Choosing between retirement accounts can feel overwhelming when you’re planning for your financial future. The IRA vs 401k debate affects millions of Americans every year.

We at Sager CPA see clients struggle with this decision daily. Both accounts offer tax advantages, but they work differently and serve different needs depending on your income, employer benefits, and retirement goals.

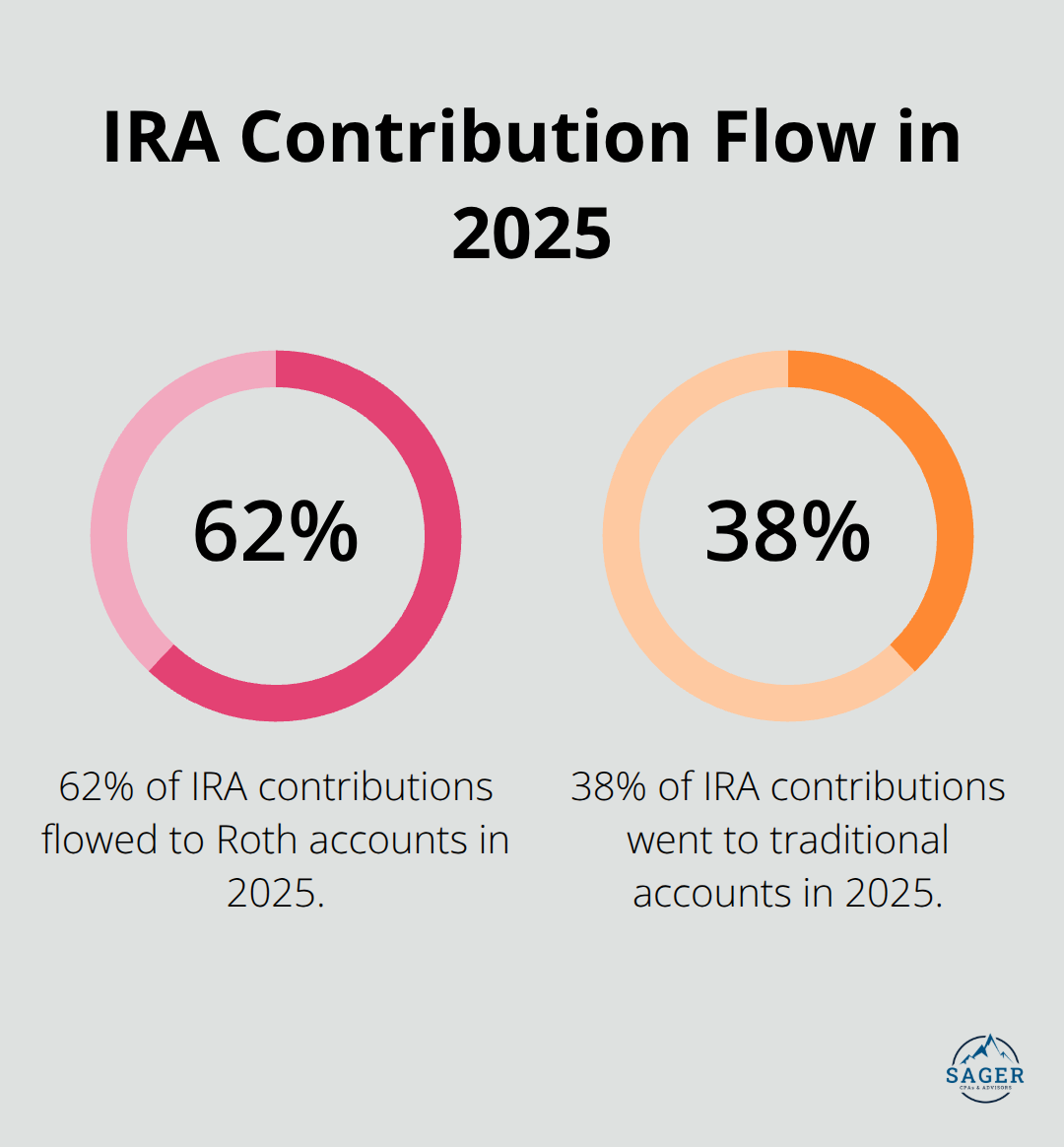

An IRA puts you in the driver’s seat for retirement savings. You open the account directly with a financial institution like Fidelity or Vanguard and select from thousands of investment options. The 2025 contribution limits allow $7,000 annually ($8,000 if you’re 50 or older). Traditional IRAs may offer tax deductions based on your income level, while Roth IRAs use after-tax dollars but provide tax-free withdrawals in retirement. Fidelity data shows the average IRA balance reached $131,366 in 2025, with 62% of contributions flowing to Roth accounts. You can contribute to an IRA whether or not your employer offers a retirement plan.

