Tax planning and optimization can significantly impact your financial well-being. At Sager CPA, we’ve seen how strategic tax management can lead to substantial savings for our clients.

This blog post will guide you through practical strategies to optimize your taxes and make the most of your financial situation. We’ll cover everything from understanding your tax situation to working with a professional advisor, providing you with actionable steps to implement right away.

Your income sources directly impact your tax liability. Create a comprehensive list of all your income streams. This includes wages, self-employment income, rental income, investment dividends, and capital gains. Each type of income is taxed differently, and understanding these nuances is essential for tax planning.

For example, in 2025, the standard deduction amounts will be $15,750 for single filers and $31,500 for married couples filing jointly. These figures help you decide whether to itemize deductions or take the standard deduction.

Deductions and credits can significantly reduce your tax burden. Many taxpayers overlook valuable deductions. Common ones include mortgage interest, property taxes, and charitable contributions.

Tax credits are even more powerful as they directly reduce your tax bill dollar-for-dollar. The Child Tax Credit, Earned Income Tax Credit, and American Opportunity Credit for education expenses are popular examples. In 2025, families can claim up to $2,000 per qualifying child under 17 for the Child Tax Credit.

Your investment strategy can have a major impact on your taxes. Consider the tax implications of your investments. For example, municipal bonds generally provide income that’s tax-free at the federal level, making them an attractive option for tax-efficient investing.

Moreover, holding investments for over a year qualifies you for long-term capital gains rates, which are typically lower than short-term rates.

While understanding your tax situation is crucial, navigating the complexities of tax law can be challenging. This is where professional guidance becomes invaluable. A qualified tax advisor can help you identify opportunities for tax savings that you might have missed on your own.

At Sager CPA, we offer expert financial management and tax planning services tailored for individuals and businesses. Our team can help you create a comprehensive tax strategy that takes into account all aspects of your financial situation.

Now that you have a clear understanding of your tax situation, it’s time to explore effective strategies for optimizing your taxes. Let’s move on to discuss some smart planning techniques that can help you minimize your tax burden and maximize your financial well-being.

