Reducing your taxable income is a smart way to keep more money in your pocket. At Sager CPA, we’ve seen firsthand how effective tax strategies can significantly lower our clients’ tax bills.

This blog post will explore practical tax strategies to reduce taxable income, from maximizing deductions to timing income and expenses. We’ll also dive into retirement and investment strategies that can help you minimize your tax burden while building wealth for the future.

Maximizing deductions and credits is a powerful way to reduce your taxable income. Let’s explore some effective strategies you can use to keep more money in your pocket.

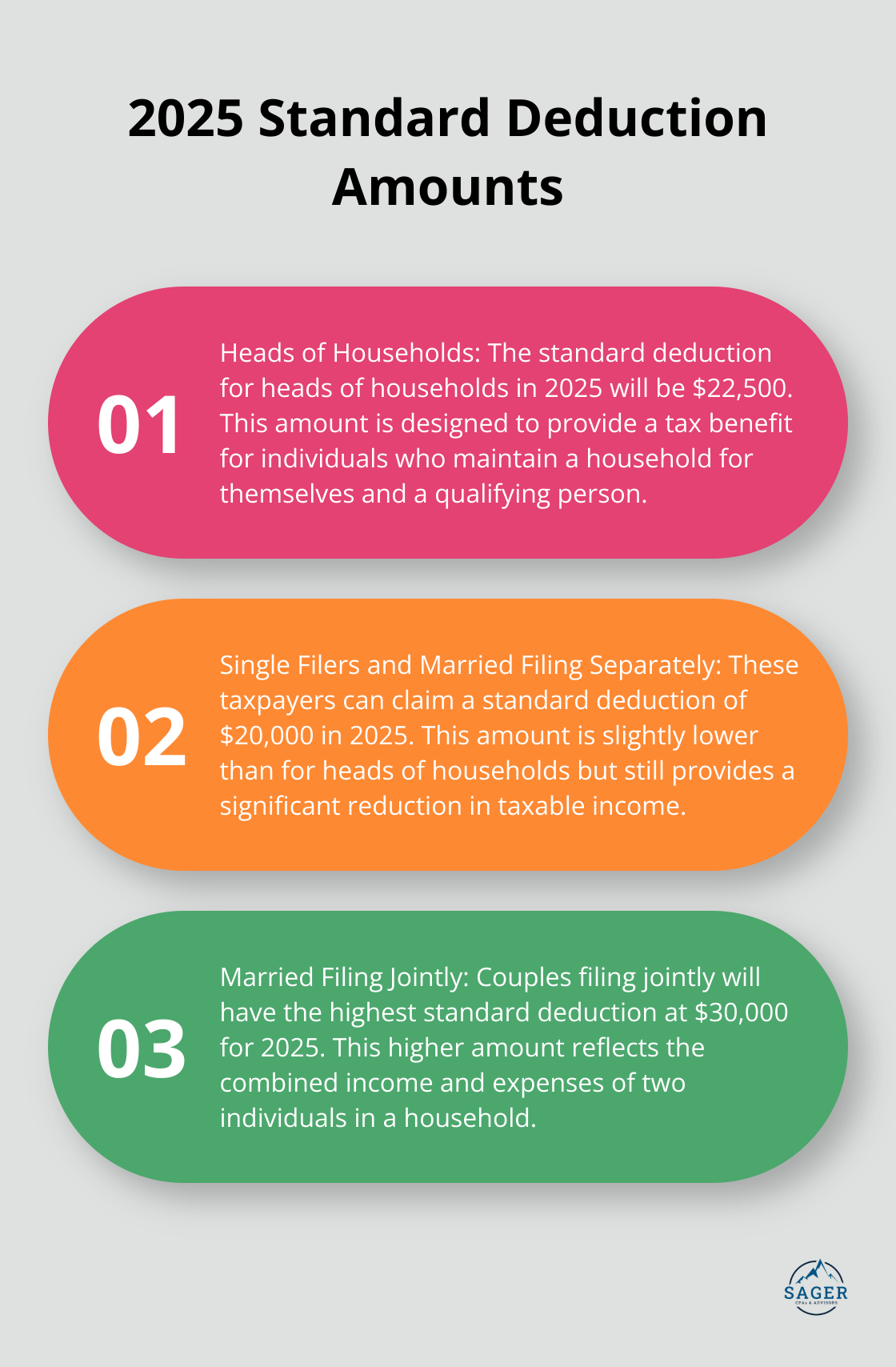

For 2025, the standard deduction will be $22,500 for heads of households. If your deductible expenses exceed these amounts, itemizing could lead to significant tax savings. Common itemized deductions include mortgage interest, state and local taxes (up to $10,000), and charitable contributions. Keep meticulous records of all potential deductions throughout the year to make an informed decision come tax time.

