Most retirees leave thousands of dollars on the table each year through tax mistakes that could have been prevented. At Sager CPA, we’ve seen how the right approach to creating tax-efficient retirement strategies can dramatically reduce what you owe to the IRS.

This guide walks you through the most common pitfalls, proven withdrawal tactics, and the personalized planning that makes the real difference in your retirement years.

The first trap is leaving money on the table by not maxing out tax-advantaged accounts. In 2026, you can contribute $7,500 to a Roth or Traditional IRA if you’re under 50, or $8,600 if you’re 50 or older. Many people contribute less than this limit, missing the opportunity to shelter income from taxes. If you have access to a workplace 401(k), the 2026 limit is $23,500 (or $31,000 if you’re 50 or older). The difference between someone who maxes these out versus someone who doesn’t compounds dramatically over time.

A person who leaves $5,000 unconributed annually for 20 years forgoes not just the $100,000 in contributions but also the tax-free growth that could have accumulated. That gap widens with every passing year. The tax-deferred or tax-free growth on those missed contributions represents real money that stays in the IRS’s pocket instead of yours.

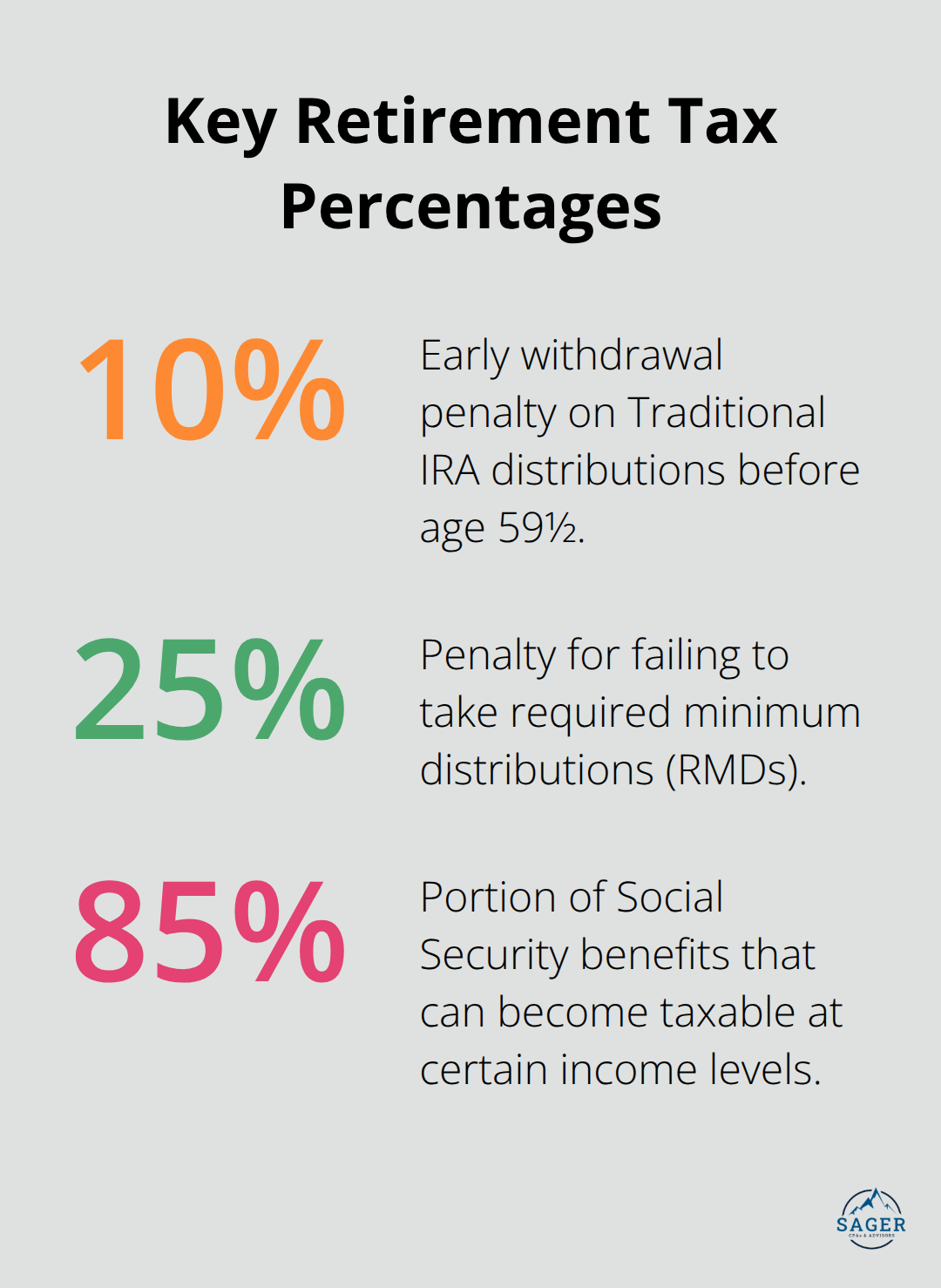

The second trap is withdrawing from retirement accounts before age 59½ without understanding the consequences. Early withdrawals from Traditional IRAs trigger a 10% penalty plus ordinary income taxes on the full amount withdrawn. From Roth IRAs, you can withdraw contributions penalty-free, but earnings withdrawn before 59½ face both the 10% penalty and income tax. The difference matters enormously.

