Trust tax planning can be a powerful tool for protecting your wealth and minimizing your tax burden. At Sager CPA, we’ve seen firsthand how well-structured trusts can significantly reduce estate taxes and provide long-term financial security for families.

This guide will walk you through the process of creating a trust for effective tax planning, covering everything from understanding different trust types to important legal considerations.

Trusts serve as powerful legal arrangements that transfer assets to a separate entity, managed by a trustee for designated beneficiaries. Their popularity continues to grow due to their ability to minimize tax liabilities and protect wealth.

Two main categories of trusts exist: revocable and irrevocable. Revocable trusts allow grantors to maintain control over assets and modify or dissolve the trust at any time. However, they offer limited tax benefits. Irrevocable trusts provide significant tax advantages by removing assets from the grantor’s estate.

Common types of trusts used for tax planning include:

Trusts can significantly reduce various types of taxes:

Trusts offer several advantages beyond tax benefits:

As we move forward, it’s important to understand the steps involved in creating a trust for effective tax planning. The next section will guide you through this process, ensuring you make informed decisions that align with your financial goals and tax reduction strategies.

The first step in creating a trust for effective tax planning involves choosing the appropriate trust type. This decision depends on your specific financial goals and circumstances. If you want to reduce estate taxes while maintaining some control over your assets, a Grantor Retained Annuity Trust (GRAT) might be ideal. A GRAT is a financial instrument used in estate planning to minimize taxes on large financial gifts to family members. For those prioritizing charitable giving, a Charitable Remainder Trust (CRT) could be more suitable.

Consider your long-term objectives. Do you want to focus on estate tax reduction, asset protection, or providing for specific beneficiaries? Your answer will guide your trust selection. For instance, someone aiming to protect assets from potential creditors might opt for an Asset Protection Trust, while a person focused on minimizing gift taxes could choose a Qualified Personal Residence Trust (QPRT).

Selecting a trustee is a critical decision that can significantly impact the effectiveness of your trust. Your trustee should be someone you trust implicitly, who has the financial acumen to manage the trust assets, and who understands your wishes for the trust’s administration.

You have several options for trustees. You can choose a family member, a close friend, or a professional trustee such as a bank or trust company. Each option has its advantages and disadvantages. Family members might better understand your wishes but may lack the necessary expertise. Professional trustees bring expertise but may charge higher fees.

When naming beneficiaries, be as specific as possible. Clearly identify who should receive trust assets and under what conditions. This clarity helps avoid potential conflicts and ensures your wishes are carried out as intended.

