As the year draws to a close, smart tax planning becomes essential for financial success. At Sager CPA, we’ve seen how effective year-end tax strategies can significantly impact our clients’ bottom lines.

This post will guide you through key tactics to optimize your tax position before December 31st. From maximizing tax-advantaged accounts to implementing savvy tax-saving moves, we’ll cover practical steps you can take now to potentially reduce your tax burden.

Start by gathering all your financial documents. This includes bank statements, investment reports, pay stubs, and receipts for major purchases or expenses. Don’t overlook digital records – many financial institutions now provide year-end summaries online. A 2024 survey by the American Institute of CPAs reveals that 68% of Americans who organize their financial records report feeling more in control of their finances.

After collecting your documents, analyze your income and expenses. Examine your total income from all sources – wages, investments, rental properties, and any side hustles. Then, add up your expenses, focusing on potentially tax-deductible items. This process often uncovers surprising insights. The Bureau of Labor Statistics reports that housing accounted for the largest share of total expenditures (32.9 percent), followed by transportation (17.0 percent) and food (12.9 percent) in 2024.

Major life events can significantly affect your tax situation. Marriage, having a child, or buying a home this year? Each of these events carries potential tax implications. For instance, new homeowners can deduct mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. If you’ve started a new job, check your eligibility for work-related deductions. The IRS allows deductions for unreimbursed employee expenses in certain professions.

Many financial apps and software can streamline this process. Tools like Mint or Personal Capital automatically categorize your expenses and provide a clear overview of your financial year. These platforms often offer features that flag potential tax deductions you might have missed.

A thorough review of your financial situation sets the stage for effective tax planning. It provides a clear picture of your financial health and positions you for success in the coming year. With this comprehensive understanding of your finances, you’re now ready to explore strategies to maximize tax-advantaged accounts and minimize your tax burden.

Tax-advantaged accounts offer powerful ways to reduce your taxable income and build wealth for the future. Let’s explore how you can make the most of these opportunities before the year-end deadline.

One of the most effective ways to lower your taxable income is to maximize contributions to your retirement accounts. For 2025, you can contribute up to $23,500 to your 401(k) if you’re under 50, and up to $34,750 if you’re 50 or older. If you haven’t reached these limits, consider increasing your contributions for the remaining pay periods of the year.

Don’t have a 401(k)? You can still contribute to an Individual Retirement Account (IRA). The limit for 2025 is $7,000 for those under 50 and $8,000 for those 50 and above. Traditional IRA contributions may be tax-deductible (depending on your income and whether you’re covered by a workplace retirement plan).

