Accounting and tax preparation can be overwhelming for many businesses. At Sager CPA, we understand the challenges you face in managing your finances efficiently.

This blog post will guide you through practical strategies to streamline your accounting processes and simplify tax preparation. We’ll explore how to leverage technology, organize financial records, and implement year-round tax planning techniques to save time and reduce stress.

Technology has become an indispensable tool for streamlining accounting processes in today’s fast-paced business environment. The right tech solutions can transform financial management, offering significant benefits to businesses of all sizes.

Cloud-based accounting software has revolutionized financial management for businesses. These platforms provide real-time access to financial data from any location, facilitating quick decision-making and team collaboration. Popular options like QuickBooks Online and Xero offer robust features suitable for various business sizes.

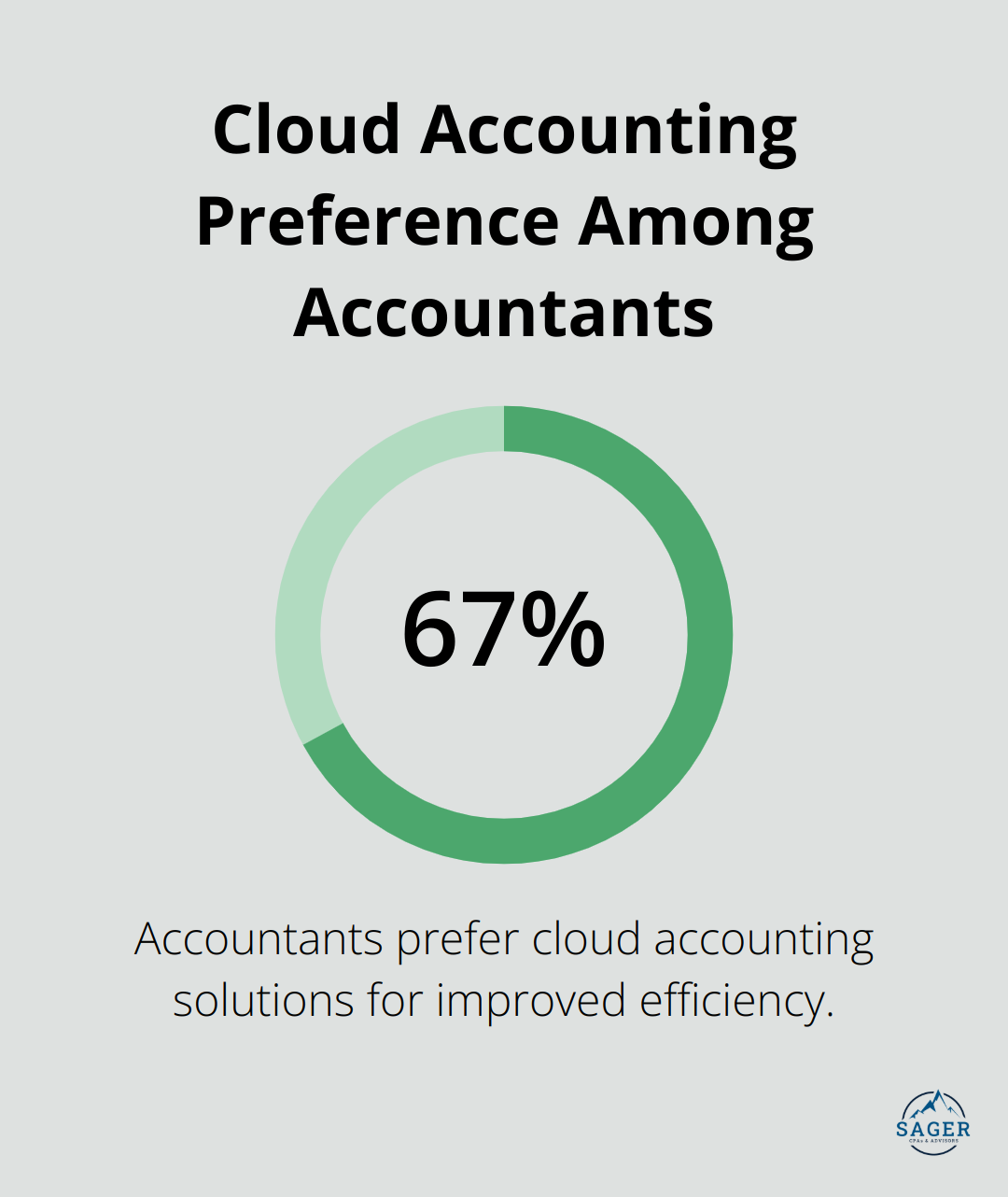

A study by Sage revealed that 67% of accountants prefer cloud accounting solutions, primarily due to improved efficiency. These systems often include automated bank feeds, which can save hours (potentially up to 10-15 hours per week) of manual data entry.

