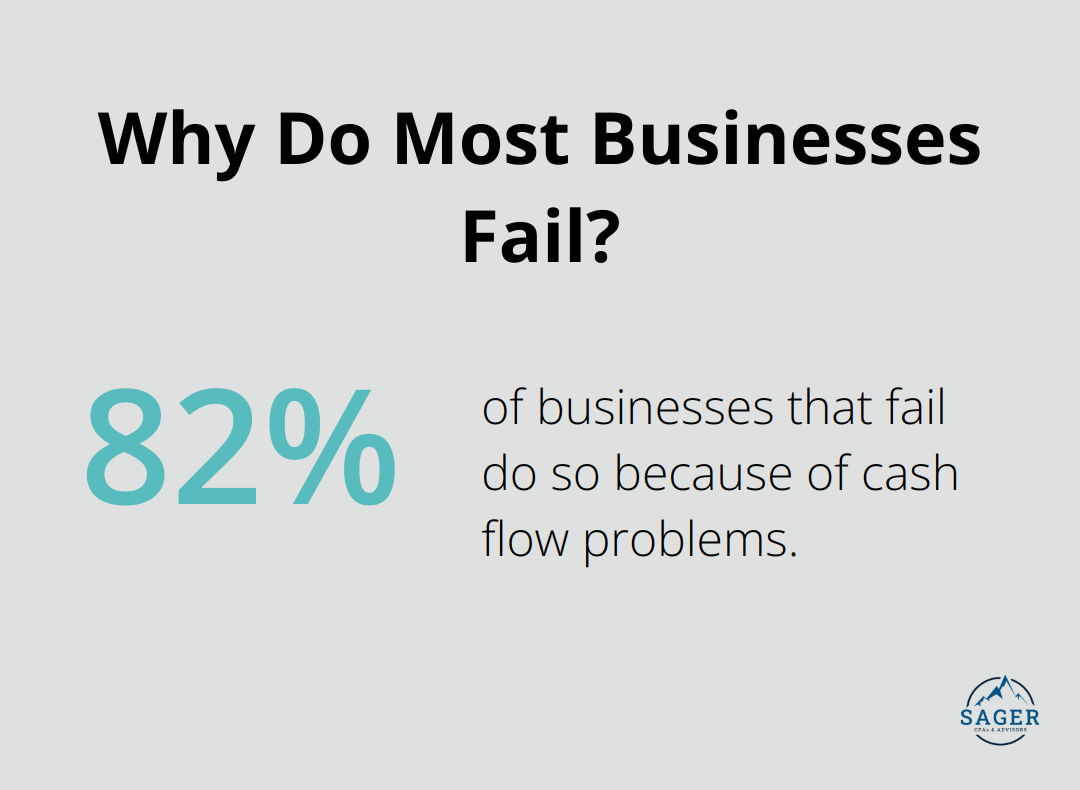

Clear financial management transforms businesses of all sizes. A study by the Small Business Administration reveals that 82% of failed businesses cite cash flow problems as a contributing factor. This statistic highlights the critical nature of maintaining financial clarity.

With a clear financial view, you can:

The path to financial clarity often presents challenges. Many businesses encounter obstacles that obscure their financial picture. Outdated or inaccurate financial data stands as a major hurdle. A FloQast survey found that 40% of accounting professionals dedicate over a week per month to financial close processes, often due to manual data entry and reconciliation issues.

The absence of standardized financial processes also poses a significant challenge. Without consistent methods for tracking and reporting financial data, obtaining a clear picture of your financial health becomes difficult.

