Tax optimization strategies can significantly reduce your tax burden and increase your financial well-being. At Sager CPA, we’ve seen countless clients benefit from smart tax planning.

This blog post will guide you through practical steps to minimize your tax liability and maximize your savings. We’ll cover everything from understanding your tax situation to working with a professional advisor.

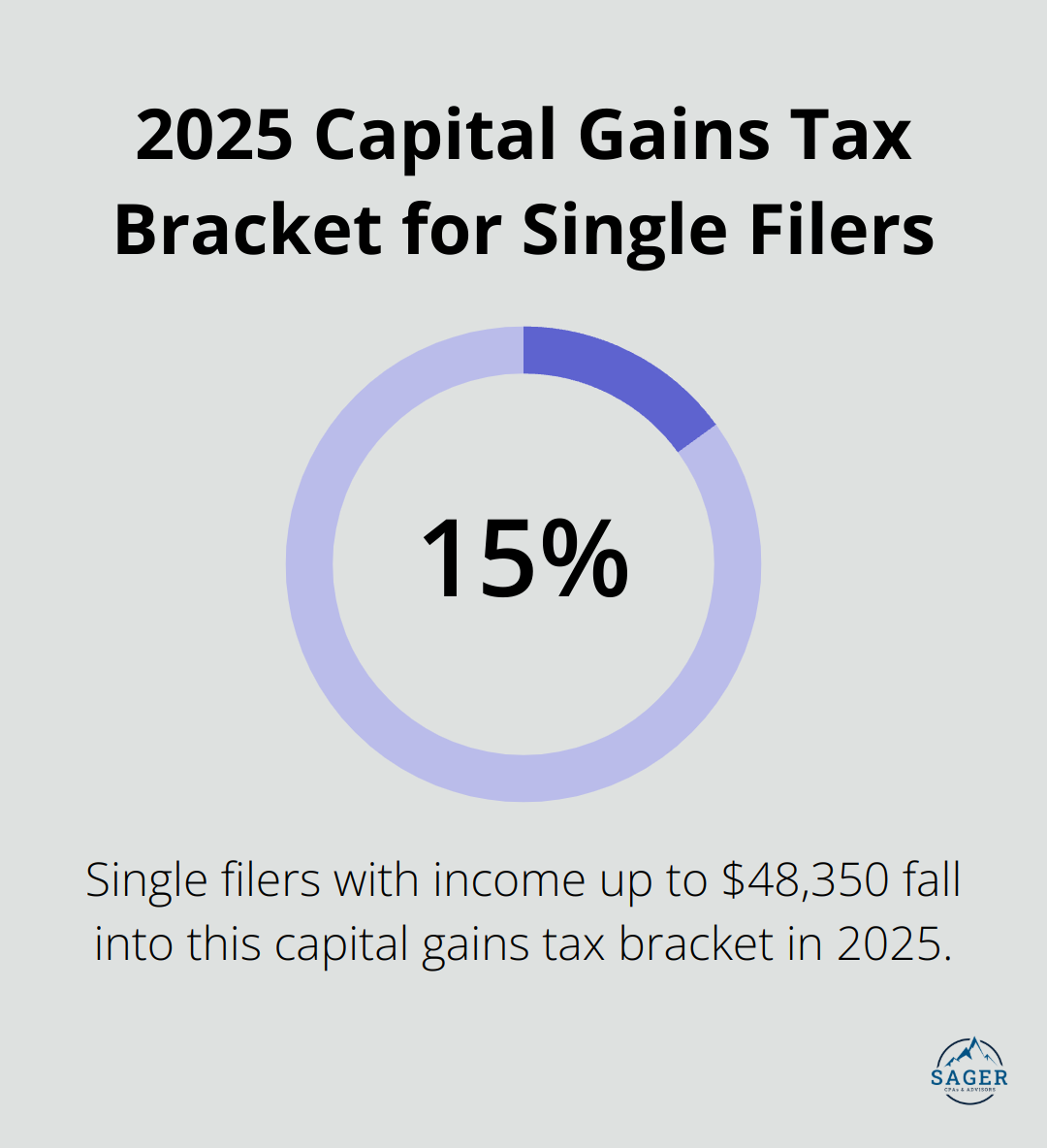

Your income sources directly influence your tax liability. Wages, self-employment income, investments, and rental properties each carry unique tax implications. Long-term capital gains (from investments held over a year) enjoy lower tax rates compared to short-term gains. The Internal Revenue Service reports that in 2025, single filers with income up to $48,350 will fall into the 15% capital gains tax bracket. This knowledge empowers you to make strategic decisions about investment sales.

Deductions and credits can slash your tax bill significantly. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Credits (which directly reduce your tax owed) often provide even greater value. The Child Tax Credit offers up to $2,000 for each qualifying child, with income limits of $200,000 for single filers and $400,000 for married couples filing jointly.

Don’t overlook lesser-known deductions. Eligible teachers can claim up to $300 for educator expenses. Self-employed individuals might deduct home office expenses, business-related vehicle use, and health insurance premiums.

Previous tax returns offer a wealth of information. They reveal patterns in your income, deductions, and credits that can inform future strategies. Look for missed opportunities or areas where you could have saved more. Did you maximize your retirement contributions? Did you take advantage of all available credits?

Reviewing past returns also helps identify potential audit triggers. The IRS typically examines returns from the past three years, but in some cases, they can extend their review to six years or more. Understanding your audit risk guides your record-keeping practices and helps you make more conservative tax decisions when necessary.