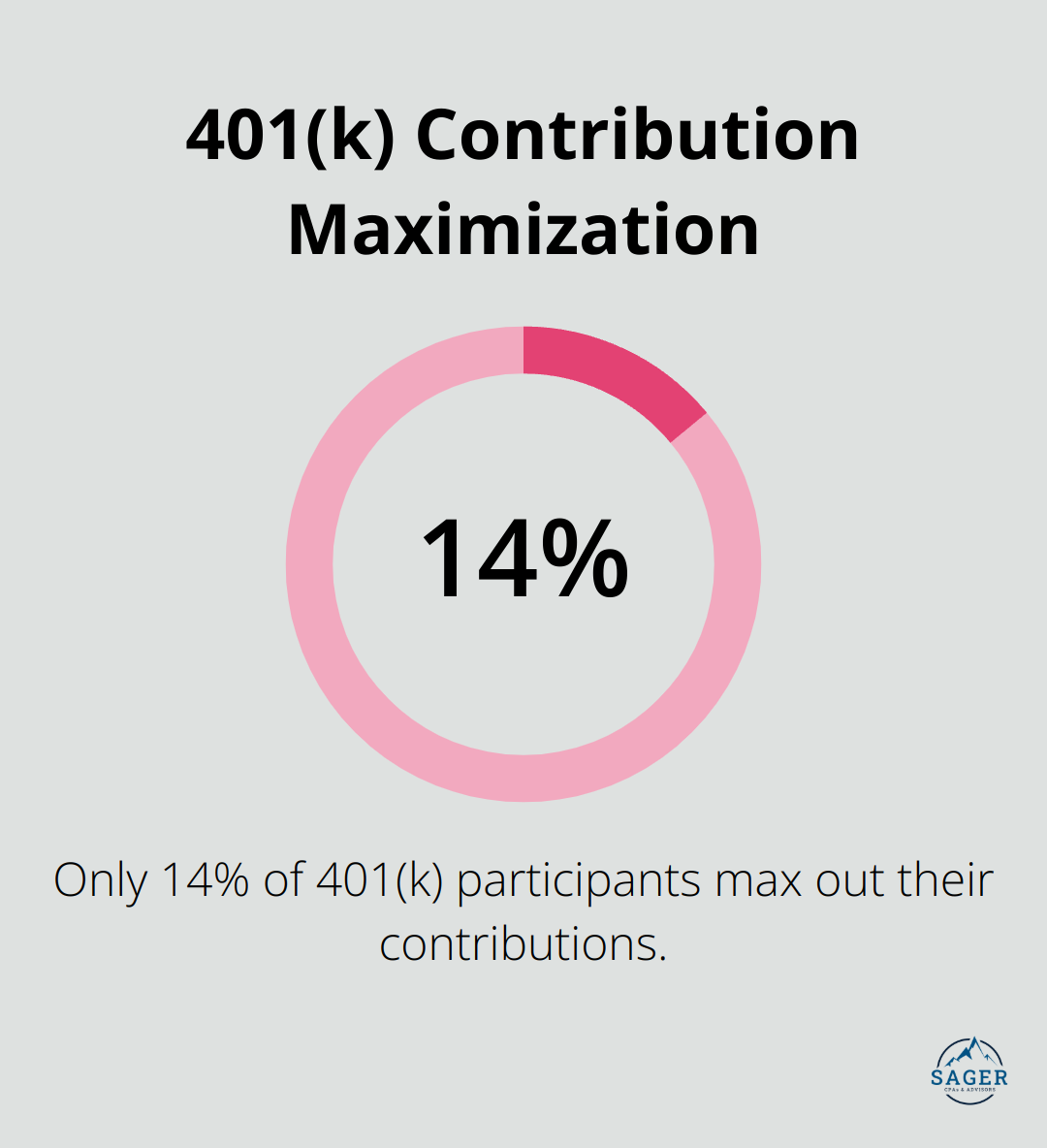

A study by Vanguard shows that only 14% of 401(k) participants max out their contributions. You can join this group to reduce your current tax burden and secure a more comfortable retirement.

If you have a high-deductible health plan, a Health Savings Account (HSA) offers triple tax benefits. Contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. For 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage (with an additional $1,000 catch-up contribution if you’re 55 or older).

HSAs are often underutilized. A report from the Employee Benefit Research Institute found that only 6% of HSA account holders max out their contributions. This presents a significant opportunity for tax savings and future healthcare cost management.

Flexible Spending Accounts (FSAs) for healthcare and dependent care can provide immediate tax savings. In 2025, you can contribute up to $3,200 to a healthcare FSA and up to $5,000 to a dependent care FSA. These contributions are made with pre-tax dollars, reducing your taxable income.

However, FSAs typically have a “use it or lose it” rule. Check if your employer offers a grace period or allows a carryover of unused funds. If not, plan how to use your remaining balance. Consider scheduling medical appointments or purchasing eligible items before year-end to avoid forfeiting your hard-earned money.

The specific benefits of these tax-advantaged accounts depend on your individual financial situation. For personalized advice on optimizing your tax strategy, you might want to schedule a consultation with a tax professional.

Now that we’ve covered how to maximize tax-advantaged accounts, let’s move on to implementing tax-saving strategies that can further reduce your tax burden.

Year-end tax planning involves smart moves that can reduce your tax burden significantly. Let’s explore some powerful tactics you can implement right now.

