Growing businesses face a common challenge: they need high-level financial expertise but can’t justify the cost of a full-time CFO. The benefits of outsourced CFO services offer a compelling solution.

At Sager CPA, we’ve seen companies transform their financial operations by partnering with experienced CFO professionals. This approach delivers executive-level strategic guidance without the hefty salary and benefits package.

An outsourced CFO handles the same strategic financial responsibilities as a full-time executive but works with your company on a flexible basis. They analyze your accounting processes, create comprehensive financial reports, and develop cash flow forecasts that guide major business decisions. Most outsourced CFOs spend 10-20 hours per week with companies, and they focus on high-impact activities like financial modeling, investor presentations, and strategic planning sessions with leadership teams.

Part-time CFO services cost between $40,000 to $60,000 annually compared to the average full-time CFO salary of $435,000 (according to recent industry data). Part-time CFOs work remotely and focus exclusively on strategic financial guidance rather than daily operational tasks. Full-time CFOs manage larger teams and handle more administrative responsibilities, but most companies need strategic expertise more than hands-on management.

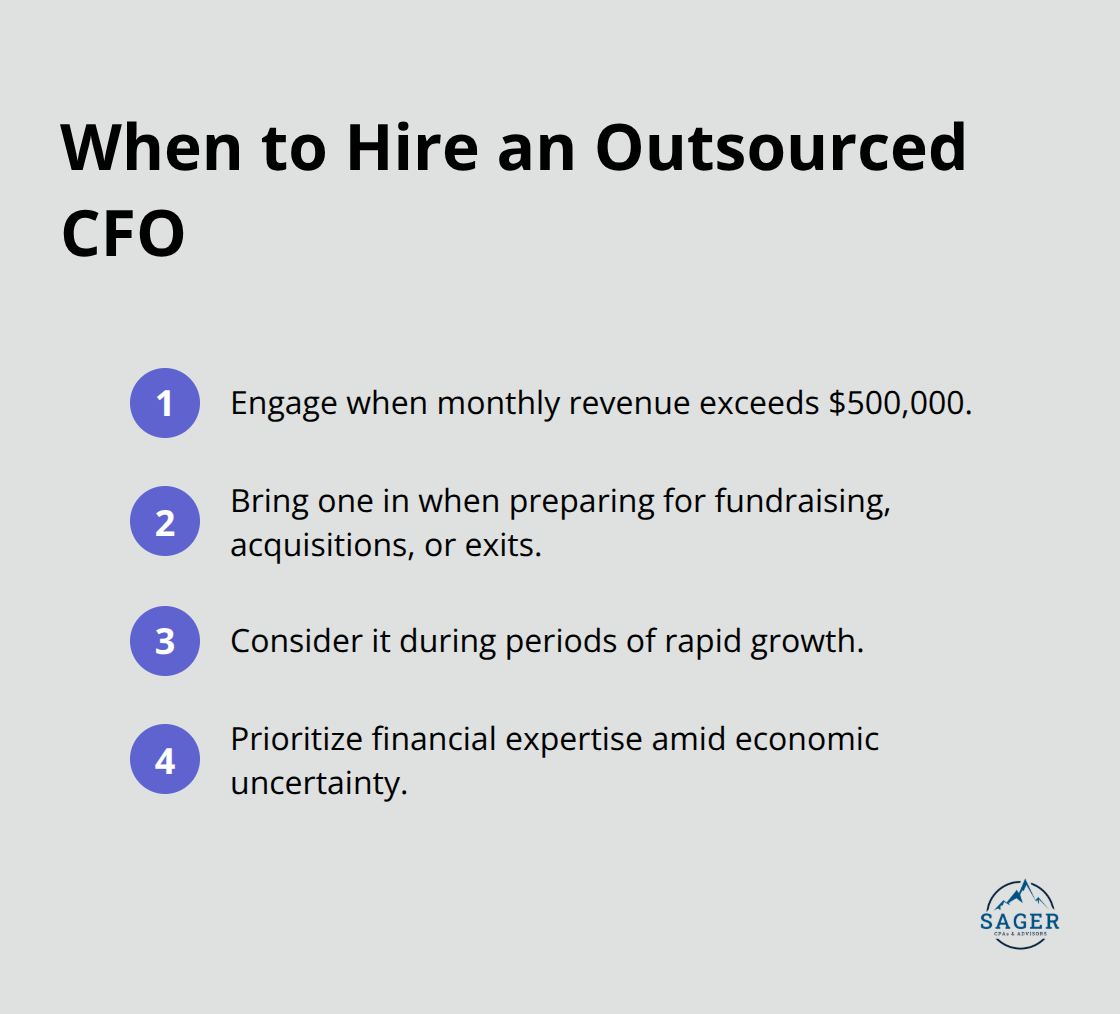

Companies should engage an outsourced CFO when monthly revenue exceeds $500,000 or when they prepare for major transitions like fundraising, acquisitions, or exit strategies. The demand for interim CFO services increased 103% in 2023, which reflects how businesses prioritize financial expertise during economic uncertainty. Companies that experience rapid growth benefit most from outsourced CFO services because they need sophisticated financial planning without the overhead costs of an entire finance department.

These strategic advantages translate into measurable improvements across multiple areas of business operations.

Outsourced CFO services can save startups money compared to hiring a full-time CFO. Fractional CFOs cost $40,000 to $60,000 per year while they deliver the same strategic financial guidance that a $435,000 full-time CFO provides. Companies access senior-level expertise without benefits, office space, or support staff expenses that traditional executives require.

A study by NAPEO found that the average cost savings from hiring a PEO can lead to a 27.2% ROI. Smart companies redirect these savings toward core business activities like product development, marketing initiatives, and technology upgrades that drive revenue growth.

Outsourced CFOs bring experience from dozens of companies across multiple sectors. They navigate economic downturns, manage successful exits, and guide businesses through complex fundraising rounds. This breadth of experience translates into faster problem-solving and proven strategies that in-house CFOs often lack.

Healthcare companies benefit from CFOs who understand Medicare reimbursements and regulatory compliance. Tech startups need professionals familiar with venture capital metrics and SaaS financial modeling. Real estate firms require expertise in property valuation and investment analysis (areas where specialized knowledge makes the difference between profit and loss).