Tax laws evolve frequently. Strategies that worked last year might not be optimal this year. Professional tax advisors stay up-to-date with the latest tax code changes to ensure their clients always have access to the most current and effective tax strategies.

As we move forward, let’s explore specific tax planning strategies that can help you maximize your savings and minimize your tax burden.

Tax planning isn’t just for the wealthy – it’s a powerful strategy for anyone who wants to keep more of their hard-earned money. Let’s explore some effective tactics that can lead to substantial savings on your tax bill.

One of the most effective ways to lower your taxable income is to maximize contributions to tax-advantaged retirement accounts. In 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional $11,250 catch-up contribution if you’re 50 or older). This not only secures your financial future but also provides immediate tax relief.

For those without employer-sponsored plans, traditional IRAs offer a great alternative. You can contribute up to $7,000 annually (as of 2025), potentially reducing your taxable income dollar-for-dollar. The key is to start early and contribute consistently to maximize the power of compound growth.

Tax-loss harvesting is a sophisticated yet accessible strategy to offset capital gains and reduce your overall tax liability. You can strategically sell underperforming investments to use those losses to counterbalance gains from other investments. This approach can save you thousands in taxes, especially in volatile market years.

The IRS allows you to deduct up to $3,000 in net capital losses against your ordinary income each year. Any excess losses can be carried forward to future tax years, providing ongoing tax benefits. However, you must be mindful of the wash sale rule – avoid repurchasing a “substantially identical” security within 30 days of the sale to ensure your loss is recognized for tax purposes.

Strategic timing of income and expenses can significantly impact your tax bill. If you’re self-employed or have control over when you receive income, you should consider deferring income to the next tax year if you expect to be in a lower tax bracket. Conversely, if you anticipate being in a higher bracket next year, accelerating income into the current year could be beneficial.

For expenses, the same principle applies. You can bunch deductible expenses into a single tax year to help you exceed the standard deduction threshold, allowing you to itemize and potentially save more. This strategy works particularly well for medical expenses, property taxes, and charitable contributions.

Charitable giving not only supports causes you care about but can also lead to substantial tax savings. For those aged 70½ or older, Qualified Charitable Distributions (QCDs) allow you to transfer up to $108,000 directly from your IRA to eligible charities. This satisfies your Required Minimum Distribution (RMD) without increasing your taxable income.

Another powerful tool is the donor-advised fund (DAF). You can contribute to a DAF to take an immediate tax deduction while spreading out the actual charitable gifts over time. This strategy works exceptionally well in high-income years, allowing you to front-load several years’ worth of charitable contributions for maximum tax benefit.

Implementing these strategies requires careful planning and execution. While the potential savings are significant, it’s important to tailor these approaches to your unique financial situation. A professional tax advisor can help you create personalized tax strategies that align with your goals and maximize your savings. Now, let’s explore how working with a tax professional can further enhance your tax optimization efforts.

Professional tax advice offers benefits that extend far beyond annual return filing. Tax professionals provide expertise in complex and ever-changing tax laws, ensuring you don’t miss potential savings or violate new regulations.

The Tax Cuts and Jobs Act of 2017 introduced significant changes, many of which will expire in 2025. A skilled tax advisor stays current with these shifts to optimize your tax strategy. For example, the IRS announced that the standard deduction for married couples filing jointly will increase to $29,200 for the 2025 tax year. This change could affect whether itemizing deductions benefits many taxpayers.

Your financial circumstances are unique. A tax professional will take time to understand your specific situation, including income sources, investment portfolio, family status, and long-term financial goals. This personalized approach allows for the development of precisely tailored tax strategies.

Self-employed individuals might benefit from strategies to maximize their qualified business income (QBI) deduction. A tax advisor could also suggest setting up a Solo 401(k) or SEP IRA to reduce taxable income while increasing retirement savings.

Working with a tax professional shifts the focus from reactive tax filing to proactive tax planning. Instead of rushing to gather documents each April, you’ll collaborate with your advisor throughout the year to implement strategies that can significantly reduce your tax burden.

Your advisor might recommend accelerating deductions or deferring income based on projected tax brackets. They could also help time the sale of investments to minimize capital gains taxes or optimize tax-loss harvesting benefits.

When choosing a tax advisor, look for credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA). These designations indicate high-level expertise and adherence to professional standards. Consider their experience with situations similar to yours. For small business owners, an advisor with a strong track record in business taxation is essential.

For your initial tax planning session, prepare financial documents, including past tax returns, investment statements, and information about major life changes (marriage, divorce, new job, etc.). Your advisor will likely ask detailed questions about your financial goals and risk tolerance to develop a comprehensive tax strategy.

The cost of professional tax advice often results in significant tax savings and peace of mind. A knowledgeable tax advisor (such as those at Sager CPA) will invest in your financial future and ensure you maximize your tax savings potential.

Tax optimization strategies empower individuals to reduce their tax burden and enhance financial well-being. Understanding your tax situation, leveraging effective planning techniques, and collaborating with a professional advisor can significantly impact your bottom line. Proactive tax planning proves essential for long-term financial success, allowing you to make informed decisions that positively influence your tax liability.

Implementing these strategies effectively requires expertise and personalized guidance. At Sager CPA, we specialize in creating tailored tax strategies that align with your financial goals. Our team stays current with the latest tax regulations to ensure you benefit from every available opportunity to minimize your tax burden.

Effective tax planning demands an ongoing commitment. As your financial situation evolves, your tax strategy should adapt accordingly. Take action now and regularly review your approach with a trusted advisor to optimize your tax position and work towards a more secure financial future.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.