Inheritance taxes can consume up to 40% of your estate’s value, leaving your beneficiaries with significantly less than you intended. The federal estate tax exemption for 2024 stands at $13.61 million per individual, but many states impose their own inheritance taxes with much lower thresholds.

We at Sager CPA have guided countless families through effective inheritance tax planning strategies that preserve wealth across generations.

The federal estate tax exemption reaches $11.58 million per individual for 2025, but this massive threshold creates a dangerous misconception. Most Americans wrongly assume they face no inheritance tax obligations simply because their estates fall below this federal limit. The reality hits harder at the state level, where Connecticut taxes estates that exceed $12.92 million, while Massachusetts starts at just $2 million. Illinois imposes its estate tax at $4 million, and New York begins at $6.58 million.

Six states impose inheritance taxes directly on beneficiaries: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Maryland stands alone as the only state that collects both estate and inheritance taxes. Pennsylvania inheritance tax rates range from 4.5% for direct descendants to 15% for non-relatives, while New Jersey exempts Class A beneficiaries but charges Class C beneficiaries up to 16%.

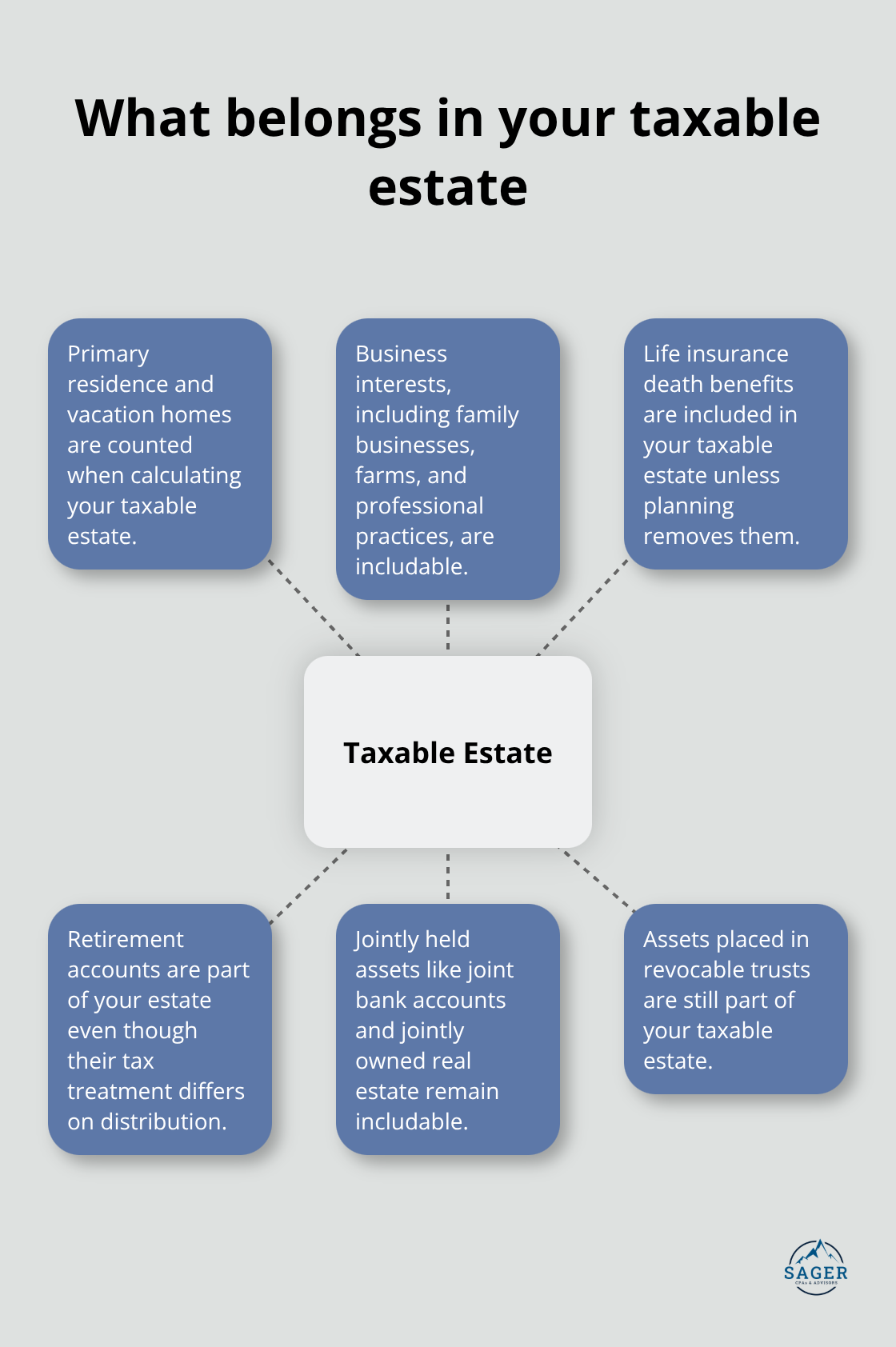

Your taxable estate includes far more than bank accounts and investment portfolios. The IRS counts your primary residence, vacation properties, business interests, life insurance death benefits, retirement accounts, and even outstanding debts that others owe to you. Joint bank accounts, jointly owned real estate, and assets in revocable trusts all remain part of your taxable estate. Many families overlook that family businesses, farms, and professional practices often represent the largest components of taxable estates.

