Your 20s and 30s are when your money decisions matter most. The habits you build now-from budgeting to investing-will shape your financial future for decades.

At Sager CPA, we’ve helped countless young adults take control of their finances. This guide walks you through the essentials of financial planning for young adults, from creating your first budget to building a retirement strategy that actually works.

Time is your most valuable asset right now, and most young adults waste it without realizing what they’re losing. If you start investing at 25 with just $150 per paycheck and earn an 8% average annual return, you’ll have approximately $1.1 million after 40 years. Wait until 35 to start the same strategy, and you’ll only accumulate around $490,000 over 30 years. That $600,000 difference comes from compound interest doing the heavy lifting while you sleep. The University of Illinois, in partnership with the CFP Board, teaches this concept in their Financial Planning for Young Adults course because it’s the single most powerful tool available to your generation. Starting early doesn’t require a large amount of money-it requires consistency and time. Even small, regular savings add up dramatically when given decades to grow, which is why delaying your first investment by even five years costs you more than you’ll likely earn in your entire career.

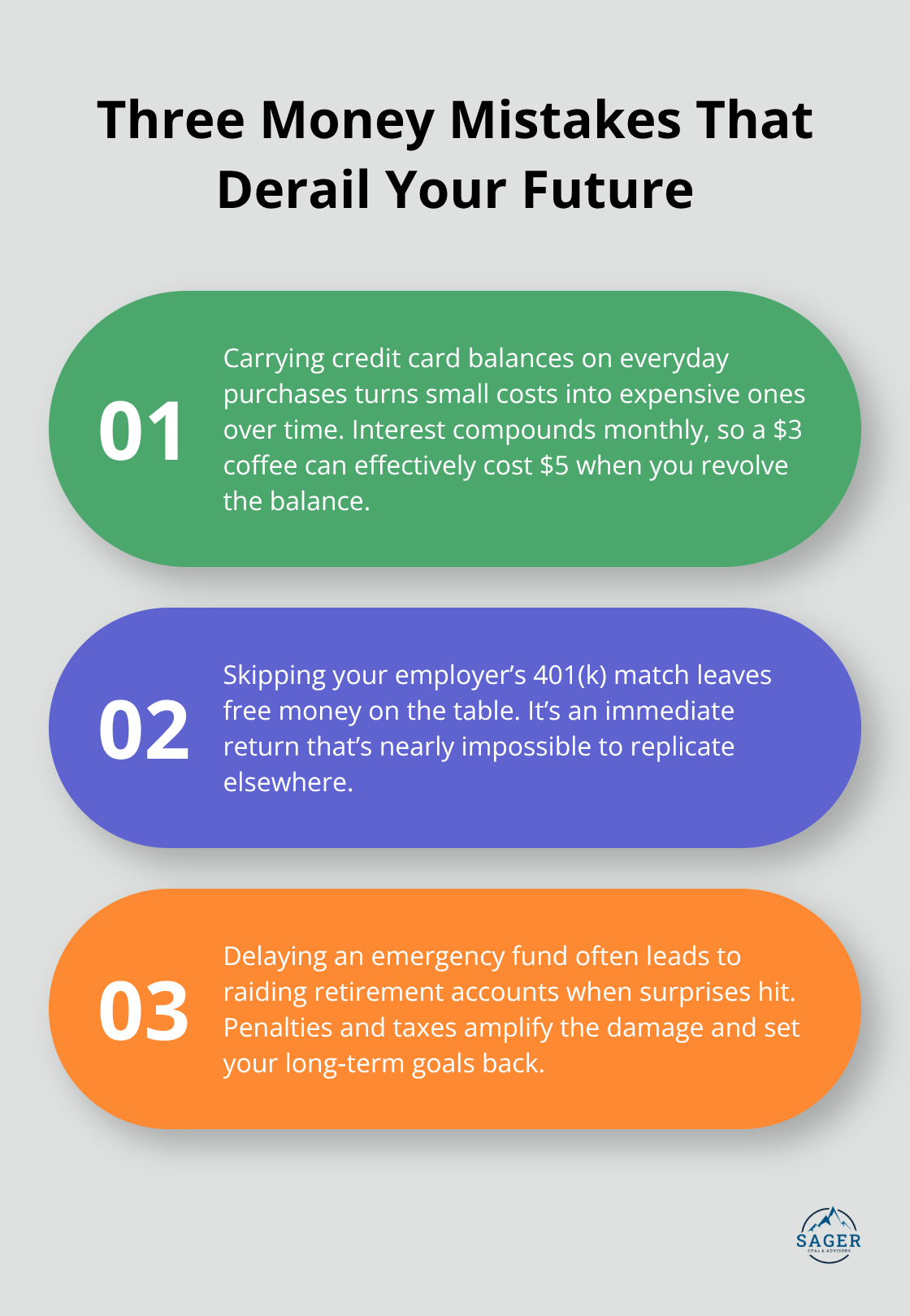

Young adults typically make three expensive errors that sabotage their financial future. First, they use credit cards for everyday purchases and carry balances, turning a $3 coffee into a $5 coffee through interest charges that compound monthly. Second, they skip employer 401(k) matching contributions-essentially leaving free money on the table. If your employer matches contributions and you don’t participate, you’re turning down an immediate return on your investment, which is impossible to replicate anywhere else. Third, they wait to build an emergency fund, then raid their retirement accounts when unexpected costs hit, paying penalties and taxes that multiply the damage.