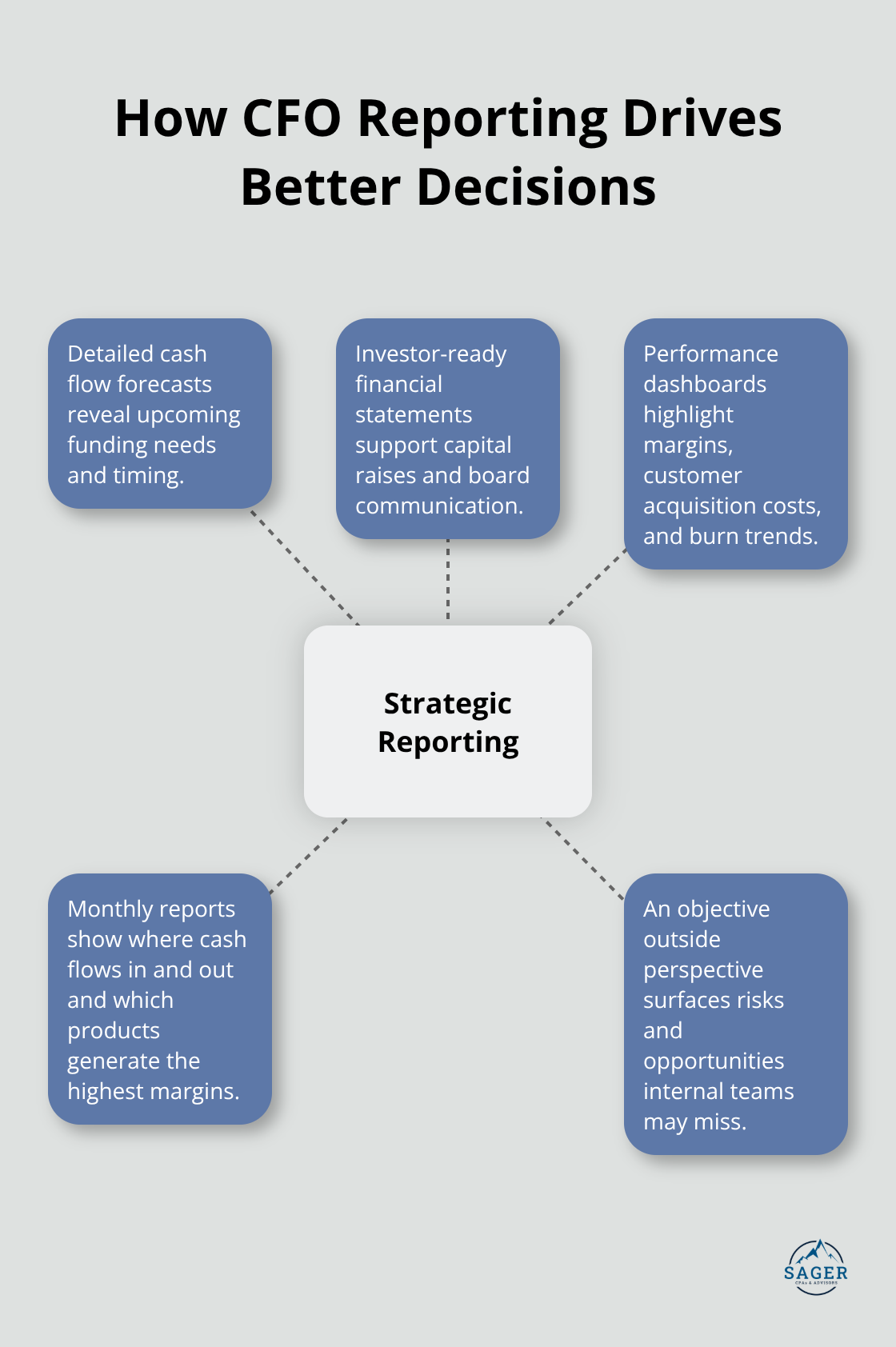

Professional CFO services transform basic bookkeeping into strategic intelligence. They create detailed cash flow forecasts, investor-ready financial statements, and performance dashboards that reveal hidden inefficiencies. Companies receive monthly reports that highlight exactly where money flows in and out, which products generate the highest margins, and when additional capital becomes necessary.

This level of financial clarity enables leadership teams to make data-driven decisions about expansion, hiring, and resource allocation rather than reliance on gut feelings or incomplete information. The objective perspective that outsourced CFOs provide often identifies risks and opportunities that internal teams miss due to their proximity to daily operations.

These strategic advantages create measurable improvements in how businesses manage their most critical financial processes and operational efficiency.

