At Sager CPA, we know that smart tax planning can make or break a business’s financial health. Tax saving strategies for business owners are essential tools for maximizing profits and fueling growth.

This blog post will reveal key tactics to help you keep more of your hard-earned money. From maximizing deductions to choosing the right business structure, we’ll cover practical steps you can take today to reduce your tax burden.

At Sager CPA, we’ve observed how proper expense management can significantly reduce a company’s tax burden. Maximizing deductions for business expenses is a powerful strategy that can lead to substantial tax savings.

The IRS allows businesses to deduct ordinary and necessary expenses incurred in the course of operations. These include office rent, employee salaries, supplies, and travel costs. However, many business owners overlook less obvious deductions.

For instance, the home office deduction can be substantial for those who qualify. Another often-missed deduction is the cost of business insurance. This includes liability insurance, workers’ compensation, and even health insurance premiums for employees. These expenses are fully deductible and can add up to significant savings.

Accurate record-keeping is essential for maximizing deductions and surviving potential audits. The IRS requires thorough documentation for all claimed expenses. We recommend you implement a system where you immediately record expenses and store receipts digitally. This practice not only ensures compliance but also helps identify patterns in spending that could lead to further cost-saving measures.

For vehicle expenses, you have two options: deduct the actual expenses or use the standard mileage rate. A detailed mileage log can result in substantial deductions, especially for businesses with high travel requirements.

Modern accounting software has revolutionized expense tracking and management. Tools like QuickBooks or Xero allow for real-time expense logging, receipt scanning, and automatic categorization of expenses. These features not only save time but also reduce the likelihood of human error in record-keeping.

Moreover, many of these platforms integrate with bank accounts and credit cards, automatically importing transactions. This integration provides a comprehensive view of your business finances and ensures no deductible expense goes unclaimed.

Some businesses even use artificial intelligence-powered apps to predict future expenses based on historical data. This technology can help with budgeting and identifying potential areas for cost reduction.

Implementing these strategies doesn’t just save on taxes; it provides valuable insights into your business operations. Every dollar saved in taxes is a dollar you can reinvest in your business’s growth.

If you’re unsure about which expenses you can deduct or how to implement an effective expense management system, professional guidance can be invaluable. Expert advice ensures you maximize your deductions while staying compliant with tax laws.

As we move forward, it’s important to consider how your business structure affects your tax situation. The next section will explore how strategic business structure and entity selection can further optimize your tax position.

