High income tax planning is a complex but essential task for those in the upper tax brackets. At Sager CPA, we understand the unique challenges faced by high-income earners when it comes to managing their tax liabilities.

This guide will explore effective strategies to optimize your tax situation, from maximizing deductions to timing income strategically. We’ll also discuss how to leverage investment opportunities and charitable giving to reduce your overall tax burden.

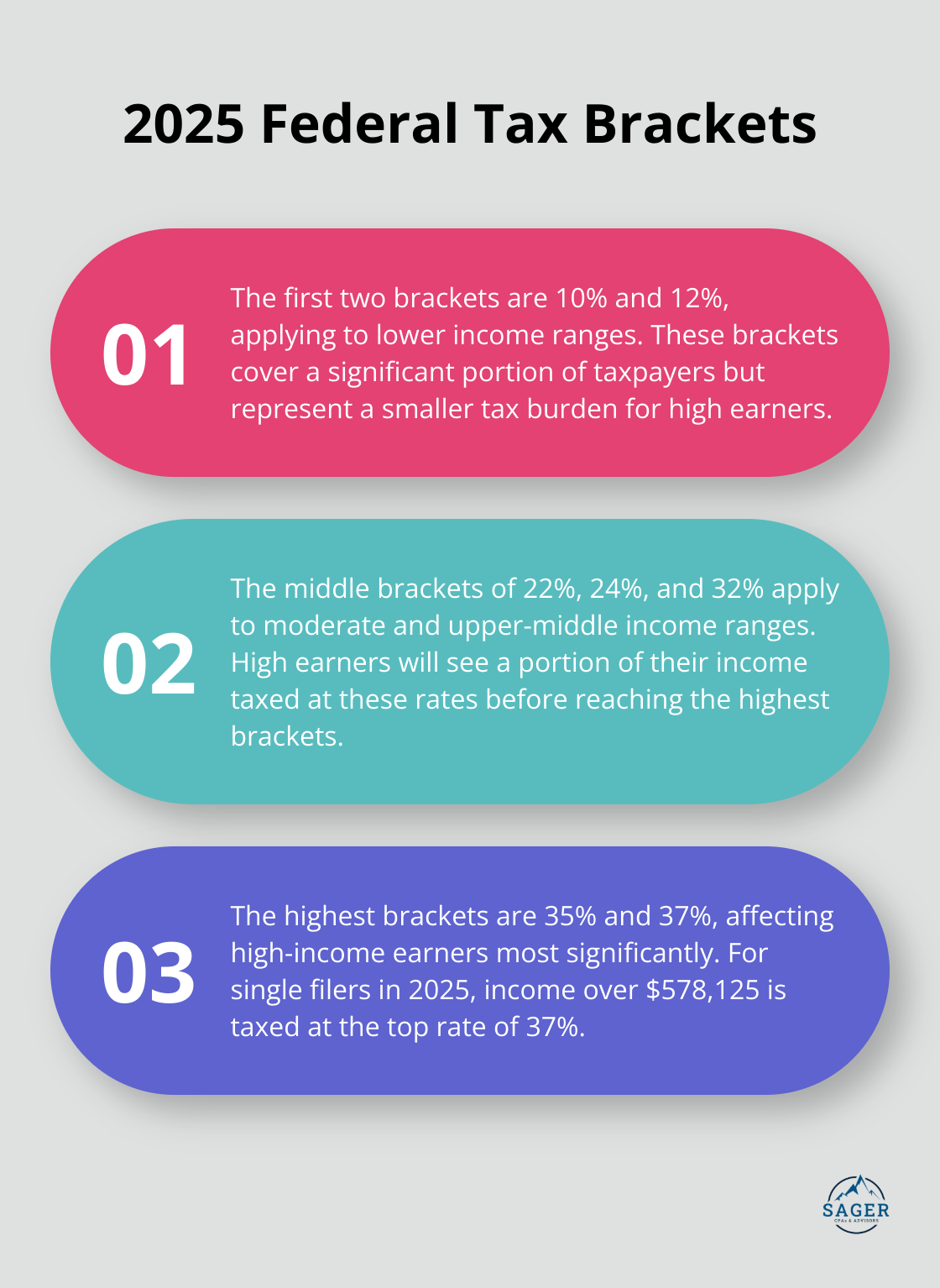

The U.S. tax system operates on a progressive tax system. In 2025, the federal tax system consists of seven brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Each bracket applies to a specific income range.

For example, a single filer earning $600,000 in 2025 will pay:

This system ensures that not all of a high earner’s income is taxed at the highest rate. However, a significant portion is subject to higher rates, which can substantially impact overall tax liability.

