High net worth individuals face unique tax challenges that require specialized strategies. At Sager CPA, we understand the complexities of managing substantial wealth and the importance of effective tax planning.

Our expertise in high net worth individual tax planning helps clients navigate complex income sources, higher tax brackets, and potential increased scrutiny from tax authorities. This blog post will explore key strategies to optimize your tax situation and maximize your financial potential.

High net worth individuals (HNWIs) operate in a financial landscape that demands specialized tax strategies. Their financial situations often present unique challenges that require expert guidance and proactive planning.

HNWIs typically receive income from multiple sources, including salaries, investments, business profits, and rental properties. This diversity complicates tax reporting and increases the risk of errors. For example, a HNWI might receive income from a hedge fund investment, which involves complex tax reporting requirements. The IRS reports that misreporting of partnership income is a common issue among high-income taxpayers.

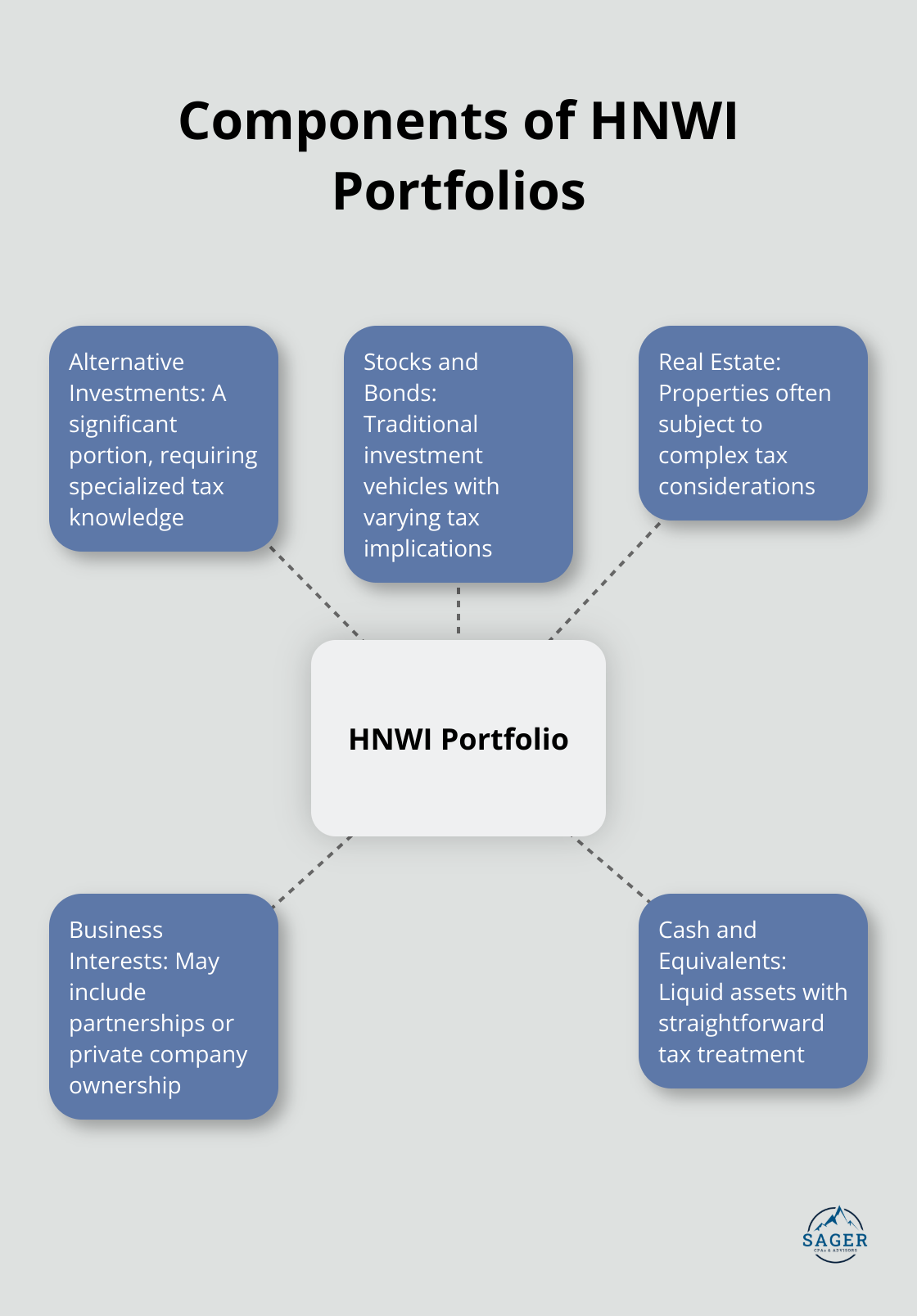

Furthermore, HNWIs often own sophisticated financial instruments and alternative investments. These may include private equity, derivatives, or foreign assets (each with its own tax implications). The Global Wealth Report 2023 by Credit Suisse notes that alternative investments constitute a significant portion of HNWI portfolios, underscoring the need for specialized tax knowledge.

