Individual tax planning strategies can save you thousands of dollars annually when implemented correctly. The average taxpayer overpays by $1,200 each year due to missed opportunities and poor timing decisions.

We at Sager CPA see clients reduce their tax burden by 15-30% through strategic planning. This guide covers proven techniques that work for real people in today’s tax environment.

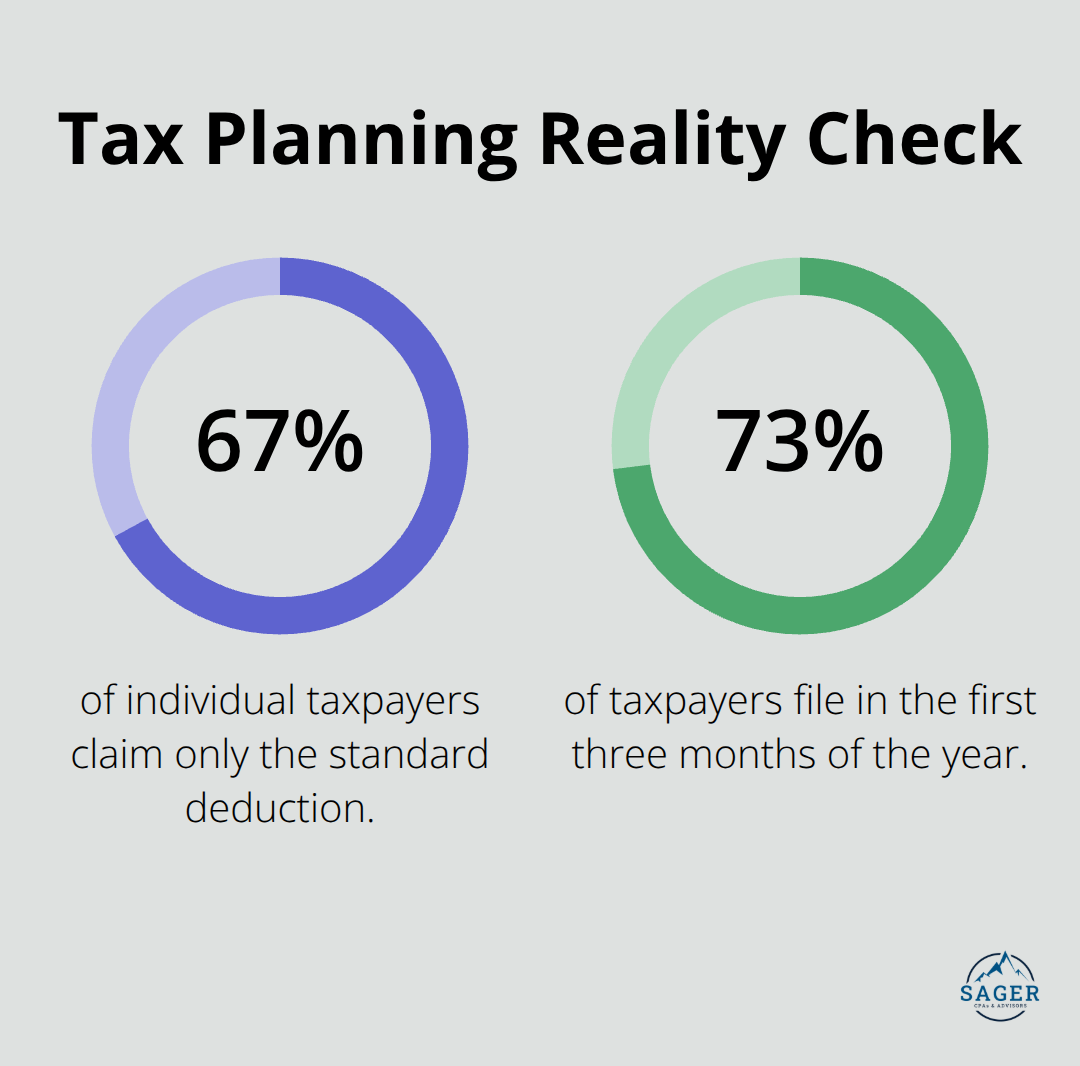

Tax planning works when you address three fundamental elements that most taxpayers completely ignore. The IRS data shows that 67% of individual taxpayers claim only the standard deduction and miss substantial opportunities for tax reduction. Effective planning requires you to understand your marginal tax rate, time income and expenses strategically, and maintain detailed records throughout the year.

Your marginal rate determines the value of every deduction – a taxpayer in the 24% bracket saves $240 for every $1,000 deduction, while someone in the 12% bracket saves only $120.