A $50,000 early withdrawal from a Traditional IRA costs you $5,000 in penalties alone, plus ordinary income taxes depending on your bracket. Some exceptions exist for first-time home purchases (up to $10,000 lifetime) and qualified education expenses, but most early withdrawals lack protection. You need to know your account type and your age before you touch a single dollar.

The third trap is ignoring Required Minimum Distributions, which is perhaps the costliest mistake. If you have a Traditional IRA, you must begin taking RMDs at age 73. Failing to take your full RMD results in a 25% penalty on the amount you should have withdrawn but didn’t. The IRS reduced this penalty from 50% in recent years, but 25% remains severe.

If your RMD is $20,000 and you miss it, you owe $5,000 in penalties plus income taxes on that $20,000. Roth IRAs have no lifetime RMDs for the account owner, which makes them particularly valuable for estate planning. The penalties for RMD mistakes are non-negotiable and automatic-the IRS doesn’t care if you forgot or didn’t realize you had an account.

What makes these three mistakes preventable is that they respond to straightforward action. Calculate your contribution capacity each year and fund accounts to the limit. Understand your age and account type before touching retirement funds. Track your RMD requirement starting five years before you turn 73. These aren’t complex strategies that require specialized knowledge, yet most retirees handle them poorly because they lack a systematic approach to managing multiple accounts and rules.

The good news is that once you understand these traps, you can build a withdrawal strategy that actually works with your accounts instead of against them.

