Corporate tax planning is a critical aspect of financial management for businesses of all sizes. At Sager CPA, we understand the complexities and challenges companies face when optimizing their tax strategies.

This blog post will guide you through effective corporate tax planning techniques, helping you navigate the ever-changing tax landscape and maximize your company’s financial efficiency. We’ll explore key strategies, potential risks, and future trends in corporate taxation to equip you with the knowledge needed for successful tax planning.

Corporate tax planning is a strategic approach to manage a company’s financial obligations while maximizing its after-tax profits. It requires a deep understanding of current tax laws, business operations, and future goals. Effective tax planning transcends mere compliance; it creates a roadmap that aligns business objectives with tax-efficient strategies. Tax planning strategies are essential for business owners to consider before year-end to position their company for future growth.

One crucial element of tax planning is timing. Companies can significantly impact their tax position by carefully scheduling income recognition and expense deductions. For example, accelerating deductions into the current year or deferring income to the next can lower immediate tax burdens.

The way a business organizes itself (e.g., C corporation, S corporation, or LLC) can have profound tax implications. Each structure offers different tax treatments, and selecting the right one can lead to substantial savings.

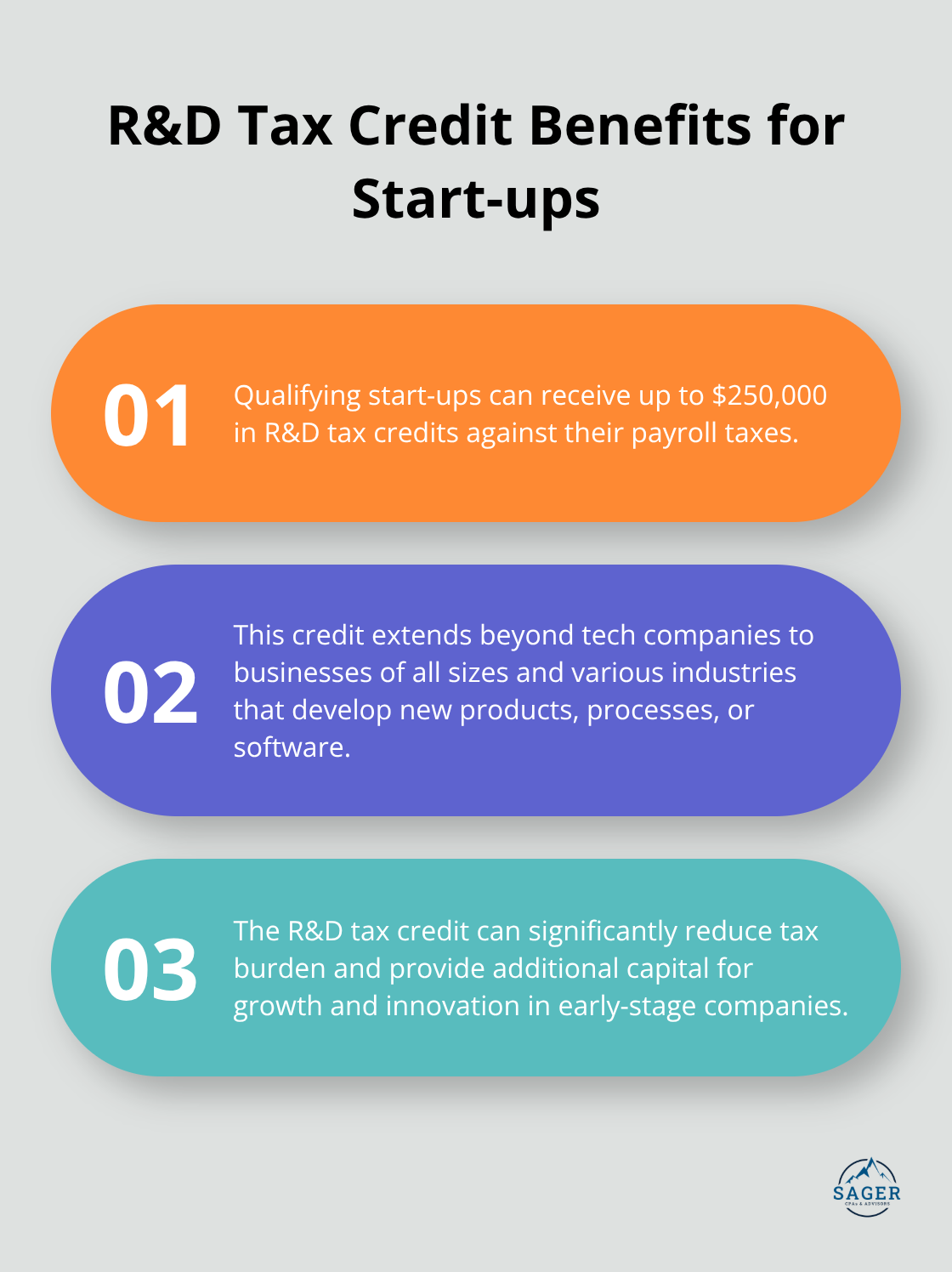

This common misconception overlooks the fact that businesses of all sizes can benefit from strategic tax planning. Even small businesses can take advantage of credits like the R&D tax credit (which offers up to $250,000 against payroll taxes for qualifying start-ups).

Effective tax planning is an ongoing process that requires regular review and adjustment. Quarterly tax planning sessions help ensure businesses stay ahead of the curve.

Advanced tax software and data analytics tools have revolutionized tax planning. These technologies enable more accurate forecasting and scenario modeling.

Corporate tax planning is a powerful tool for financial optimization and business growth. It supports business goals while ensuring compliance. As we move forward, we will explore effective corporate tax planning strategies that can help businesses maximize their financial efficiency.

The Research and Development (R&D) tax credit offers substantial benefits for businesses across various industries. This credit extends beyond tech giants to businesses of all sizes. Companies that develop new products, processes, or software may qualify. For instance, a manufacturing company that improves its production methods could secure significant tax savings through this credit.