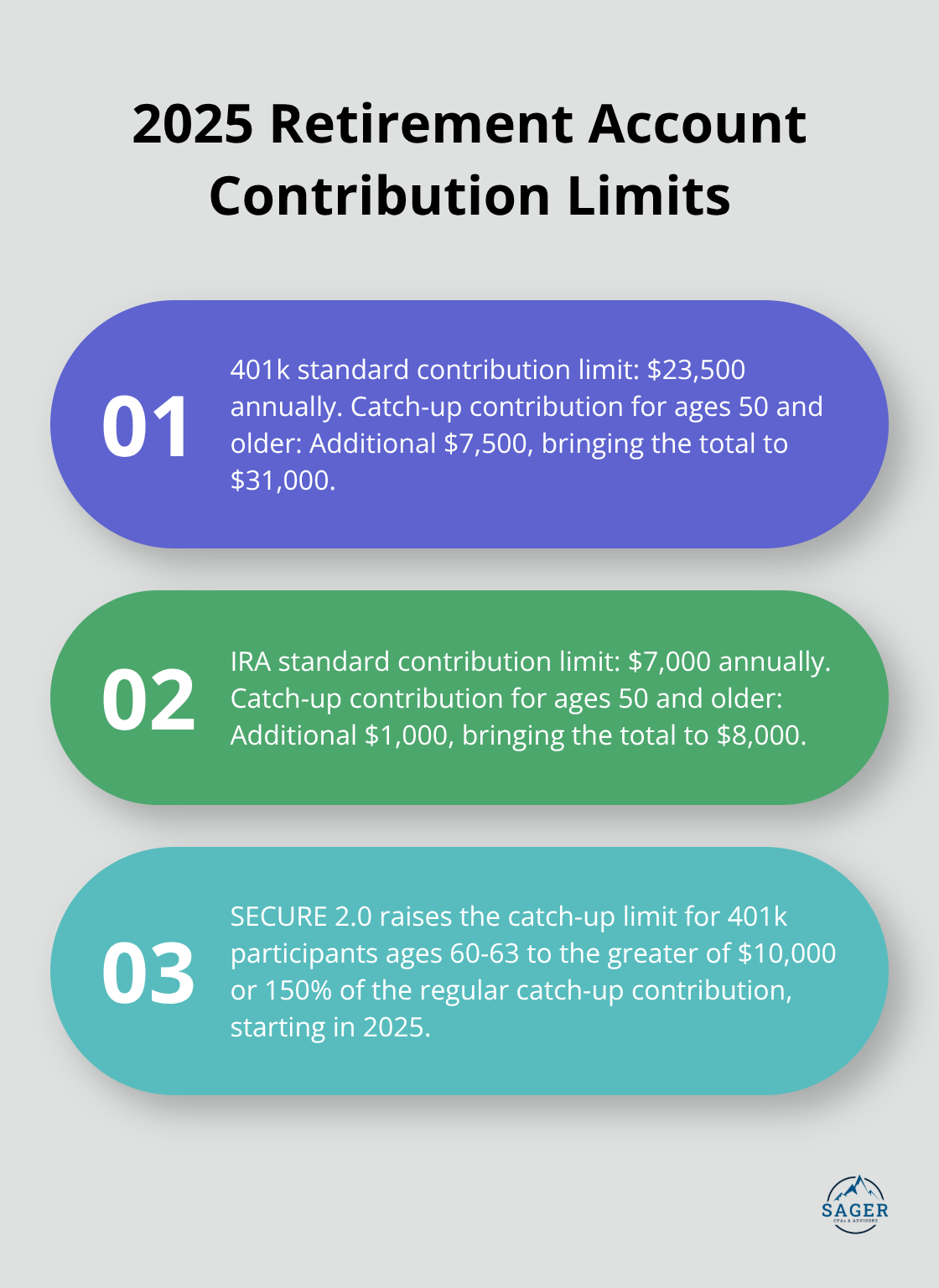

A 401k exists only through your employer and restricts your investment choices to company-selected options (typically around 28 according to FINRA data). The contribution limits reach much higher levels at $23,500 for 2025, rising to $31,000 if you’re 50 or older. Fidelity reports that 95.1% of participants choose target-date funds, and the average 401k balance hit $137,800 in 2025. The real advantage comes from employer matching, with the average employer match ranging between 4% and 6% of compensation. The most common structure is a 50% partial match on employee contributions.