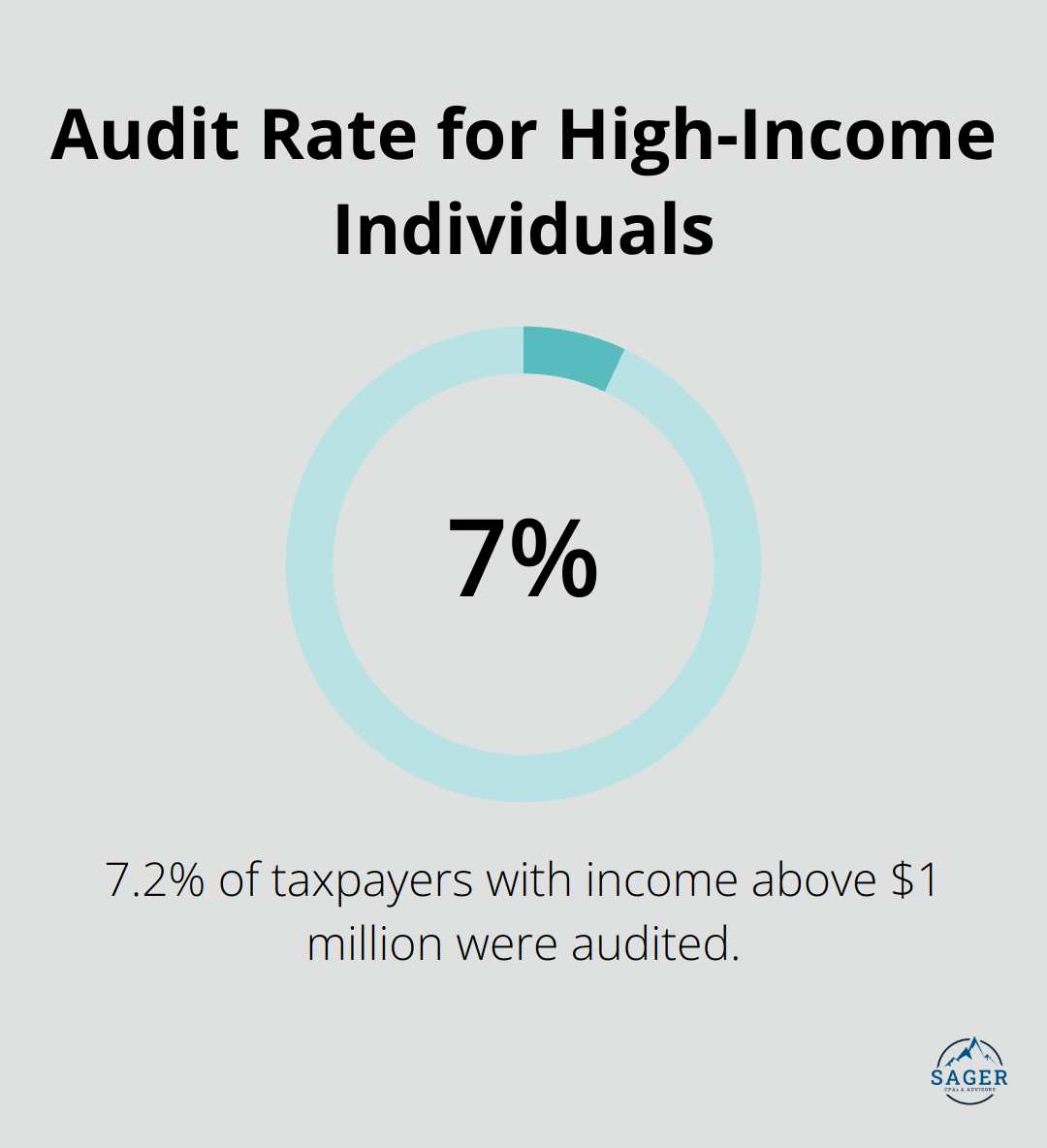

The IRS scrutinizes high-income tax returns more closely. In fact, prior Treasury Inspector General for Tax Administration (TIGTA) reports have focused on the IRS’s compliance efforts with respect to high-income taxpayers.

This increased attention requires HNWIs to maintain meticulous records and ensure full compliance with tax laws. Even unintentional errors can result in substantial penalties and time-consuming audits. Comprehensive record-keeping and proactive compliance measures help stay ahead of these risks.