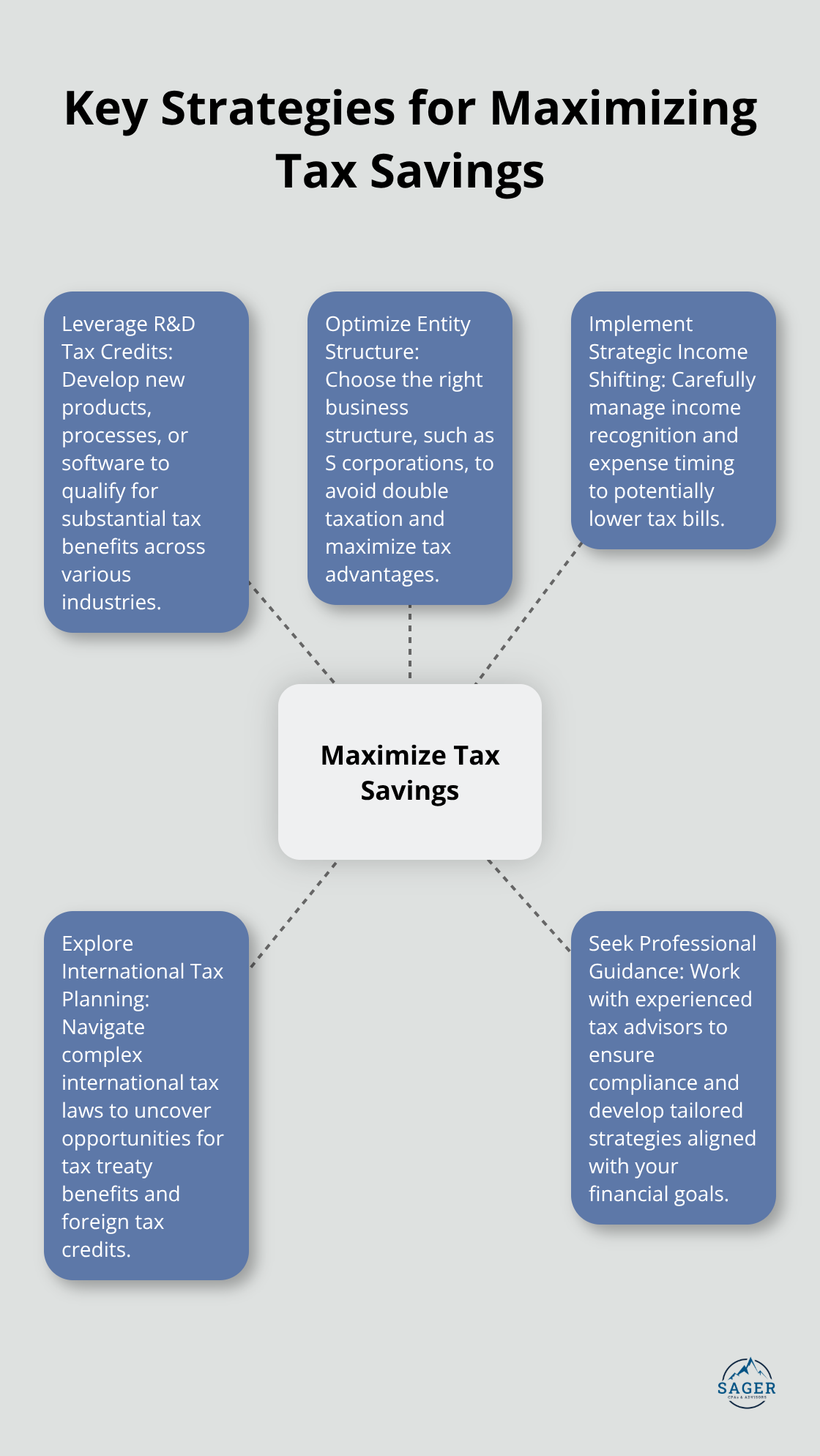

Selecting the right business structure can lead to considerable tax advantages. S corporations, for example, allow owners to avoid double taxation. However, the optimal structure depends on each company’s specific circumstances. A transition from sole proprietorship to an S corporation or LLC taxed as an S corporation can result in substantial savings.

Timing plays a critical role in tax planning. Companies can potentially lower their tax bills by carefully managing when they recognize income and incur expenses. If a business expects to fall into a lower tax bracket next year, deferring income to that year could result in substantial savings.

For businesses with global operations, international tax planning presents unique opportunities. This change necessitates a reassessment of international tax strategies for multinational companies. Navigating complex international tax laws can uncover opportunities for tax treaty benefits and foreign tax credits, potentially resulting in significant savings.

While these strategies offer significant benefits, they require expertise and attention to detail. Working with experienced professionals ensures compliance and maximizes savings. Tax laws change frequently, and staying current with these changes is essential for effective tax planning. Professional tax advisors (such as those at Sager CPA) can provide tailored strategies that align with a company’s specific financial goals and circumstances.

As we move forward, let’s examine the challenges and risks associated with corporate tax planning, and how businesses can navigate these complexities effectively.

Corporate tax planning presents numerous challenges. The tax landscape changes rapidly, which requires constant vigilance and adaptability. In 2023, the IRS implemented over 275 updates to the tax code (according to the National Taxpayer Advocate). This rapid pace of change complicates businesses’ efforts to maintain compliance and optimize their tax strategies.

Non-compliance carries a hefty price tag. The projected annual gross tax gap for Tax Year 2022 is $696 billion. This figure emphasizes the critical importance of staying current with tax obligations. Companies must prioritize ongoing education and professional advice to avoid costly mistakes.

