Strategic tax planning is more than just a yearly chore-it’s a powerful tool for business growth and financial stability. At Sager CPA, we’ve seen firsthand how a well-crafted tax strategy can significantly impact a company’s bottom line.

This blog post will guide you through the essential steps to implement effective tax planning for your business. We’ll cover key components, practical strategies, and expert insights to help you optimize your tax position and drive long-term success.

Strategic tax planning is a proactive approach to manage your business’s tax obligations. It involves strategically identifying and leveraging available tax deductions and tax credits to minimize tax liabilities. This comprehensive strategy aligns with your business goals and maximizes your financial resources.

Many business owners confuse tax planning with tax preparation. Tax preparation is a reactive process that occurs after the fiscal year ends. It involves the collection of financial documents and the filing of tax returns. Tax planning, on the other hand, is proactive and continuous. It analyzes your business operations, financial situation, and future goals to minimize tax liabilities legally.

The benefits of a strategic tax plan are substantial.

Effective tax planning involves several key components:

Strategic tax planning requires regular review and adjustment. This ensures it remains aligned with your business goals and compliant with changing tax laws. The implementation of a strategic tax plan creates a roadmap for long-term financial success.

As we move forward, let’s explore the essential components of an effective tax strategy in more detail. These elements will form the foundation of your customized tax plan, setting you on the path to optimized tax efficiency and improved financial performance.

The legal structure of your business determines your tax obligations. Each entity type (sole proprietorship, partnership, LLC, S corporation, or C corporation) has distinct tax implications. Choosing the right business structure is crucial for tax planning and can significantly impact your financial success. It’s important to consider factors such as liability protection, tax treatment, and operational flexibility when deciding which structure is best for your business.

Strategic management of income recognition and expense incurrence can significantly influence your tax liability. Deferring income to the following tax year or accelerating deductions into the current year can lower your immediate tax burden. This approach proves particularly effective for businesses with fluctuating income or those anticipating changes in tax rates.