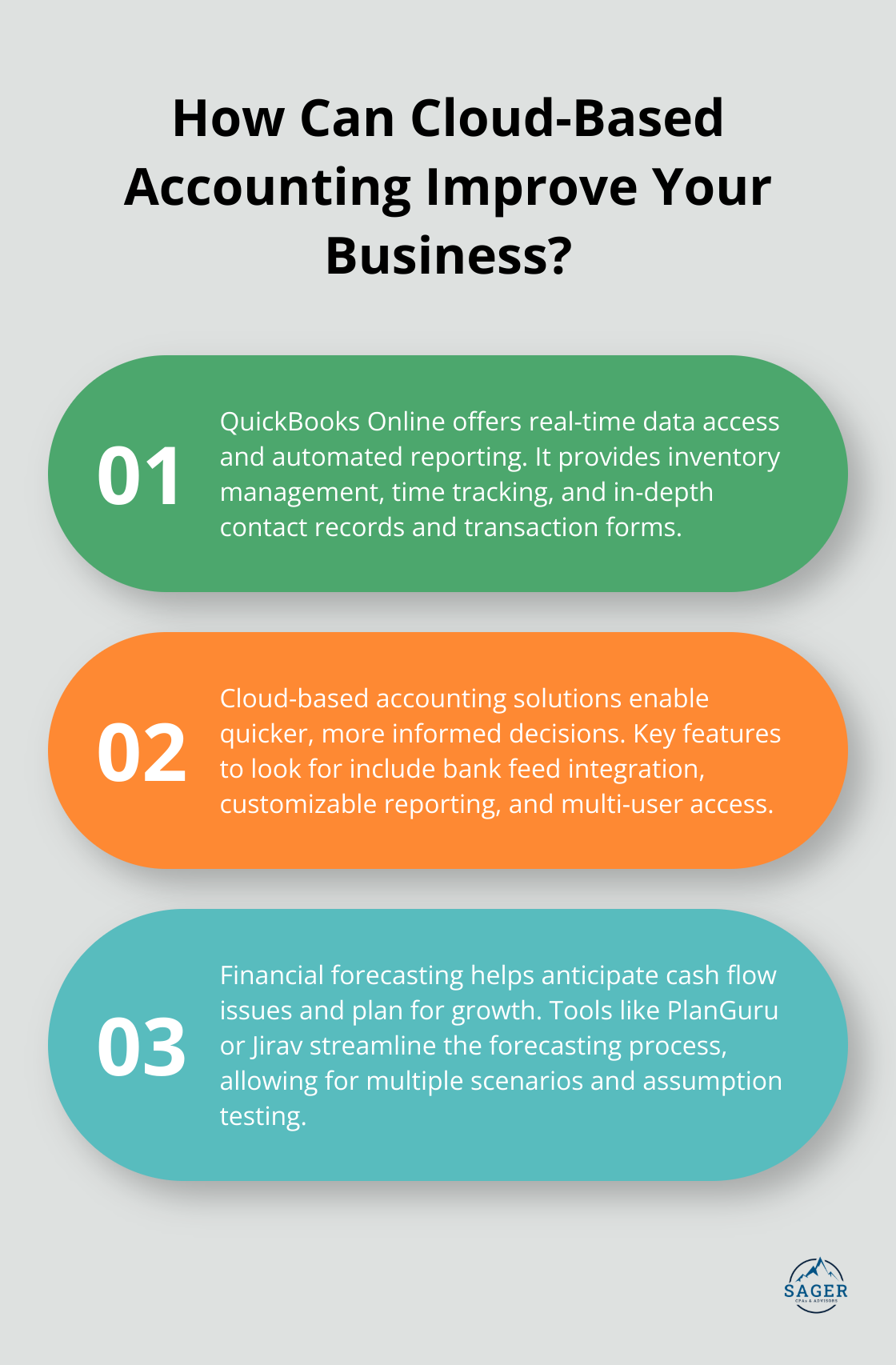

Powerful tools exist to help businesses overcome these challenges. Cloud-based accounting software (such as QuickBooks or Xero) automates many financial processes, reducing errors and providing real-time financial data. These platforms can save businesses an average of 11 hours per month on bookkeeping tasks (according to an Intuit study).

For more complex financial management needs, professional accounting firms offer invaluable insights and expertise. They can help implement robust financial systems, conduct regular financial health checks, and provide strategic advice to keep your business on track. (Sager CPA stands out as a top choice in this regard.)

Investing in financial education for yourself and your team proves crucial. A study by the Financial Industry Regulatory Authority found that individuals with higher financial literacy more likely engage in beneficial financial behaviors. This principle applies equally to business. When you and your team understand financial concepts and reports, you become better equipped to use that information to drive your business forward.

As we move forward, let’s explore the key components that form the foundation of clear financial management. Understanding these elements will help you build a solid framework for achieving and maintaining financial clarity in your organization.