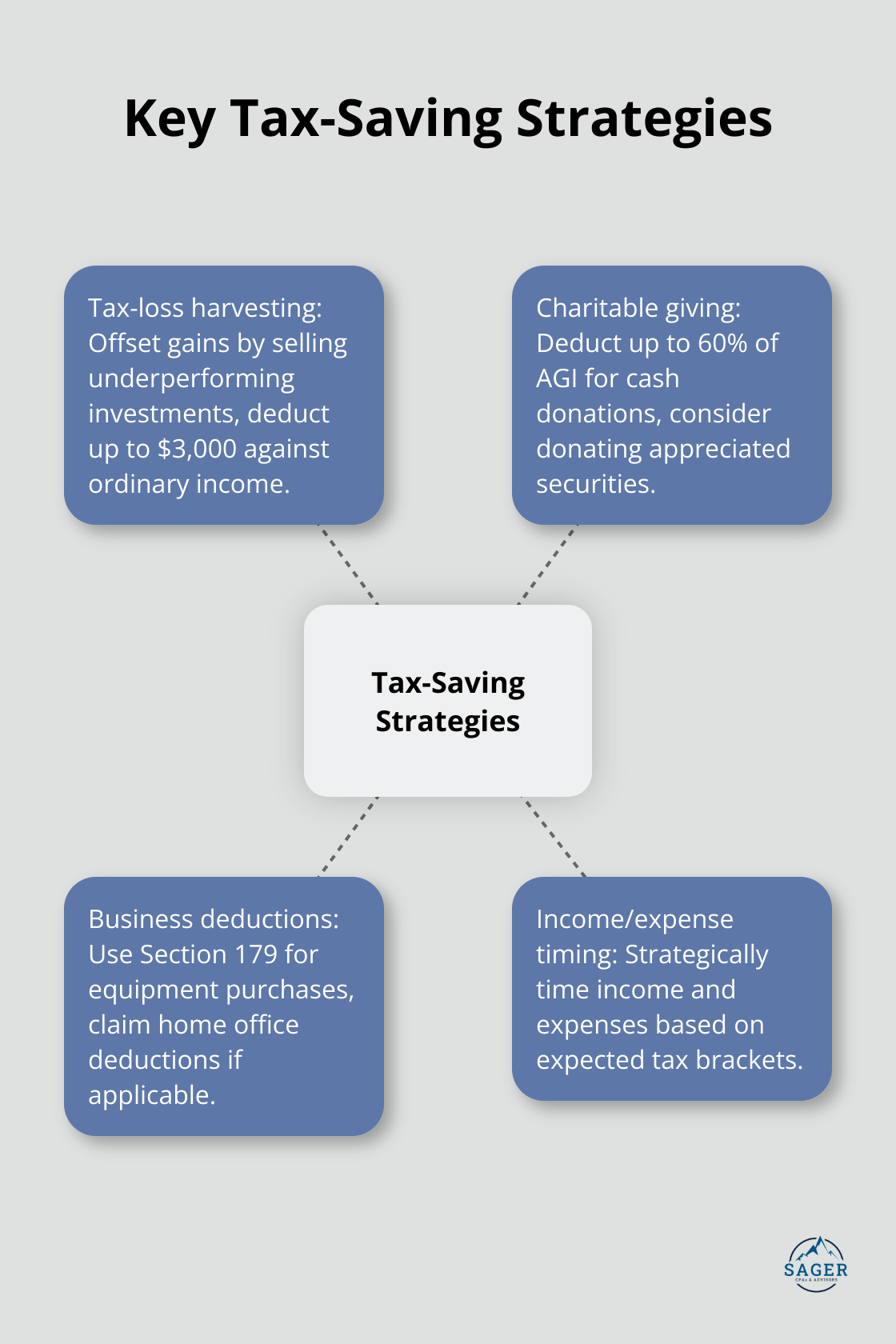

Tax-loss harvesting is a potent strategy for investors. You can offset capital gains and potentially reduce your tax liability by selling underperforming investments that are losing money. The IRS allows you to deduct up to $3,000 of net capital losses against ordinary income. Any excess losses can carry forward to future years.

If you’ve realized $10,000 in capital gains this year, selling investments with $13,000 in losses would not only offset those gains but also provide a $3,000 deduction against your ordinary income. This strategy requires careful execution to avoid wash sale rules (which disallow the loss if you repurchase the same or substantially identical security within 30 days).

Charitable contributions can lead to substantial tax savings while supporting causes you care about. For 2025, you can deduct charitable contributions up to 60% of your adjusted gross income for cash donations to public charities.

You should consider donating appreciated securities instead of cash. This strategy allows you to avoid capital gains tax on the appreciation while still claiming a deduction for the full fair market value.

Self-employed individuals and small business owners have numerous opportunities to reduce their taxable income. The Section 179 deduction allows you to deduct the full purchase price of qualifying equipment or software purchased or financed during the tax year. For tax years beginning in 2025, the maximum section 179 expense deduction is $1,250,000.

Don’t overlook home office deductions if you use part of your home exclusively for business. The IRS allows you to deduct $5 per square foot of your home office, up to 300 square feet, for a maximum deduction of $1,500.

Strategic timing of income and expenses can have a significant impact on your tax bill. If you expect to be in a lower tax bracket next year, you should consider deferring income to the following year. Conversely, if you anticipate being in a higher bracket, accelerating income into the current year might benefit you.

For expenses, the opposite approach applies. Youductible expenses into the current year if you expect to be in a higher tax bracket, and defer them if you anticipate a lower bracket next year.

Tax planning is complex and highly individual. While these strategies can be powerful, their effectiveness depends on your specific financial situation. You should take tax professional to create tailored tax strategies that align with your unique circumstances and goals.

Year-end tax planning requires proactive steps to impact your financial future positively. A review of your current situation, maximization of tax-advantaged accounts, and implementation of strategic tax-saving moves can reduce your tax burden significantly. Professional guidance proves invaluable when navigating the complexities of tax laws and creating tailored strategies.

At Sager CPA, we specialize in developing personalized tax strategies that align with individual goals and financial situations. Our team of experts can help you identify opportunities for savings and develop a comprehensive plan to optimize your tax position. We stand ready to partner with you, providing the expertise and support needed to make informed decisions and achieve your financial objectives.

Take control of your tax situation as the year comes to a close. Schedule a consultation with Sager CPA today to create a personalized year-end tax planning strategy. Let’s work together to set you up for success in the years to come.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.