Small businesses face unique financial challenges that can make or break their success. At Sager CPA, we understand the critical role that accounting services play in navigating these challenges and driving growth.

This guide explores the top accounting services for small business success, from essential bookkeeping to advanced financial planning. We’ll help you identify the right services and providers to support your business’s financial health and long-term prosperity.

Accurate bookkeeping forms the cornerstone of small business financial management. It involves maintaining all financial transactions, proper tax preparation, easy understanding of business targets, saving more money, and making better decisions. This process creates a clear financial picture, which enables informed decision-making.

Many small business owners find bookkeeping challenging. A study by Wasp Barcode Technologies revealed that 40% of small business owners consider bookkeeping and taxes the worst part of owning a business. However, neglecting this task can lead to financial disarray.

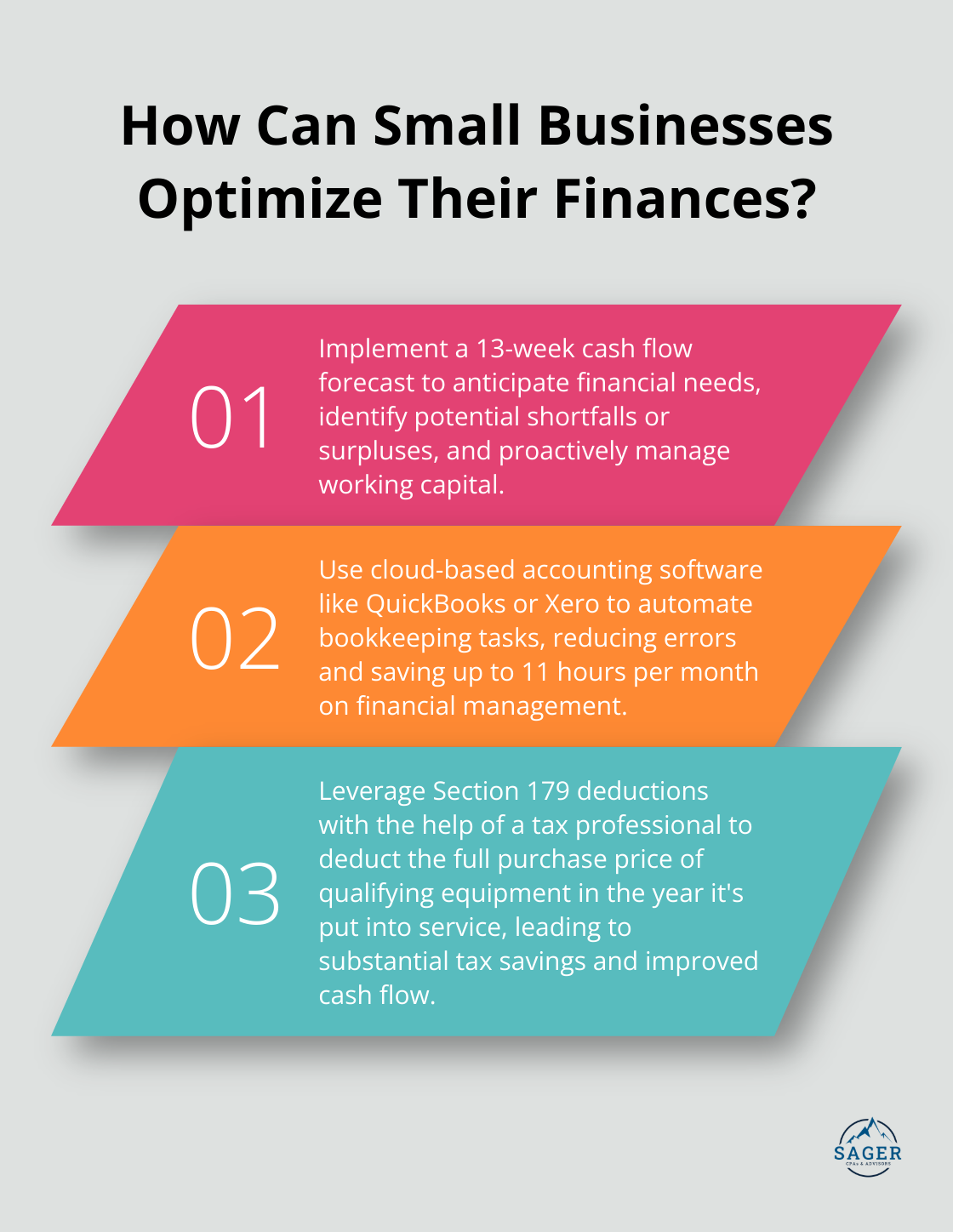

Cloud-based accounting software like QuickBooks or Xero can streamline bookkeeping processes. These platforms automate many tasks, which reduces errors and saves time. For example, QuickBooks can automatically categorize transactions and reconcile accounts, cutting bookkeeping time by up to 11 hours per month (according to an Intuit study).