The practical fix is straightforward. Treat savings like a fixed monthly bill before you spend on anything else, build an emergency fund covering three to six months of living expenses in a high-yield savings account, and contribute enough to your 401(k) to capture any employer match. These three actions eliminate most of the financial chaos that derails young adults in their 30s and 40s. Once you’ve locked in these fundamentals, you’re ready to move beyond basic budgeting and explore how to structure your savings and investments for maximum growth.

Most young adults skip budgeting because they think it means tracking every dollar and giving up fun. That’s wrong. A real budget is a spending plan that tells your money where to go instead of wondering where it went, and it requires only 30 minutes per month to maintain.

The first step is to track what you actually spend for one month without changing anything. Use your bank app or a free tool like your bank’s built-in expense tracker to categorize spending automatically. After 30 days, you’ll see exactly where your money goes.

Most young adults are shocked to find they spend $150 to $300 monthly on subscriptions they forgot about, food delivery fees that add up to restaurant prices, and small purchases that individually seem harmless but collectively drain thousands annually. Once you see the real numbers, you stop guessing and start deciding.

The University of Illinois course on Financial Planning for Young Adults recommends reviewing your spending every two to three months to stay on track and reallocate funds as life changes. This isn’t about cutting everything fun-it’s about cutting the wasteful spending that doesn’t bring satisfaction and redirecting that money toward things that matter to you.

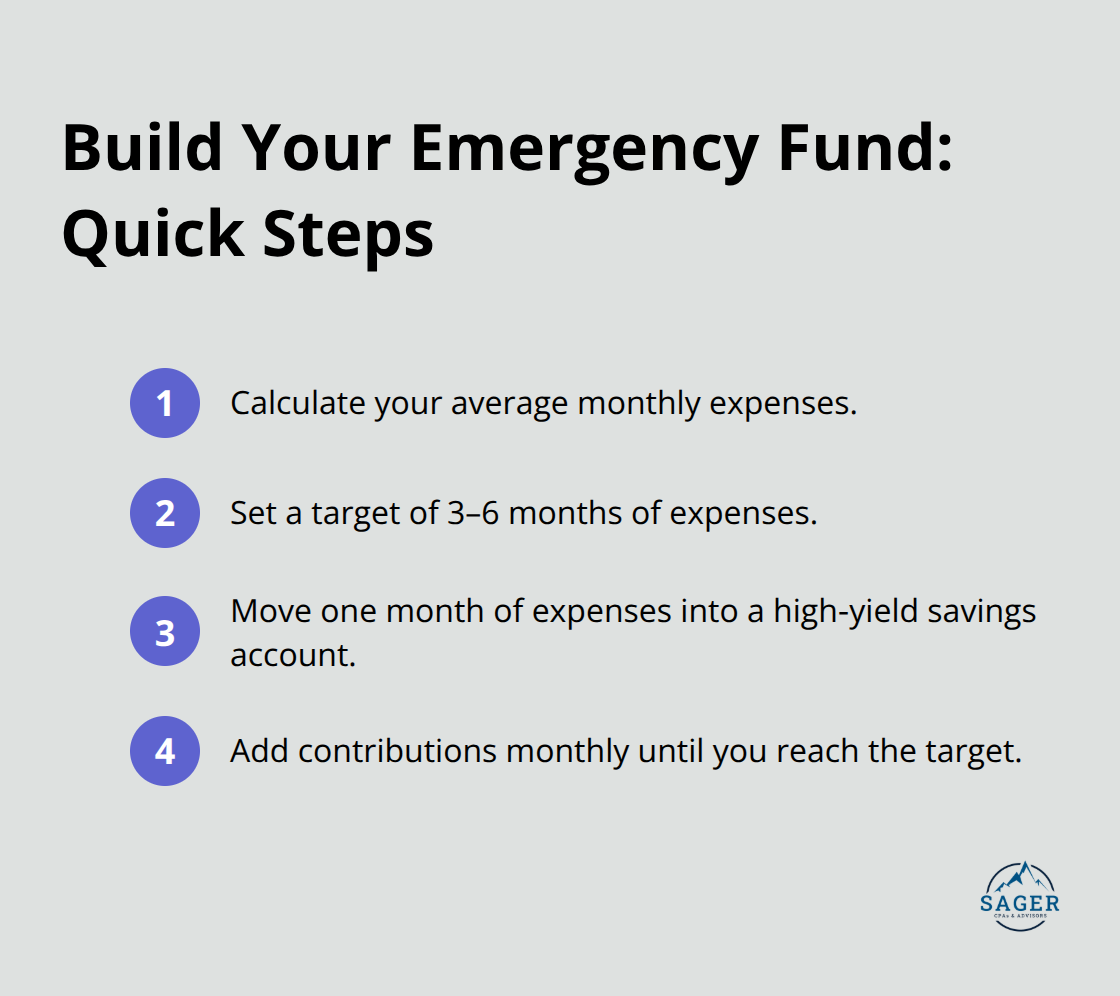

An emergency fund covering three to six months of living expenses kept in a high-yield savings account is the single most important financial tool you can build right now. This isn’t optional if you want to avoid raiding your retirement accounts when your car breaks down or you face medical bills.