For HNWIs, reactive tax preparation falls short. Strategic tax planning throughout the year minimizes liabilities and maximizes wealth preservation. This involves analyzing the tax implications of major financial decisions before execution.

The timing of income recognition or the structuring of business entities can significantly impact tax outcomes. Research has shown that higher capital gains taxes affect both investment length and patterns of realizations and reinvestments for high-income taxpayers.

Moreover, tax laws change frequently, making it essential to stay informed and adapt strategies. The Tax Cuts and Jobs Act of 2017 brought significant changes affecting HNWIs, and future tax reforms may introduce new challenges and opportunities.

Many HNWIs have international financial interests, which add another layer of complexity to their tax situations. These individuals must comply with foreign tax laws, report foreign bank accounts (FBAR requirements), and navigate complex treaties to avoid double taxation.

The penalties for non-compliance with international tax regulations can be severe. For instance, failing to file an FBAR can result in penalties of up to $10,000 per violation (or 50% of the account balance in some cases).

As we move forward, let’s explore the key strategies that HNWIs can employ to optimize their tax planning and address these unique challenges effectively.

High net worth individuals can access deductions and credits unavailable to average taxpayers. The IRS permits deductions for investment expenses, including financial advisor fees. These deductions can result in substantial savings, especially for those with large investment portfolios.

Cost segregation studies for real estate investments offer another powerful strategy. This approach accelerates depreciation deductions, potentially saving significant amounts in taxes over a property’s lifetime. Cost segregation can unlock substantial tax savings for clients who own investment or business-use real estate.

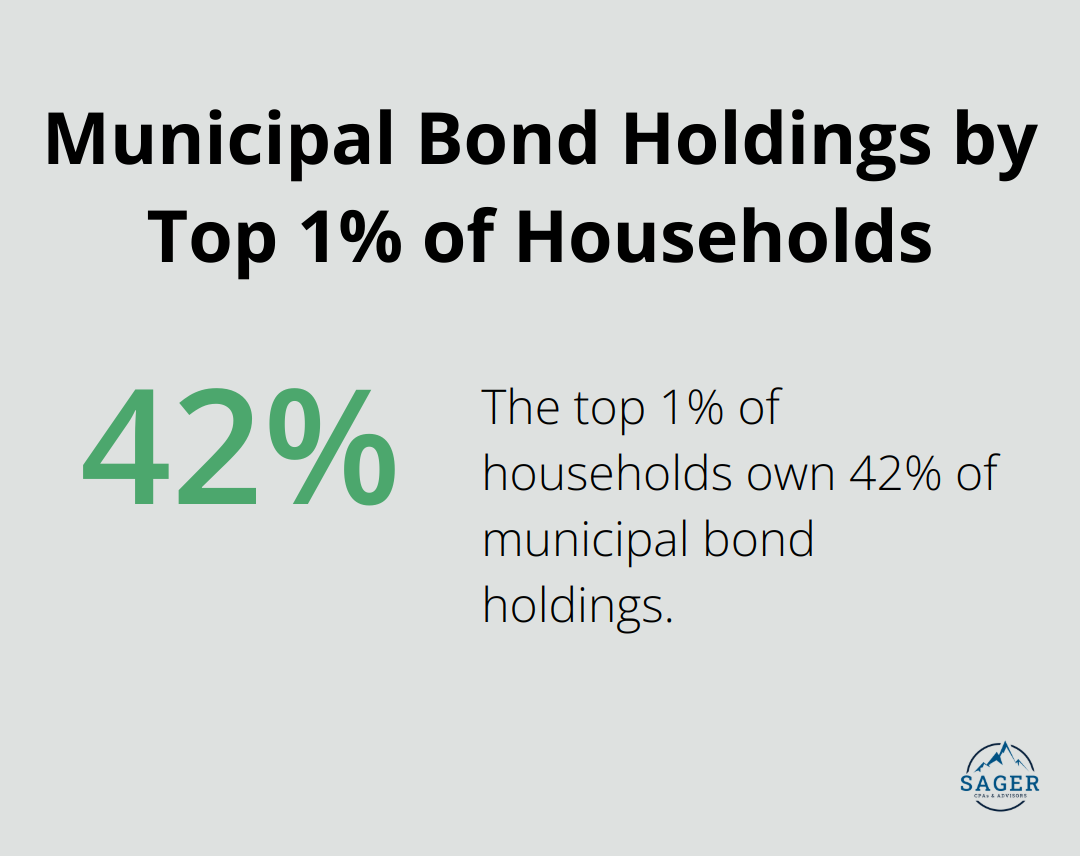

Tax-advantaged investment vehicles play a crucial role for high net worth individuals. Municipal bonds provide tax-free interest income at the federal level and often at the state level for in-state residents. The Tax Policy Center reports that the top 1% of households own about 42% of municipal bond holdings, underscoring their popularity among high-income taxpayers.