Tax services extend beyond annual return filing. Effective tax planning involves ongoing strategies to minimize liabilities and maximize deductions. This proactive approach can result in significant savings.

The U.S. Chamber of Commerce provides comprehensive data on small businesses and the national economy. Professional tax services can alleviate this burden while ensuring compliance and identifying opportunities for tax savings.

A tax professional can help you leverage Section 179 deductions, which allow you to deduct the full purchase price of qualifying equipment in the year it’s put into service. This can lead to substantial tax savings and improved cash flow for small businesses.

Regular financial statement preparation provides essential insights into your business’s performance. These statements include the balance sheet, income statement, and cash flow statement.

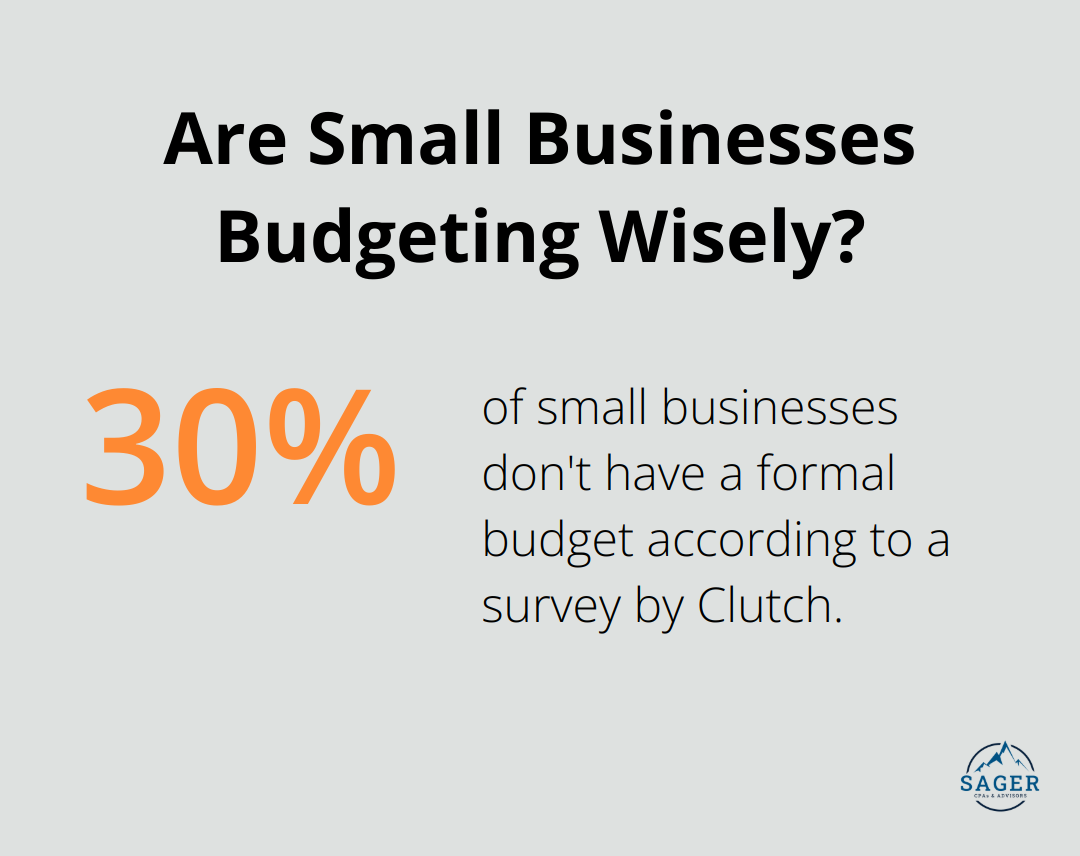

A survey by Clutch found that 30% of small businesses don’t have a formal budget. This oversight can result in poor financial decisions and missed growth opportunities. Regular review of financial statements allows you to identify trends, spot potential issues early, and make data-driven decisions.

Analyzing your income statement can reveal which products or services are most profitable, allowing you to focus your resources effectively. Similarly, a cash flow statement can help you anticipate and prepare for periods of tight cash flow, preventing potential crises.

