Tax season doesn’t have to be a stressful scramble through boxes of receipts and missing documents. Smart tax preparation planning starts months before April 15th arrives.

We at Sager CPA see too many clients miss valuable deductions because their records are scattered and disorganized. The right systems and strategies can transform your tax process from chaotic to streamlined.

The foundation of streamlined tax preparation lies in a systematic approach to document organization that operates continuously throughout the year. Most taxpayers wait until January to start their document collection, which creates unnecessary stress and increases the likelihood they will miss valuable deductions. Organized taxpayers benefit significantly from maintaining proper documentation systems throughout the year compared to those who scramble to collect documents at the last minute.

Create dedicated physical folders or digital directories for each tax category immediately after you file your current year return. Set up separate sections for W-2s, 1099s, charitable donations, medical expenses, and business expenses. The IRS reports that taxpayers who maintain organized records throughout the year face 60% fewer audit complications. Label folders with specific years and update them monthly rather than wait for year-end. This approach prevents the common mistake of mixed documents from different tax years, which can lead to missed deductions or incorrect filings.

Modern expense tracking applications like Expensify and Receipt Bank automatically categorize transactions and store digital copies of receipts. These tools reduce manual data entry by up to 75% according to accounting software company studies. Photograph receipts immediately after purchases to prevent fading and loss. Set up automatic bank feeds to capture all transactions, then review and categorize them weekly. Small business owners who implement digital systems typically identify 15-20% more deductible expenses than those who rely on manual methods. Configure your system to separate business and personal expenses automatically (this prevents the time-consuming task of sorting mixed records during tax preparation).

Maintain completely separate record-keeping systems for business and personal finances to avoid IRS scrutiny and simplify tax preparation. Use dedicated business bank accounts and credit cards exclusively for business transactions. Mixed personal and business expenses create significant compliance challenges and audit risks for small business owners. Create distinct digital folders and physical filing systems for each category, never allow crossover between the two. This separation becomes particularly important for Schedule C filers (where personal use of business assets must be clearly documented and properly allocated).

With your document organization system in place, the next step involves strategic tax planning that maximizes your deductions and minimizes your tax liability throughout the year.