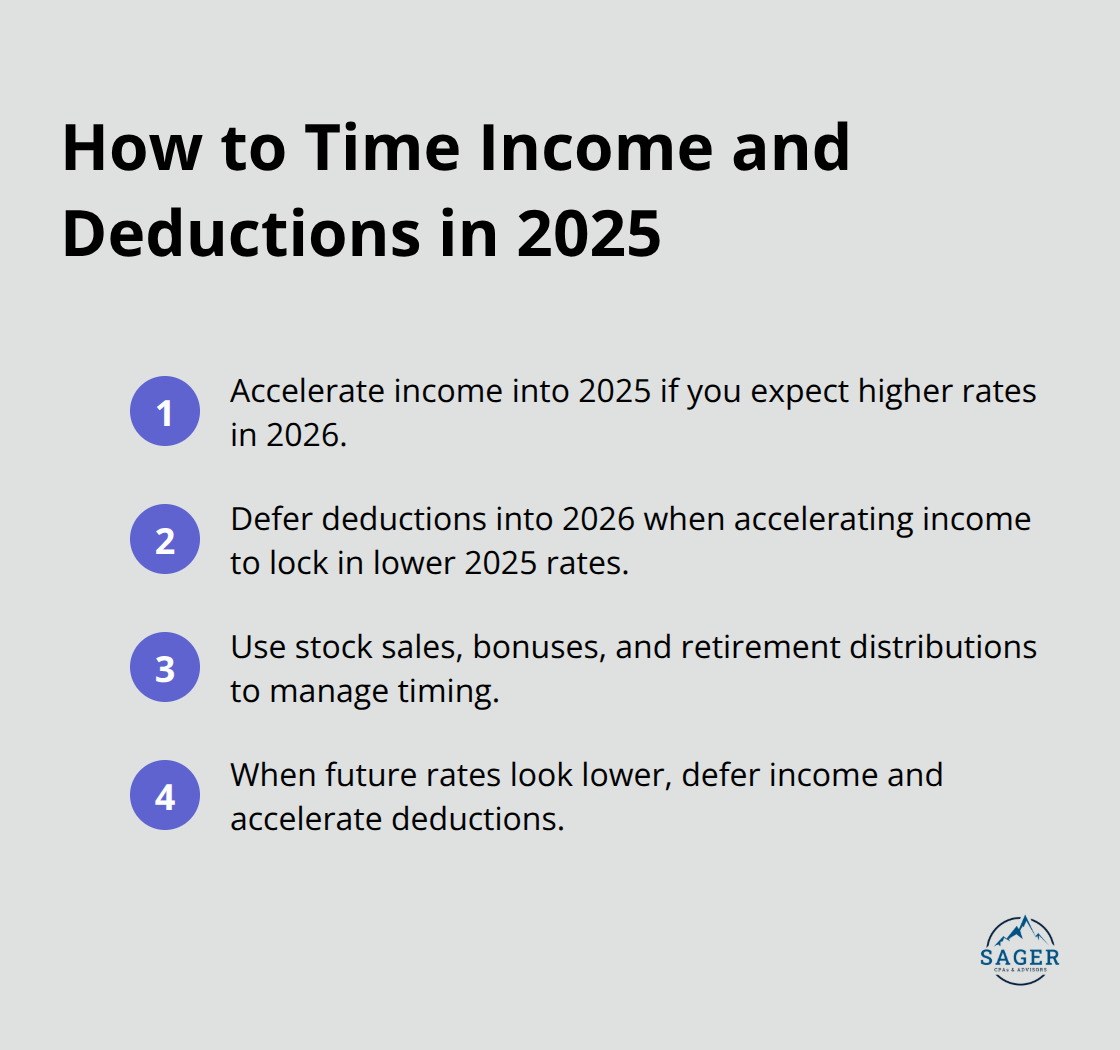

Strategic income control can reduce your tax liability by thousands annually. If you expect lower rates next year, defer income when you delay year-end bonuses or postpone asset sales until January. Conversely, accelerate income when you face higher future rates. The Tax Cuts and Jobs Act provisions expire after 2025, which potentially increases rates for many taxpayers. Clients save $3,000-$8,000 annually through careful control of stock sales, retirement distributions, and business income recognition.

The biggest mistake taxpayers make involves waiting until December to think about taxes. The IRS reports that 73% of taxpayers file in the first three months of the year, which indicates reactive rather than proactive plans. Another critical error involves ignoring state tax implications – high earners who move from California to Texas can save over $50,000 annually in state income taxes alone. Many also fail to maximize retirement contributions and leave $6,000-$23,500 in annual tax savings on the table (depending on their contribution limits and tax bracket).

