At Sager CPA, we understand that effective wealth management and tax planning are essential for financial success. These two areas are closely intertwined, each playing a crucial role in maximizing your financial potential.

In this blog post, we’ll explore strategies to optimize your wealth management approach and implement smart tax planning techniques. By mastering these skills, you can take control of your financial future and make informed decisions that align with your long-term goals.

Wealth management represents a comprehensive approach to financial stewardship. It encompasses investment strategies, retirement planning, estate planning, and risk management. The primary objective is to grow assets over time while shielding them from market volatility and other financial risks.

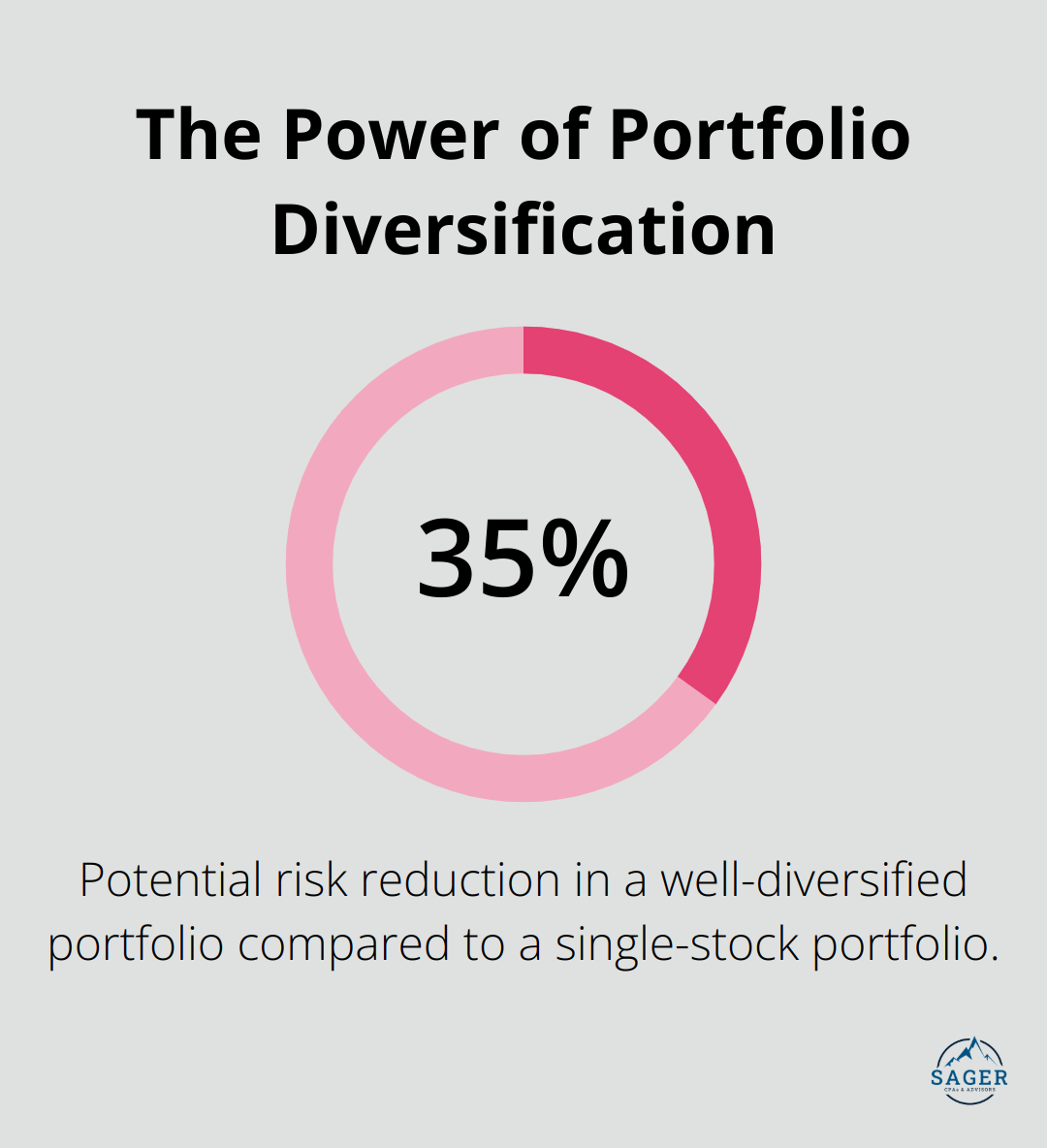

A cornerstone of wealth management is diversification. This strategy involves spreading investments across various asset classes (stocks, bonds, real estate, and alternative investments). A study by Vanguard highlights the power of diversification: a well-diversified portfolio can potentially reduce risk by up to 35% compared to a single-stock portfolio.