Payroll directly impacts employee satisfaction and compliance, but it’s also complex and time-consuming. The IRS reports that 40% of small businesses pay an average penalty of $845 per year for late or incorrect filings and payments.

Outsourcing payroll ensures accuracy, timeliness, and compliance with tax laws. It also frees up valuable time for business owners to focus on core operations. Many payroll services offer additional features (like time tracking, benefits administration, and HR support), which provide comprehensive workforce management solutions.

These essential accounting services form the bedrock of sound financial management for small businesses. The next section will explore advanced accounting services that can drive growth and take your business to new heights.

As small businesses evolve, their financial needs become more complex. Advanced accounting services provide the strategic insights and support necessary to drive growth and ensure long-term success. This chapter explores sophisticated financial services designed to take your business to the next level.

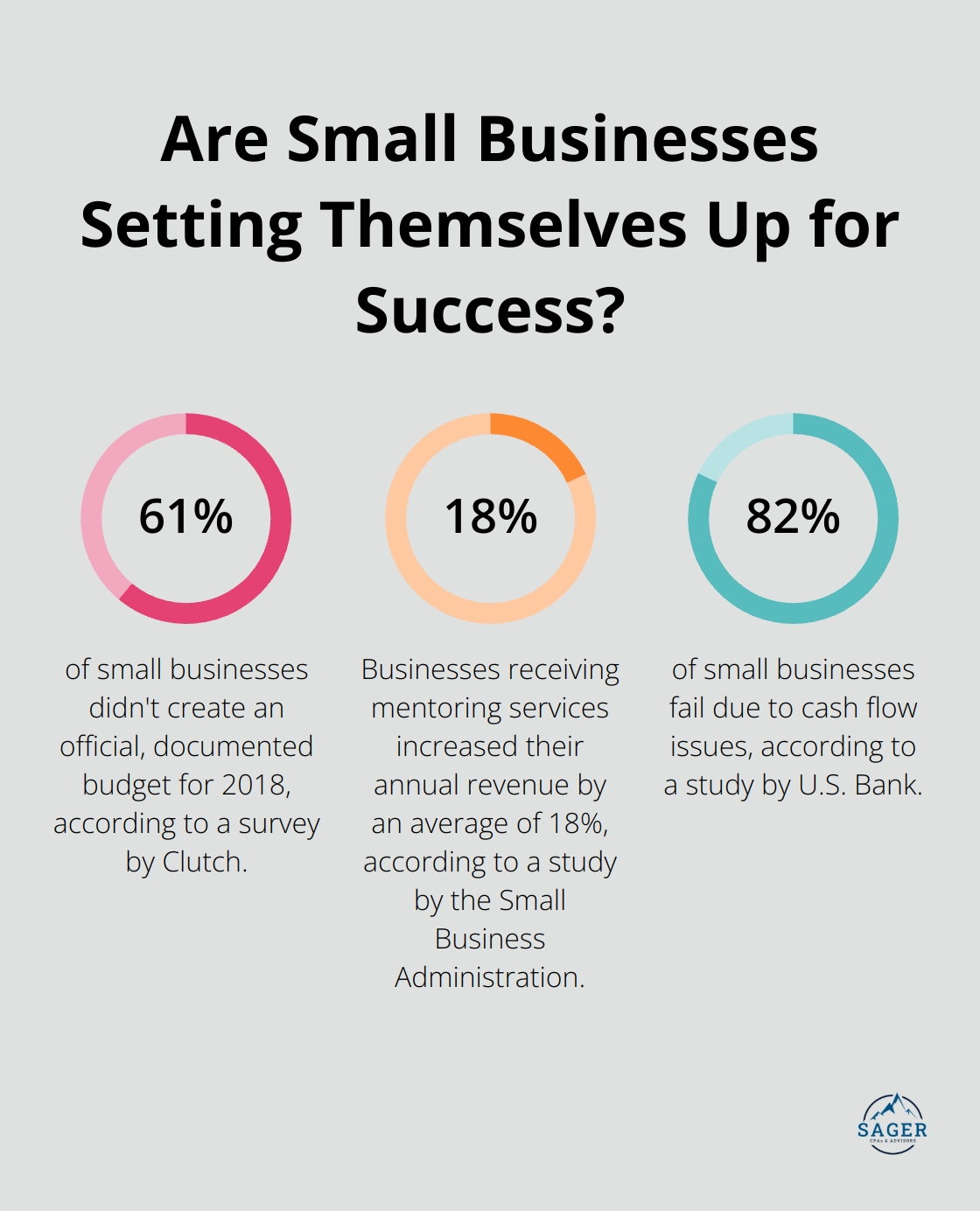

Effective cash flow management is critical for business success. A study by U.S. Bank found that 82% of small businesses fail due to cash flow issues. Robust cash flow forecasting techniques help businesses anticipate future financial needs and make informed decisions about investments, expansions, and operational changes.