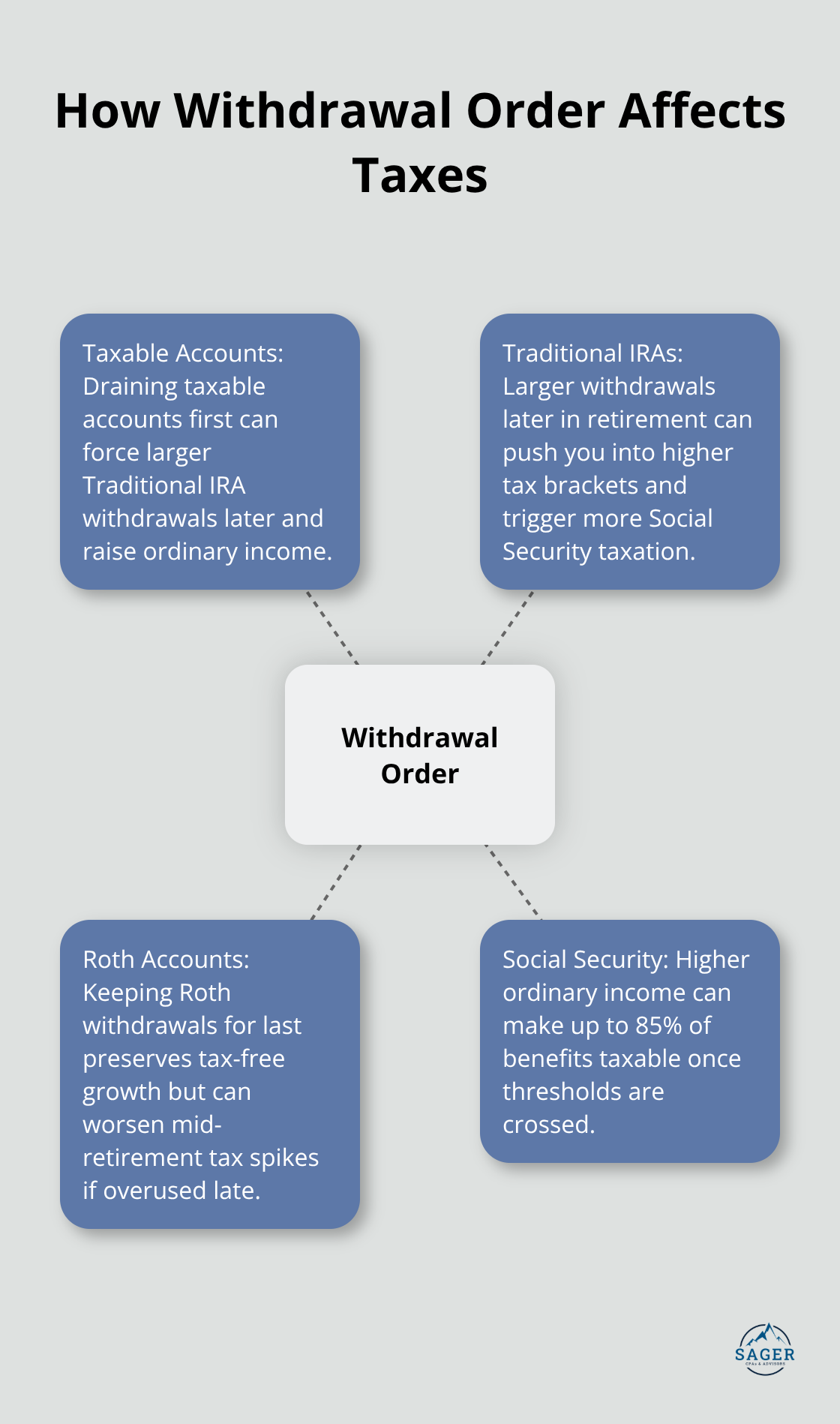

The order in which you withdraw from taxable, tax-deferred, and Roth accounts fundamentally changes how much you pay in taxes over retirement. Most retirees follow the traditional approach: drain taxable accounts first, then tap Traditional IRAs, then Roth accounts last. This strategy sounds logical but creates a tax disaster in mid-retirement. Tax-Efficient Withdrawal Strategies can provide different approaches that reduce your lifetime tax burden.

When you deplete your taxable accounts early, you’re forced to withdraw larger amounts from Traditional IRAs later, which pushes your ordinary income higher and subjects more of your Social Security benefits to taxation. In 2025, if you’re a single filer with provisional income above $34,000, up to 85% of your Social Security benefits become taxable. That income threshold gets crossed quickly when you’re forced to take large Traditional IRA withdrawals.

The better approach uses proportional withdrawals, where you take from each account type in proportion to its share of your total portfolio. This strategy works because it prevents the income spikes that trigger higher tax brackets and Social Security taxation rules.

Another powerful tactic targets the 0% long-term capital gains bracket. In 2025, single filers can realize up to $48,350 of long-term capital gains at 0% tax. If you withdraw from your taxable brokerage account first and realize gains within this bracket, you pay nothing on those gains. This approach works especially well if you expect substantial capital gains later in retirement, since you control when those gains hit your tax return and at what rate.

Roth conversions in low-income years work together with strategic distribution timing to flatten your tax bracket across retirement. With a Roth conversion strategy, you convert all or part of your traditional IRA to a Roth IRA and pay regular income taxes on the converted amount. This sounds expensive until you realize you’re paying taxes at today’s rates rather than future rates, which may be higher.

