At Sager CPA, we know that implementing effective business tax savings strategies can significantly impact your bottom line. Smart tax planning is not just about compliance; it’s about maximizing your financial resources and fueling growth.

In this post, we’ll explore practical ways to reduce your tax burden legally and ethically. From understanding your business structure to leveraging deductions and credits, we’ll guide you through key strategies that can lead to substantial savings.

Your business structure forms the foundation of effective tax planning. Different structures impact tax obligations and savings opportunities significantly.

Sole proprietorships and partnerships operate as pass-through entities. The business income appears on the owner’s personal tax return. This structure avoids double taxation but exposes owners to personal liability for business debts and legal issues.

Sole proprietors file Schedule C with their personal tax return (due April 15th). Partnerships submit Form 1065 and provide K-1 forms to partners (typically due March 15th).

C Corporations face double taxation – at the corporate level and when dividends reach shareholders. However, they offer more deduction flexibility, which benefits larger businesses.

S Corporations blend corporation and pass-through entity benefits. They avoid double taxation while providing liability protection. S Corps file Form 1120S (usually due March 15th).

Most businesses can deduct operating expenses (office supplies, marketing costs, employee wages). The Section 179 deduction allows immediate expensing of certain equipment purchases (up to $1,250,000 for the 2025 tax year).

The Qualified Business Income (QBI) deduction enables eligible taxpayers to deduct up to 20% of their qualified business income, plus 20% of qualified real estate investment trust (REIT) dividends.

Choosing the right business structure requires balancing tax implications against factors like liability protection and growth plans. Freelancers or small startups might prefer sole proprietorships, while growing businesses could benefit from an LLC or S Corporation structure.

We recommend an annual review of your business structure. As your business evolves, your tax strategy should adapt. Many businesses transition between structures to optimize their tax position and support growth goals.

The next step in implementing effective tax savings strategies involves maximizing deductions and credits. These powerful tools can significantly reduce your tax burden and free up capital for business growth.

Strategic use of deductions and credits can dramatically reduce a business’s tax burden. Let’s explore some powerful strategies to keep more money in your pocket.

Depreciation offers a potent tool for tax savings. The IRS allows businesses to deduct the cost of certain assets over time. Accelerated depreciation methods can front-load these deductions, providing immediate tax relief.

For 2025, businesses can expense up to $1,250,000 in qualifying equipment purchases under Section 179. This provision changes the game for companies investing in new technology or machinery. Bonus depreciation allows for an immediate write-off of 40% of the cost of eligible assets.

Time your major purchases strategically. Acquire assets near the end of your tax year to provide a full year’s deduction with minimal time in service.

Employee costs often represent a significant portion of business expenses. Wages, salaries, and bonuses are generally fully deductible. Don’t overlook other employee-related expenses that can reduce your tax bill.

Health insurance premiums, retirement plan contributions, and employee training costs are all deductible. If you offer a 401(k) plan, your business may qualify for a tax credit of up to $5,000 for the first three years.

The Society for Human Resource Management reports the average cost of hiring an employee is $4,129. Deduct these costs to invest in your team and reduce your tax liability.

For eligible businesses, the home office deduction can yield substantial savings. The IRS offers two methods for calculating this deduction: the simplified method and the regular method.

The simplified method allows a standard deduction of $5 per square foot of home office space (up to 300 square feet). This can result in a deduction of up to $1,500.

The regular method involves calculating the actual expenses of your home office, including mortgage interest, insurance, utilities, repairs, and depreciation. While more complex, this method often results in a larger deduction.