Proper documentation separates successful tax planners from those who face IRS challenges. The IRS audits taxpayers who claim business deductions at three times the rate of those who don’t. You need organized records that track every deductible expense throughout the year, not scrambled receipts in April. Digital tools like QuickBooks or even smartphone apps can capture expenses instantly and categorize them automatically. This systematic approach protects your deductions and positions you to implement more advanced strategies that require detailed financial tracking.

The three most powerful tax strategies work together to create substantial savings when you implement them correctly. Retirement account contributions remain the fastest way to reduce current taxes – the 401k limit for 2025 reaches $23,500, with an additional $7,500 catch-up contribution for those over 50. Workers in the 24% tax bracket save $5,640 annually by maxing out their 401k, while those over 50 save $7,440. Traditional IRA contributions add another $7,000 in potential deductions (though income limits apply for those with workplace retirement plans).

Strategic control of income and deductions can shift thousands between tax years and different rate brackets. Taxpayers who face higher rates in 2026 when Tax Cuts and Jobs Act provisions expire should accelerate income into 2025 and defer deductions. Stock sales, bonus payments, and retirement distributions all offer flexibility for optimal tax rates. The opposite strategy works when you expect lower future rates – defer income and accelerate deductions like charitable contributions or business expenses.

Tax-loss harvesting amplifies these benefits by offsetting up to $3,000 of ordinary income annually through strategic sale of underperforming investments. Long-term capital gains face maximum rates of 20% compared to ordinary income rates up to 37%, which makes the holding period critical for investment decisions. Investors who hold assets for more than one year access these preferential rates and reduce their overall tax burden significantly.