Calculate your monthly expenses by adding rent, utilities, food, insurance, and transportation costs. If that total is $2,500 per month, your target emergency fund is $7,500 to $15,000.

Start by moving one month’s expenses into a separate high-yield savings account earning 4% to 5% annually, then add to it monthly until you hit your target.

Most people complete this goal within 12 to 18 months when they treat it like a bill they must pay. Once your emergency fund is fully funded, you stop living paycheck to paycheck and you stop making desperate financial decisions when unexpected costs hit.

The real benefit of an emergency fund shows up when you face a $2,000 car repair or lose your job temporarily-you handle it without credit card debt, without tapping retirement savings, and without the stress that destroys your long-term financial decisions. This financial cushion gives you the stability to make smart choices about your next move, whether that’s investing more aggressively or adjusting your career path without panic.

With your budget tracked and your emergency fund in place, you’ve eliminated the financial chaos that derails most young adults. The next step is to move beyond basic budgeting and explore how to structure your savings and investments for maximum growth through retirement accounts and diversified investing strategies.

Your emergency fund now protects you, which means you can finally invest without panic. The money you invest from now until retirement will grow far more than the money you earn from your job, which is why where you put your investments matters more than how much you contribute each month. Most young adults waste years in low-interest savings accounts or delay investing because they think they need thousands to start. That’s false. You can open a 401(k) or IRA with your first paycheck, and many investment platforms let you start with $1 or $5 per transaction through micro-investing apps. The real decision isn’t whether you have enough money to invest-it’s which accounts give you the biggest tax advantage, because taxes will cost you more over 40 years than almost any investment fee.

Your employer’s 401(k) is your first move if it exists. A traditional 401(k) lets you contribute pre-tax dollars, which immediately reduces your taxable income and lowers what you owe to the IRS this year. If your employer offers matching contributions-say they match 3% of your salary-that’s an instant 100% return on your money, and you’ll never find that elsewhere. A Roth 401(k) works differently: you contribute after-tax dollars now, but withdrawals in retirement are completely tax-free, which matters enormously if you expect to be in a higher tax bracket later.

The University of Illinois Financial Planning for Young Adults course recommends choosing based on your current income level-if you’re in a low tax bracket now, the Roth is usually smarter because you lock in a low tax rate forever. If your employer doesn’t offer a 401(k), open a Roth IRA or traditional IRA instead. You can contribute up to $7,000 per year to an IRA as of 2025, and that account grows tax-free or tax-deferred depending on which type you choose. The account compounds for decades without requiring you to pay taxes on growth each year, which is why starting at 25 instead of 35 creates that $600,000 difference we discussed earlier.

Once your retirement account is open, your next step is deciding what to invest in, and this is where most young adults overthink things. You don’t need to pick individual stocks or chase trendy investments. A simple approach is to invest in low-cost index funds or target-date funds inside your 401(k) or IRA. A target-date fund automatically adjusts your investments as you age-it’s aggressive when you’re 25 because you can recover from market downturns over 40 years, then gradually becomes more conservative as you approach retirement. This eliminates the need to constantly rebalance your portfolio yourself.

If you want more control, diversify across three categories: stocks for growth, bonds for stability, and potentially real estate through REITs if you have enough invested to justify the complexity. The key is that your risk tolerance should match your time horizon. You’re 25 with 40 years until retirement, so a portfolio that’s 80% stocks and 20% bonds is appropriate. That same portfolio would be reckless at 55. Your age does most of the work for you-starting early means you can afford to be aggressive, which means higher returns over time.

You now have the roadmap for financial planning for young adults. Start by tracking your spending and building an emergency fund, then move your money into tax-advantaged retirement accounts where compound interest works for you. The difference between starting at 25 and waiting until 35 is $600,000-that’s not motivation, that’s math.

The three actions that matter most are simple: contribute enough to capture your employer’s 401(k) match, build an emergency fund covering three to six months of expenses, and invest in low-cost index funds or target-date funds inside your retirement account. These three moves eliminate the financial chaos that derails most young adults and set you up for decades of growth. Everything else is refinement.

Your next step is to take action this week. Open a high-yield savings account for your emergency fund, enroll in your employer’s 401(k), or track your spending for 30 days-small actions compound just like money does. If you want to move faster or need help structuring a plan that fits your specific situation, Sager CPA and Advisors offers personalized financial strategy and tax planning designed to reduce your liabilities and clarify your path forward.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.