Retirement tax planning can be a complex maze, but it’s a critical aspect of securing your financial future. At Sager CPA, we’ve seen firsthand how proper planning can significantly impact our clients’ retirement savings and quality of life.

Partnering with a retirement tax planning CPA can help you navigate the intricacies of retirement accounts, withdrawal strategies, and tax-saving opportunities. This blog post will guide you through essential strategies and highlight how professional expertise can optimize your retirement tax plan.

Retirement accounts present various tax implications that can significantly affect your financial future. Traditional IRAs and 401(k)s offer tax-deferred growth, with taxes paid on withdrawals in retirement. Roth IRAs and Roth 401(k)s, however, provide tax-free withdrawals if specific conditions are met. A 2022 report by the Investment Company Institute revealed that about 60 million American households have at least one IRA, underscoring the importance of understanding these accounts’ tax implications.

High-income earners can leverage backdoor Roth IRA conversions as a powerful strategy. This involves contributing to a traditional IRA and then converting it to a Roth IRA, potentially allowing those who exceed income limits to still benefit from Roth accounts.

The tax treatment of retirement withdrawals varies based on the account type. Traditional IRA and 401(k) withdrawals are taxed as ordinary income. For example, if you’re in the 22% tax bracket, a $10,000 withdrawal could result in $2,200 in taxes.

Roth account withdrawals, conversely, are generally tax-free if you’re over 59½ and have held the account for at least five years. This can significantly impact your tax liability management in retirement.

Strategic withdrawal planning is essential. If you have both traditional and Roth accounts, you might choose to withdraw from your Roth account in high-income years to avoid pushing yourself into a higher tax bracket.

Required Minimum Distributions (RMDs) often surprise retirees. RMDs must start at age 73 for traditional IRAs and most 401(k)s. The IRS calculates these mandatory withdrawals based on your account balance and life expectancy.

Failure to take RMDs can result in an excise tax of 25% on the amount not withdrawn, which can be reduced to 10% if corrected in a timely manner.

Interestingly, Roth IRAs don’t require RMDs during the owner’s lifetime, which can be a significant advantage for estate planning. However, inherited Roth IRAs are subject to RMDs for non-spouse beneficiaries.

To minimize your tax burden in retirement, consider implementing tax-efficient withdrawal strategies. One approach involves balancing withdrawals from different account types to manage your tax bracket. For example, you might combine withdrawals from taxable accounts, tax-deferred accounts, and tax-free accounts to optimize your tax situation.

Another strategy involves Roth conversions in low-income years. This allows you to pay taxes on the converted amount at a lower rate, potentially reducing your overall tax liability in retirement.

As you plan your retirement tax strategy, it’s important to consider how these various aspects of retirement account taxation interact. The next section will explore additional strategies for minimizing retirement taxes, including charitable giving and its tax advantages.

Roth IRA conversions offer a powerful strategy to reduce your tax burden during retirement. This approach involves transferring funds from a traditional IRA to a Roth IRA, paying taxes on the converted amount now to enjoy tax-free withdrawals later. The key lies in strategic timing of these conversions.