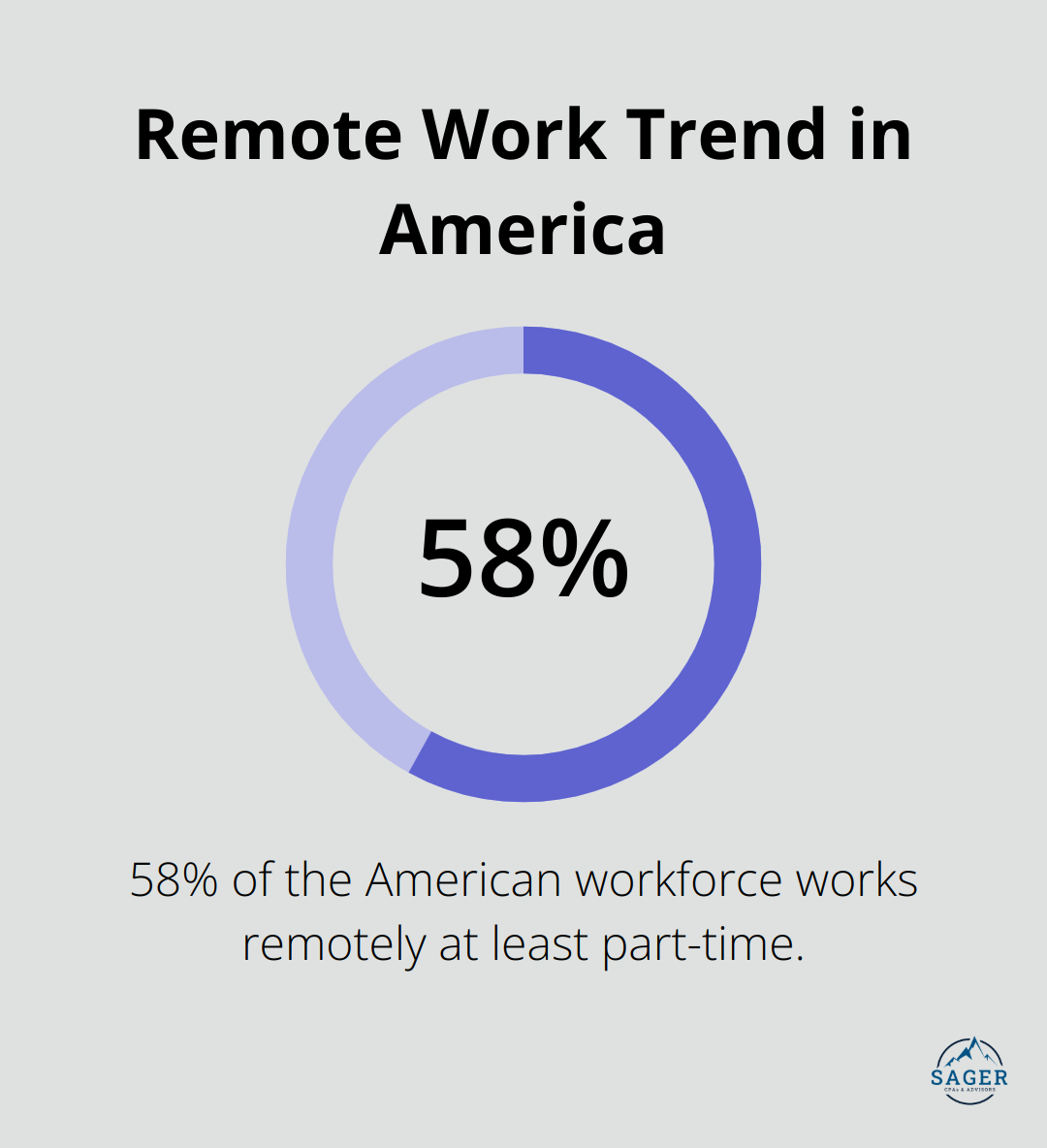

Flexjobs found that 58% of the American workforce now works remotely at least part of the time. If you’re part of this trend, don’t miss out on potential savings.

The Research and Development (R&D) tax credit is often overlooked, especially by smaller businesses. It’s not just for large corporations or tech companies. Any business that invests in innovation or improvement of products, processes, or software may qualify.

The credit can reach up to 20% of qualified research expenses over a base amount. For startups and small businesses, it can offset payroll taxes up to $250,000 annually.

Use Form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280C, and to elect other options related to the R&D tax credit.

To fully harness these deductions and credits, consider working with a qualified tax professional. They can help you identify additional opportunities and ensure you’re compliant with all regulations. The next step in implementing effective tax savings strategies involves planning throughout the year to optimize your tax position.

Accurate financial records form the foundation of effective tax planning. The IRS reports that poor recordkeeping often leads to issues in small business audits. To avoid this problem, implement a robust bookkeeping system. Cloud-based accounting software allows real-time tracking of income and expenses. This simplifies tax preparation and provides valuable insights for business decisions.

Set aside time each week to review and categorize transactions. This regular practice helps identify tax-saving opportunities and prevents last-minute rushes during tax season. It also proves crucial for maximizing deductions – organized records reduce the likelihood of missing valuable write-offs.

Timing plays a key role in tax planning. Accounting method changes or elections may decrease taxable income. If higher income is expected next year, reverse this strategy.

For example, a major equipment purchase in December rather than January could provide a full year’s depreciation deduction. Similarly, delaying client billing from late December to early January can push that income into the next tax year.

The National Federation of Independent Business (NFIB) found that 20% of small businesses struggle with cash flow management. Strategic timing of income and expenses can help alleviate this issue while optimizing tax positions.

Retirement plans serve as powerful tax-saving tools for business owners. Contributions to qualified plans like SEP IRAs, SIMPLE IRAs, or 401(k)s reduce current year tax liability while building retirement savings.

For 2025, the contribution limit for a SEP IRA is 25% of compensation or $69,000 (whichever is less). A solo 401(k) allows contributions up to $23,500, plus an additional $7,500 for those 50 or older. These high limits provide significant opportunities for tax savings.

Offering retirement plans can also attract and retain talent. The Plan Sponsor Council of America reports that 87% of eligible employees participate in their company’s 401(k) plan, highlighting its importance as an employee benefit.

State and local taxes significantly impact overall tax burdens. Each jurisdiction has its own rules and rates. Businesses operating in multiple states may face complex nexus and apportionment issues.

The Tax Foundation’s 2025 State Business Tax Climate Index provides insights into state tax environments. Consider how business activities align with various state tax structures. Some states offer tax incentives for specific industries or activities, which could influence business decisions like expansion or relocation.

Stay informed about changes in state and local tax laws. Many jurisdictions aggressively pursue out-of-state businesses for tax revenue. Proactive planning helps navigate these complexities and avoid unexpected tax liabilities.

Effective business tax savings strategies demand a comprehensive approach. Understanding your business structure, maximizing deductions and credits, and engaging in year-round tax planning will reduce your tax burden significantly. Strategic timing of income and expenses, combined with precise record-keeping, forms the core of a solid tax strategy.

Tax laws change constantly, so staying informed and adaptable proves essential for long-term success. The implementation of these strategies often requires specialized knowledge. A qualified tax professional can help you identify additional opportunities, ensure compliance, and tailor strategies to your specific business needs.

Sager CPA specializes in developing customized tax planning strategies for businesses of all sizes. Our team of experts can help you navigate tax law complexities, maximize your deductions, and implement proactive strategies that align with your long-term financial goals (including business tax savings strategies). Start implementing these strategies today to secure a more prosperous future for your business.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.