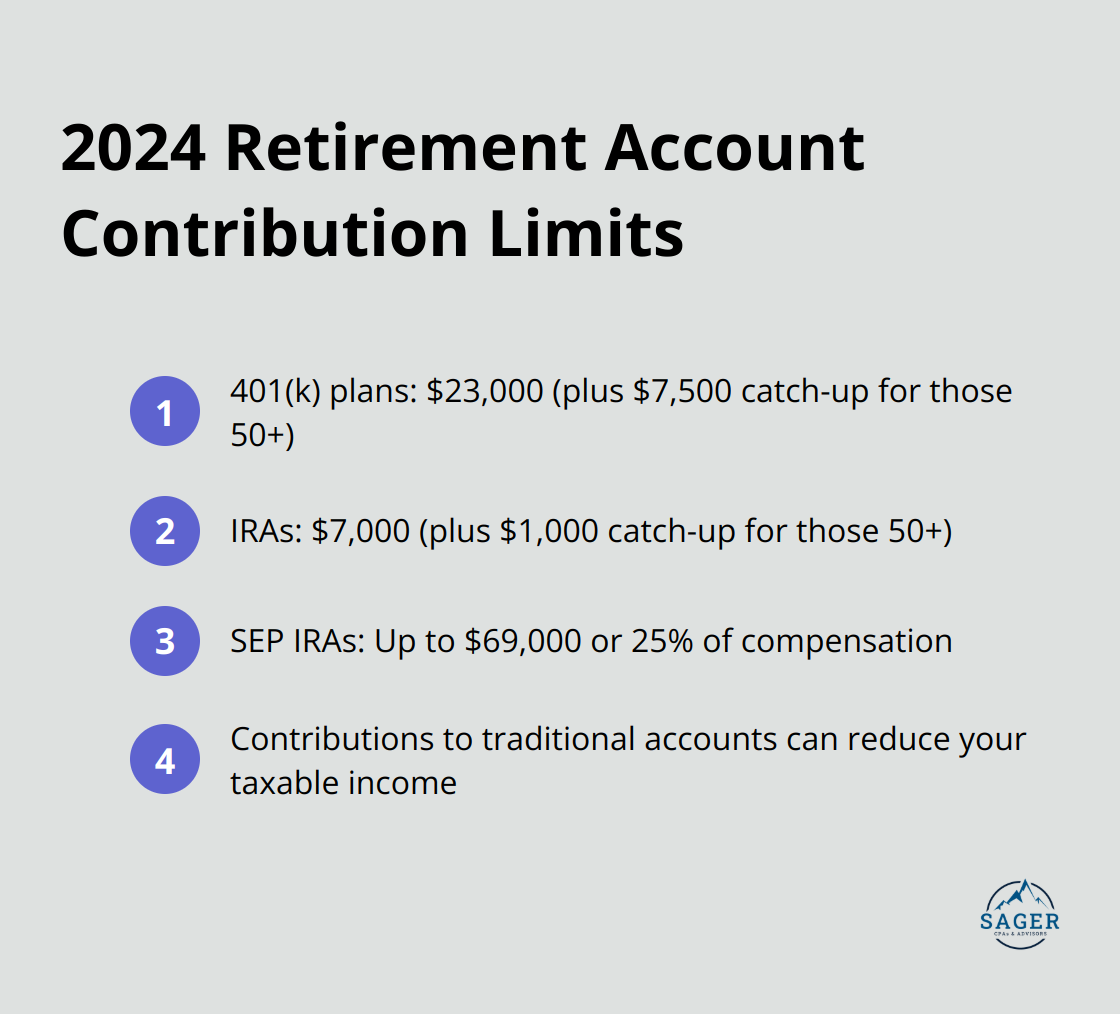

One of the most effective ways to lower your taxable income is to maximize contributions to retirement accounts. In 2024, you can contribute up to $23,000 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). For IRAs, the limit is $7,000 (with a $1,000 catch-up option).

These contributions not only secure your future but also provide immediate tax benefits. Traditional 401(k) and IRA contributions reduce your taxable income for the year. Self-employed individuals should consider a SEP IRA, which allows contributions of up to 25% of an employee’s total compensation, up to $69,000 for 2024.

Tax-loss harvesting is a powerful strategy, especially in volatile markets. This involves selling investments that have declined in value to offset capital gains from other investments. You can even use up to $3,000 of net losses to offset ordinary income.

For example, if you sold Stock A for a $10,000 gain and Stock B for an $8,000 loss, your net taxable gain would be only $2,000. However, you must avoid the wash sale rule, which prohibits buying the same or a similar security within 30 days before or after the sale.

Charitable giving isn’t just good for the soul; it’s good for your tax bill too. In 2024, you can deduct charitable contributions up to 60% of your adjusted gross income for cash donations to qualified charities.

For those aged 70½ or older, qualified charitable distributions (QCDs) allow you to donate up to $105,000 directly from your IRA without counting as taxable income. This strategy can satisfy your required minimum distribution (RMD) while supporting causes you care about.

Timing plays a key role in tax planning. If you’re self-employed or have control over when you receive income, consider deferring income to the next tax year if you expect to be in a lower tax bracket. Conversely, if you anticipate being in a higher bracket next year, accelerating income into the current year might benefit you.

The same principle applies to deductible expenses. If you’re close to the threshold for itemizing deductions, try bunching two years’ worth of charitable contributions or medical expenses into one year to exceed the standard deduction amount.

These strategies can lead to significant savings, but it’s important to consult with a tax professional to ensure they align with your overall financial goals and comply with current tax laws. A qualified advisor can help you navigate the complexities of tax optimization and create a personalized plan that maximizes your financial well-being.