Qualified Opportunity Zones (QOZs) offer another powerful strategy. QOZ investments can defer capital gains taxes and potentially eliminate them if held for at least 10 years. Qualified Opportunity Funds have raised $75 billion in investments.

Charitable giving serves as both a philanthropic endeavor and a potent tax strategy. Donor-Advised Funds (DAFs) have gained popularity among high net worth individuals. These funds allow for an immediate tax deduction while providing flexibility in the timing and recipients of charitable distributions.

For individuals aged 70½ or older, Qualified Charitable Distributions (QCDs) from IRAs can satisfy Required Minimum Distributions (RMDs) without increasing taxable income. This strategy can lead to significant tax savings, particularly for those in higher tax brackets.

Estate planning forms a critical component of tax optimization for high net worth individuals. Irrevocable trusts, such as Grantor Retained Annuity Trusts (GRATs), can transfer wealth to heirs while minimizing gift and estate taxes. A Bernstein Global Wealth Management study found that GRATs have saved families billions in estate taxes over the past decade.

Family Limited Partnerships (FLPs) provide another effective technique. These structures can offer significant estate tax savings by allowing for the transfer of assets at discounted values. However, proper structuring of FLPs remains essential to withstand IRS scrutiny.

The implementation of these advanced strategies requires expert guidance and a deep understanding of complex tax laws. Professional tax advisors (such as those at Sager CPA) can tailor these approaches to each client’s unique financial situation, ensuring maximum benefit from every available opportunity for tax optimization. As tax laws continue to evolve, staying informed and adapting strategies becomes paramount for high net worth individuals seeking to preserve and grow their wealth.

High net worth individuals face complex tax situations that demand specialized knowledge and experience. The U.S. tax code contains over 7.7 million words (according to a study by the National Taxpayer Advocate), which underscores its complexity. Expert tax advisors stay current with these changes, ensuring tax strategies remain compliant and effective. High net worth families must pay adequate attention to three distinct taxes on their wealth: income tax, capital gains tax, and estate tax.

The Tax Cuts and Jobs Act of 2017 introduced significant changes affecting high net worth individuals. Professional advisors quickly adapted strategies to leverage new opportunities, such as the increased estate tax exemption (which rose to $11.7 million per individual in 2021).

High net worth individuals often have diverse income streams and complex asset structures. A survey by Capgemini found that 31% of high net worth individuals’ portfolios consist of alternative investments, which require specialized tax knowledge.

Expert tax advisors analyze the entire financial picture to develop comprehensive strategies. They consider factors such as:

This holistic approach ensures that every aspect of a client’s financial life is optimized for tax efficiency.

Year-round tax planning is essential for high net worth individuals. About 7.2 percent of taxpayers with positive income above $1 million were audited, indicating a higher audit rate for high-income individuals. Proactive planning with expert advisors helps mitigate audit risks and ensures preparedness for any scrutiny.

Regular communication with a tax advisor allows for timely adjustments to strategies. For example, when considering selling a business, an advisor can help structure the sale to minimize tax implications. The National Association of Certified Valuators and Analysts states that proper tax planning can save business owners up to 35% on taxes during a business sale.

Expert tax advisors emphasize ongoing communication and proactive planning. They work closely with clients throughout the year, not just during tax season. This approach allows for the identification of opportunities and addresses potential issues before they become problems.

The right tax advisor is more than just a service provider-they’re a strategic partner in financial success. Their expertise allows clients to navigate the complex tax landscape with confidence, knowing that their wealth is managed with precision and foresight.

High net worth individual tax planning requires a comprehensive approach to address unique challenges. Sophisticated strategies such as maximizing deductions, utilizing tax-advantaged investments, and implementing advanced estate planning techniques can significantly optimize tax situations. The complex nature of tax laws and the ever-changing financial landscape make professional guidance invaluable for substantial tax savings and wealth preservation.

Expert tax advisors possess the knowledge and experience to navigate intricate tax codes and develop tailored strategies. At Sager CPA, we specialize in high net worth individual tax planning and offer personalized solutions to help our clients achieve their financial goals. Our team of experienced professionals works closely with high net worth individuals to develop comprehensive tax strategies that align with their unique financial situations and long-term objectives.

Effective tax planning goes beyond annual tax preparation and requires year-round attention and regular communication. With the right partner, high net worth individuals can minimize their tax liabilities and maximize their wealth preservation and growth opportunities. As you consider your financial future, expert guidance in tax planning can unlock your full financial potential.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.