Financial clarity goes beyond numbers on a spreadsheet. It requires understanding those numbers and using them to propel your business forward. Four key elements form the foundation of clear financial management.

Timely and accurate reporting stands as the cornerstone of financial clarity. To truly unlock the opportunities in big data, management accountants will need to partner more closely with key stakeholders in their organization.

To achieve this:

This discipline ensures you always have current financial data at your fingertips.

Effective budgeting and forecasting prove essential for navigating your business’s financial future. A PwC survey revealed that companies with effective forecasting processes are 1.5 times more likely to be top performers in their industry.

Try these strategies:

This approach allows you to anticipate challenges and seize opportunities before they arise.

Cash flow management can determine a business’s success or failure. A U.S. Bank study found that 82% of business failures result from poor cash management. To avoid this fate, implement robust cash flow tracking and forecasting.

Key steps include:

Consider using invoice factoring or lines of credit to bridge temporary cash gaps.

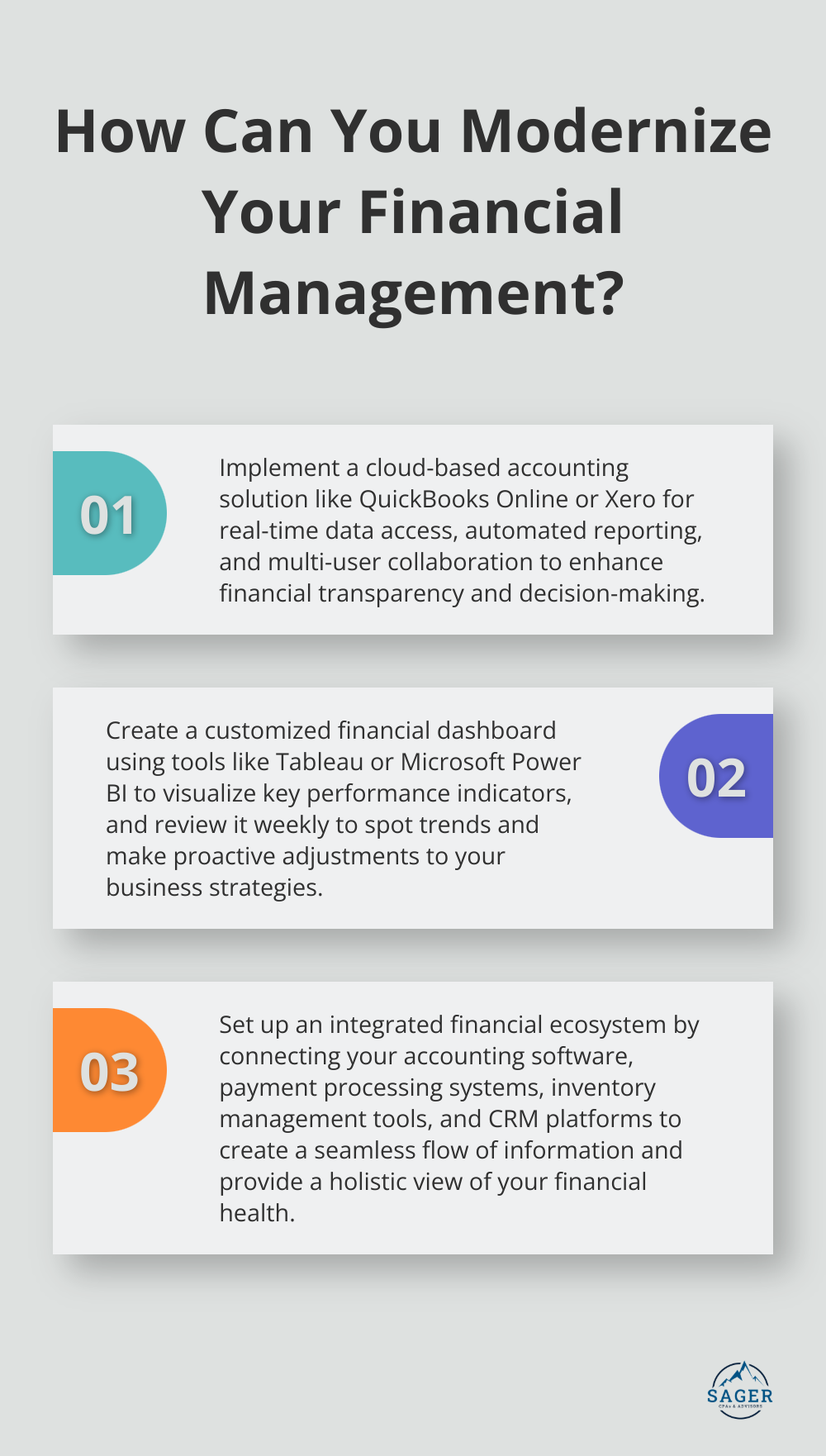

Modern technology offers powerful tools to enhance financial clarity. Cloud-based accounting software (such as QuickBooks or Xero) automates many financial processes, reducing errors and providing real-time financial data. These platforms can save businesses an average of 11 hours per month on bookkeeping tasks (according to an Intuit study).

For more complex financial management needs, professional accounting firms offer invaluable insights and expertise. They can help implement robust financial systems, conduct regular financial health checks, and provide strategic advice to keep your business on track. (Sager CPA stands out as a top choice in this regard.)

With these building blocks in place, you’ll create a solid foundation for clear financial management. This clarity will empower you to make informed decisions, seize opportunities, and navigate challenges with confidence. The next section will explore practical strategies to implement these building blocks effectively in your organization.

Manual bookkeeping wastes time and introduces errors. Implement a robust accounting system as your first step towards financial clarity. Cloud-based software like QuickBooks or Xero automates many accounting tasks, saving time and reducing errors. A study by Sage found that businesses using cloud accounting software spend 15% less time on administrative tasks.

Choose software that integrates with your bank accounts and credit cards. This integration allows automatic transaction imports, significantly reducing manual data entry. Set up rules to categorize transactions automatically, further streamlining your bookkeeping process.

Financial clarity requires ongoing attention. Schedule weekly, monthly, and quarterly financial reviews to stay on top of your numbers. Regular financial reviews can bring numerous benefits like improved savings, better investment decisions, and more. During these reviews, analyze key performance indicators (KPIs) such as revenue growth, profit margins, and cash flow.

