Corporate tax planning is a critical aspect of financial management for businesses of all sizes. At Sager CPA, we’ve seen how strategic reactions in corporate tax planning can significantly impact a company’s bottom line.

In this post, we’ll explore key strategies, recent tax reforms, and their effects on corporate planning. We’ll also discuss the importance of professional guidance in navigating the complex world of corporate taxation.

Corporate tax planning is a strategic approach to manage a company’s tax obligations while maximizing financial efficiency. It involves understanding and applying tax laws to benefit the business financially. This strategy extends beyond simply paying less tax; it aims to optimize the company’s overall financial position.

Effective tax strategies rely on several essential components:

Understanding the difference between tax avoidance and tax evasion is critical:

The line between these two can sometimes blur.

In practice, corporate tax planning might include:

As we move forward, we’ll explore common corporate tax planning strategies that businesses employ to optimize their tax positions and enhance their financial performance.

Corporate tax planning involves a combination of strategic approaches that help businesses reduce their tax liabilities and contribute to overall financial health. This chapter explores key strategies for optimizing tax positions and enhancing financial performance.

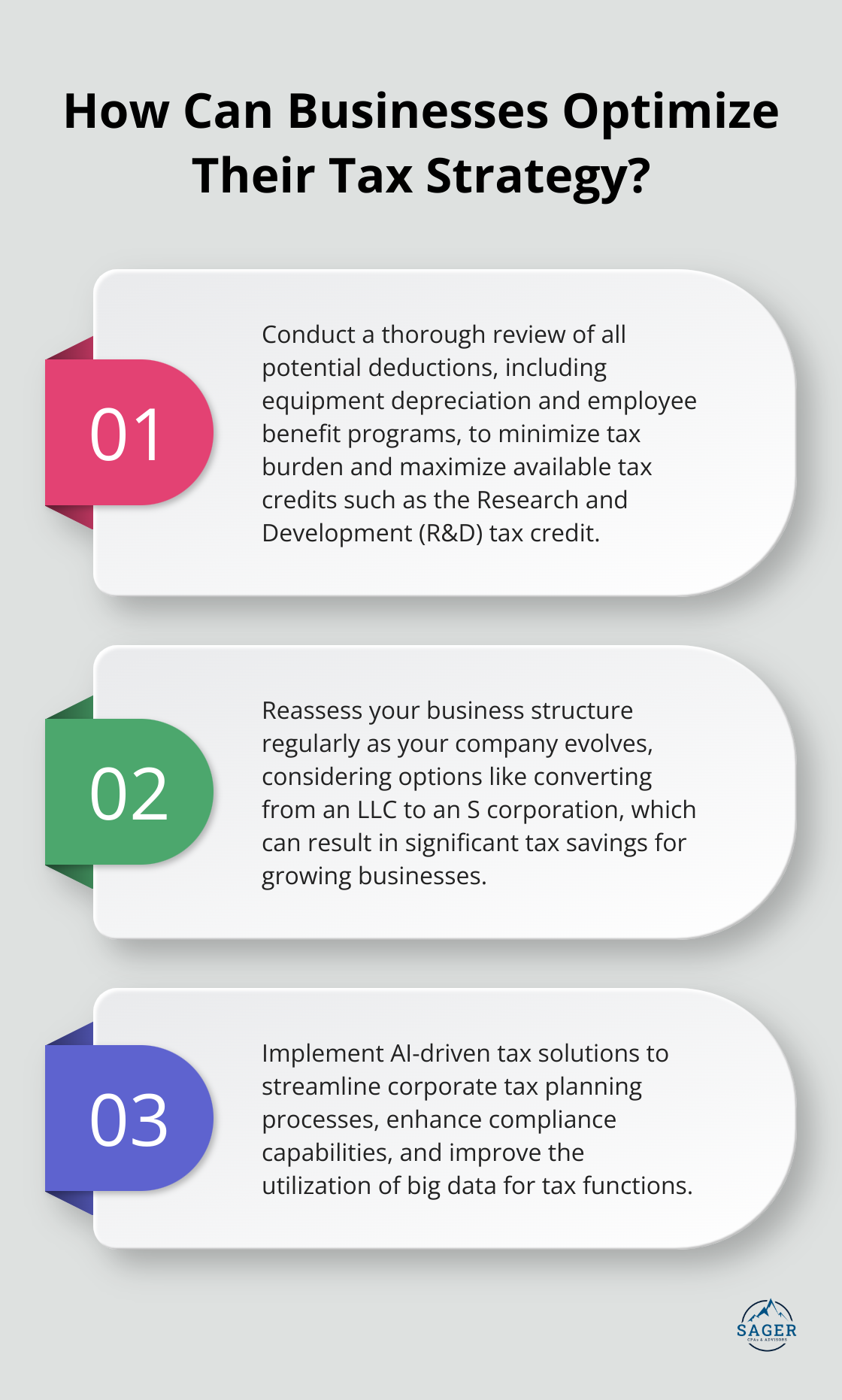

One of the most impactful strategies is the full utilization of available tax deductions and credits. The Research and Development (R&D) tax credit is intended to encourage companies to invest more in basic and applied research and some stages of development than they would if the credit did not exist. Companies should conduct a thorough review of all potential deductions, from equipment depreciation to employee benefit programs, to minimize their tax burden.