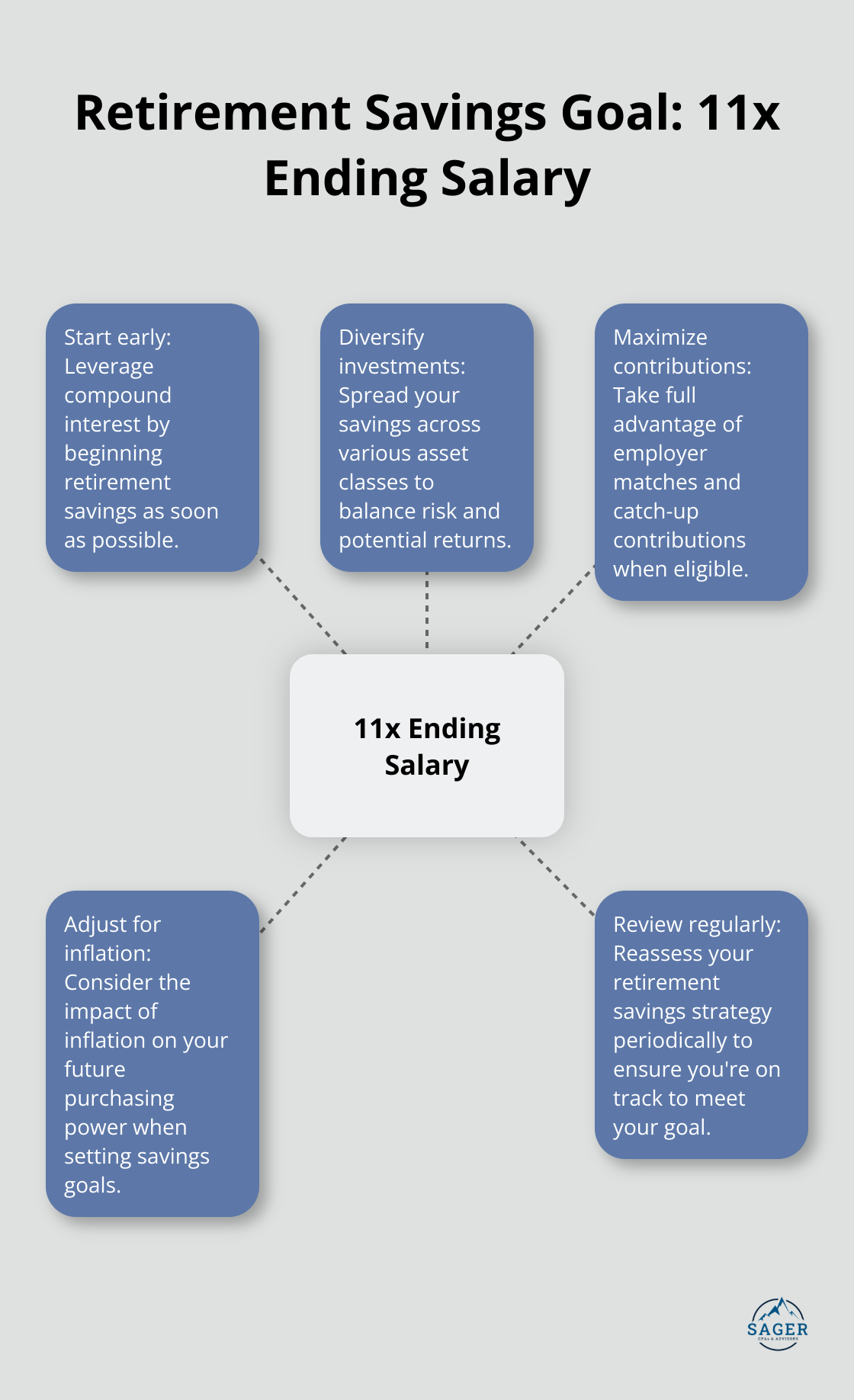

If your current tax bracket is lower than your expected retirement tax bracket, a Roth conversion could result in significant long-term tax savings. T. Rowe Price analysis shows that you should have 11 times your ending salary saved by the time you retire.

However, you must plan these conversions carefully. Converting too much in a single year could push you into a higher tax bracket, potentially negating the benefits. Work with a CPA to determine the optimal amount to convert each year based on your current and projected future tax situations.

The order in which you withdraw from your retirement accounts can significantly impact your tax liability. A common strategy starts with taxable accounts, then moves to tax-deferred accounts (like traditional IRAs), and finally taps into tax-free accounts (like Roth IRAs).

This approach allows your tax-advantaged accounts to continue growing tax-free for longer. However, the optimal strategy depends on your individual circumstances. For example, if you have a year with unusually high medical expenses, it might make sense to take more from your tax-free Roth account to avoid pushing yourself into a higher tax bracket.

Another consideration is Social Security. Delay Social Security benefits to increase your monthly payment by up to 8% per year from full retirement age to age 70. Fund this delay with strategic withdrawals from your retirement accounts, potentially reducing your overall tax burden in the long run.