Tax planning involves the strategic organization of financial affairs to minimize tax liability within legal boundaries. It extends beyond accurate tax filing; it’s about making year-round financial decisions that can reduce overall tax burden.

Income timing serves as an effective tax planning strategy. For instance, deferring income to a future tax year or accelerating deductions into the current year can lower taxable income.

Wealth management and tax planning yield optimal results when used in conjunction. The selection of tax-efficient investment vehicles, for example, can significantly impact after-tax returns.

Professional guidance plays a pivotal role in navigating the complexities of wealth management and tax planning. Financial advisors can provide tailored strategies that align with individual financial goals and circumstances.

The financial landscape is dynamic, with evolving market conditions and tax laws. Successful wealth management and tax planning require regular reviews and adjustments. As financial situations change and new tax regulations emerge, strategies must adapt accordingly.

The synergy between wealth management and tax planning forms the foundation for a robust financial strategy. In the next section, we’ll explore specific strategies to optimize your wealth management approach, building on this fundamental understanding.

A robust wealth management strategy starts with diversification. A diversified portfolio reduces overall risk while still allowing for long-term growth potential. We recommend spreading investments across various asset classes (stocks, bonds, real estate, and alternative investments).

For instance, if your portfolio heavily favors tech stocks, add exposure to other sectors like healthcare or consumer staples. This approach buffers your portfolio against sector-specific downturns.

Financial markets change constantly, and your portfolio should reflect these changes. We advise clients to review their portfolios at least quarterly. This practice allows for timely adjustments to maintain desired asset allocation and risk profile.

These reviews assess whether investments still align with financial goals. If they don’t, adjustments become necessary. As retirement approaches, a gradual shift towards more conservative investments helps protect wealth.

Risk management plays a critical role in wealth preservation. One effective technique involves the use of stop-loss orders, which automatically sell a security when it reaches a predetermined price. This helps limit potential losses in volatile markets.

Another strategy uses options to hedge your portfolio. Buying put options on stocks you own can provide downside protection if the market takes a downturn.