Automation tools significantly reduce time spent on repetitive tasks and minimize human error. Early research indicates that AI automation in accounting can reduce labor costs by over 50% for some tasks, such as invoice processing.

A Gartner report indicates that finance departments can cut operational costs by 25% through automation of core processes. This translates to substantial time savings that businesses can redirect towards strategic financial planning and growth initiatives.

The true power of accounting technology emerges when different financial apps work in harmony. Integration between point-of-sale systems, inventory management software, and accounting platforms creates a seamless data flow, providing a comprehensive view of business finances.

For instance, connecting an e-commerce platform (like Shopify) with accounting software can automatically sync sales, fees, and payouts. This integration eliminates manual data transfer and reduces the risk of discrepancies, leading to more accurate financial reporting.

While technology offers numerous benefits, it’s crucial to select solutions that align with your specific business needs. Start with a thorough assessment of your current processes to identify areas where technology can make the most significant impact. Consider factors such as:

If you find yourself unsure about which tools best suit your business, consulting with a professional accounting firm can provide valuable insights and guidance.

As we move forward, let’s explore how organizing financial records can further simplify your tax preparation process and complement your tech-driven accounting approach.

Effective organization of financial records forms the backbone of smooth tax preparation. A well-structured system saves time and reduces stress during tax season. This chapter outlines strategies to streamline your record-keeping process for easier tax filing.

The foundation of organized finances rests on a robust filing system. Develop a method that suits your business, whether it’s a physical filing cabinet or a digital folder structure. Categorize documents by type (income, expenses, investments) and year. This approach enables quick retrieval when needed.

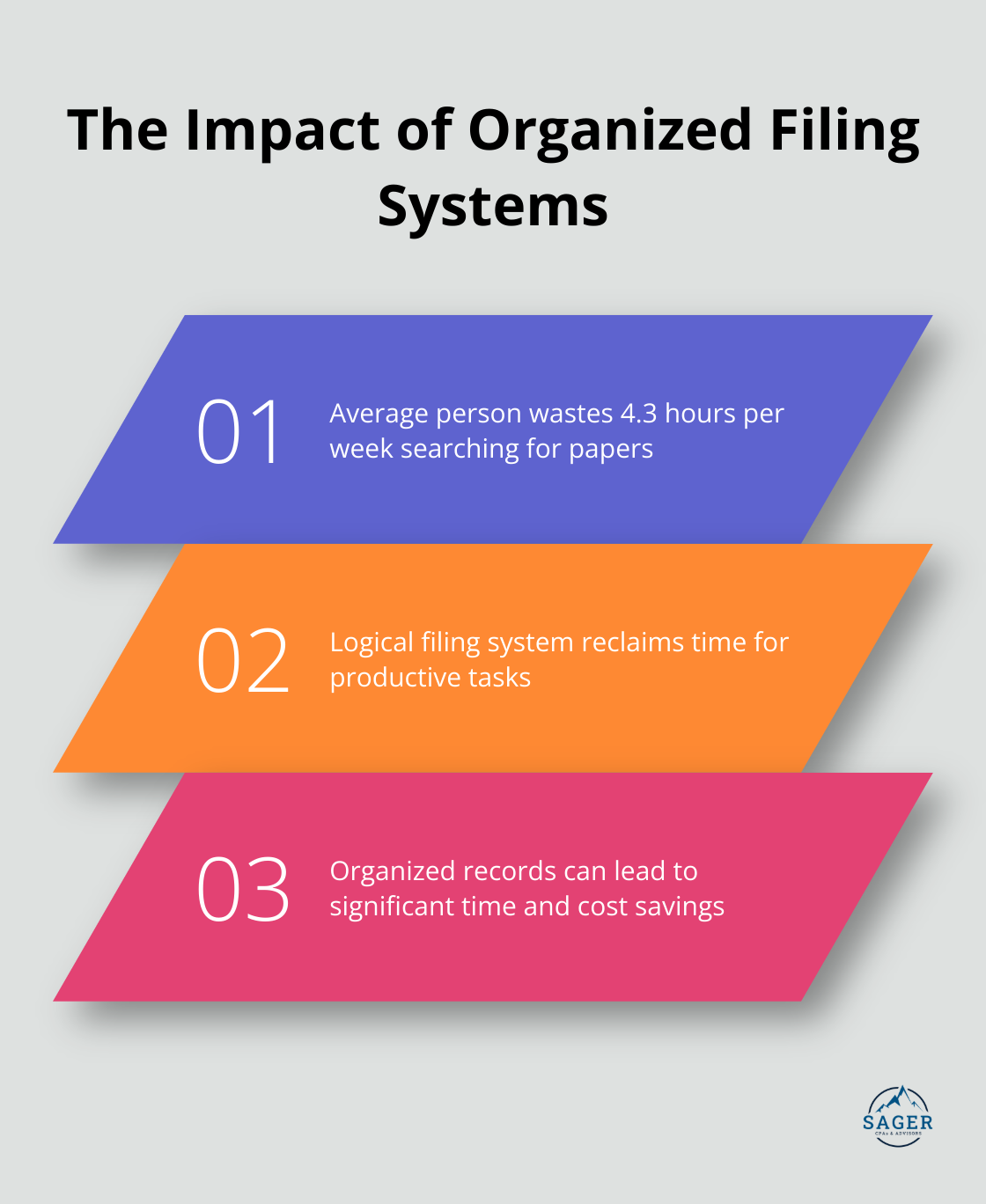

A study by the National Association of Professional Organizers revealed that the average person wastes 4.3 hours per week searching for papers. The implementation of a logical filing system allows you to reclaim this time for more productive tasks.