Self-employed individuals and small business owners have a unique opportunity to reduce their taxable income through business expense deductions. These can include home office expenses, vehicle costs, supplies, and even a portion of your internet and phone bills. The key is to ensure these expenses are ordinary and necessary for your business. The IRS scrutinizes these deductions closely, so maintain detailed records and receipts.

If you or your dependents pursue higher education, you might qualify for valuable tax benefits. The American Opportunity Tax Credit offers up to $2,500 per eligible student. For graduate students or lifelong learners, the Lifetime Learning Credit provides up to $2,000 per tax return. These credits can directly reduce your tax bill, making them more valuable than deductions in many cases.

Charitable giving not only supports causes you care about but can also reduce your taxable income. For 2025, you can deduct charitable contributions up to 60% of your adjusted gross income for cash donations to public charities. Only donations to qualified organizations are tax-deductible. Consider bunching your charitable contributions into a single tax year to exceed the standard deduction threshold and maximize your tax benefit.

As we move forward, it’s important to consider how these deductions and credits fit into your overall financial strategy. The next section will explore retirement and investment strategies that can further reduce your taxable income while building long-term wealth.

Retirement and investment strategies provide powerful tools to reduce your taxable income while building long-term wealth. Let’s explore effective approaches that can make a real difference in your tax situation.

One of the most effective ways to lower your taxable income is to contribute to tax-advantaged retirement accounts. For 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). These contributions use pre-tax dollars, which directly reduces your taxable income for the year.

Self-employed individuals or those with side gigs should consider opening a SEP IRA or Solo 401(k). These accounts often have higher contribution limits than traditional IRAs, allowing you to shelter even more income from taxes.

Health Savings Accounts (HSAs) offer a unique triple tax advantage. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. For 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, making them an excellent vehicle for long-term savings and investment. Many people use HSAs as a supplemental retirement account, taking advantage of the tax-free growth over decades.

Tax-loss harvesting is a sophisticated strategy that can help offset capital gains and reduce your overall tax burden. This strategy involves selling investments that have declined in value to realize losses, which can then offset capital gains or up to $3,000 of ordinary income.

For example, if you have $10,000 in capital gains this year, you could sell underperforming investments with $10,000 in losses to completely offset those gains. (Just be aware of the wash-sale rule, which prohibits repurchasing the same or substantially identical security within 30 days.)

Municipal bonds can be an excellent addition to your investment portfolio, especially if you’re in a higher tax bracket. The interest from these bonds is typically exempt from federal taxes (and often from state and local taxes if you live in the issuing state).

While municipal bonds generally offer lower yields than taxable bonds, their tax-exempt status can result in a higher after-tax return. For instance, a municipal bond yielding 3% could be equivalent to a taxable bond yielding 4.5% for someone in the 33% tax bracket.

The success of these retirement and investment strategies depends on careful planning and execution. What works best for you will depend on your individual financial situation, goals, and risk tolerance. As we move forward, we’ll explore how timing your income and expenses can further enhance your tax reduction efforts.