Tax efficiency remains a priority, but it must align with ethical considerations. Overly aggressive tax planning can backfire, resulting in reputational damage and legal consequences. The 2020 State of Tax Justice report revealed that corporate tax avoidance costs countries $245 billion annually. This statistic highlights the increasing scrutiny on corporate tax practices.

Tax audits pose a real risk for many businesses. The IRS audited 3.8% of large corporations (those with assets over $10 million) in 2022. To mitigate this risk, companies should maintain meticulous records and prepare to justify their tax positions. The implementation of a robust internal control system can help identify potential issues before they trigger an audit.

International businesses face additional complexities. The OECD’s Base Erosion and Profit Shifting (BEPS) project aims to combat tax avoidance strategies that exploit gaps and mismatches in tax rules to avoid paying tax. This initiative impacts how multinational companies structure their operations and report income across borders.

Corporate tax planning requires strategic approaches to reduce tax liabilities while maintaining compliance. Companies can maximize R&D tax credits, optimize entity structures, and time income recognition effectively. International tax planning proves essential for businesses with global operations, especially in light of initiatives like the OECD’s BEPS project.

The complex world of corporate taxation demands expertise and constant vigilance. Rapid changes in tax laws and high non-compliance costs underscore the need for professional guidance. We at Sager CPA offer expert financial management and tax planning services tailored to meet unique business needs (ensuring enhanced financial clarity and long-term stability).

Technology will play an increasing role in tax planning and compliance, opening new opportunities for businesses. Companies must stay informed, adaptable, and ethically sound to navigate complexities successfully. Partnering with experienced professionals and maintaining a proactive approach to tax management will position businesses for sustainable growth and financial success.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.