Use these reviews to identify trends, spot potential issues early, and make data-driven decisions.

While DIY financial management works for some, most businesses benefit from professional guidance. A survey by Wasp Barcode Technologies revealed that 60% of small business owners feel they aren’t very knowledgeable about accounting and finance.

Consider partnering with a financial advisor or CPA firm to gain expert insights and ensure compliance with tax laws and regulations. (Sager CPA stands out as a top choice for tailored financial advisory services to help businesses achieve and maintain financial clarity.)

Empower yourself and your team with financial knowledge. The National Financial Educators Council reports that 88% of Americans believe financial education should be taught in schools. Don’t wait for formal education – take the initiative to learn.

Attend workshops, webinars, or online courses on financial management. Encourage your team to do the same. The more everyone understands about finance, the better equipped you’ll be to maintain financial clarity.

Numbers alone can overwhelm. Data visualization tools transform complex financial data into easy-to-understand charts and graphs. A study by the Aberdeen Group found that companies using visual data discovery tools are 28% more likely to find timely information than those relying on traditional business intelligence tools.

Try tools like Tableau or Microsoft Power BI to create visual representations of your financial data (these visuals can help you quickly identify trends and make informed decisions).

Implement proactive tax planning to boost efficiency and potentially save money. By staying ahead of tax obligations and leveraging available strategies, you can enhance your overall financial management and clarity.

Financial clarity management empowers businesses to make informed decisions and navigate challenges confidently. We explored essential components and strategies to achieve this clarity throughout this guide. Implementing robust accounting systems, conducting regular financial reviews, and leveraging professional expertise help businesses gain a comprehensive understanding of their financial position.

Automation tools and data visualization software enhance clarity, transforming complex financial data into actionable insights. Investing in financial education for yourself and your team proves important in maintaining long-term financial clarity. As your understanding of financial concepts grows, so does your ability to interpret and act upon financial data effectively.

Sager CPA understands the transformative power of financial clarity. Our expert team offers tailored financial management and tax planning services designed to enhance your financial understanding and decision-making capabilities. We provide the tools and insights necessary to achieve and maintain clarity in your financial management (from precise accounting to comprehensive tax planning).

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.