One effective strategy involves the creation of a 13-week cash flow forecast. This short-term projection allows for more accurate predictions and helps identify potential cash shortfalls or surpluses. With this information, businesses can proactively manage their working capital, negotiate better terms with suppliers, and optimize their pricing strategies.

A well-crafted budget serves as a roadmap for your business’s financial future. However, many small businesses struggle with this task. A survey by Clutch revealed that 61% of small businesses didn’t create an official, documented budget for 2018.

To create an effective budget, analyze your historical financial data and industry benchmarks. Set realistic revenue targets and carefully estimate expenses. Regular review and adjustment of your budget to reflect changing market conditions and business goals is essential. This dynamic approach to budgeting can help you identify cost-saving opportunities and allocate resources more efficiently.

Business advisory services offer valuable insights and expertise to support strategic decision-making. These services include performance analysis, risk assessment, and growth planning. A study by the Small Business Administration found that businesses receiving mentoring services increased their annual revenue by an average of 18%.

Tailored business advisory services go beyond traditional accounting. Identify key performance indicators (KPIs) specific to your industry and business model. Tracking these metrics enables data-driven decisions that drive profitability and growth.

Strong internal controls are essential for preventing fraud and ensuring the accuracy of financial reporting. The Association of Certified Fraud Examiners reports that small businesses lose an average of 5% of their annual revenue to fraud.

To mitigate this risk, implement segregation of duties where possible, conduct regular audits, and use technology to automate and monitor financial processes. Cloud-based accounting systems (such as QuickBooks or Xero) provide real-time visibility into your finances and help detect unusual activity quickly.

Investment in these advanced accounting services can give small businesses a competitive edge and position them for sustainable growth. The right financial strategies transform challenges into opportunities for success. As we move forward, let’s explore how to choose the right accounting service provider to implement these strategies effectively.

Start with a thorough evaluation of your current financial processes and future objectives. Identify pain points in your existing accounting system and areas where you need additional support. If you struggle with cash flow management, look for a provider with strong forecasting capabilities. If tax compliance is a major concern, prioritize firms with extensive tax expertise.

