At Sager CPA, we know that reducing your income tax burden is a top priority for many individuals and businesses.

Effective income tax reduction strategies can significantly impact your financial well-being. This blog post will explore practical methods to lower your tax liability while staying compliant with IRS regulations.

We’ll cover key areas including maximizing deductions, leveraging tax-advantaged accounts, and implementing strategic income management techniques.

The decision between standard and itemized deductions can significantly impact your tax liability. For 2025, the standard deduction rises to $30,000 for married couples filing jointly. If your eligible expenses exceed these amounts, itemizing might prove more beneficial.

Itemizing allows you to deduct specific expenses such as mortgage interest, state and local taxes (up to $10,000), and charitable contributions. However, this method requires more extensive record-keeping and documentation. We recommend calculating both ways to determine which method results in the lower tax bill.

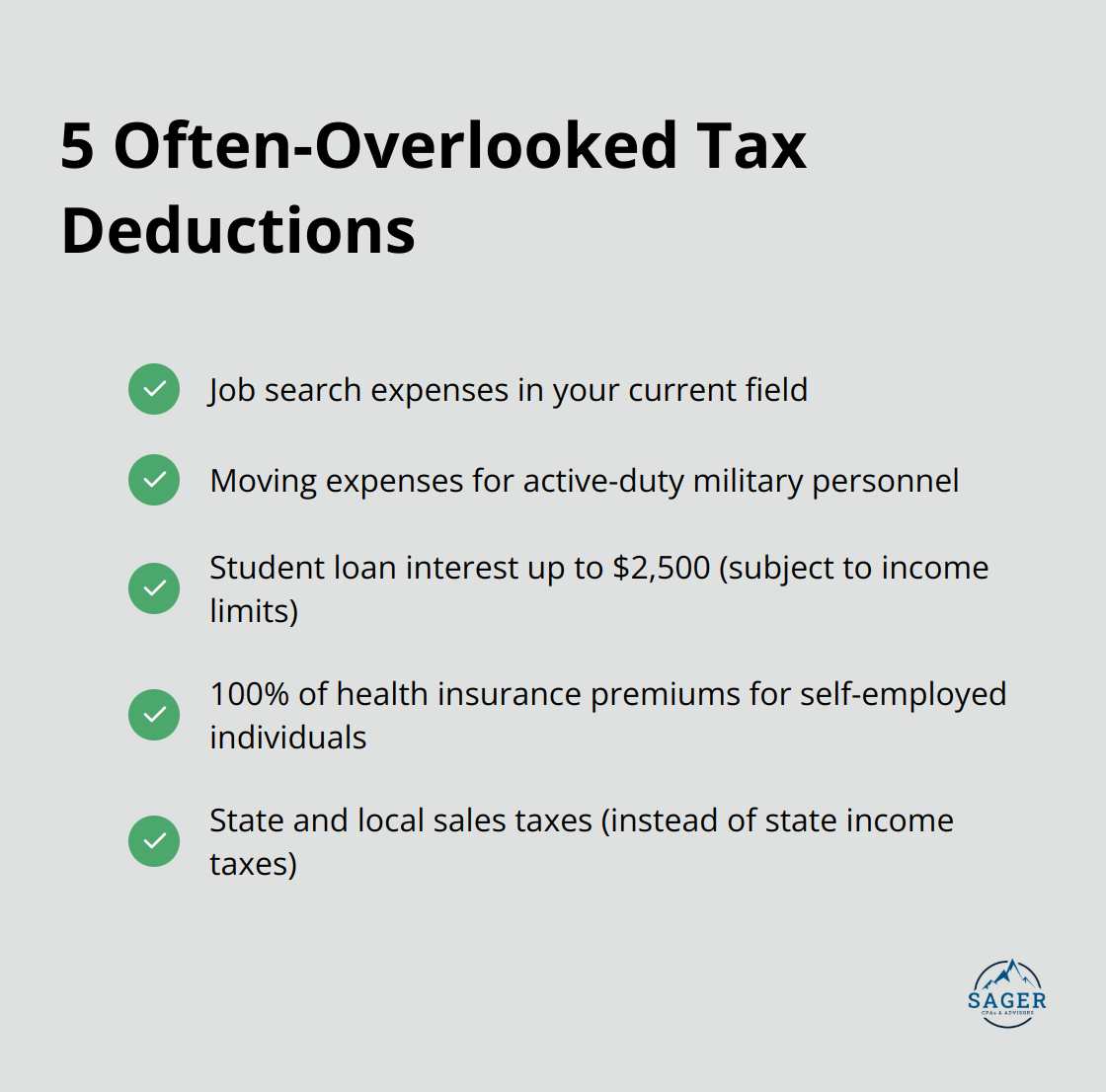

Many taxpayers miss out on valuable deductions simply because they don’t know about them. Here are some frequently overlooked deductions:

Proper documentation proves essential for maximizing your deductions and protecting yourself in case of an audit. We advise our clients to:

Tax laws change frequently, and staying informed can prove challenging. Working with a knowledgeable tax professional ensures you take advantage of every available deduction. A tax expert can help you navigate complex tax situations, identify lesser-known deductions, and develop strategies to minimize your tax liability.

Now that we’ve explored how to maximize your deductions, let’s turn our attention to another powerful strategy for reducing your income tax: leveraging tax-advantaged accounts.

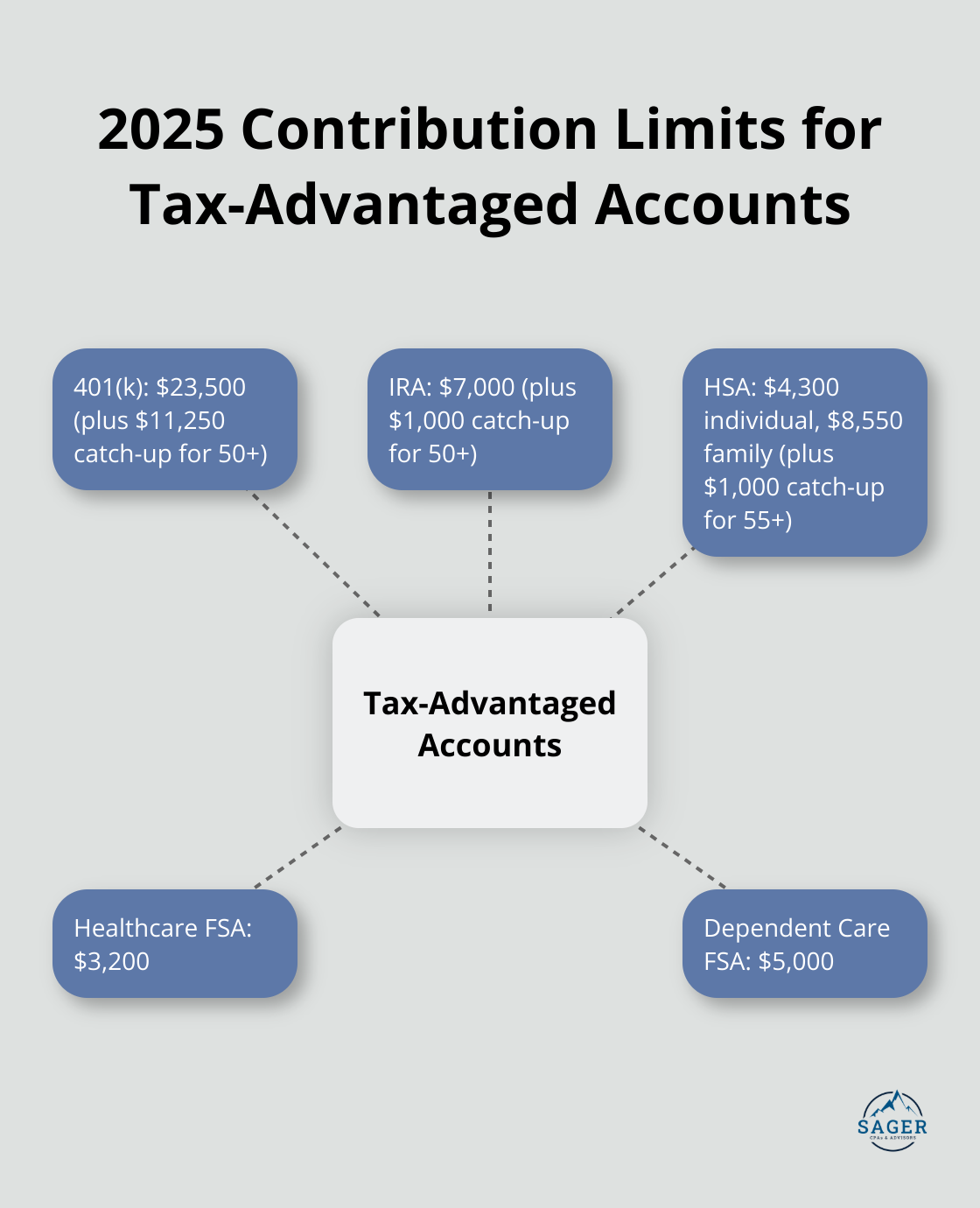

Tax-advantaged accounts offer significant opportunities to reduce your income tax burden. Retirement accounts stand out as particularly effective tools. For 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional catch-up contribution of $11,250 for those 50 or older). These pre-tax contributions directly lower your taxable income for the year.

Self-employed individuals or those without employer-sponsored 401(k)s should consider Individual Retirement Accounts (IRAs). The 2025 contribution limit for IRAs is $7,000 (plus an extra $1,000 for those 50 and above). Depending on your income and employer-sponsored retirement plan status, these contributions may be tax-deductible.

Health Savings Accounts (HSAs) provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, individuals can contribute up to $4,300, while families can contribute up to $8,550 (those 55 or older can add an extra $1,000 as a catch-up contribution).

To qualify for an HSA, you must enroll in a high-deductible health plan (HDHP). HSA funds roll over year to year, making them an excellent long-term savings vehicle for healthcare costs.

Flexible Spending Accounts (FSAs) allow you to set aside pre-tax dollars for specific expenses. The two most common types are healthcare FSAs and dependent care FSAs. For 2025, you can contribute up to $3,200 to a healthcare FSA and up to $5,000 to a dependent care FSA.

FSAs typically have a “use it or lose it” policy, requiring you to spend the funds within the plan year or a grace period. However, some employers allow a carryover of up to $640 for healthcare FSAs.

To fully leverage these tax-advantaged accounts, you must plan ahead and contribute consistently throughout the year. The optimal contribution levels will depend on your individual financial situation and goals. A tax professional can help you determine the best strategy for your specific circumstances.

As we move forward, let’s explore how strategic income management can further reduce your tax liability and complement the benefits of tax-advantaged accounts.