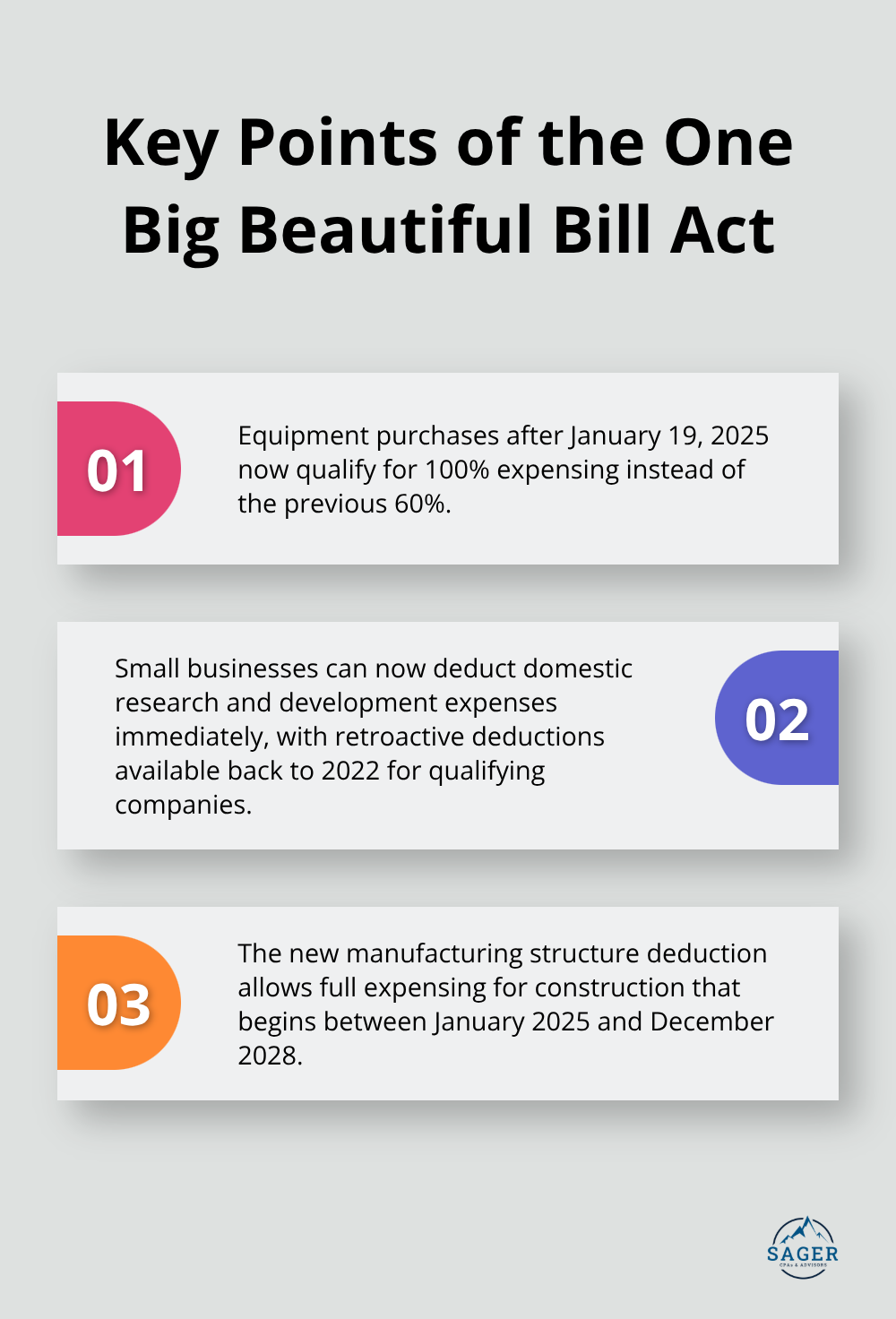

Tax planning works best when you think like a chess player and make strategic moves throughout the year rather than scramble in April. The One Big Beautiful Bill Act signed in July 2025 created immediate opportunities for business owners, with equipment purchases after January 19, 2025 now qualifying for 100% expensing instead of the previous 60%.

Maximize your 2025 retirement contributions early in the year to capture compound growth and reduce current tax liability. The annual 401k contribution limit increased to $23,500 for 2025, with those 50 to 59 or 64 or older able to contribute up to $31,000 and those 60 to 63 able to contribute up to $34,750. Business owners with pass-through entities benefit from SEP-IRA contributions up to 25% of compensation or $70,000 (whichever is lower). These contributions remain deductible until your tax return due date, but early contributions generate more investment growth. The 20% qualified business income deduction for pass-through businesses became permanent under the new tax law, which makes retirement planning even more valuable for business owners.

Coordinate your income recognition and expense acceleration with your CPA based on your expected annual earnings. Defer client invoices until January if you anticipate lower income next year, or accelerate equipment purchases before December 31st to maximize current-year deductions. The new manufacturing structure deduction allows full expensing for construction that begins between January 2025 and December 2028. Gift and estate tax exemptions will increase to $15 million per individual in 2026, which makes this an optimal time for wealth transfer strategies.

Track your quarterly estimated tax payments carefully, as the IRS requires payments equal to 90% of current year tax or 100% of prior year tax to avoid penalties. The expanded qualified small business stock benefits now raise the capital gains exclusion limit to $15 million for stock held more than five years. Pass-through entity owners can elect to pay taxes at the entity level, which generates deductions that lower their federal taxable income. These strategic decisions require professional guidance to navigate the complex interactions between federal and state tax laws.

Technology solutions and professional resources can amplify these tax planning strategies and create even greater efficiency in your overall tax management approach.

Tax preparation software works well for straightforward returns, but complex situations demand professional CPA services that provide strategic value beyond basic compliance. TurboTax and similar consumer software handle simple W-2 filings effectively, but business owners with multiple income streams, rental properties, or international transactions benefit significantly from professional expertise. Clients who attempted DIY tax preparation often miss deductions due to compliance costs according to National Association of Tax Professionals data. Professional services become particularly valuable under the One Big Beautiful Bill Act provisions, where tax breaks for businesses in multiple industries require expert guidance to maximize benefits.

Cloud-based accounting software like ShareFile and SmartVault allow real-time document sharing between you and your tax professional, which reduces preparation time by up to 40% compared to traditional paper methods. These platforms automatically organize documents by tax categories and send reminder notifications for missing items. Clients who use integrated document management complete their tax preparation 2-3 weeks faster than those who rely on email attachments and physical delivery. Set up automated workflows that capture bank statements, receipts, and tax documents directly into categorized folders throughout the year.

Advanced tax software like UltraTax CS and ProSeries handle intricate business structures that consumer software cannot process effectively. These professional platforms manage multi-state returns, partnership allocations, and depreciation schedules with precision that prevents costly errors. Tax professionals who use enterprise-level software complete complex returns 50% faster than those who rely on basic programs (according to accounting industry benchmarks). The software integrates seamlessly with bookkeeping systems and generates detailed audit trails that satisfy IRS documentation requirements.