Inherited assets receive a stepped-up cost basis equal to their fair market value at death, which eliminates capital gains taxes on appreciation that occurred during the deceased owner’s lifetime. This benefit applies to stocks, real estate, and other appreciated assets. However, inherited retirement accounts like traditional IRAs and 401(k)s retain their tax-deferred status, which requires beneficiaries to pay ordinary income taxes on distributions according to specific withdrawal schedules.

State inheritance tax laws vary dramatically in their approach and rates. Kentucky charges inheritance tax rates from 4% to 16% based on the relationship between the deceased and beneficiary (with spouses exempt entirely). Nebraska applies rates from 1% to 18%, while Iowa phases out its inheritance tax completely by 2025. These variations make state residency a significant factor in estate tax planning strategies that families must address proactively.

The annual gift tax exclusion for 2025 allows you to transfer $19,000 per recipient without federal gift tax consequences. Married couples can combine their exclusions to gift $38,000 annually to each beneficiary. This strategy proves most effective when you implement it consistently over multiple years. A family with four children can transfer $76,000 annually without affecting their lifetime estate tax exemption, which removes $760,000 from their taxable estate over a decade. Strategic timing matters because gifts made within three years of death may still count toward your taxable estate under certain circumstances.

Grantor Retained Annuity Trusts allow you to transfer assets while you retain an income stream for a specified period. Any appreciation above the IRS Section 7520 rate passes tax-free to beneficiaries. Qualified Personal Residence Trusts let you transfer your primary residence at a discounted value while you continue to live there for a predetermined term. Irrevocable Life Insurance Trusts remove life insurance death benefits from your taxable estate entirely (provided you survive three years after the transfer and relinquish all ownership rights). Generation-Skipping Transfer Trusts help wealthy families avoid estate taxes across multiple generations, though they require careful planning to prevent triggering the generation-skipping transfer tax.