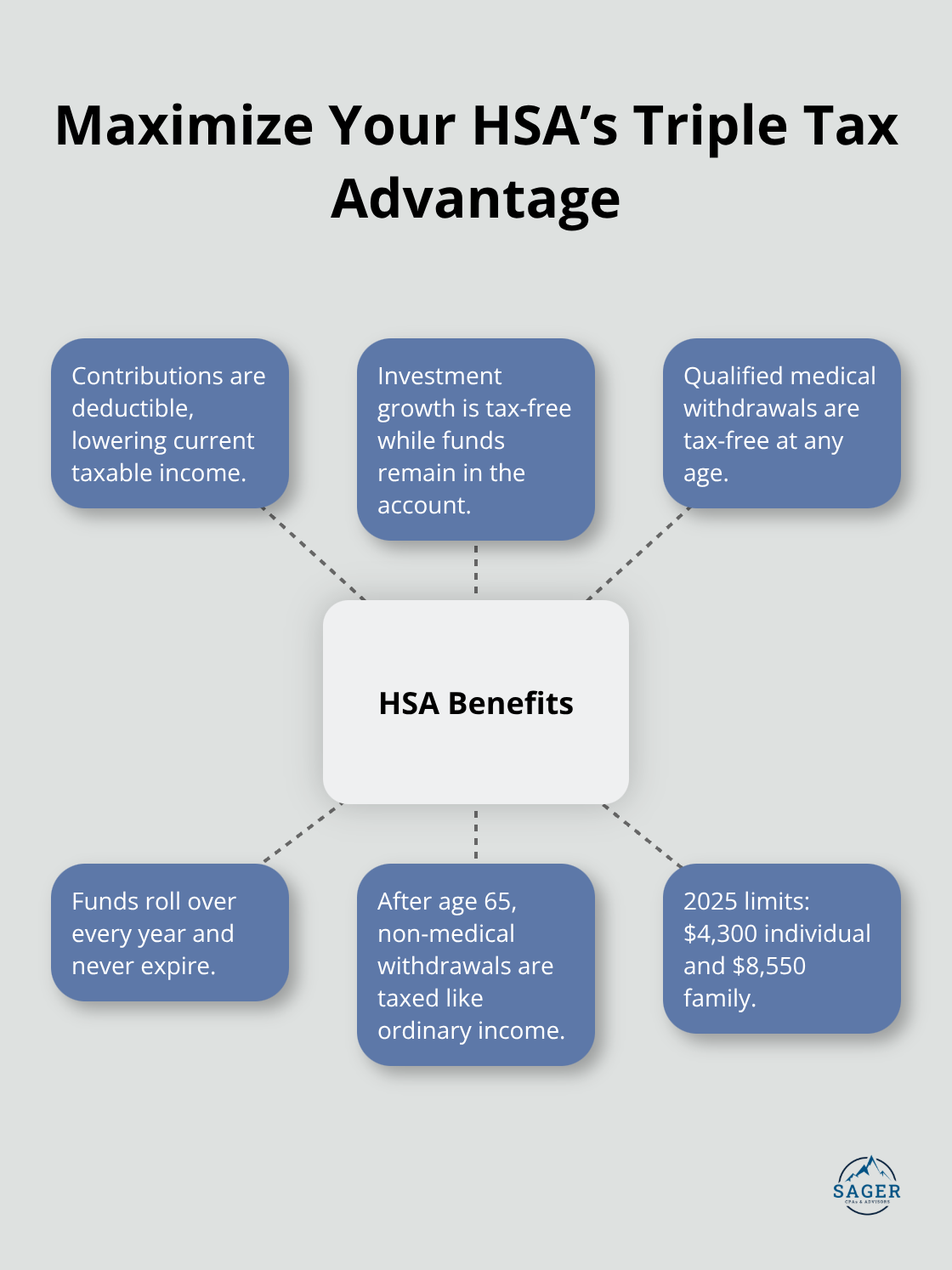

Health Savings Accounts provide triple tax benefits that retirement accounts cannot match – deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. The 2025 contribution limits reach $4,300 for individuals and $8,550 for families. HSA funds roll over indefinitely and become retirement accounts after age 65, which makes them superior to flexible spending accounts that require annual use-it-or-lose-it decisions.

These foundational strategies create the framework for more sophisticated approaches that can further reduce your tax liability through estate planning and specialized savings vehicles.

Estate and gift tax planning creates powerful wealth transfer opportunities that most taxpayers overlook completely. The federal estate tax exemption and increases annually with inflation, but the Tax Cuts and Jobs Act provisions expire in 2025. After 2025, exemptions revert to approximately $7 million per person unless Congress acts. High-net-worth families who gift assets now can lock in current exemption levels and remove future appreciation from their taxable estates. Annual gift exclusions allow $19,000 per recipient in 2025, which means married couples can gift $38,000 annually to each child without using lifetime exemptions.

The permanent estate tax exemption under recent legislation reaches $15 million for individuals and $30 million for married couples starting in 2026. Families should act quickly to transfer wealth before potential rate increases. Gift assets during temporary value declines to maximize the impact of your lifetime exemption. Trusts can hold these gifts and exclude future appreciation from your taxable estate while you retain some control over the assets.

529 education savings plans provide tax-free growth and withdrawals for qualified education expenses, but their benefits extend far beyond college tuition. Contributions up to $19,000 annually per beneficiary qualify for the gift tax exclusion, though you can contribute up to five years worth upfront ($95,000 per beneficiary) without gift tax consequences. The SECURE Act expanded qualified expenses to include K-12 tuition up to $10,000 annually and student loan repayments up to $10,000 lifetime. Many states offer additional tax deductions for contributions, with some providing credits instead. New York residents can deduct up to $10,000 annually, while Illinois offers deductions up to $20,000 for married couples filing jointly.

Health Savings Accounts represent the most tax-advantaged savings vehicle available, but medical expense planning extends beyond HSA contributions. After age 65, HSA withdrawals for non-medical expenses face only ordinary income tax rates, making them effective retirement accounts.

The 2025 contribution limits reach $4,300 for individuals and $8,550 for families. HSA funds roll over indefinitely and become powerful retirement tools that combine immediate tax deductions with long-term tax-free growth.

Flexible Spending Accounts allow $3,200 in pre-tax contributions for 2024, though use-it-or-lose-it rules apply with limited carryover options. Medical expenses exceeding 7.5% of adjusted gross income qualify for itemized deductions, which makes timing of elective procedures and medical equipment purchases strategically important. Dependent care FSAs accept up to $5,000 annually for childcare expenses, providing immediate tax savings for working parents who need professional care services.

Individual tax planning strategies deliver measurable results when you implement them systematically throughout the year. Strategic retirement contributions, income timing, and tax-loss harvesting create substantial annual savings that compound over time. The combination of maximized 401k contributions, controlled income recognition, and HSA utilization generates significant tax reductions.

Professional guidance becomes essential as tax laws evolve and your financial situation grows more complex. The expiration of Tax Cuts and Jobs Act provisions in 2025 will impact most taxpayers significantly (affecting marginal rates and deduction limits). Estate planning opportunities, education savings strategies, and advanced investment techniques require expertise to implement correctly and avoid costly mistakes.

Start your tax planning journey by maximizing current-year retirement contributions and organizing your financial records. Review your withholdings and estimated payments to avoid penalties. Sager CPA provides comprehensive tax planning services that create personalized strategies for your specific situation, helping you achieve long-term financial stability through proactive tax management.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.