Small businesses face unique financial challenges that require expert guidance. At Sager CPA, we specialize in providing comprehensive CPA services tailored to the needs of small business owners.

Our range of CPA small business services covers everything from accounting and tax planning to strategic business advisory. We’re committed to helping you navigate the complex financial landscape and drive your business towards success.

Accounting and bookkeeping services form the foundation of any thriving small business. A comprehensive approach ensures that financial records not only maintain accuracy but also provide valuable insights for strategic decision-making.

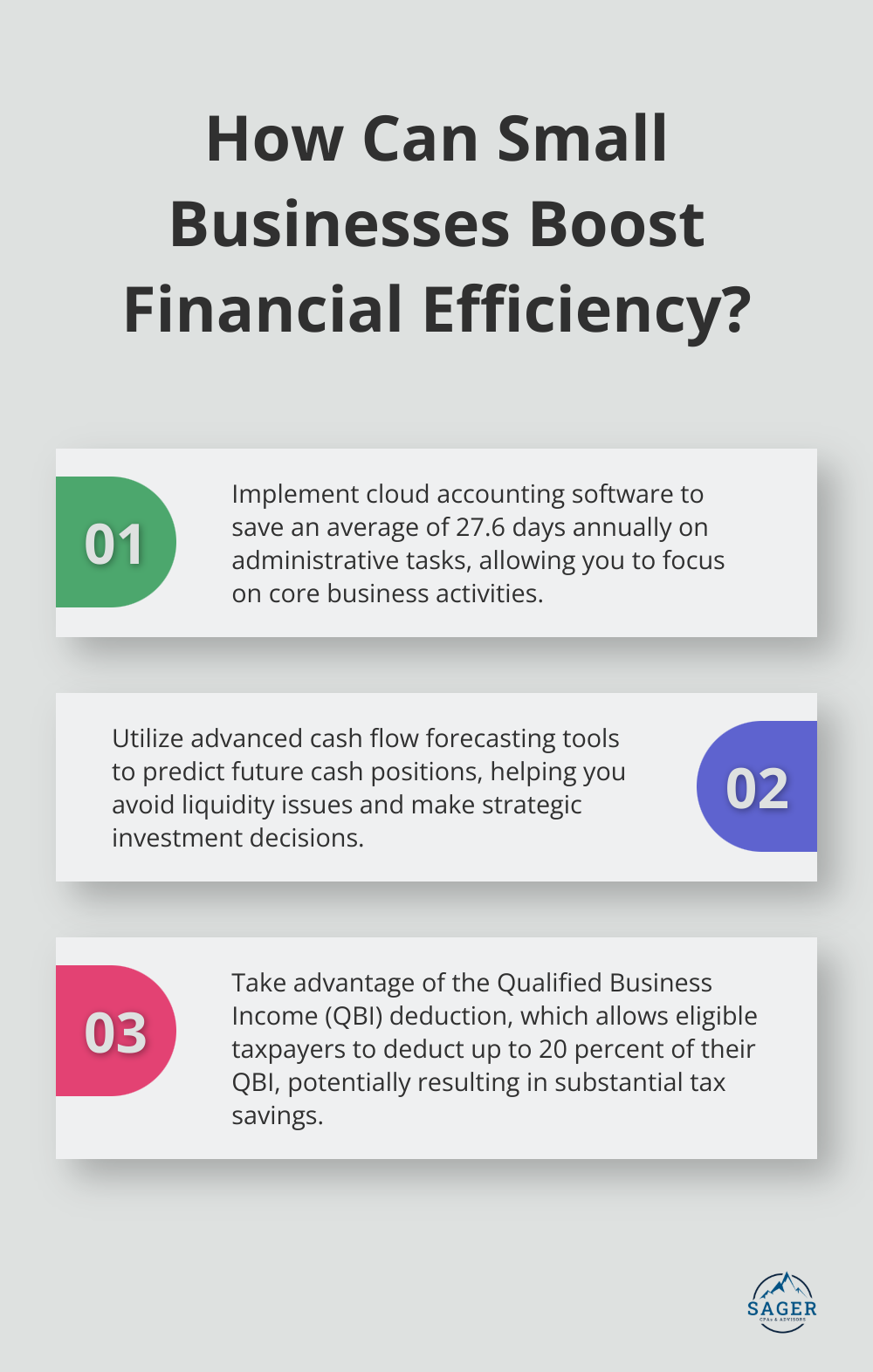

Accurate financial record-keeping is essential for small businesses. Modern accounting software (tailored to specific needs) automates processes, reduces errors, and saves time. This allows business owners to concentrate on core activities. A Sage study found that businesses using cloud accounting software save an average of 27.6 days annually on administrative tasks compared to those using traditional methods.