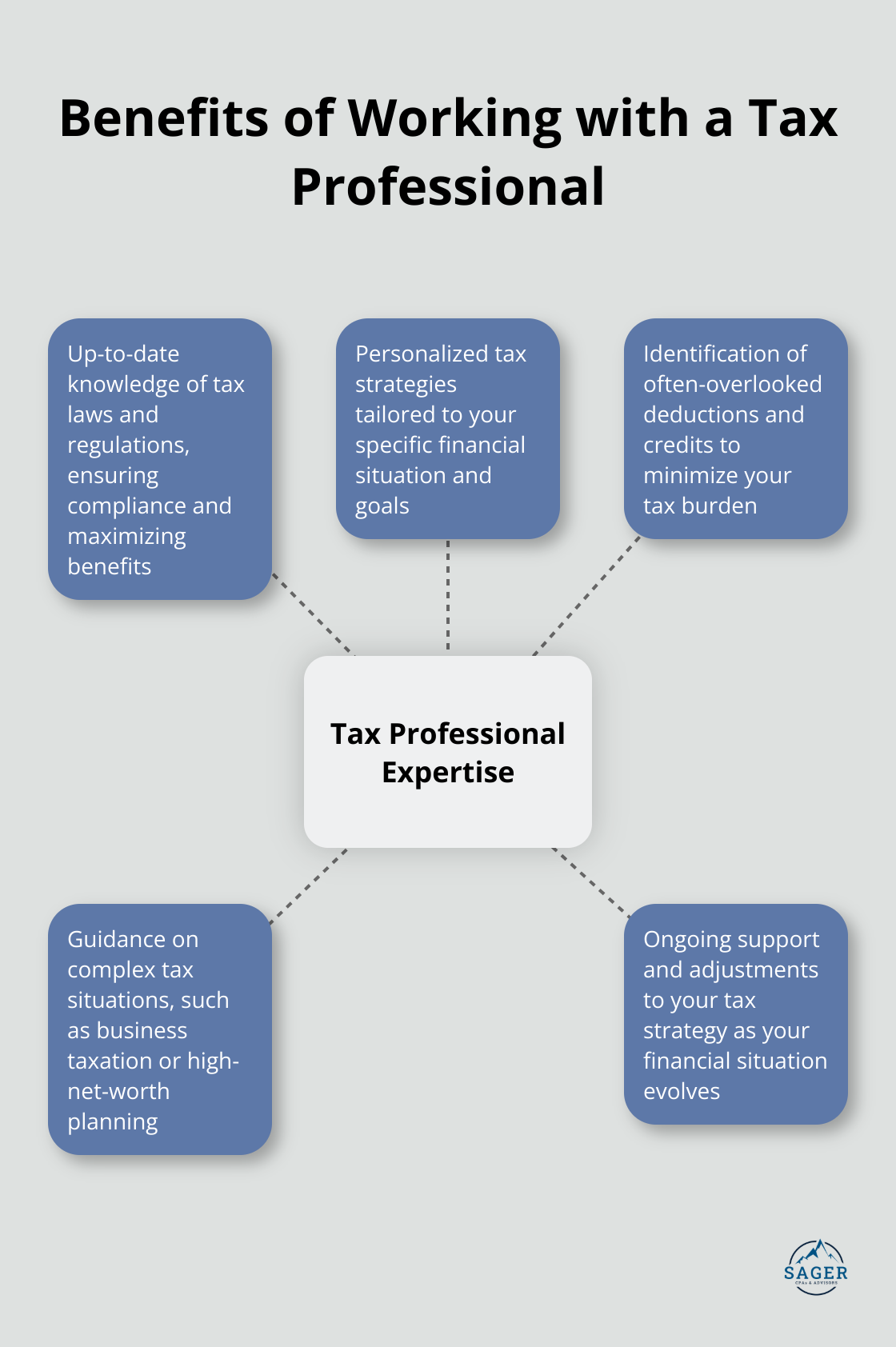

Tax optimization requires deep knowledge and constant vigilance. While DIY tax preparation software has made filing taxes more accessible, it often falls short in strategic tax planning. A tax professional can make a significant difference in this area.

Tax professionals bring a wealth of knowledge and experience to the table. They stay up-to-date with the latest tax laws and regulations, which change frequently. The Tax Cuts and Jobs Act changed deductions, depreciation, expensing, tax credits and other things that affect businesses. A tax professional can help you navigate these changes and identify opportunities you might otherwise miss.

Choosing the right tax advisor is important. Look for professionals with relevant certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA). EAs specialize in taxation, while CPAs can specialize in taxation and typically have a broader knowledge of accounting.

Experience in your specific financial situation is also key. If you’re a small business owner, seek an advisor with a strong track record in business taxation. For high-net-worth individuals, look for someone well-versed in estate planning and investment tax strategies.

Don’t hesitate to ask potential advisors about their experience, approach to tax planning, and communication style. A good tax professional should explain complex concepts in terms you can understand and suggest strategies to optimize your tax situation proactively.

A comprehensive tax planning session goes beyond simply preparing your annual tax return. It should involve a thorough review of your financial situation, including income sources, investments, and long-term financial goals.

Your tax professional will ask detailed questions about your financial life. They might inquire about major life changes (such as marriage, divorce, or the birth of a child), as these events can significantly impact your tax situation.

A skilled tax advisor will use this information to develop a tailored tax strategy. This might include recommendations for adjusting your investment portfolio, maximizing deductions, or restructuring your business to minimize tax liabilities.

Effective tax planning is an ongoing process, not a one-time event. Regular check-ins with your tax professional can help you stay on track and adjust your strategy as your financial situation evolves or tax laws change.

Working with a tax professional can provide peace of mind and potentially significant financial benefits. You can ensure you’re not leaving money on the table when it comes to your taxes by leveraging their expertise.

Tax planning and optimization will improve your financial health. You can reduce your tax burden and keep more money through smart strategies and professional advice. We recommend you review your current financial situation and apply the techniques we discussed.

A tax professional can provide personalized advice for your specific circumstances. At Sager CPA, we offer expert financial management and tax planning services for individuals and businesses. Our team creates comprehensive tax strategies that align with your financial goals and maximize your savings.

Tax planning is not a one-time event but an ongoing process. It requires continuous attention as your financial situation evolves and tax laws change. Proactive tax planning allows you to capitalize on new opportunities and make informed decisions throughout the year.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.