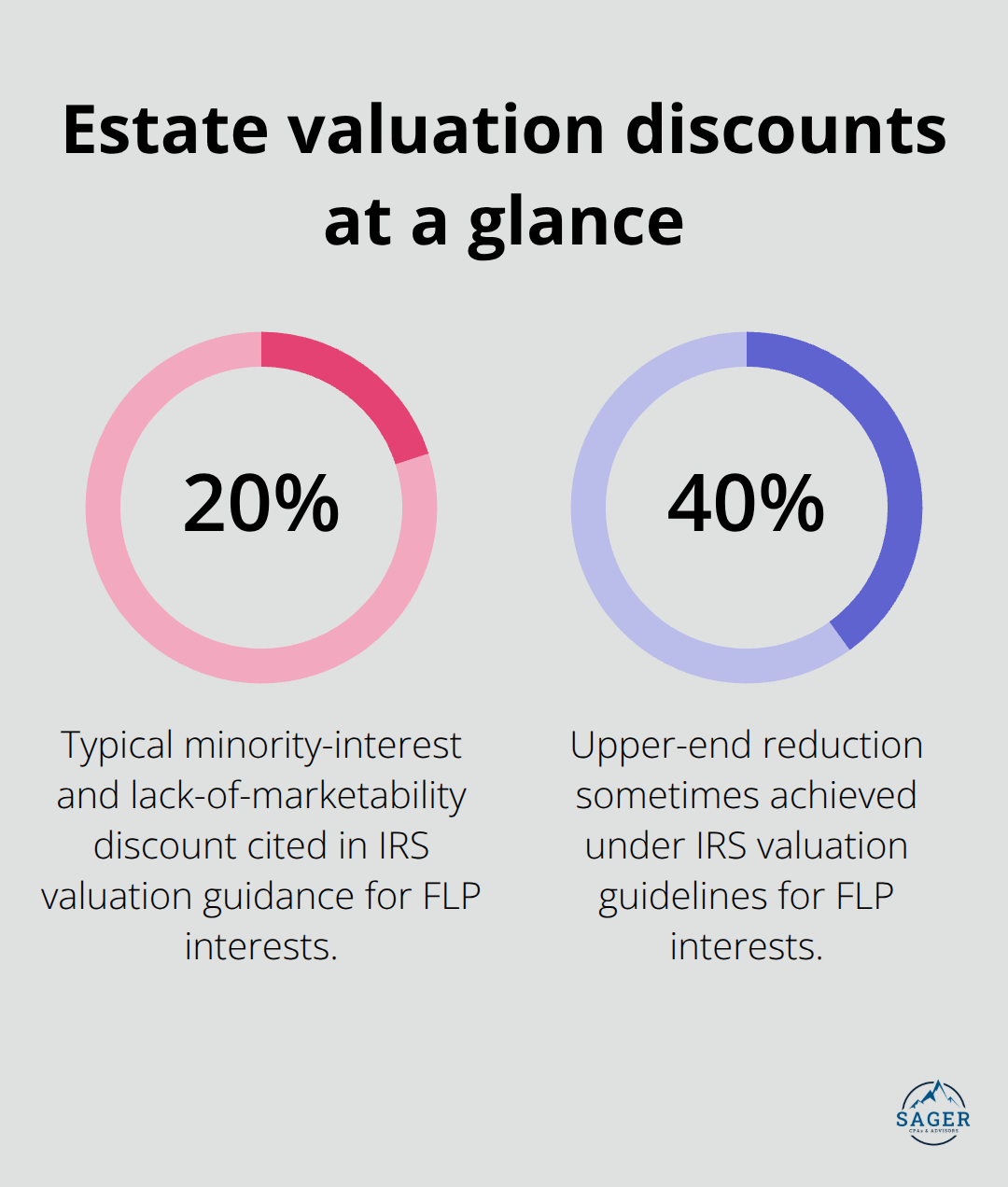

Family Limited Partnerships create significant valuation discounts because minority partnership interests lack marketability and control. These discounts often reduce taxable values by 20% to 40% according to IRS valuation guidelines. Installment sales to family members allow you to receive payments over time while you freeze the asset’s value for estate tax purposes. Employee Stock Ownership Plans provide immediate estate liquidity while they offer substantial income tax deductions (though they require careful structure to maximize benefits while you maintain business operations).

These tax minimization strategies work best when you combine them with comprehensive estate planning tools that address your specific financial situation and family goals.

Life insurance death benefits typically increase your taxable estate, but proper structure transforms this liability into a tax-saving tool. An Irrevocable Life Insurance Trust removes the death benefit from your estate entirely when you transfer ownership and survive three years after the transfer. This strategy works best for policies with substantial death benefits relative to premium costs.

Second-to-die policies prove particularly effective for married couples because they pay benefits only after both spouses die. This approach provides lower premiums while the surviving spouse uses the unlimited marital deduction. The key lies in never retaining any ownership rights or the power to change beneficiaries once you establish the trust.

Charitable Remainder Trusts allow you to receive income during your lifetime while you remove assets from your taxable estate and claim immediate income tax deductions. You transfer appreciated assets into the trust, receive annual payments based on a fixed percentage (typically 5% to 8%), and the remainder passes to charity upon your death. This eliminates capital gains taxes on the contributed assets while it provides predictable income streams.

Charitable Lead Trusts work in reverse. They pay income to charity for a specified term, then transfer the remainder to your heirs at reduced gift tax values. The IRS requires minimum annual charitable payments of 5% of the trust’s initial value, but any growth above this rate passes tax-free to beneficiaries.