Proper expense categorization proves essential for accurate tax reporting and maximization of deductions. Create clear, specific categories that align with tax form requirements. For instance, instead of a general “Office Expenses” category, break it down into “Office Supplies,” “Software Subscriptions,” and “Equipment Rentals.”

The IRS reports that small businesses often overlook deductions due to poor record-keeping. Maintenance of detailed expense categories can potentially save thousands in tax liabilities. A study by the National Small Business Association found that businesses who keep organized records save an average of $5,000 annually on tax payments.

In today’s digital age, maintenance of physical copies for all documents proves unnecessary and inefficient. Implementation of a digital document management system to store and organize your financial records offers numerous benefits. Many cloud-based solutions provide secure storage, easy searchability, and automatic backups.

A survey by Concur showed that businesses that switched to digital receipt management saved an average of 11 hours per month on expense reporting. This time savings can redirect towards strategic financial planning and growth initiatives.

When you select a digital document management system, prioritize features like OCR (Optical Character Recognition) for easy searchability, multi-device access, and robust security measures. The IRS accepts digital copies of receipts and documents, as long as they’re legible and contain all necessary information.

Regular financial check-ins prove invaluable for maintaining organized records. Schedule monthly or quarterly reviews of your financial documents and categorizations. This practice helps identify any gaps in your record-keeping and allows for timely corrections.

These regular check-ins also provide an opportunity to assess your business’s financial health and make informed decisions. You’ll spot trends, identify areas for improvement, and stay ahead of potential issues before they become significant problems.

As you streamline your record-keeping processes, you’ll find that tax preparation becomes less daunting. The next chapter will explore strategies for year-round tax planning, building on the foundation of organized financial records to further simplify your tax obligations.

Tax planning requires attention throughout the year. Quarterly tax reviews help you stay on top of your tax situation. These reviews allow you to assess your current financial position, estimate tax liabilities, and make necessary adjustments. If a business owner calculates what they owe each quarter, their payments will be more accurate. However, this will require the business owner to be more diligent in their record-keeping and financial management.

During these reviews, analyze your income, expenses, and potential deductions. If you’re self-employed or own a business, consider making estimated tax payments to avoid penalties.

Tax laws change constantly. You must stay informed about these changes for effective planning. Subscribe to reputable tax news sources, attend webinars, or follow tax authority websites to keep up with updates. The tax plan has undergone a series of reforms and changes over the years, tracing its roots back to pre-independence America, highlighting the importance of staying informed.

One practical way to stay updated is to set up Google Alerts for key tax-related terms relevant to your situation. This can help you catch important changes as they happen, allowing you to adjust your strategies promptly.

While self-education is valuable, a professional tax advisor can provide personalized insights and strategies. When selecting a tax advisor, look for credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA). These professionals have the expertise to navigate complex tax situations and can offer tailored advice based on your specific financial circumstances.

Effective tax planning involves more than just filling out forms correctly. It requires strategic decisions throughout the year that positively impact your financial future. Try to anticipate potential tax implications before making major financial decisions (such as selling assets or changing your business structure).

Schedule monthly or quarterly reviews of your financial documents and categorizations. This practice helps identify any gaps in your record-keeping and allows for timely corrections. These regular check-ins also provide an opportunity to assess your business’s financial health and make informed decisions.

Streamlined accounting and tax preparation processes are essential for business success in today’s fast-paced environment. Technology, organized financial records, and year-round tax planning strategies reduce time and stress associated with financial management and tax compliance. Cloud-based software, automation tools, and integrated financial apps revolutionize how businesses handle their finances, saving time and improving accuracy.

Proactive financial management involves regular check-ins, staying informed about tax law changes, and making strategic decisions with tax implications in mind. This approach allows businesses to anticipate potential issues, maximize deductions, and minimize tax liabilities. Implementing these strategies can transform your approach to accounting and tax preparation, creating a solid financial foundation that supports your business goals.

Sager CPA offers expert financial management and tax planning services tailored for individuals and businesses. Their comprehensive approach includes precise accounting, strategic advisory services, and tax planning to reduce liabilities (where possible). Sager CPA ensures you make informed decisions through regular communication and supportive partnerships, fostering long-term financial stability and growth.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.