High income earners face unique challenges due to this system. As income grows, individuals may find themselves in higher tax brackets, potentially leading to a larger portion of their income being taxed at higher rates.

Given these implications, high income earners must employ strategic tax planning. Some effective approaches include:

Professional tax planning can help high income earners navigate these complex tax scenarios. Expert advisors can develop tailored strategies to optimize tax positions while ensuring compliance with all relevant tax laws and regulations.

As we move forward, we’ll explore specific tax reduction strategies that high income earners can implement to further optimize their tax situation and potentially reduce their overall tax burden.

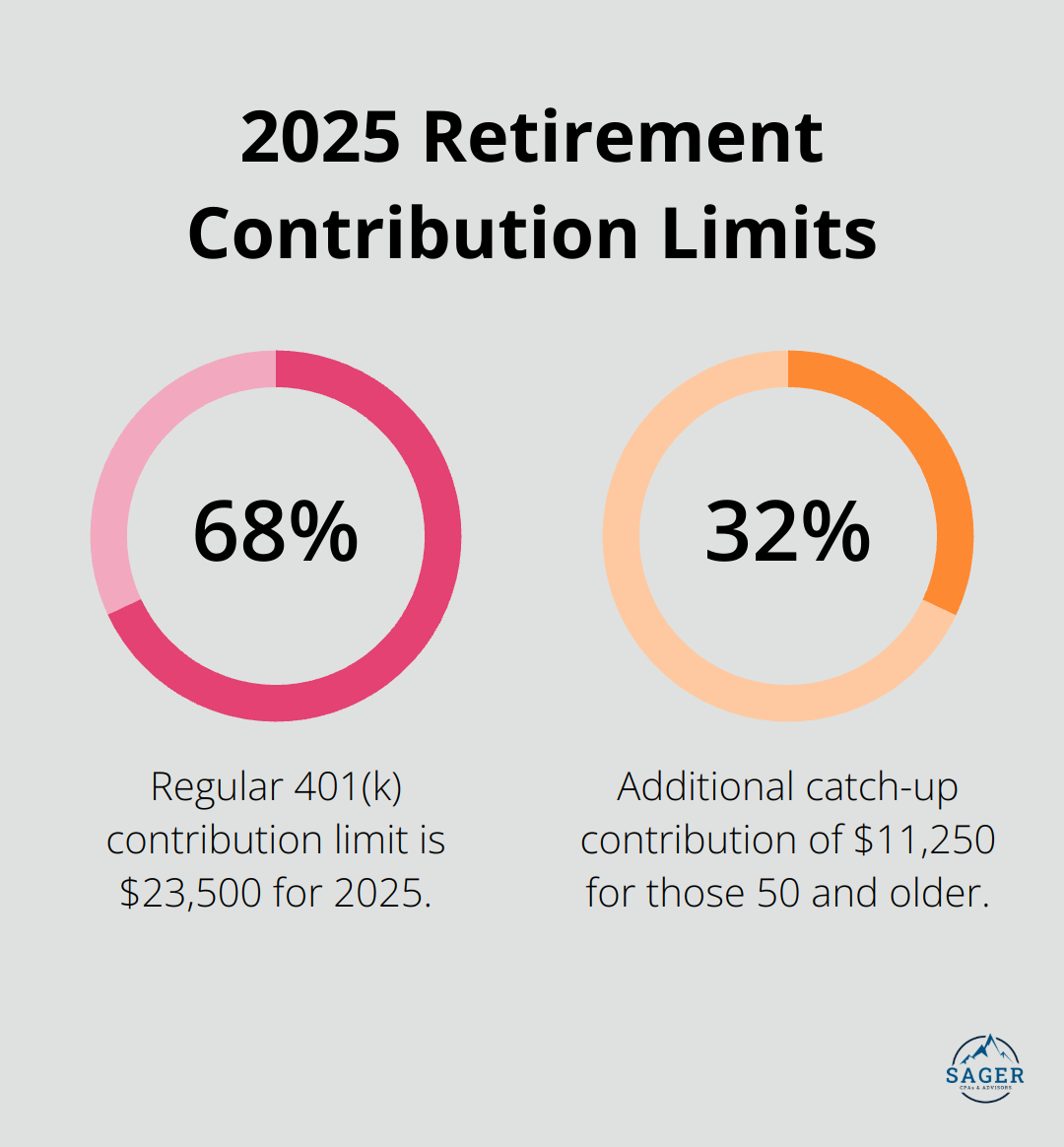

High income earners can significantly reduce their taxable income by maximizing contributions to retirement accounts. In 2025, individuals can contribute up to $23,500 to their 401(k) plans (with an additional $11,250 catch-up contribution for those 50 and older). This strategy can potentially lower taxable income by $34,750 or more.