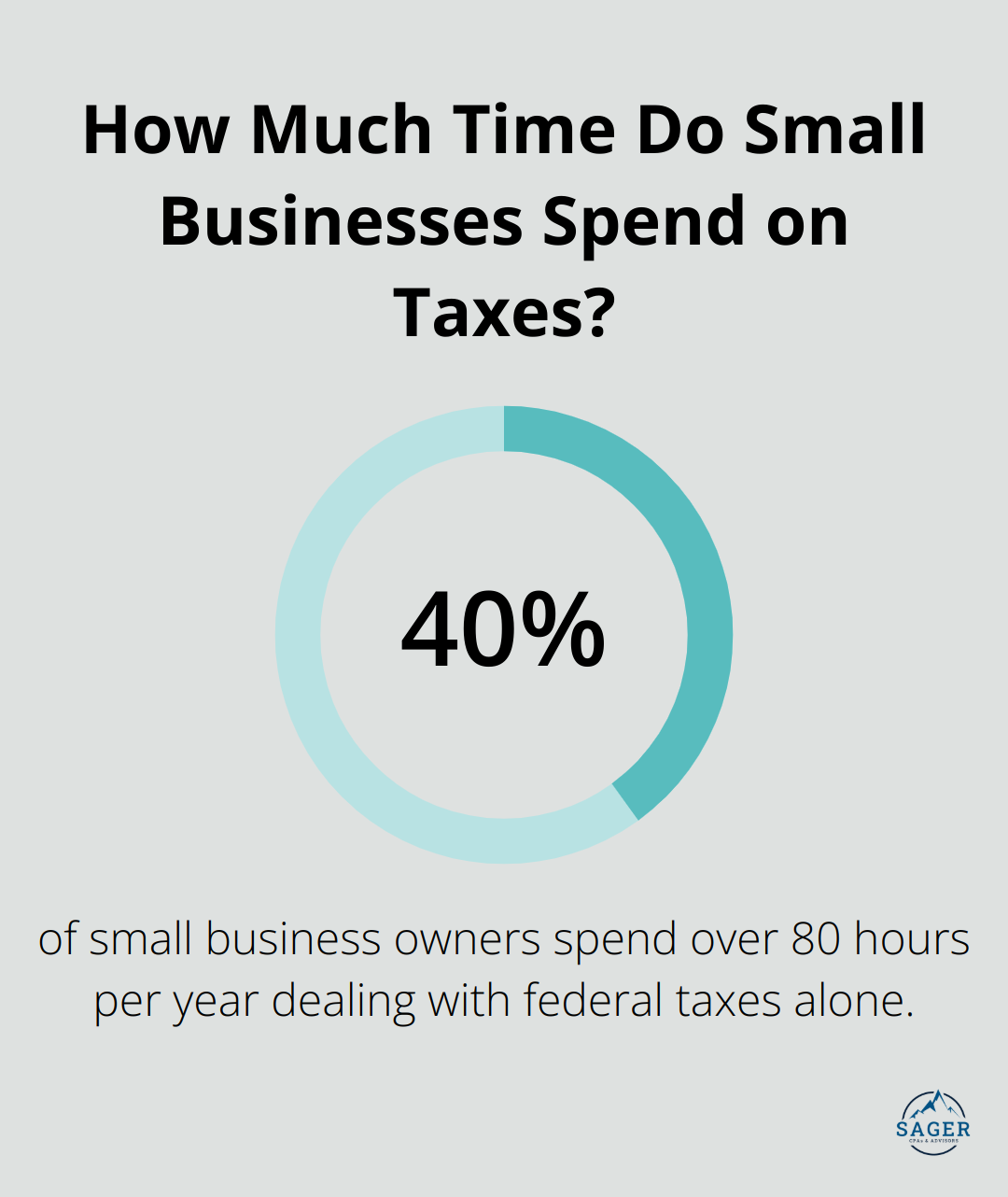

A survey by the National Small Business Association found that 40% of small business owners spend over 80 hours per year dealing with federal taxes alone. This statistic highlights the importance of professional tax assistance when selecting an accounting service provider.

Search for accounting firms with experience in your specific industry. They will know sector-specific regulations, tax implications, and financial benchmarks that can provide valuable insights for your business.

Check the provider’s credentials and certifications. Certified Public Accountants (CPAs) adhere to strict ethical standards including integrity, objectivity, professional competence, and confidentiality. The American Institute of CPAs reports that businesses working with CPAs are 15% more likely to succeed than those that don’t.

Ask for references or case studies from similar businesses. This will give you a real-world perspective on the provider’s capabilities and client satisfaction levels.

Technology plays a key role in efficient accounting processes. Look for providers that use modern, cloud-based accounting software. These platforms offer real-time financial insights, automate repetitive tasks, and facilitate seamless collaboration between you and your accountant.

A study by Sage found that businesses using cloud accounting software experienced a 15% year-over-year revenue growth compared to businesses not using cloud solutions. This statistic underscores the importance of choosing a tech-savvy accounting partner.

Ensure the provider’s systems can integrate with your existing business software. Seamless integration reduces data entry errors and provides a more comprehensive view of your financial situation.

Accounting service fees can vary widely, so it’s essential to understand what you’re getting for your money. Some providers offer fixed monthly fees, while others charge hourly rates or use value-based pricing models.

Compare the services included in different packages. Some firms (like Sager CPA) offer comprehensive service bundles that include bookkeeping, tax preparation, and advisory services. This can be more cost-effective than piecing together services from multiple providers.

Be cautious of providers that offer significantly lower prices than the industry average. While it might seem attractive initially, it could indicate a lack of experience or limited service offerings.

The goal is to find a provider that offers the best value for your business (not necessarily the lowest price). A skilled accountant can often save you more money through tax strategies and financial planning than the cost of their services.

Professional accounting services form the backbone of small business success in today’s competitive landscape. These services provide essential insights and support, enabling informed decision-making and sustainable growth. From basic bookkeeping to advanced financial planning, businesses can optimize their financial health and seize opportunities with expert guidance.

As businesses evolve, they require more sophisticated financial strategies to maintain their competitive edge. Cash flow forecasting, strategic budgeting, and business advisory services become indispensable tools for driving growth and navigating complex financial challenges. These advanced services unlock valuable insights that shape business strategy and fuel expansion.

Sager CPA offers tailored accounting services for small businesses, providing comprehensive financial management and tax planning solutions. We work closely with our clients to develop proactive strategies and customized action plans that enhance financial clarity and drive long-term success. Our team of experts stands ready to support your business’s financial journey and help you achieve your goals.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.