The timing of income recognition and expense realization can substantially affect a company’s tax position. Companies can lower their immediate tax burden by deferring income to the following tax year or accelerating deductible expenses into the current year. This strategy proves particularly effective when companies anticipate changes in tax rates or company profitability.

The choice of business entity can have far-reaching tax implications. S corporations, C corporations, partnerships, and LLCs each have unique tax treatments. Companies should regularly reassess their business structure as they evolve, as changing from one entity type to another (e.g., from an LLC to an S corporation) can result in significant tax savings for growing businesses.

For companies operating across borders, international tax planning is essential. This involves strategies like transfer pricing optimization and utilizing tax treaties. The Global Minimum Tax represents a major step forward in international cooperation on the taxation of multinational enterprises (MNEs). This development underscores the importance of staying informed about international tax developments and adjusting strategies accordingly.

Modern tax planning integrates technology and business insights to meet compliance and strategic goals. Companies should adopt digital tax strategies to address tax administration, effectiveness, and big data utilization for improved tax functions. Utilizing AI-driven tax solutions can streamline corporate tax planning processes and enhance compliance capabilities.

The implementation of these strategies requires careful consideration of specific business circumstances and long-term goals. While these approaches can lead to substantial tax savings, companies must ensure compliance with all relevant tax laws and regulations. Professional guidance from experienced tax advisors can help develop tailored tax strategies that align with financial goals while maintaining full legal compliance.

As we move forward, we’ll explore the impact of recent tax reforms on corporate planning and how these changes have shifted the focus of tax planning strategies.