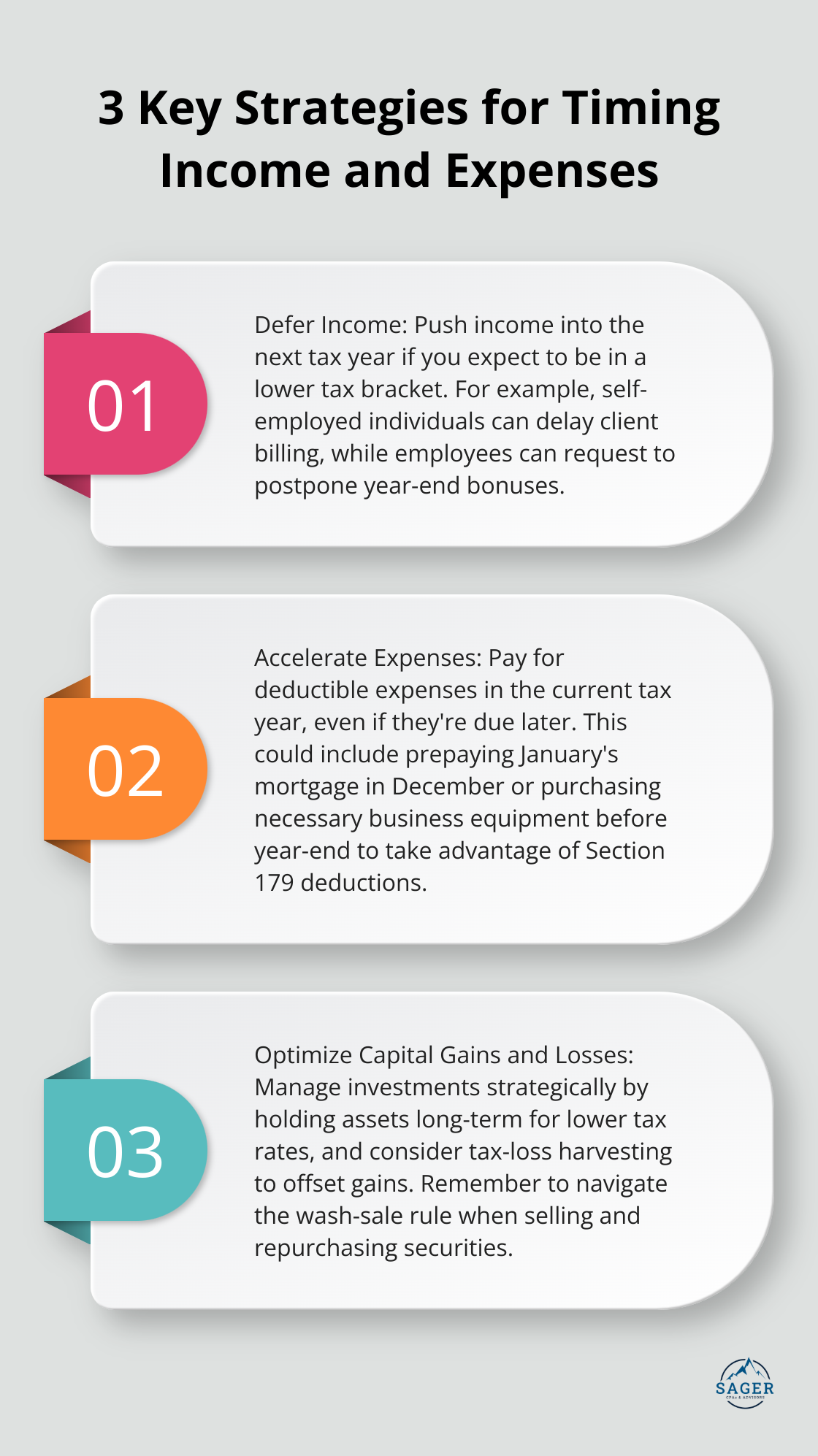

You can reduce your tax liability by pushing income into the next tax year. This strategy works well if you expect to be in a lower tax bracket in the future. Self-employed individuals might delay client billing until late December. Employees could request their employer to postpone year-end bonuses until January. However, you must balance this approach with your current financial needs. The IRS prohibits deferring income you have the right to receive (known as constructive receipt). Always consult a tax professional to ensure IRS compliance.

The counterpart to income deferral is expense acceleration. This method involves paying for deductible expenses in the current tax year, even if they’re due later. For example, you could prepay your January mortgage payment in December to claim the interest deduction this year. Business owners can purchase necessary equipment or supplies before year-end. The Section 179 deduction allows businesses to deduct up to $1,250,000 in qualifying purchases for 2025.

Managing capital gains and losses can lead to substantial tax savings. Long-term capital gains (from assets held for over a year) are taxed at lower rates than short-term gains. In 2025, individuals in the 10% and 12% tax brackets pay 0% on long-term capital gains.

Tax-loss harvesting is another effective strategy. It involves selling investments at a loss to offset gains in other investments. If your capital losses exceed your gains, you can use up to $3,000 of the excess to offset other income. Any remaining losses can carry forward to future years.