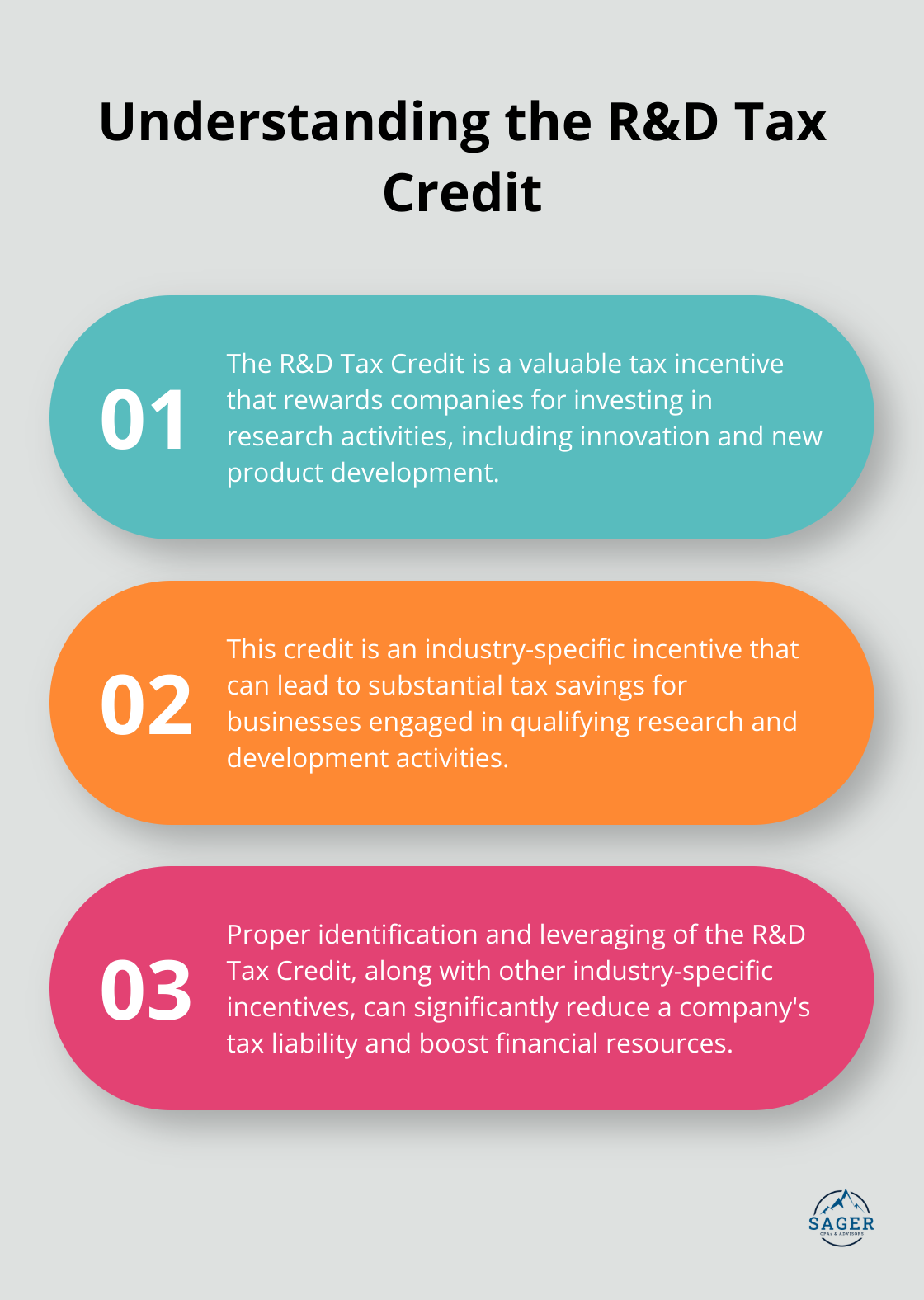

Every industry offers unique tax opportunities. The Research and Development (R&D) Tax Credit rewards companies investing in research activities such as innovation and new product development. Identification and leverage of these industry-specific incentives can lead to substantial tax savings.

A well-designed employee benefits and compensation package can provide tax advantages for both the business and its employees. This might include retirement plans, health insurance, and other fringe benefits. The right mix of benefits can help attract and retain top talent while also providing tax deductions for the business.

For businesses with international operations or expansion plans, understanding and planning for international tax implications is essential. This includes considerations such as transfer pricing, foreign tax credits, and compliance with international tax laws. Proper planning in this area can help avoid double taxation and ensure compliance with complex international regulations.

Tax planning requires a deep understanding of your business, industry, and the ever-changing tax landscape. Expert guidance from experienced professionals (like those at Sager CPA) can help create tailored tax strategies that align with your unique business goals and maximize your financial resources. The next section will explore how to implement these strategies effectively in your business operations.