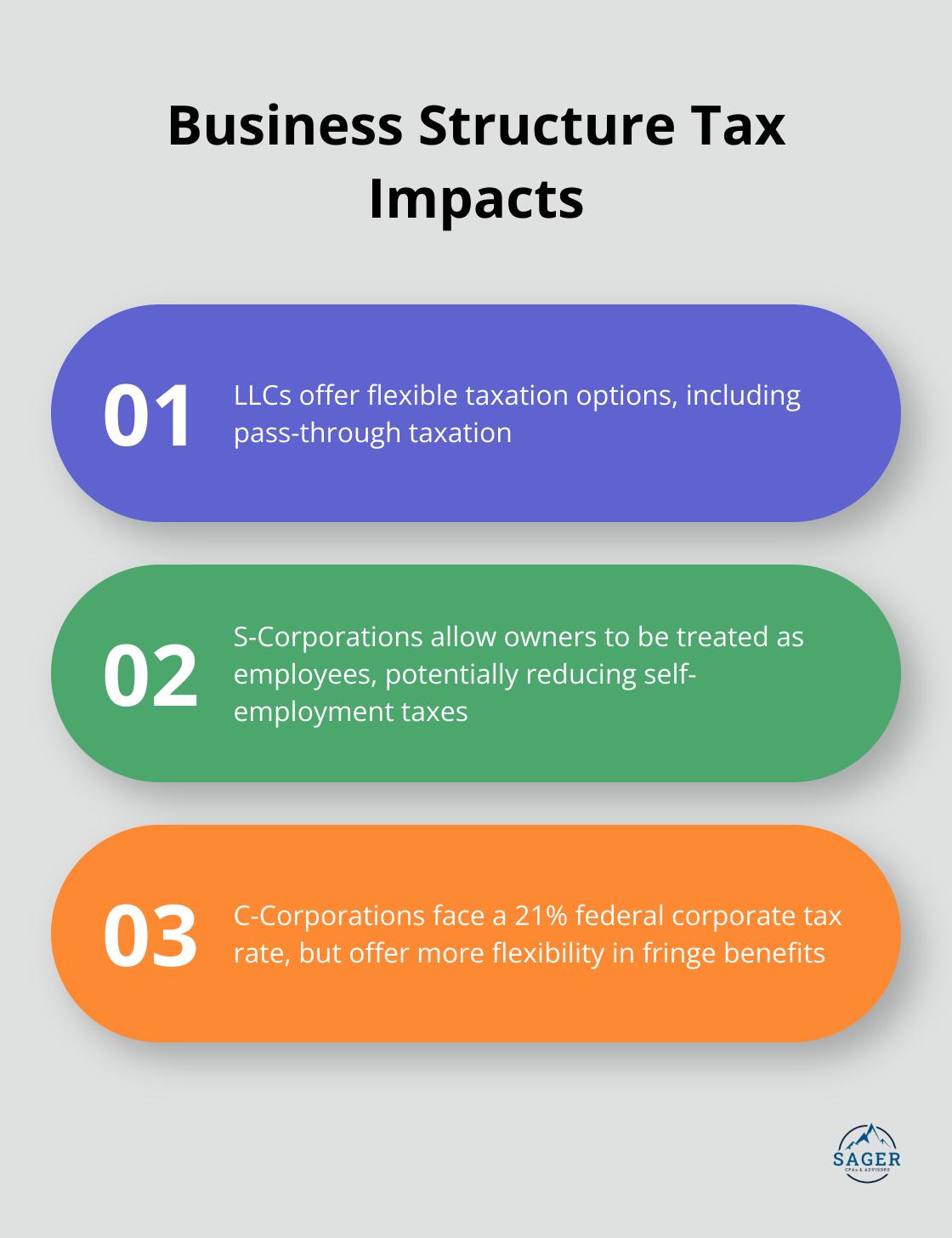

Limited Liability Companies (LLCs) offer flexibility in taxation. Single-member LLCs are treated as sole proprietorships for tax purposes, while multi-member LLCs are taxed as partnerships. This pass-through taxation means profits and losses are reported on the owners’ personal tax returns, avoiding double taxation.

LLCs can also elect to be taxed as S-Corporations or C-Corporations, which provides additional tax planning opportunities. An LLC taxed as an S-Corporation can potentially reduce self-employment taxes by allowing owners to receive both a salary and distributions.

S-Corporations have become increasingly popular among small business owners due to their potential tax advantages. Like LLCs, S-Corps offer pass-through taxation, but they also allow owners to be treated as employees. This structure can lead to significant savings on self-employment taxes.

S corp owners may pay between 10-39.6% for federal personal income taxes on their share of the company’s income, in addition to state and local income taxes.

C-Corporations face double taxation, where profits are taxed at the corporate level at a statutory federal rate of 21 percent, and again when distributed to shareholders as dividends. However, this lower corporate tax rate can be advantageous for businesses planning to reinvest profits heavily.

C-Corps also provide more flexibility in fringe benefits. They can deduct the cost of health insurance, life insurance, and other benefits for employees (including owner-employees) without the limitations faced by pass-through entities.

The right structure depends on various factors, including your business’s current profitability, growth plans, and exit strategy. A startup expecting initial losses might benefit from a pass-through entity to offset personal income, while a rapidly growing company might prefer a C-Corp structure to reinvest profits at a lower tax rate.

It’s important to reassess your business structure periodically as your company evolves. What works in the startup phase may not be optimal as you scale. We recommend an annual review of your business structure to ensure it aligns with your current needs and future goals.

Changing your business structure can have significant tax implications. It’s not a decision to make lightly or without professional guidance. A tax professional who understands the nuances of different business structures can save you from costly mistakes and help you make an informed decision.

As we move forward, let’s explore how retirement planning and tax-advantaged accounts can further optimize your tax strategy and secure your financial future.