Self-employed individuals should consider a SEP IRA or Solo 401(k). These accounts allow for even higher contribution limits (potentially up to $69,000 in 2025, depending on income).

Municipal bonds offer an excellent choice for high-income investors. The interest from these bonds typically avoids federal taxes and often state taxes (if you reside in the issuing state). While yields might be lower than taxable bonds, the tax savings can make them more attractive on an after-tax basis.

Investing in qualified opportunity zones provides another option. This program allows investors to defer capital gains taxes by investing in designated economically distressed communities. Investments held for ten years can see any appreciation become tax-free.

Charitable donations support causes you care about and provide significant tax benefits. Consider donating appreciated securities instead of cash. This strategy avoids capital gains taxes on the appreciation and still provides a deduction for the full market value of the securities.

Donor-advised funds (DAFs) offer more control over giving. You can contribute a lump sum to a DAF in a high-income year, receive an immediate tax deduction, and then distribute the funds to charities over time.

Tax-loss harvesting involves selling investments that have declined in value to offset capital gains from other investments. This strategy can help reduce overall tax liability. For example, if you have $50,000 in capital gains from one investment, you could sell other investments at a $50,000 loss to negate the tax impact of the gains.

Tax-loss harvesting requires careful planning and execution. You must avoid wash sale rules, which prohibit claiming a loss on a security if you buy the same (or a substantially identical) security within 30 days before or after the sale.

High income earners should also consider more advanced tax strategies. These might include:

These strategies can significantly reduce your tax burden, but they require careful planning and execution. Professional guidance can help navigate these complex tactics and develop a personalized plan to optimize your tax situation.

As we move forward, we’ll explore how timing your income and deductions can further enhance your tax planning efforts and contribute to effective corporate financial strategies for growth.

High-income earners can reduce their tax burden through strategic income deferral. There are 11 proven ways for high-income earners to minimize their taxes, including maxing out contributions and recharacterizing income.

Self-employed individuals or business owners should consider delaying billing for services until January of the following year. This action pushes income into the next tax year, potentially lowering the current year’s tax liability. Employees can negotiate to receive year-end bonuses in January instead of December for a similar effect. However, this strategy must align with overall financial needs and goals.

While deferring income, taxpayers should consider accelerating deductions into the current year. This strategy works well for those who itemize deductions and expect to be in a higher tax bracket this year compared to the next. Prepaying property taxes due in the first few months of the next year or making charitable contributions before year-end can provide immediate tax benefits. Taxpayers must be aware of limitations on deductions (such as the $10,000 cap on state and local tax deductions).

Roth IRA conversions can serve as a powerful tool for high-income earners. Converting traditional IRA funds to a Roth IRA requires paying taxes on the converted amount now but allows for tax-free withdrawals in retirement. This strategy proves particularly effective in years with lower income or when tax rates are expected to increase in the future. A temporary dip in income or significant deductions in a particular year might present an opportune time to execute a Roth conversion.

Effective management of capital gains and losses can significantly impact a taxpayer’s situation. Holding appreciated investments for at least a year before selling qualifies for long-term capital gains rates, which are generally lower than short-term rates. Conversely, selling investments that have decreased in value realizes losses that can offset capital gains and up to $3,000 of ordinary income. This strategy, known as tax-loss harvesting, means selling investments at a loss to offset your capital gains and lower your tax bill. It can be particularly effective when implemented near the end of the tax year.

These strategies require careful planning and execution. What works best for one individual might not be optimal for another. Professional tax advisors specialize in creating personalized tax strategies that align with unique financial situations and goals. Expert guidance can help navigate complex decisions and implement a tax plan that maximizes financial benefits while ensuring compliance with all relevant tax laws.

High income tax planning requires a proactive and strategic approach. The strategies discussed in this guide offer powerful tools to optimize your tax situation and preserve more of your hard-earned wealth. Professional tax advisors play a vital role in navigating the intricacies of tax law and developing tailored strategies for high-income earners.

The long-term financial benefits of strategic tax management can result in significant savings over a lifetime. These preserved funds can be redirected towards investments, retirement savings, or other financial priorities, compounding the benefits over time. Effective high income tax planning is an ongoing process that adapts to changing tax laws and evolving financial situations.

At Sager CPA, we provide expert financial management and tax planning services for high-income individuals and businesses. We work closely with our clients to develop proactive strategies and customized action plans (ensuring financial clarity for informed decision-making). Take control of your financial future by making tax planning a cornerstone of your overall financial strategy.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.