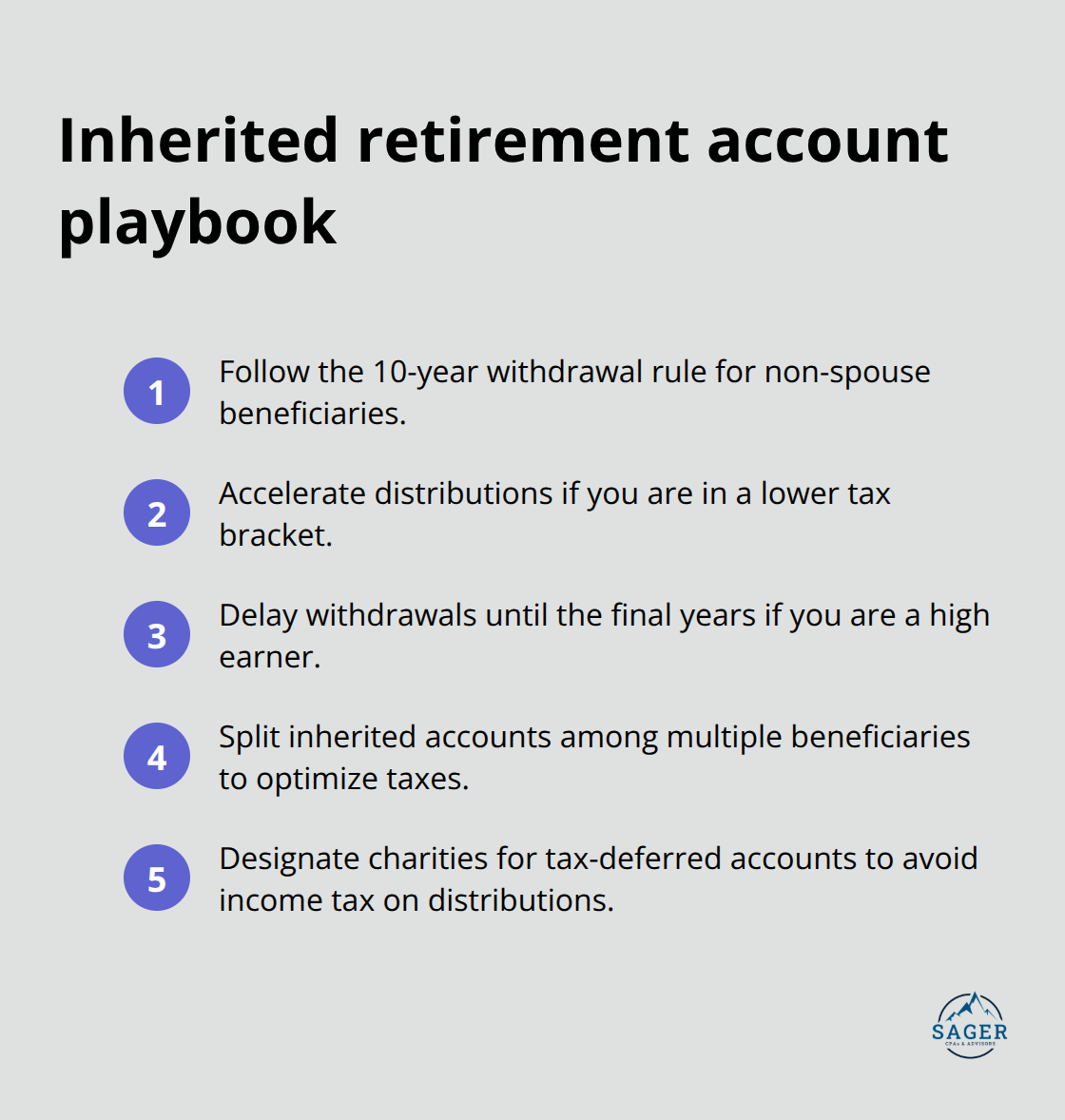

Non-spouse beneficiaries must withdraw inherited retirement accounts within 10 years under current IRS rules. This creates significant income tax planning opportunities. Beneficiaries in lower tax brackets should accelerate distributions to minimize overall tax burdens, while high earners should delay withdrawals until the final years.

Roth IRA conversions during your lifetime eliminate future income taxes for beneficiaries (though you pay taxes at conversion). Multiple beneficiaries can split inherited accounts to optimize their individual tax situations. Charitable organizations can receive retirement account distributions without any income tax consequences, making them ideal beneficiaries for tax-deferred accounts when you have sufficient other assets for family members.

Effective inheritance tax planning demands immediate action as the federal estate tax exemption drops to approximately $5.49 million in 2026. The window for maximum exemption benefits closes rapidly, which makes 2025 a pivotal year for strategic transfers. Families who act now can lock in current exemption levels before they revert to lower thresholds.

The most successful families combine multiple approaches that include annual gifts to reduce estate values, trust structures that provide valuation discounts, and life insurance strategies that create liquidity without tax burdens. State-specific considerations add complexity because inheritance tax rates and thresholds vary dramatically across jurisdictions. Tax laws change frequently, and implementation mistakes can trigger unintended consequences that cost families hundreds of thousands in additional taxes.

We at Sager CPA provide comprehensive tax planning services that integrate inheritance tax planning strategies with your overall financial objectives. Start your process by documenting current asset values, identifying potential tax liabilities, and establishing clear distribution goals for your beneficiaries. The strategies outlined in this guide work best when you implement them consistently over multiple years rather than as last-minute estate measures.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.