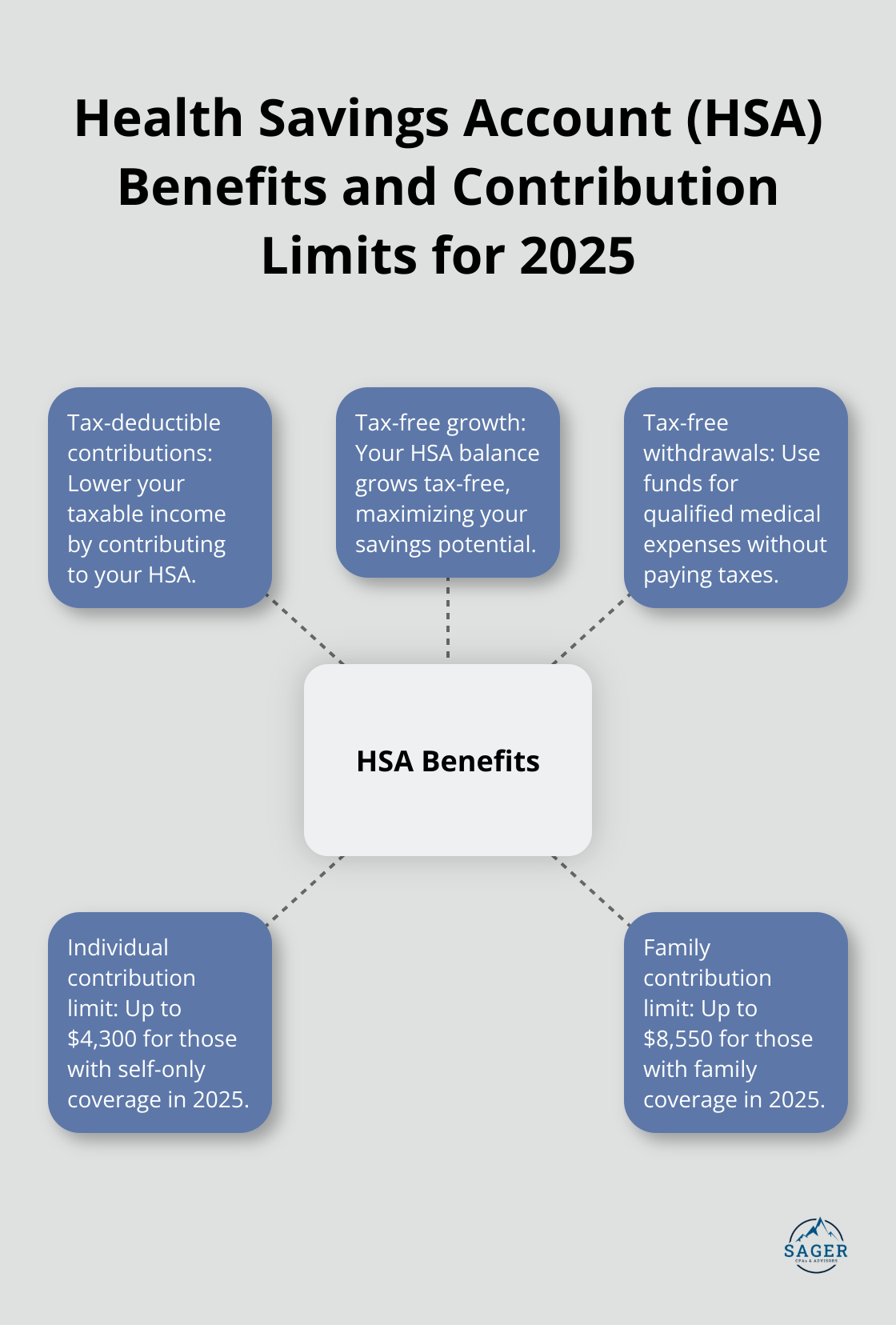

Maximizing contributions to tax-advantaged accounts boosts wealth over time. Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,300 if you are covered by a high-deductible health plan just for yourself, or $8,550 if you have coverage for your family.

Wealth management isn’t a one-size-fits-all approach. Professional guidance tailors strategies to your unique financial situation and goals. A skilled advisor helps navigate complex financial landscapes, providing insights that may not be apparent to the individual investor.

The next section explores effective tax planning techniques that complement these wealth management strategies, further optimizing your financial position.

We recognize the power of strategic timing in tax planning. High-income earners can save thousands by managing the timing of large gains to avoid being subject to the Medicare surtax. For example, pushing a large bonus to a year when you anticipate lower income could result in substantial tax savings. Conversely, accelerating deductions into the current tax year can lower your taxable income. This might involve prepaying property taxes or making charitable donations before year-end. Align these decisions with your overall financial picture and expected future income.

Despite increased standard deductions, itemizing can still benefit many taxpayers. Keep detailed records of potential deductions such as mortgage interest, state and local taxes, and charitable contributions. Don’t overlook often-missed deductions like unreimbursed medical expenses exceeding 7.5% of your adjusted gross income. Business owners should consider home office deductions if they use a portion of their home exclusively for business purposes.