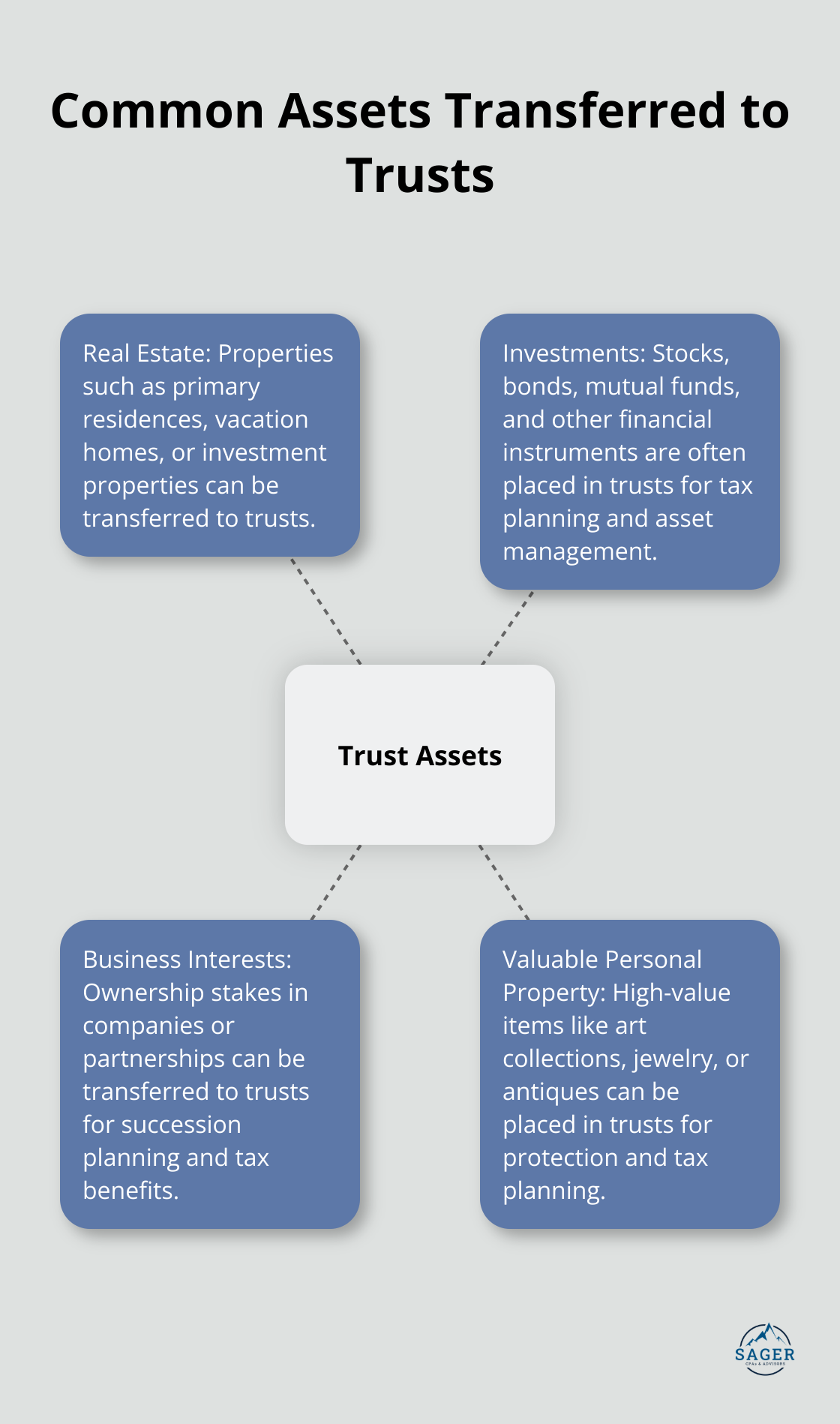

Once you establish your trust structure, the next step involves funding it with assets. This process, known as trust funding, is essential for the trust to function as intended. Common assets transferred to trusts include real estate, investments, business interests, and valuable personal property.

The type of assets you transfer can impact the trust’s effectiveness in achieving your tax planning goals. For example, transferring appreciating assets to an irrevocable trust can effectively reduce estate taxes. However, be mindful of potential gift tax implications when transferring assets (consult with a tax professional for specific advice).

It’s important to note that creating a trust document isn’t enough. You must actually transfer ownership of the assets to the trust. This often involves retitling assets in the name of the trust, which can be a complex process requiring attention to detail.

While DIY trust creation tools exist online, we strongly advise against this approach for tax planning trusts. The complexities of tax law and the potential consequences of errors make professional assistance invaluable.

Work with an experienced estate planning attorney to draft your trust documents. They can ensure your trust complies with all relevant laws and regulations, and that it’s structured to maximize tax benefits. Your attorney can also help you navigate complex issues such as generation-skipping transfer taxes and state-specific trust laws. The generation-skipping transfer (GST) tax is separate from the estate tax; it applies when you transfer assets to recipients two or more generations below you.

Many financial professionals collaborate with clients’ attorneys to ensure the trust aligns with their overall financial and tax strategy. This collaborative approach helps create a comprehensive plan that addresses all aspects of your financial life.

As you move forward in the trust creation process, it’s important to consider several key factors that can significantly impact the effectiveness of your trust. Let’s explore these important considerations in the next section.

The choice between a revocable and irrevocable trust forms the foundation of your trust strategy. Revocable trusts offer flexibility, allowing modifications or dissolution at any time. However, they provide limited tax benefits as assets remain part of your taxable estate. Irrevocable trusts offer substantial tax advantages by removing assets from your estate, but require you to relinquish control over those assets.

Many individuals underestimate the implications of this decision. For example, a person who opts for a revocable trust to maintain control might later regret not leveraging the tax benefits of an irrevocable trust when their estate value surpasses the federal exemption limit.