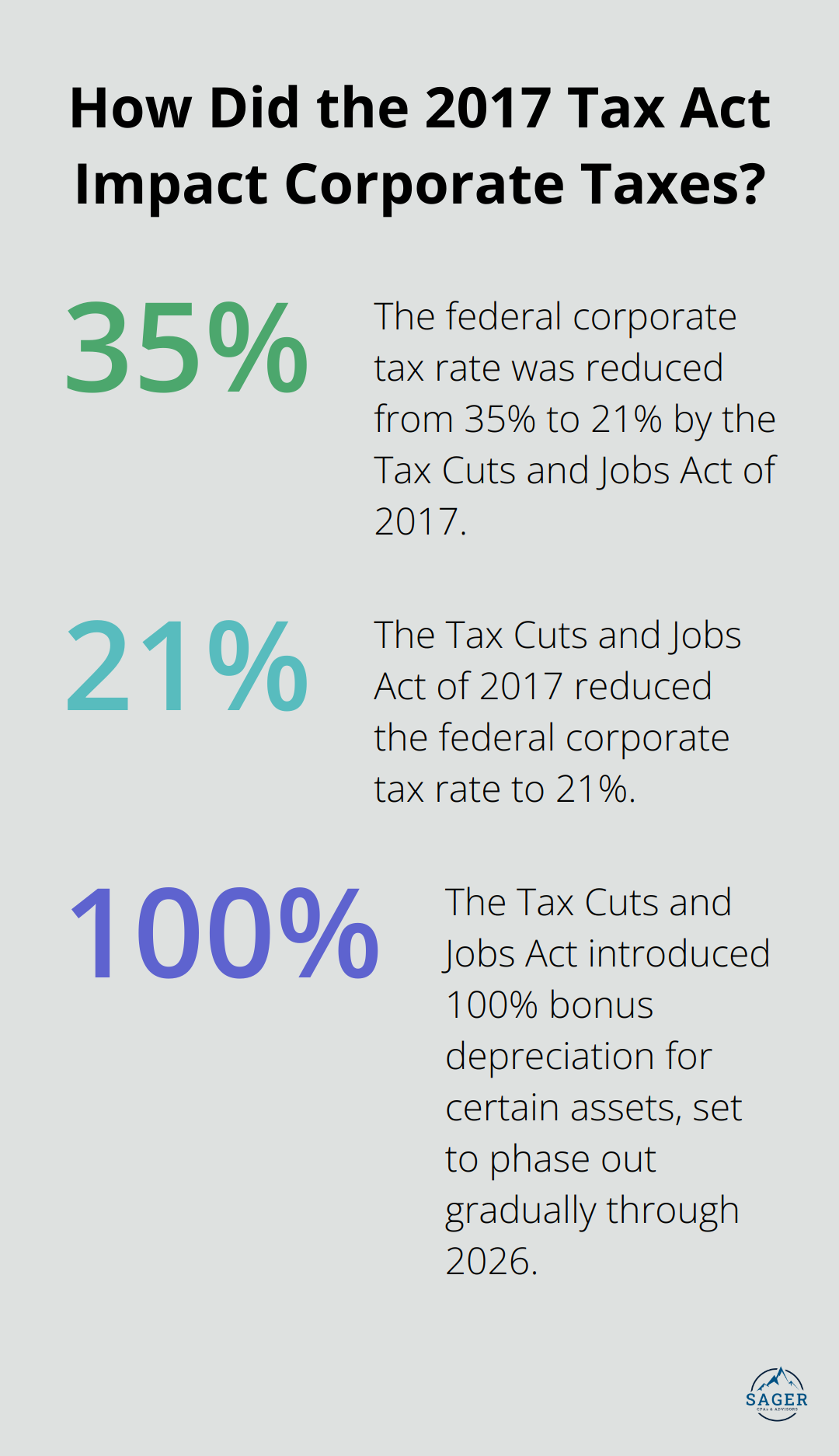

The Tax Cuts and Jobs Act (TCJA) of 2017 reduced the federal corporate tax rate from 35% to 21%. This decrease prompted businesses to reevaluate their entity structures. S corporations might now find it advantageous to convert to C corporations to benefit from the lower rate. However, this decision requires careful analysis of long-term implications (including potential future tax rate changes).

The TCJA expanded immediate expensing options for businesses. Section 179 deduction limits increased, allowing companies to deduct up to $1 million for qualifying property in the year of purchase. The introduction of 100% bonus depreciation for certain assets (set to phase out gradually through 2026) also occurred. Companies should consider accelerating major equipment purchases to maximize these deductions before they decrease.

The international tax landscape underwent significant changes. The Global Intangible Low-Taxed Income (GILTI) provision impacted U.S. multinationals with foreign subsidiaries. GILTI creates a minimum tax on foreign earnings, compelling companies to reassess their global tax strategies. The Base Erosion and Anti-Abuse Tax (BEAT) targets large corporations making significant payments to foreign affiliates, necessitating a review of intercompany transactions.

The Foreign-Derived Intangible Income (FDII) deduction offers a tax break for income derived from foreign sales and services. This provision encourages companies to keep intellectual property in the U.S. while serving foreign markets. Businesses should evaluate their export strategies to potentially benefit from this deduction.

These reforms continue to evolve, making it essential for businesses to stay informed and agile in tax planning. Companies need to monitor these changes to navigate the complex tax environment effectively. Expert guidance (such as that provided by Sager CPA) ensures that businesses can adapt their strategies promptly, maximizing benefits while maintaining compliance with the ever-changing tax code.

Corporate tax planning requires constant vigilance and adaptability. Strategic reactions in corporate tax planning significantly impact a company’s financial health and long-term success. The ever-changing landscape of tax laws and regulations demands that businesses remain informed and proactive in their approach to tax management.

Proactive tax planning offers numerous benefits for corporations. It allows companies to optimize their tax positions, reduce liabilities, and allocate resources more efficiently. Expert tax advisors play a vital role in developing and implementing effective strategies tailored to each company’s unique circumstances.

Sager CPA specializes in providing comprehensive tax planning services that help businesses navigate the intricacies of corporate taxation. Our team offers strategic advice, customized action plans, and ongoing support to ensure our clients make informed financial decisions. We work closely with businesses to develop proactive tax strategies that reduce liabilities and contribute to long-term financial stability (and growth).

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.