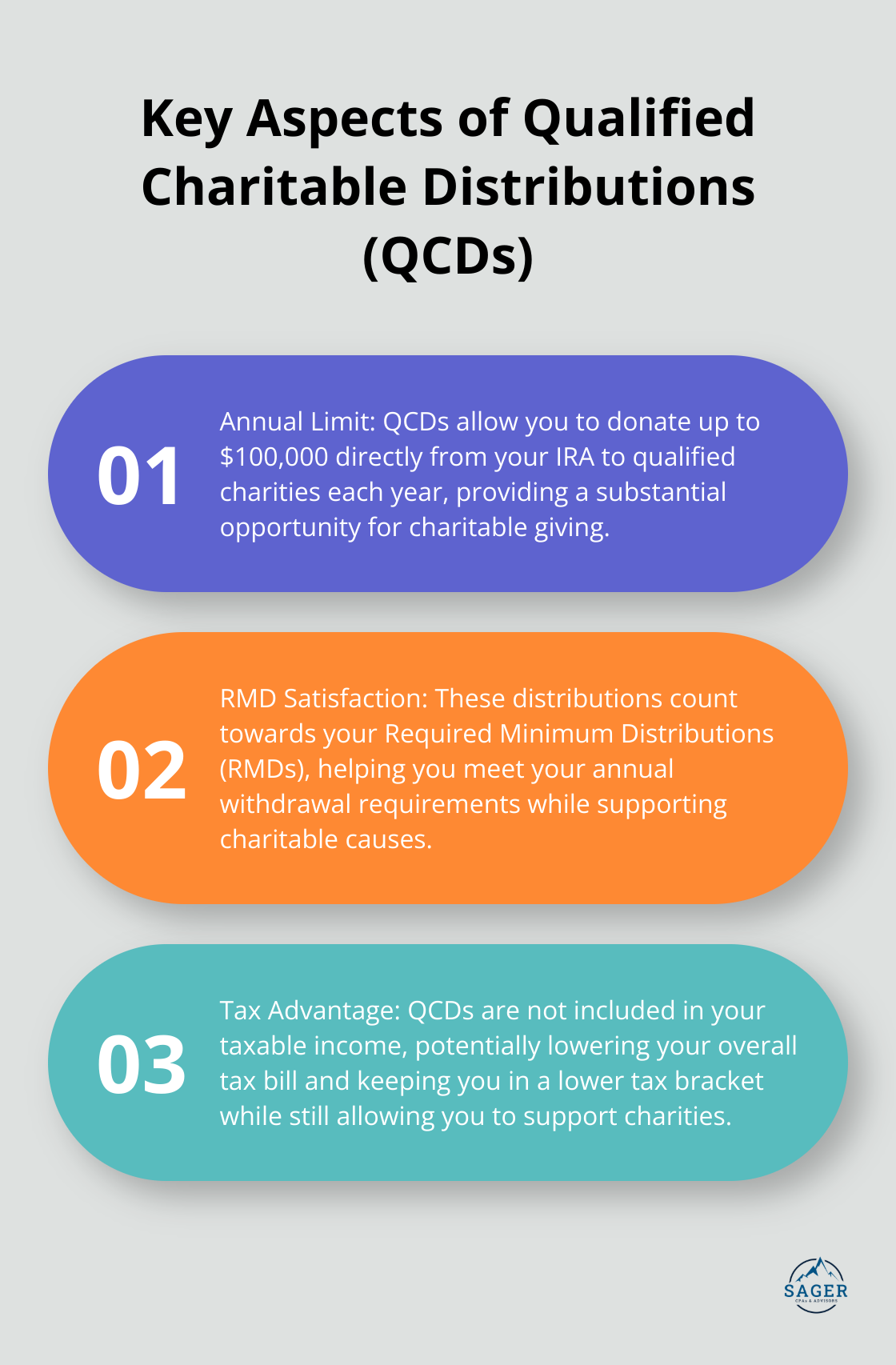

Charitable giving allows you to support causes you care about while potentially reducing your tax liability. For those over 70½, Qualified Charitable Distributions (QCDs) offer a particularly attractive option.

QCDs allow you to donate up to $100,000 annually directly from your IRA to qualified charities. These distributions count towards your Required Minimum Distributions (RMDs) but aren’t included in your taxable income. This can lower your overall tax bill and potentially keep you in a lower tax bracket.

For those with appreciated assets, donate these directly to charity to provide tax benefits. You avoid paying capital gains tax on the appreciation, and you can deduct the full fair market value of the asset from your taxes.

Tax laws are complex and constantly changing. What works best for one person may not be optimal for another. That’s why it’s important to work with a knowledgeable CPA who can tailor these strategies to your unique financial situation and goals. In the next section, we’ll explore how partnering with a CPA can further enhance your retirement and tax planning efforts.

Retirement tax planning requires specialized knowledge and experience. The strategies we discussed can significantly impact your financial future, but their effectiveness depends on proper implementation tailored to your unique circumstances. A Certified Public Accountant (CPA) brings an unmatched level of knowledge, experience, and education to the process of tax planning and managing your money.

CPAs stay current with ever-changing tax laws and regulations, ensuring your strategy remains compliant and optimized. For example, the SECURE Act 2.0 (passed in 2022) affects virtually all retirement plans and introduces numerous changes to retirement savings rules. A CPA can help you navigate these changes and adjust your plan accordingly.

CPAs use sophisticated financial modeling tools to project various retirement scenarios. These tools account for factors like inflation, market performance, and your specific financial goals. This level of analysis can reveal opportunities and potential pitfalls that might otherwise go unnoticed.

A CPA provides proactive tax planning rather than simply reacting to your current financial situation. They help you anticipate future tax implications and plan accordingly. This might involve strategies like strategic Roth conversions, timing of Social Security benefits, or structuring your investments for optimal tax efficiency.

CPAs play a key role in risk management. They identify potential financial risks in your retirement plan and develop strategies to mitigate them. For instance, they might suggest diversifying your retirement income sources to reduce reliance on any single account type or investment.

To maximize the benefits of working with a CPA, ask these key questions:

The goal is to develop a comprehensive, personalized strategy that aligns with your financial objectives and risk tolerance. A skilled CPA can help you navigate these complex questions and develop a plan that maximizes your retirement savings while minimizing your tax burden.

Retirement tax planning requires a deep understanding of complex financial strategies and ever-changing regulations. A retirement tax planning CPA provides invaluable expertise to navigate this intricate landscape. Professional guidance helps optimize retirement account contributions, develop tax-efficient withdrawal strategies, and integrate estate planning into your overall financial approach.

We encourage you to start your retirement tax planning early. Early planning allows more time to implement strategies, make adjustments, and benefit from compound growth. Every financial decision you make today can significantly impact your future tax liability and overall financial well-being.

At Sager CPA, we offer expert financial management and tax planning services for individuals and businesses. Our comprehensive approach ensures you have a solid retirement tax plan in place. Take action today and partner with a CPA to create a personalized retirement tax strategy that aligns with your unique financial goals and circumstances.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.