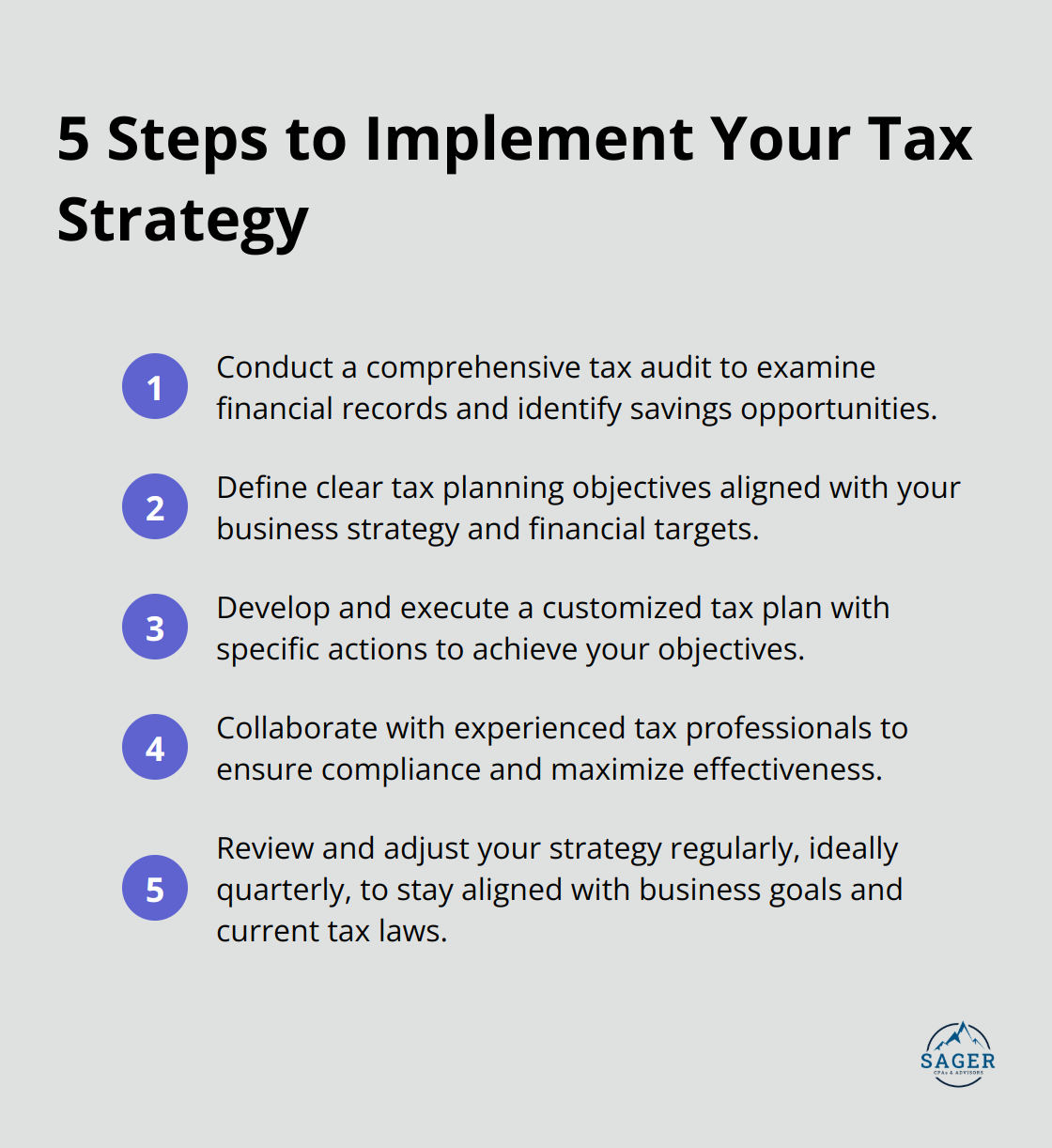

The first step to implement your tax strategy is to perform a thorough tax audit. This process involves an in-depth examination of your financial records, past tax returns, and current business operations. A comprehensive audit will uncover areas where you may overpay taxes and identify opportunities for savings.

During this process, examine your income sources, expense categories, and asset depreciation schedules. Focus on any tax credits or deductions you might have missed in previous years. The Government Accountability Office reports that businesses often overlook valuable tax credits, potentially missing out on thousands of dollars in savings each year.

After you gain a clear picture of your current tax situation, set specific tax planning goals. These objectives should align with your overall business strategy and financial targets. You might aim to reduce your effective tax rate by a certain percentage, maximize specific tax credits, or structure your business to take advantage of new tax laws.

Prioritize your goals based on their potential impact and feasibility. Some tax planning strategies may require significant changes to your business operations, while others can be implemented more quickly.

With your goals in place, create a tailored tax plan. This plan should outline specific actions you’ll take to achieve your tax objectives. It might include strategies such as:

As you execute your plan, monitor your progress regularly. This will allow you to make necessary adjustments and ensure you move towards your tax planning goals.

Effective tax planning requires expertise in complex and ever-changing tax laws. While some business owners attempt to handle tax planning on their own, partnering with experienced tax professionals can lead to significantly better outcomes.

Professional tax advisors work closely with clients to develop and implement customized tax strategies. These experts stay up-to-date on the latest tax laws and regulations, ensuring that your tax plan remains compliant and effective.

Tax planning is not a one-time event. It requires ongoing attention and adjustment. Schedule regular reviews of your tax strategy, ideally quarterly, to ensure it remains aligned with your business goals and compliant with current tax laws.

During these reviews, assess the effectiveness of your current strategies and consider new opportunities for tax savings. For instance, the Tax Cuts and Jobs Act changed deductions, depreciation, expensing, tax credits and other things that affect businesses. Stay informed about such changes to adapt your strategy and maximize your tax savings.

A proactive approach to tax planning can lead to substantial savings and contribute significantly to your business’s financial health. Follow these steps and work with experienced professionals to implement a tax strategy that drives long-term success for your business.

Strategic tax planning empowers businesses to optimize their financial health and drive long-term success. A proactive approach to tax management unlocks substantial savings, improves cash flow, and creates opportunities for growth. Professional guidance proves invaluable in navigating complex tax scenarios and capitalizing on often-overlooked savings opportunities.

At Sager CPA, we develop customized tax strategies that align with unique business objectives. Our team of experts stays current with the latest tax laws and regulations, ensuring effective and compliant tax plans. We specialize in creating personalized strategies that set businesses on the path to sustained growth and financial stability.

Take the first step towards optimizing your tax position and driving long-term success. Schedule a consultation with Sager CPA today and let us help you create a tax strategy that builds a stronger, more resilient business for the future. Strategic tax planning doesn’t just save money today-it shapes a more prosperous tomorrow for your company.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.