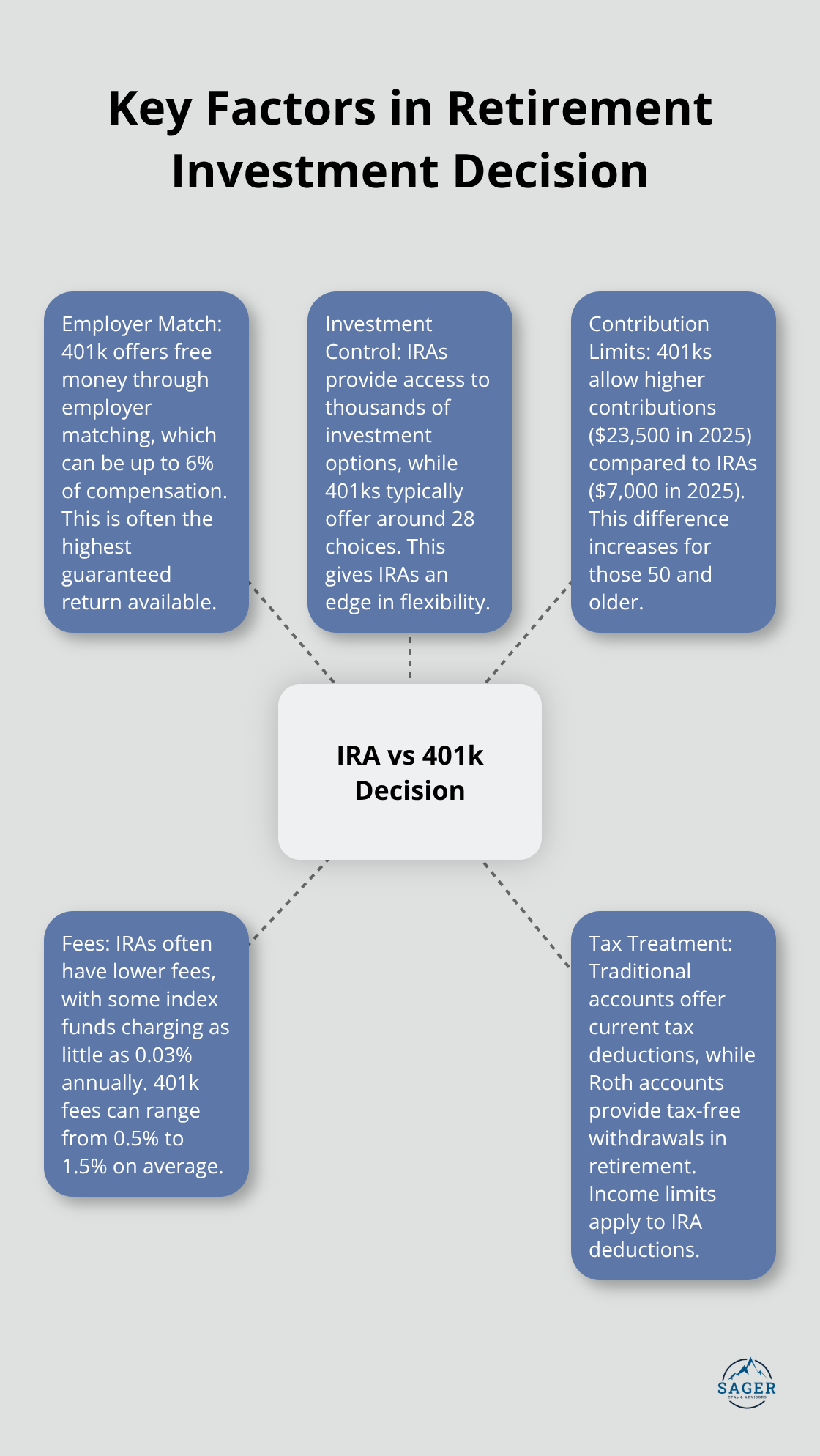

Both accounts offer tax advantages, but the timing differs significantly. Traditional versions reduce your current taxable income, while Roth versions provide tax-free growth and withdrawals in retirement. The key difference lies in income limits: 401ks have no income restrictions, but IRA deductibility phases out at higher incomes. Both require minimum distributions starting at age 73 (except for Roth IRAs which never require withdrawals during your lifetime). These tax differences become even more important when you consider contribution limits and employer benefits in your retirement strategy.