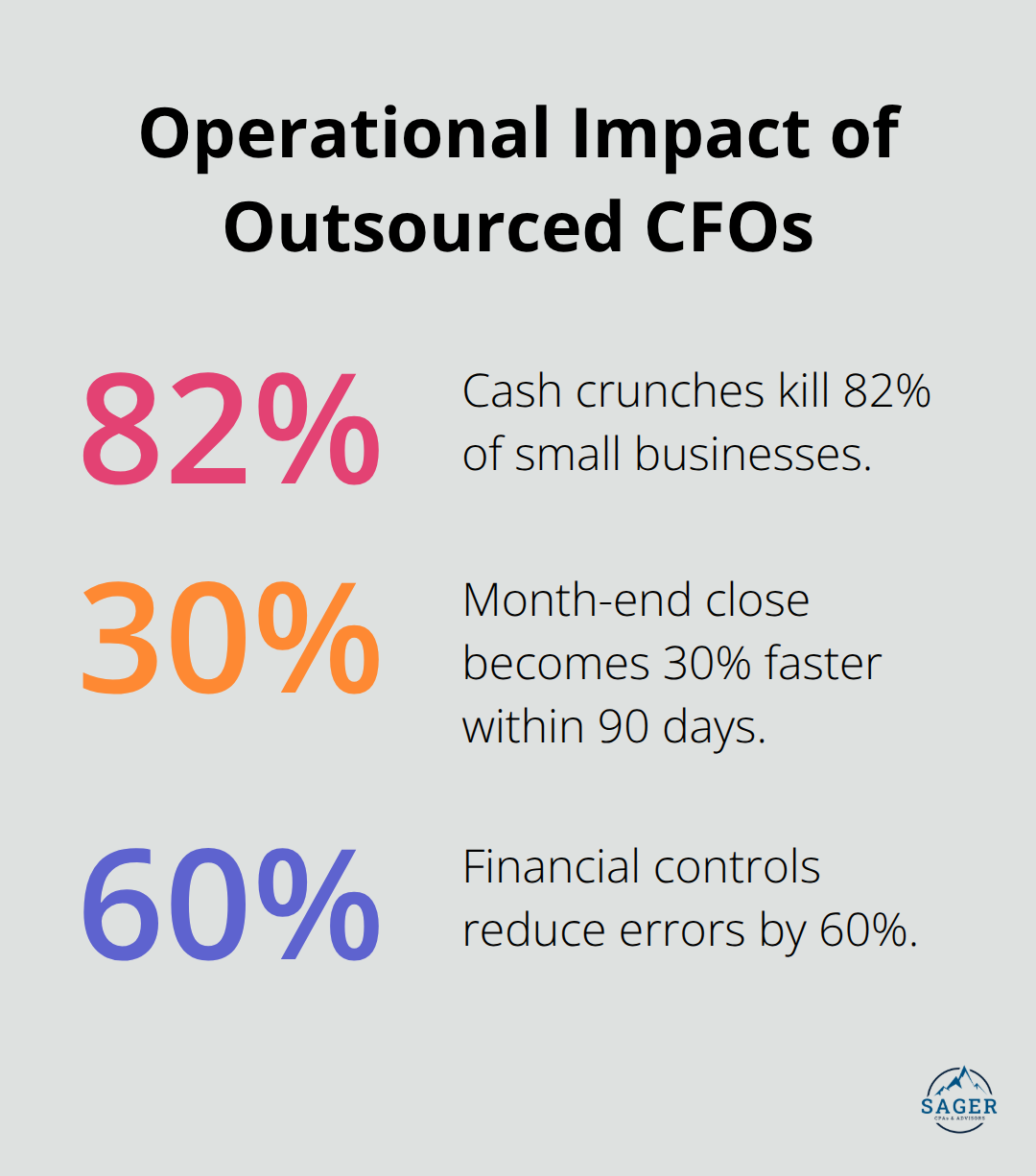

Outsourced CFOs implement systematic changes that revolutionize how companies handle money management and strategic decisions. They establish weekly cash flow forecasts that predict funding needs 13 weeks ahead, which prevents the cash crunches that kill 82% of small businesses (according to U.S. Bank data). These professionals create automated financial reports that generate real-time dashboards showing profit margins by product line, customer acquisition costs, and burn rates. Companies typically see 30% faster month-end close processes within 90 days of CFO engagement.

Professional CFOs analyze every major expenditure through return on investment calculations and payback period analysis. They evaluate whether additional sales staff generates higher returns than marketing automation software, or if office space expansion beats investment in remote work technology. Companies with disciplined capital allocation practices achieve higher total returns to shareholders over extended periods. Smart CFOs also negotiate better terms with vendors, restructure debt to reduce interest payments, and identify tax strategies that save companies 15-25% on annual tax liabilities.

Experienced CFOs implement approval workflows that require dual authorization for payments above $5,000, monthly bank reconciliations, and separation of duties between cash handling and record keeping. They establish Key Performance Indicator tracking that alerts management when gross margins drop below target thresholds or when accounts receivable ages beyond 45 days. These controls typically reduce financial errors by 60% and prevent fraud that costs U.S. businesses $48 billion annually (according to Association of Certified Fraud Examiners data). Companies gain confidence in their financial statements and avoid embarrassing corrections that damage credibility with investors and lenders.

CFOs transform basic cash tracking into sophisticated prediction models that forecast revenue patterns, seasonal fluctuations, and expense timing. They create 13-week rolling forecasts that identify exactly when companies need additional capital and how much funding gaps will require. This proactive approach eliminates the surprise cash shortfalls that force businesses into expensive emergency financing or missed growth opportunities.

The benefits of outsourced CFO services transform companies through strategic financial leadership at a fraction of traditional costs. Companies save hundreds of thousands annually while they gain access to senior-level expertise that drives better cash flow management, investment decisions, and operational efficiency. The 103% increase in demand for these services reflects how smart companies prioritize financial expertise during uncertain economic conditions.

Your business needs outsourced CFO services when monthly revenue exceeds $500,000, when you prepare for major transitions, or when financial complexity outpaces your current capabilities. Success depends on finding the right partner who understands your industry challenges and growth objectives. Companies that engage experienced CFO professionals position themselves for accelerated growth and improved profitability.

We at Sager CPA offer strategic business advisory services that help companies make informed decisions through regular communication and supportive partnerships. Our expert team creates customized action plans that enhance financial clarity and foster long-term stability. The investment in professional CFO services pays dividends through improved profitability, reduced risks, and sustained success.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.