Monthly financial statement preparation transcends mere compliance requirements. Raw data transforms into clear, actionable reports, offering a snapshot of a business’s financial health. These statements highlight areas of strength and potential improvement. The American Institute of CPAs reports that Client Advisory Services practices are thriving and making an impact for their clients.

Cash flow management and forecasting are vital for small business survival. Advanced forecasting tools predict future cash positions, helping businesses avoid liquidity issues. This proactive approach enables better inventory management, timely bill payments, and strategic investment decisions. A U.S. Bank study reveals that 82% of small business failures stem from poor cash flow management, underscoring the importance of this service.

Payroll processing and reporting often present compliance challenges for small businesses. Professional payroll services ensure accurate and timely employee payments while maintaining compliance with ever-changing tax laws. These services handle tax filings, W-2 preparations, and provide detailed payroll reports. This comprehensive approach saves time and reduces the risk of costly penalties. The IRS reports that 40% of small businesses incur an average of $845 in penalties each year for late or incorrect filings.

Professional accounting services provide small businesses with a competitive edge. Clients often report significant improvements in financial efficiency after implementing tailored solutions. Whether a business aims to scale operations or streamline existing processes, expert accounting services prove invaluable.

As businesses navigate the complex world of finance, the next critical area to address is tax planning and preparation. This aspect of financial management can significantly impact a company’s bottom line and long-term success.

Tax planning and preparation play a vital role in financial management for small businesses. Effective tax strategies can significantly reduce liabilities and improve overall financial health. This chapter explores key aspects of tax planning and preparation that can help small businesses optimize their tax positions.

Strategic tax planning starts early and requires regular reviews. Exploring expert tax planning strategies for your business can help maximize deductions and tackle financial complexities with ease. This approach enables businesses to make informed decisions about major purchases, hiring, and investments that impact their tax position.

Understanding available tax credits and deductions is essential for minimizing tax liabilities. The Research and Development (R&D) Tax Credit can provide significant savings for businesses engaged in innovation.

Other often-overlooked deductions include home office expenses for self-employed individuals and vehicle expenses for business use. Meticulous record-keeping substantiates these deductions and reduces the risk of audit issues.

Tax laws constantly evolve, making compliance challenging for small business owners. The Tax Cuts and Jobs Act of 2017 introduced significant changes, including new deductions for pass-through entities. Staying informed about these changes ensures businesses benefit from the latest tax-saving opportunities.

The Qualified Business Income (QBI) deduction can result in substantial tax savings for eligible businesses. The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI, plus 20 percent of qualified real estate investment trust (REIT) dividends. However, its complexity often leads to underutilization.

While proper planning reduces audit risks, expert representation becomes crucial if an audit occurs.

Comprehensive support during audits includes handling all communications with tax authorities and protecting clients’ rights. Expert representation often results in favorable outcomes, minimizing additional tax liabilities and penalties.

As businesses navigate the complex landscape of tax planning and preparation, they must also consider the broader financial picture. The next chapter explores how business advisory services can provide valuable insights and strategies for overall financial success.

Financial analysis and performance metrics provide powerful tools for decision-making. We examine key performance indicators (KPIs) to help businesses identify trends, strengths, and areas for improvement. A PwC study found that companies using data-driven insights are three times more likely to report significant improvements in decision-making.

We analyze metrics such as gross profit margin, operating expenses ratio, and customer acquisition cost. This analysis pinpoints inefficiencies and opportunities for cost reduction or revenue growth.

Effective budgeting and forecasting ensure financial stability and growth. We create realistic budgets that align with business goals and market conditions. Our forecasting models incorporate historical data, market trends, and economic indicators to provide accurate projections.

