High-income earners have access to sophisticated tax strategies that most people never hear about. These legal methods can significantly reduce tax burdens when implemented correctly.

We at Sager CPA regularly help clients navigate these tax loopholes for the wealthy, from charitable trusts to business structure optimization. The key lies in understanding which strategies align with your financial situation and long-term goals.

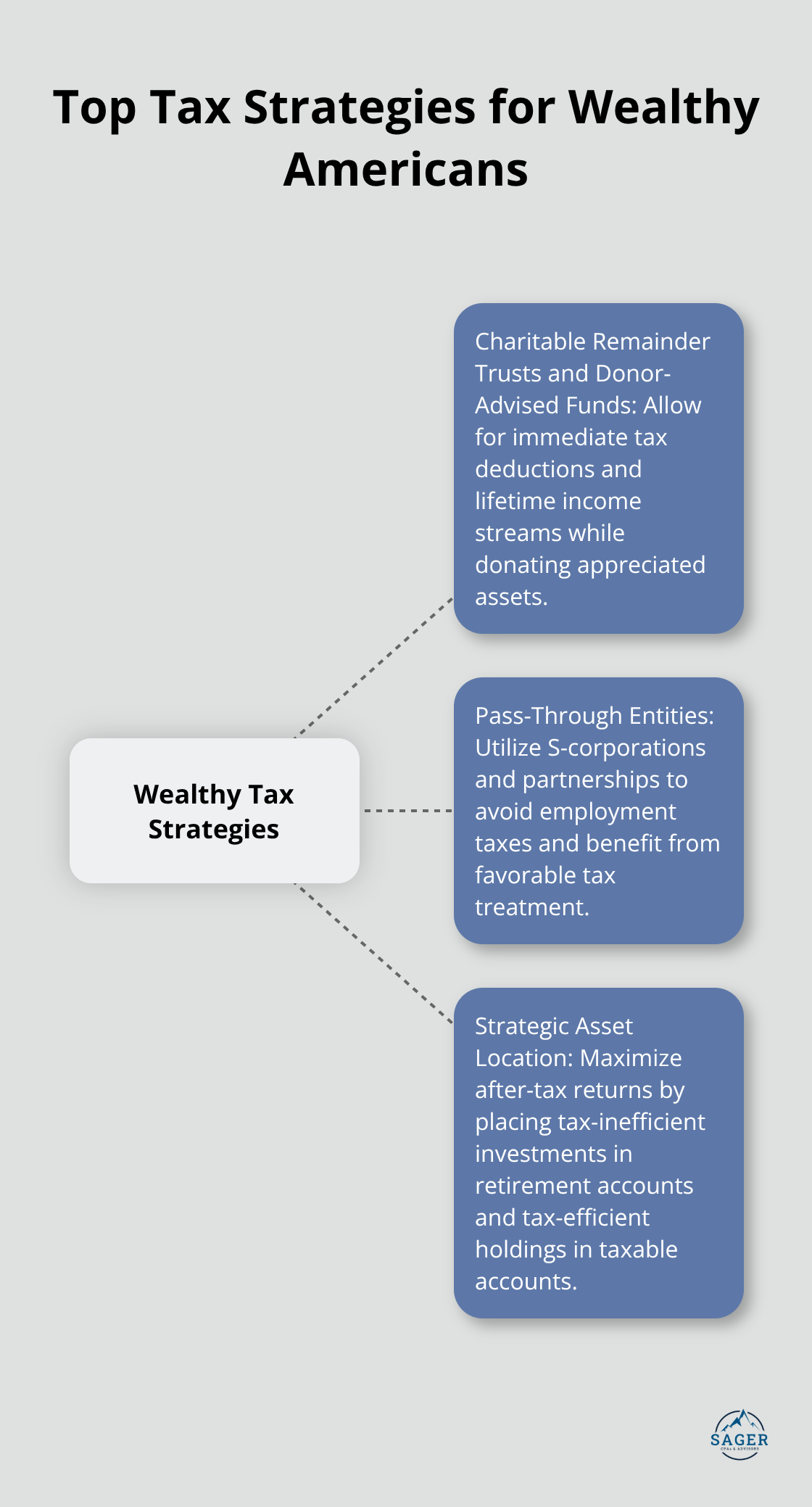

Wealthy Americans consistently outmaneuver the tax system through charitable remainder trusts, which stand as the most powerful wealth preservation tool available. High earners donate appreciated assets while they receive lifetime income streams and immediate tax deductions. The donor establishes the trust, transfers assets worth millions, and claims deductions up to 60% of adjusted gross income. Annual payments flow back to the donor for life, creating a win-win scenario.

Donor-advised funds offer similar benefits with greater flexibility. Contributors get immediate deductions while they retain advisory privileges over grant distributions to qualified charities. This approach allows wealthy individuals to time their charitable giving strategically while they maximize tax benefits.

Pass-through entities represent the second pillar of wealthy tax planning, with top earners utilizing S-corporations and partnerships to avoid employment taxes. These businesses’ profits and losses are passed through to the owners, who pay taxes on the business via their personal income tax rather than at the corporate level.

The Tax Cuts and Jobs Act attempted to address this disparity but failed to fully equalize treatment between W-2 employees and pass-through entity owners. Professional service industries (including law firms and consulting businesses) contribute heavily to this income structure found in the top income brackets.

Strategic asset location completes the trinity when investors place tax-inefficient investments in retirement accounts while they keep tax-efficient holdings in taxable accounts. This positioning maximizes after-tax returns across all portfolio components.