The conversion amount counts as income that year, so you want to execute conversions in low-income years, typically early in retirement before you claim Social Security or take large RMDs. The key is keeping your ordinary income low enough to stay within favorable tax brackets while gains remain at 0%.

Traditional IRA withdrawal timing matters equally. Instead of withdrawing $100,000 in one year and $0 in another, spreading withdrawals across multiple years keeps your income stable and prevents bracket creep. This prevents the situation where a single large withdrawal pushes your income so high that it triggers the 85% Social Security taxation rule or higher Medicare premiums.

The IRS doesn’t care if you take your RMD all at once or spread it throughout the year, so you can strategically time distributions to avoid pushing yourself into a higher bracket. When you combine proportional account sequencing with targeted Roth conversions in low-income years and spread Traditional IRA withdrawals across time, you reduce lifetime taxes significantly compared to the default approach most retirees follow.

The complexity of coordinating these three strategies-account sequencing, Roth conversions, and distribution timing-is exactly why working with a tax professional makes such a difference. Each decision affects the others, and small changes in one area ripple through your entire retirement plan. A tax advisor helps you model different scenarios, identify which strategies apply to your specific situation, and execute them in the right order and timing. The strategies outlined here form the foundation of tax-efficient retirement planning, but implementing them requires understanding your complete financial picture, including your accounts, income sources, and long-term goals.