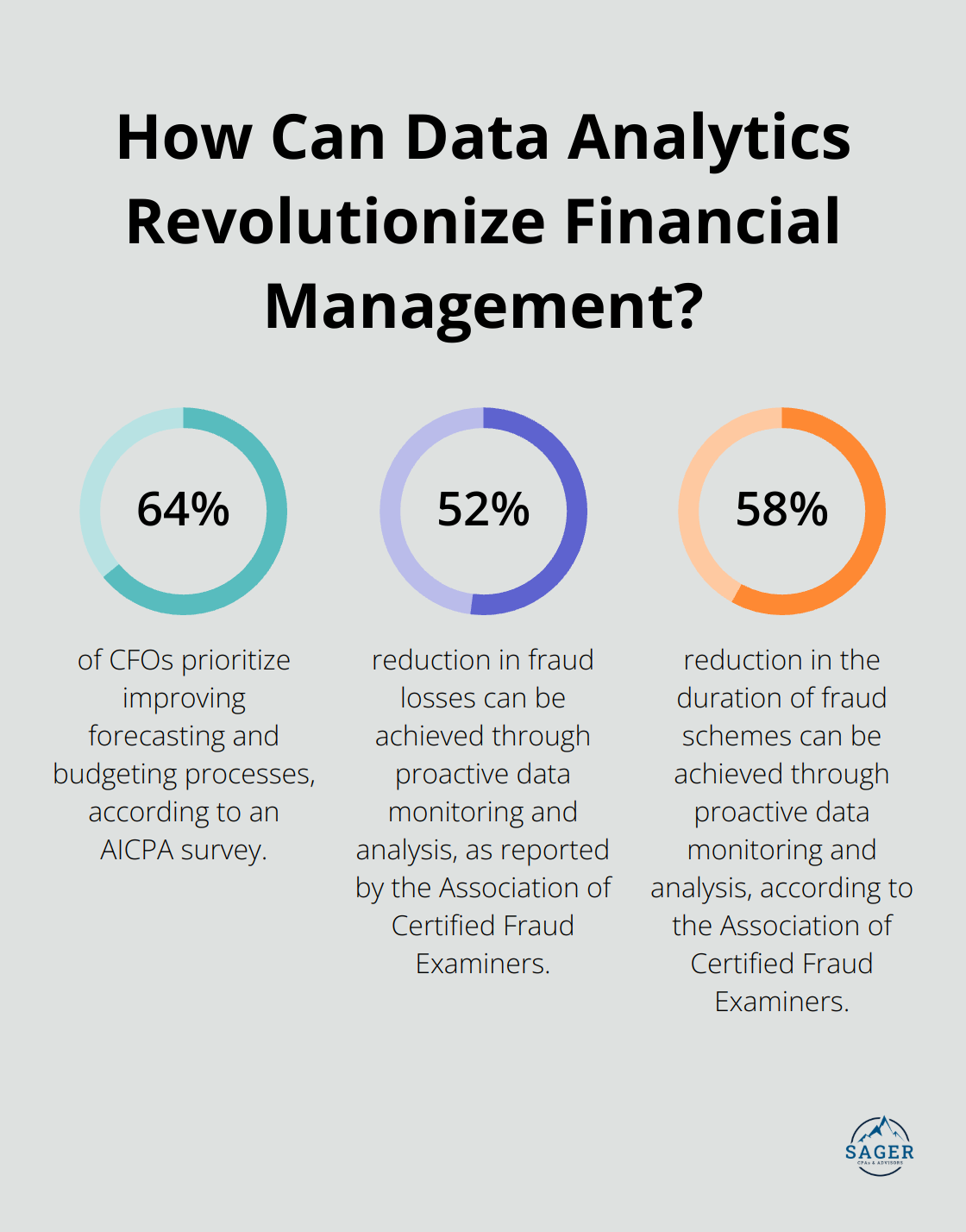

An American Institute of CPAs (AICPA) survey revealed that 64% of CFOs prioritize improving forecasting and budgeting processes. We use advanced forecasting tools to help businesses anticipate cash flow needs, plan for capital expenditures, and make informed hiring decisions.

Every business has unique growth potential. We work closely with clients to develop customized growth strategies that leverage their strengths and market opportunities. This might involve exploring new markets, diversifying product lines, or optimizing pricing strategies.

A McKinsey study found that companies with a clear, well-articulated strategy are 2.5 times more likely to achieve above-average profitability in their industry. We help businesses identify and prioritize growth initiatives, ensuring effective resource allocation for maximum impact.

Risk assessment and management are vital for long-term business success. We identify potential financial, operational, and strategic risks that could impact your business. We develop mitigation strategies to protect your assets and reputation.

The Association of Certified Fraud Examiners reports that proactive data monitoring and analysis can reduce fraud losses by 52% and cut the duration of fraud schemes by 58%. Our risk management approach includes implementing internal controls, conducting regular financial audits, and developing contingency plans for various scenarios.

We don’t just provide numbers – we offer actionable insights that drive business success. Our comprehensive approach to business advisory services ensures that small businesses have the tools and strategies needed to thrive in today’s competitive landscape.

Small businesses need more than basic accounting services in today’s complex financial landscape. They require comprehensive CPA small business services that include accounting, tax planning, and strategic business advisory. These services enable informed decision-making, financial stability, and sustainable growth for businesses of all sizes.

Professional financial management helps small businesses navigate challenges, seize opportunities, and achieve their goals more effectively. Sager CPA understands the unique needs of small businesses and offers a wide range of services tailored to meet the specific needs of each client. Our team works closely with clients to develop personalized financial strategies that foster long-term stability and growth.

Partnering with Sager CPA provides small businesses access to proactive strategies, customized action plans, and enhanced financial clarity. We believe in regular communication and supportive partnerships, ensuring our clients are always informed and empowered to make the best decisions for their businesses. Don’t leave your financial future to chance – invest in expert CPA services and set your business on the path to long-term success.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.