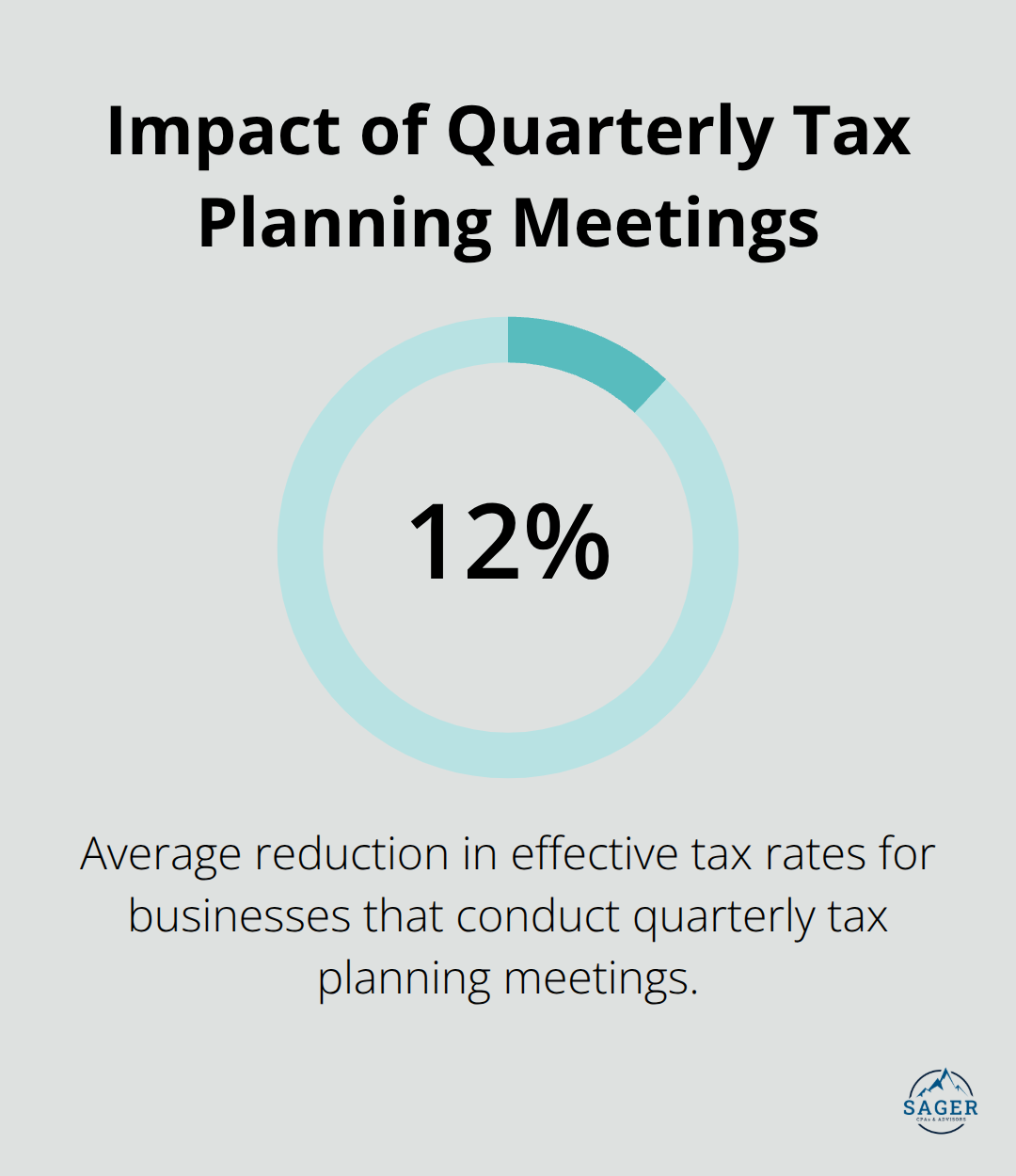

Schedule quarterly meetings with your CPA to review estimated tax payments, assess deduction opportunities, and adjust strategies based on actual business performance. These sessions allow proactive planning for equipment purchases, retirement contributions, and income timing that can save thousands in annual tax liability. Businesses that conduct quarterly tax planning meetings reduce their effective tax rates by an average of 12% compared to those who only meet annually. Regular communication prevents costly mistakes and positions you to capitalize on mid-year tax law changes or business opportunities that affect your tax situation.

Organized tax preparation planning transforms your financial management from reactive scrambling to proactive strategy. Businesses that implement systematic document organization and year-round planning reduce their effective tax rates by an average of 12% while they eliminate the stress of last-minute preparation. The financial benefits compound over time as consistent planning allows you to capitalize on tax law changes, maximize deductions, and make strategic decisions that protect your wealth.

The long-term impact extends beyond immediate tax savings. Streamlined processes free up valuable time during busy seasons, which allows you to focus on business growth rather than hunt for missing receipts. Professional guidance becomes particularly valuable under current tax law changes (where new deductions and planning opportunities require expert navigation to maximize benefits).

Start these streamlined processes immediately when you set up your document organization system and schedule quarterly planning sessions. We at Sager CPA provide comprehensive tax planning services that reduce liabilities through proactive strategies and customized action plans. Our team helps you achieve long-term financial stability and growth through expert tax preparation planning.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.