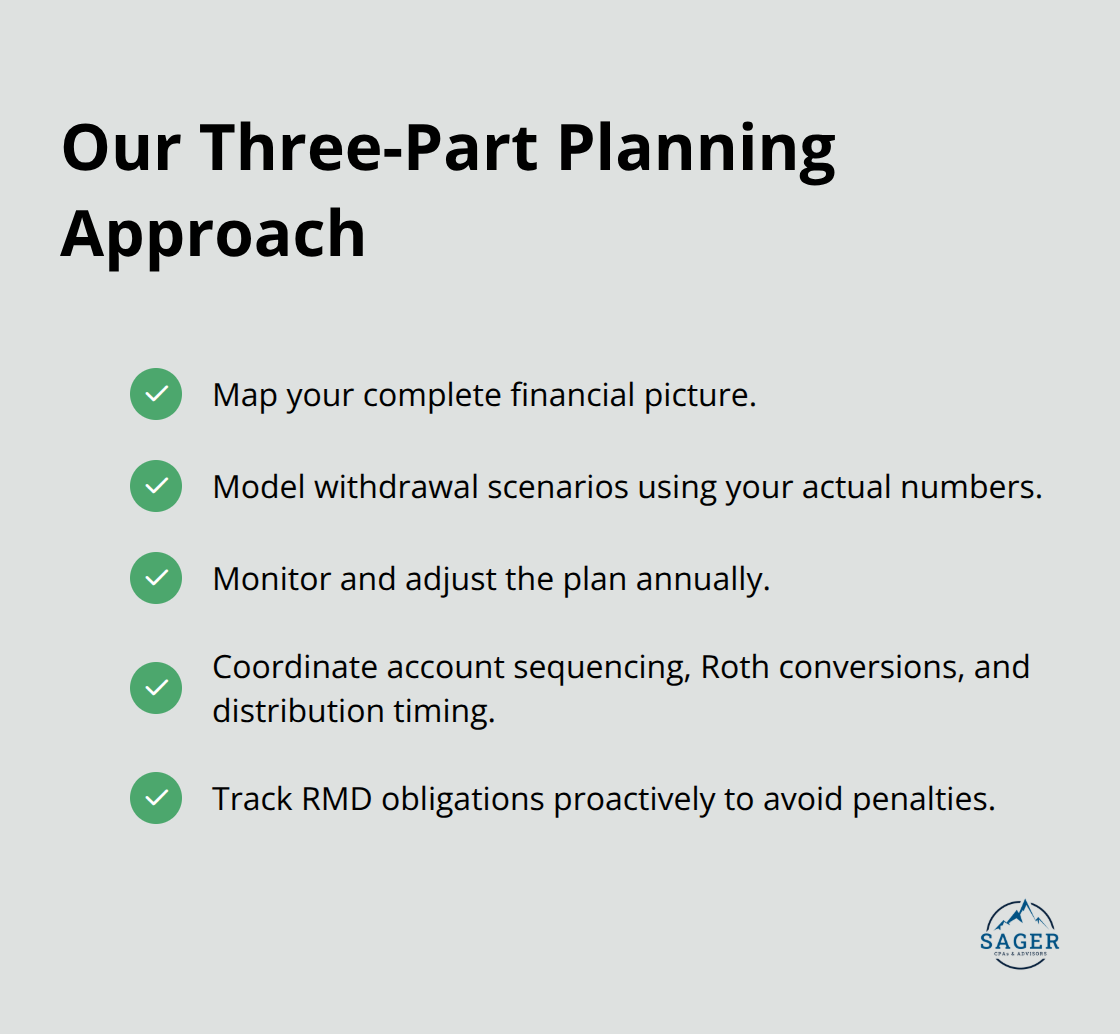

The strategies in the previous section work only when someone actually implements them, which is where most retirees struggle. The gap between knowing what to do and doing it consistently across multiple accounts, changing tax laws, and shifting life circumstances is where professional guidance becomes invaluable. We at Sager CPA take a fundamentally different approach than the typical advisor who hands you a plan once and disappears. Your retirement tax situation isn’t static, and neither is our involvement.

We start by mapping your complete financial picture, including every retirement account you own, your expected income sources, your Social Security claiming strategy, and your spending goals. This comprehensive view reveals opportunities that single-account analysis misses entirely. For example, if you have a Traditional IRA worth $400,000 and a taxable brokerage account worth $150,000, the sequencing decision alone could save you tens of thousands in taxes over retirement.

We model different withdrawal scenarios against your actual numbers to show you exactly how each strategy affects your lifetime tax burden and after-tax income. Most retirees never see these projections, so they default to whatever feels safest rather than what actually works best. This modeling reveals which withdrawal sequence minimizes your lifetime taxes and which Roth conversion opportunity in a low-income year makes the most sense for your situation.

The coordination between your withdrawal strategy, Roth conversions, and distribution timing requires continuous attention to your specific circumstances. We handle that complexity so you don’t have to worry about whether you’re making the right moves each year.

Once we establish your withdrawal strategy, we monitor it annually and adjust when circumstances change. Life doesn’t follow a five-year plan, and neither should your retirement strategy. When the market drops 20%, your income needs shift, tax laws change, or you experience a major life event, we recalibrate your approach.

This ongoing oversight prevents costly mistakes like accidentally triggering excess Social Security taxation or missing a Roth conversion opportunity in a low-income year. We also track your RMD obligations proactively, calculating exactly what you owe and when you must withdraw it, eliminating the risk of that 25% penalty. This proactive partnership gives you confidence that your retirement income stays optimized and your plan adapts as your life evolves.

Tax-efficient retirement strategies require consistent execution across multiple accounts and ongoing adjustments as circumstances shift. The three mistakes we covered at the start of this guide are preventable, but prevention demands a systematic approach that most retirees lack. A Roth conversion that makes sense in isolation might conflict with your Social Security claiming strategy or push you into a higher Medicare premium bracket, which is why coordination matters so much.

We at Sager CPA help you navigate this complexity by mapping your complete financial picture, modeling scenarios against your actual numbers, and monitoring your strategy throughout retirement. This proactive partnership prevents costly mistakes like missing RMD deadlines or accidentally triggering excess Social Security taxation. The difference between a retiree who implements these strategies and one who doesn’t often amounts to tens of thousands of dollars in lifetime taxes.

Your next step is straightforward: schedule a consultation with Sager CPA to review your current retirement accounts, income sources, and tax situation. A personalized approach tailored to your circumstances will show you exactly where you stand and what adjustments could reduce your tax burden. The cost of professional guidance is far outweighed by the taxes you’ll save through proper planning and execution.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.