Tax-loss harvesting amplifies these benefits significantly. Investors can offset unlimited capital gains with losses and deduct $3,000 annually against ordinary income. The combination of these strategies can reduce effective tax rates by 15-25 percentage points compared to traditional W-2 employees who earn similar amounts.

These foundational strategies create the framework for even more sophisticated wealth preservation techniques that target specific investment types and long-term estate planning goals.

Section 1202 qualified small business stock exemptions deliver the most powerful tax benefits available to individual investors. This provision allows complete exclusion of up to $10 million or 10 times the original basis from federal taxes when you sell stock that meets specific requirements. The company must operate as a C corporation with gross assets under $50 million when it issued the stock, and you must hold shares for at least five years.

Technology startups, manufacturing companies, and retail businesses frequently qualify for this treatment. The exclusion applies per company and per taxpayer, which means married couples can exclude $20 million from the same investment. High-net-worth individuals structure their investments to maximize these benefits and often participate in multiple companies simultaneously. Professional investors build portfolios around Section 1202 opportunities because the tax savings can reach $3.7 million per investment at current rates.

Section 1031 like-kind exchanges represent the gold standard for real estate tax deferral strategies. You can swap investment properties without recognition of capital gains, which effectively rolls appreciation into larger assets indefinitely. The exchange must involve similar property types and follow strict timing rules: 45 days to identify replacement properties and 180 days to complete the transaction.

Sophisticated real estate investors use these exchanges to pyramid wealth across generations. A $1 million property appreciation becomes $3 million through successive exchanges, all while taxes that would otherwise consume 20-25% of gains remain deferred. Delaware Statutory Trusts and tenant-in-common arrangements allow fractional ownership participation in institutional-grade properties (which makes exchanges accessible even for smaller investors).

Generation-skipping trusts exploit the $13.61 million lifetime exemption to transfer massive wealth while they avoid estate taxes across multiple generations. These trusts pay beneficiaries directly while they preserve principal for future generations, which effectively creates permanent tax-free wealth transfer vehicles. The trust assets grow outside the taxable estate, and distributions to grandchildren avoid the generation-skipping transfer tax when you structure them properly.

Wealthy families combine these trusts with discount valuation techniques to multiply transfer capacity. Family limited partnerships, grantor retained annuity trusts, and charitable lead annuity trusts can reduce asset values 30-40% for gift tax purposes (which allows families to transfer $20-25 million in actual value while they consume only the standard exemption amount).

These advanced strategies require careful implementation and ongoing management to maintain their tax benefits and legal compliance.

Tax strategy execution requires specialists who master complex regulations and their interconnections. The ideal tax professional holds advanced certifications like CPA, EA, or tax attorney credentials and demonstrates experience with high-net-worth clients in similar situations. Interview potential advisors about their specific experience with Section 1202 stock, generation-skipping trusts, or like-kind exchanges based on your needs.

Fee structures vary dramatically, with hourly rates that range from $300-800 for specialized work. The tax savings typically exceed professional fees by 10-20 times when strategies execute properly. Your team should include a tax attorney for complex structures, a CPA for compliance oversight, and a financial advisor who coordinates investment decisions with tax implications.

The IRS scrutinizes wealthy taxpayers at higher rates, with millionaires facing audit odds of 1.1 percent, which makes meticulous documentation your primary defense against audits and penalties. Every charitable remainder trust requires formal trust documents, annual valuations, and detailed beneficiary records. Like-kind exchanges demand qualified intermediary agreements, identification notices within 45 days, and completion within 180 days with precise documentation at each step.

Business structure changes need board resolutions, operating agreements, and election filings that establish the timing and legitimacy of tax positions. Digital record-keeping systems should maintain all supporting documents for seven years minimum (with cloud backup systems that protect against data loss). Professional advisors typically provide document checklists and compliance calendars that track deadlines and requirements for each strategy in your portfolio.

Tax law changes annually, which requires active strategy management rather than set-and-forget approaches. The Tax Cuts and Jobs Act provisions allow taxpayers to expense qualified assets and deduct a maximum of $500,000, with a phaseout threshold of $2 million. Quarterly reviews with your tax team allow adjustments based on income fluctuations, investment performance, and regulatory changes that affect strategy effectiveness.

Trust modifications, business structure updates, and investment rebalancing often become necessary as circumstances evolve or new opportunities emerge. Market conditions can trigger tax-loss harvesting opportunities (while regulatory changes may require strategy pivots to maintain compliance and effectiveness).

Tax loopholes for the wealthy represent legitimate strategies that can dramatically reduce your tax burden when you implement them correctly. Charitable remainder trusts provide lifetime income streams while Section 1202 stock exemptions deliver millions in tax savings. These approaches offer substantial benefits that traditional tax planning cannot match.

The complexity of these strategies demands professional expertise and precise execution. Generation-skipping trusts, like-kind exchanges, and pass-through entity optimization require ongoing compliance management (where a single documentation error or missed deadline can eliminate years of potential tax savings). Wealthy individuals who attempt these strategies without proper guidance often face costly penalties and lost opportunities.

We at Sager CPA help clients implement sophisticated tax strategies while maintaining full compliance with federal regulations. Your next step involves conducting a thorough analysis of your current tax position and assembling the right advisory team. Schedule a consultation with Sager CPA to develop a personalized strategy that leverages these powerful tax optimization techniques for your specific financial situation.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.