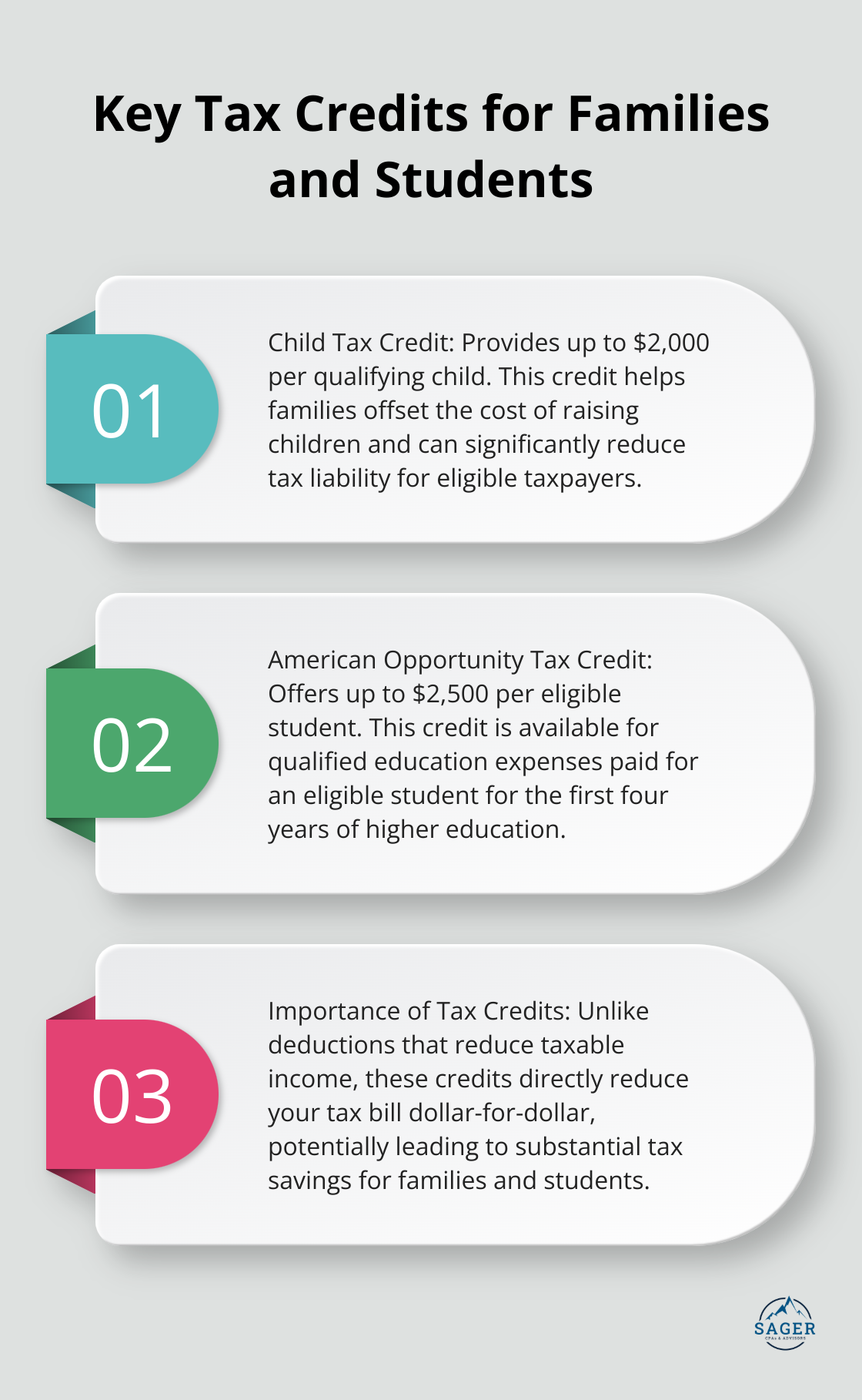

Tax credits offer dollar-for-dollar reductions in your tax bill. The Child Tax Credit provides up to $2,000 per qualifying child. For those pursuing higher education, the American Opportunity Tax Credit offers up to $2,500 per eligible student.

Your choice of investment vehicles can significantly impact your after-tax returns. Tax-efficient investing is a strategy to use specific products and accounts in a portfolio to maximize returns and minimize the taxes paid on those returns. For long-term investors, exchange-traded funds (ETFs) often offer tax advantages over mutual funds due to their structure and lower turnover.

Try to maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. In 2025, you can contribute up to $23,000 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older. These contributions reduce your taxable income for the year and grow tax-deferred.

Estate planning is a vital component of comprehensive tax planning for everyone, not just the ultra-wealthy. The annual gift tax exclusion allows you to give up to $18,000 per recipient in 2025 without incurring gift tax. This can effectively transfer wealth to family members while reducing your taxable estate.

For larger estates, consider establishing trusts. Irrevocable life insurance trusts (ILITs) can provide liquidity to pay estate taxes while keeping the proceeds out of your taxable estate.

Tax laws are complex and constantly changing. What works this year might not be optimal next year. Professional guidance can help you navigate the complexities of tax law and develop a comprehensive strategy tailored to your unique financial situation. At Sager CPA, we emphasize the importance of regular reviews and adjustments to your tax strategy.

Effective wealth management and tax planning form the cornerstone of a successful financial strategy. You can optimize your approach through portfolio diversification, regular asset reviews, and risk management techniques. Smart tax strategies, including income timing and maximizing deductions, will significantly reduce your tax burden. The synergy between these disciplines creates a powerful framework for financial growth and stability.

Professional guidance proves invaluable when navigating complex financial markets and ever-changing tax laws. At Sager CPA, we provide comprehensive financial management and tax planning services tailored to individual and business needs. Our team of experts will help you develop a personalized strategy that aligns with your financial goals, ensuring informed decisions that support long-term financial stability and growth.

You should start your optimization journey by assessing your current financial position. Identify areas to diversify investments, maximize tax-advantaged accounts, and implement tax-efficient strategies. Consider scheduling a consultation with a financial advisor to create a customized action plan that addresses your unique circumstances (including both wealth management and tax planning aspects).

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.