The 2025 contribution limits create a massive gap between 401k and IRA options. Your 401k allows $23,500 annually, which jumps to $31,000 at age 50, while IRAs cap at just $7,000 ($8,000 over 50). This $16,500 difference means 401ks offer triple the retirement savings capacity for most workers. Fidelity data shows the average 401k contribution rate hits 7.7% of income, while the average IRA contribution reaches only $3,200 annually. The math is simple: max out your 401k first if you want serious retirement wealth.

Traditional IRA deductions may be disallowed if you or your spouse participates in a retirement plan at work, based on income ranges set by the IRS. Roth IRA contributions get blocked entirely at $153,000 single or $228,000 married. Meanwhile, 401ks ignore income completely. High earners face a backdoor Roth IRA strategy as their only path to Roth benefits, which involves conversion of traditional IRA contributions to Roth status. This creates tax complications that most people handle poorly without professional guidance.

The math favors traditional accounts for workers in their peak income years. Current tax rates of 22% to 24% for middle-class earners will likely drop to 12% or 15% in retirement when income falls. Vanguard research shows the average retiree needs just 75% of pre-retirement income, which pushes most people into lower tax brackets. Roth accounts only win if you expect higher future tax rates or plan to leave money to heirs. The 62% of IRA contributions that flow to Roth accounts according to Fidelity suggests most people make emotional rather than mathematical decisions about tax schedules.

Workers aged 50 and older get additional contribution room that changes the retirement savings game. The extra $7,500 for 401ks and $1,000 for IRAs helps people who started late or need to accelerate their savings. Beginning in 2025, SECURE 2.0 raises the catch-up limit for participants ages 60–63 to the greater of $10,000 or 150% of the regular catch-up contribution. These catch-up rules recognize that peak income years often coincide with peak savings capacity, but employer match programs and investment options become even more important factors in your decision.

The 401k employer match represents the highest guaranteed return you will ever find. Nearly 40% of retirement savers increased their contribution rate in 2024 with an average increase of 2.9%. This creates an immediate 100% return on your contributed dollars up to the match limit. Workers who skip their company match lose $1,336 annually according to Financial Engines research. The total average contribution rate from employees and employers reaches 14.3%, which puts most workers close to the recommended 15% savings rate. Always maximize employer match before you consider IRAs, regardless of investment options or fees.

IRA investment flexibility destroys 401k limitations completely. While 401k plans restrict you to an average of 27.6 investment choices (according to FINRA), IRAs provide access to thousands of mutual funds, ETFs, individual stocks, and bonds. Vanguard Total Stock Market Index charges just 0.03% annually in an IRA, while typical 401k plans charge 0.5% to 1.5% in administrative and investment fees. American workers’ 401(k) plans charge fees of approximately 1 percent of assets managed on average. Large company 401k plans offer better fee structures, but small business plans often carry excessive costs that make IRAs the clear winner for investment growth.

The optimal strategy combines both accounts to maximize benefits and minimize weaknesses. Contribute enough to your 401k to capture the full employer match, then switch to IRA contributions for better investment options and lower fees. Return to 401k contributions only after you max your IRA at $7,000 annually. This approach captures free employer money while it maintains investment control and cost efficiency. High earners who max both accounts create $30,500 in annual retirement contributions, plus employer match. Maximizing contributions to tax-advantaged retirement accounts helps reduce your taxable income while building wealth. The 595,000 401k millionaires and 501,481 IRA millionaires that Fidelity reported prove that consistent contributions to both account types build serious wealth over time.

The IRA vs 401k decision depends entirely on your specific financial situation and employer benefits. Workers with generous employer matches should prioritize 401k contributions up to the match limit first, then shift to IRAs for better investment control and lower fees. High earners benefit most from traditional accounts due to current tax bracket advantages, while younger workers in lower brackets might consider Roth options.

The optimal strategy combines both accounts to maximize benefits. Capture your full employer match through 401k contributions, maximize your $7,000 IRA contribution for investment flexibility, then return to 401k contributions if you can afford additional savings. This approach builds the $30,500 annual contribution capacity (including catch-up contributions for older workers) that creates real wealth over decades.

Your retirement success requires ongoing tax planning and investment optimization. We at Sager CPA help clients navigate these complex decisions through comprehensive tax planning that reduces liabilities while maximizes retirement savings. The 595,000 401k millionaires and 501,481 IRA millionaires prove that consistent contributions and smart tax strategies create financial security.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.