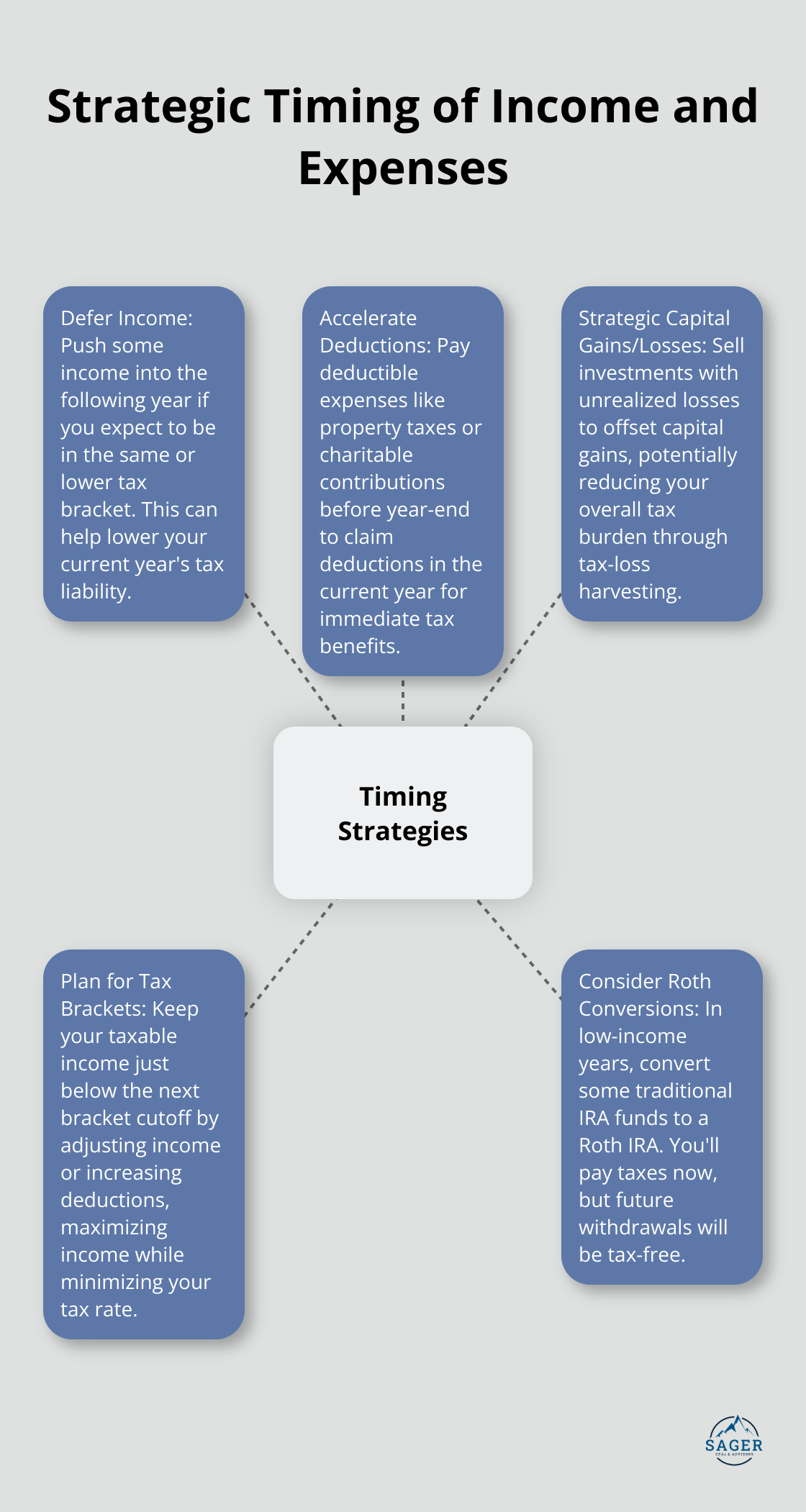

Strategic timing of income and expenses can significantly impact your tax liability. Let’s explore some effective strategies to optimize your tax situation.

You can reduce your tax liability by pushing some income into the following year. This strategy works best if you expect to be in the same or lower tax bracket next year. Self-employed individuals might delay billing clients until late December. Employees could request to receive year-end bonuses in January rather than December. This approach keeps you in a lower bracket for the current year.

While you defer income, it often makes sense to accelerate deductions into the current year. Pay deductible expenses like property taxes, state and local income taxes, or charitable contributions before December 31st. Business owners should consider purchasing necessary equipment or supplies before year-end to claim the deduction in the current year. This strategy provides immediate tax benefits.

You can significantly reduce your tax burden through the strategic use of capital gains and losses. Consider selling investments with unrealized losses to offset capital gains. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Be cautious of the wash-sale rule, which disallows the loss if you repurchase the same or a substantially identical security within 30 days.

Understanding tax bracket thresholds allows you to plan your income and deductions more effectively. Try to keep your taxable income just below the next bracket cutoff. This approach maximizes your income while minimizing your tax rate. For example, if you’re close to the 24% bracket threshold, you might increase your 401(k) contributions to stay within the 22% bracket.

In years when your income is lower than usual, consider converting some of your traditional IRA to a Roth IRA. You’ll pay taxes on the converted amount now, but future withdrawals will be tax-free. Roth IRAs also provide advantages such as no required minimum distributions and the potential to leave a tax-free inheritance to heirs. It’s important to consult with a tax professional to determine if this approach aligns with your long-term financial goals.

Smart tax strategies to reduce taxable income can significantly impact your financial picture. These approaches range from maximizing deductions and credits to leveraging retirement accounts and timing income and expenses. Your unique financial situation, goals, and risk tolerance should guide your tax reduction strategies.

A tax professional can provide invaluable benefits in navigating the complex world of tax reduction. Sager CPA offers expert financial management and tax planning services tailored for individuals and businesses. Our team can help you develop a comprehensive tax strategy that aligns with your financial goals.

Effective tax planning is an ongoing process, not a once-a-year event. You can take control of your financial future and keep more of your hard-earned money working for you. A trusted tax professional can help you create a customized action plan that reduces your current tax liability and sets you up for long-term financial success.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.