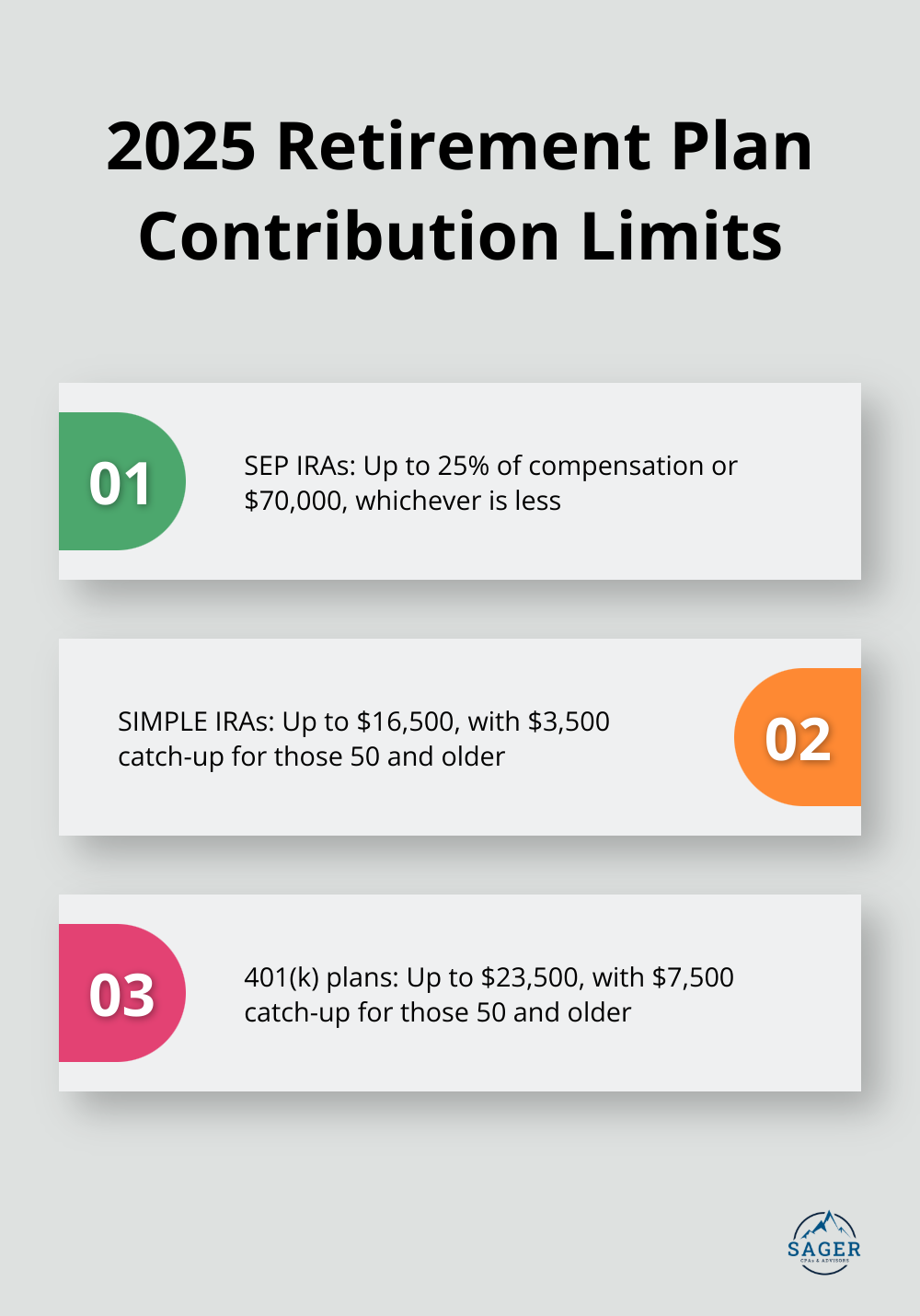

SEP IRAs offer excellent options for self-employed individuals and small business owners. In 2025, you can contribute up to 25% of your total compensation, up to $70,000. These contributions are tax-deductible, which reduces your taxable income for the year.

If you’re in the 32% tax bracket and contribute $50,000 to a SEP IRA, you could save $16,000 in taxes. This represents a substantial reduction in your tax bill while you build your retirement nest egg.

Savings Incentive Match PLan for Employees (SIMPLE) IRAs are designed for businesses with 100 or fewer employees. In 2025, employees can contribute up to $16,500, with an additional $3,500 catch-up contribution for those 50 and older. As an employer, you must match contributions, but these matching contributions are tax-deductible for your business.

The simplicity of setup and lower administrative costs make SIMPLE IRAs an attractive option for many small businesses. However, contribution limits are lower than those for 401(k) plans.

401(k) plans offer the highest contribution limits for businesses looking to maximize retirement savings. In 2025, employees can contribute up to $23,500, with an additional $7,500 catch-up contribution for those 50 and older. As an employer, you can make additional contributions, potentially allowing for total contributions of up to $69,000 per year.

The tax benefits of 401(k) plans are twofold. Employee contributions reduce their taxable income, while employer contributions are tax-deductible for the business. This dual benefit can lead to significant tax savings for both you and your employees.

Eligible employers may be able to claim a tax credit of up to $5000, for three years, for the ordinary and necessary costs of starting a SEP, SIMPLE IRA, or qualified plan such as a 401(k) plan. This credit can offset the costs of starting and maintaining the plan.

When selecting between these options, consider factors such as your business size, profitability, and long-term goals. Each type of plan has its own rules regarding eligibility, contribution limits, and employer obligations. Understanding these nuances is essential to make the best choice for your situation.

Retirement planning isn’t just about reducing your current tax bill. It’s about creating a comprehensive strategy that balances your present needs with your future goals. Maximizing your retirement contributions not only saves on taxes now but also secures your financial future.

A tax professional (such as those at Sager CPA) who understands the intricacies of retirement planning can help you analyze your specific situation and create a retirement strategy that optimizes your tax savings while setting you up for long-term financial success.

Tax saving strategies for business owners require continuous attention and adaptation. Proper expense management, strategic business structure selection, and smart retirement planning form the cornerstone of effective tax reduction. These approaches not only minimize tax liability but also provide valuable insights into business operations and secure long-term financial stability.

Tax laws change, and businesses evolve, necessitating regular reassessment of tax strategies. Proactive tax planning demands ongoing effort and expertise to navigate complex regulations and maximize savings. Staying informed and flexible allows business owners to minimize their tax burden consistently year after year.

Sager CPA offers expert guidance to help you implement comprehensive tax plans tailored to your specific needs. Our team can assist you in making informed decisions that align with your business goals and maximize tax savings. Take control of your financial future with Sager CPA and schedule a consultation today to discover how we can help you implement effective tax-saving strategies.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.