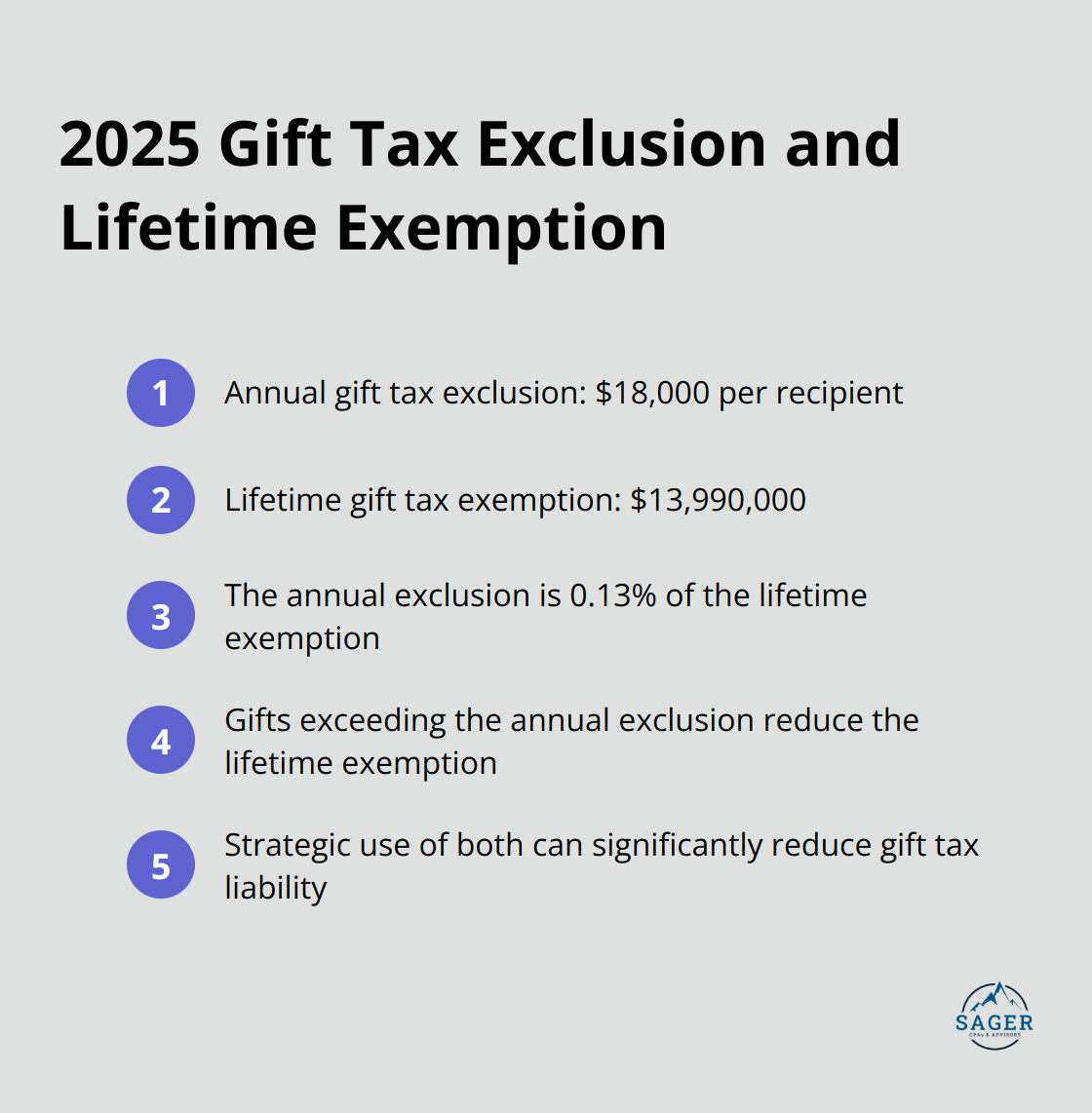

When you fund a trust, you must consider potential gift tax consequences. As of 2025, the annual gift tax exclusion stands at $18,000 per recipient. Exceeding this amount requires you to file a gift tax return and potentially pay gift tax. However, strategic use of your lifetime gift tax exemption (currently $13,990,000) can mitigate these issues.

Some individuals successfully use techniques like grantor retained annuity trusts (GRATs) to transfer significant wealth with minimal gift tax impact. For instance, a person might transfer $5 million in appreciating stock to a GRAT, resulting in a taxable gift of only $50,000.

The generation-skipping transfer (GST) tax adds complexity to trust planning. This tax applies to transfers to beneficiaries who are two or more generations below you, with a rate as high as 40%. The Tax Cuts and Jobs Act of 2017 significantly increased the federal estate, gift, and generation-skipping transfer (GST) tax exemptions.

A dynasty trust, with full GST exemption allocation, can shield multiple generations from this tax. This strategy potentially saves millions in future taxes for a family.

Trust laws vary significantly by state, impacting taxation and asset protection. Some states, like Delaware and Nevada, are known for their trust-friendly laws. Nevada allows settlors (but not testators) to create electronic trusts, while Delaware does not have a comparable provision.

You might consider establishing trusts in favorable jurisdictions even if you reside elsewhere. For example, moving a trust to South Dakota (a state with no income tax on undistributed trust income) could save thousands annually.

Creating an effective trust for tax planning involves complex processes with far-reaching implications. While this overview highlights key considerations, each situation requires unique solutions. Working closely with financial advisors and legal professionals ensures that your trust not only minimizes tax liabilities but also provides the financial security and legacy planning you desire.

Trust tax planning provides a powerful method to protect wealth and reduce tax burdens. A well-structured trust can significantly lower estate taxes, safeguard assets, and ensure financial security for families. The process requires careful consideration of trust types, trustee and beneficiary selection, and strategic asset transfers.

Professional guidance proves essential due to the complexities of trust creation and management. Tax laws, state-specific regulations, and potential pitfalls demand expert navigation to align trusts with financial goals while maximizing tax benefits. A well-crafted trust offers asset protection, privacy, and controlled wealth distribution across generations.

At Sager CPA, we understand the nuances of trust tax planning and its role in comprehensive financial strategies. Our team can guide you through the process to minimize tax liabilities and support your broader financial objectives. Regular reviews and adjustments ensure your trust continues to serve its intended purpose as tax laws and personal circumstances evolve.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.