The wash-sale rule prohibits claiming a loss on a security if you buy the same or a substantially identical security within 30 days before or after the sale. This rule aims to prevent taxpayers from creating artificial losses. To avoid triggering this rule, you can wait 31 days before repurchasing the same security or buy a similar (but not identical) security.

Tax laws change frequently, and staying informed can prove challenging. Working with a knowledgeable tax professional ensures you take advantage of every available strategy. A tax expert can help you navigate complex tax situations, identify lesser-known opportunities, and develop strategies to minimize your tax liability.

Income tax reduction strategies require a personalized approach. Your unique financial situation demands tailored solutions, as what works for one taxpayer may not suit another. A tax professional can provide invaluable expertise in creating strategies that align with your specific needs and objectives.

At Sager CPA, we specialize in comprehensive tax planning services that go beyond simple tax preparation. Our team of experts stays current with the latest tax laws and regulations to help you benefit from every available opportunity to reduce your tax burden. We can help you navigate complex tax situations, identify often-overlooked deductions, and develop long-term strategies to minimize your tax liability.

Effective tax planning is an ongoing process that adapts to your evolving financial situation and changing tax laws. Take control of your tax situation and pave the way for long-term financial success. Schedule a consultation with Sager CPA today to discover how our personalized approach to tax planning can benefit you.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.