As the year draws to a close, small business owners face the critical task of year-end tax planning. At Sager CPA, we understand the complexities and challenges this process can present.

Our guide will walk you through essential strategies to optimize your tax position, maximize deductions, and prepare for a smooth filing season. Let’s explore how you can set your business up for financial success in the coming year.

As year-end approaches, you should reassess your business structure. Your choice directly impacts your tax obligations and potential benefits. The right structure can lead to significant tax savings.

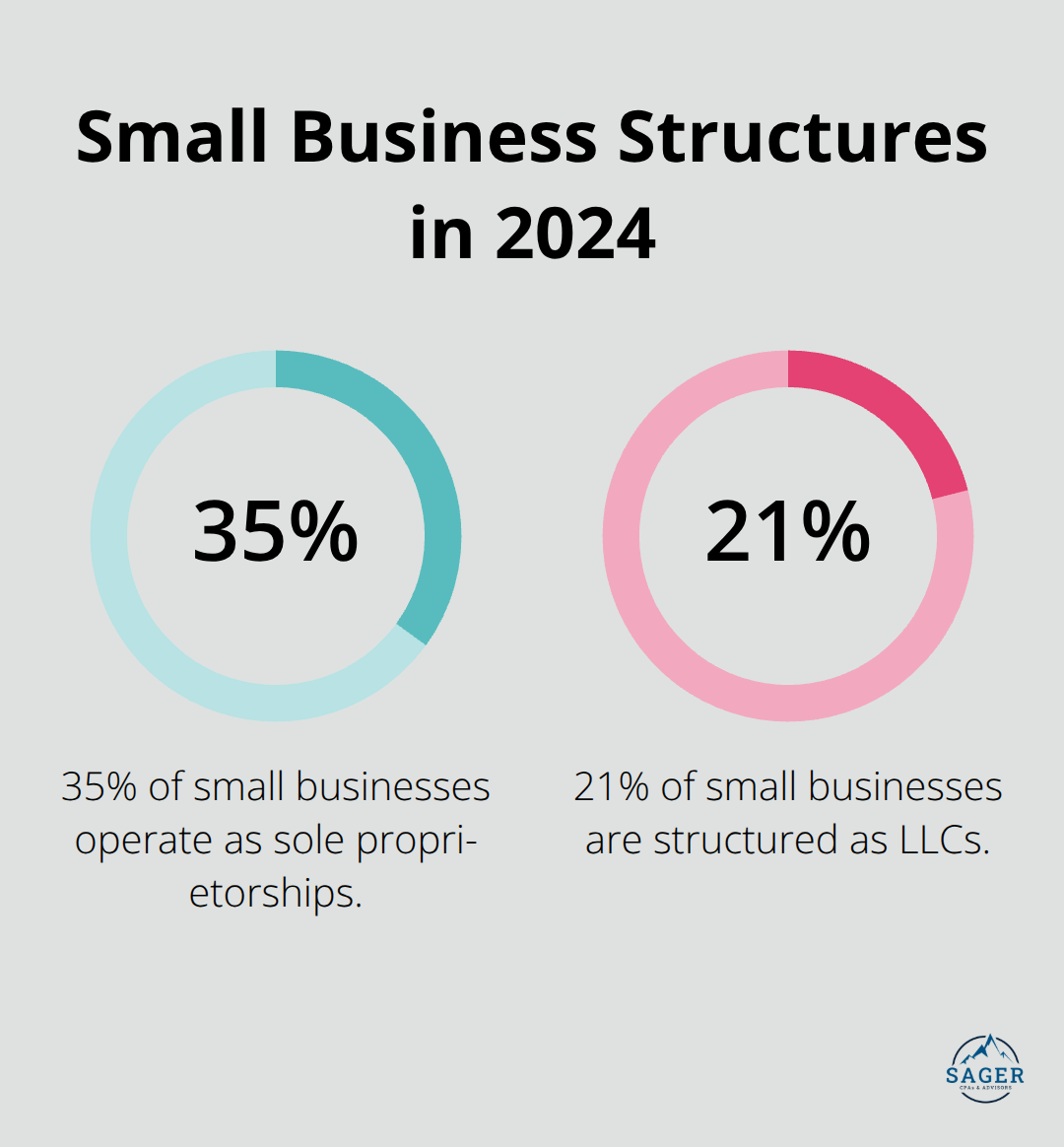

Sole proprietorships offer simplicity but no liability protection. LLCs provide flexibility and protection, with options for how you’re taxed. In 2024, 35% of small businesses operate as sole proprietorships, while 21% are LLCs (according to the National Small Business Association).

S-corporations can offer tax advantages through income splitting. Operating as an S-Corp for self-employment taxes can reduce your tax liability. Owners can pay themselves a reasonable salary and take additional income as distributions, potentially reducing self-employment taxes. The IRS reports that S-corporations have grown by 15% over the past five years.

C-corporations face double taxation but benefit from a flat 21% corporate tax rate. This structure might advantage businesses that plan to reinvest profits or attract outside investors. The Tax Foundation notes that C-corporations account for 5% of small businesses but generate 50% of small business revenue.

Your business structure shouldn’t remain static. As your company grows and evolves, so should your structure. We recommend an annual review of your business structure, especially before year-end. This allows time to implement changes that could affect your upcoming tax year.

For example, switching from a sole proprietorship to an S-corporation could save you thousands in self-employment taxes. However, timing matters. Changes made too late in the year might not take effect for the current tax period.

Tax obligations vary significantly between structures. Sole proprietors report business income on their personal tax returns, while corporations file separate returns. Understanding these differences is key to compliance and strategic planning.

A tax professional can help you navigate complex IRS rules and regulations (which often change), ensuring you make informed decisions about your business structure. This expert guidance proves invaluable as you move forward to maximize deductions and credits in your tax planning strategy.

Small business owners often miss valuable tax deductions and credits. Let’s explore strategies to maximize your tax benefits.

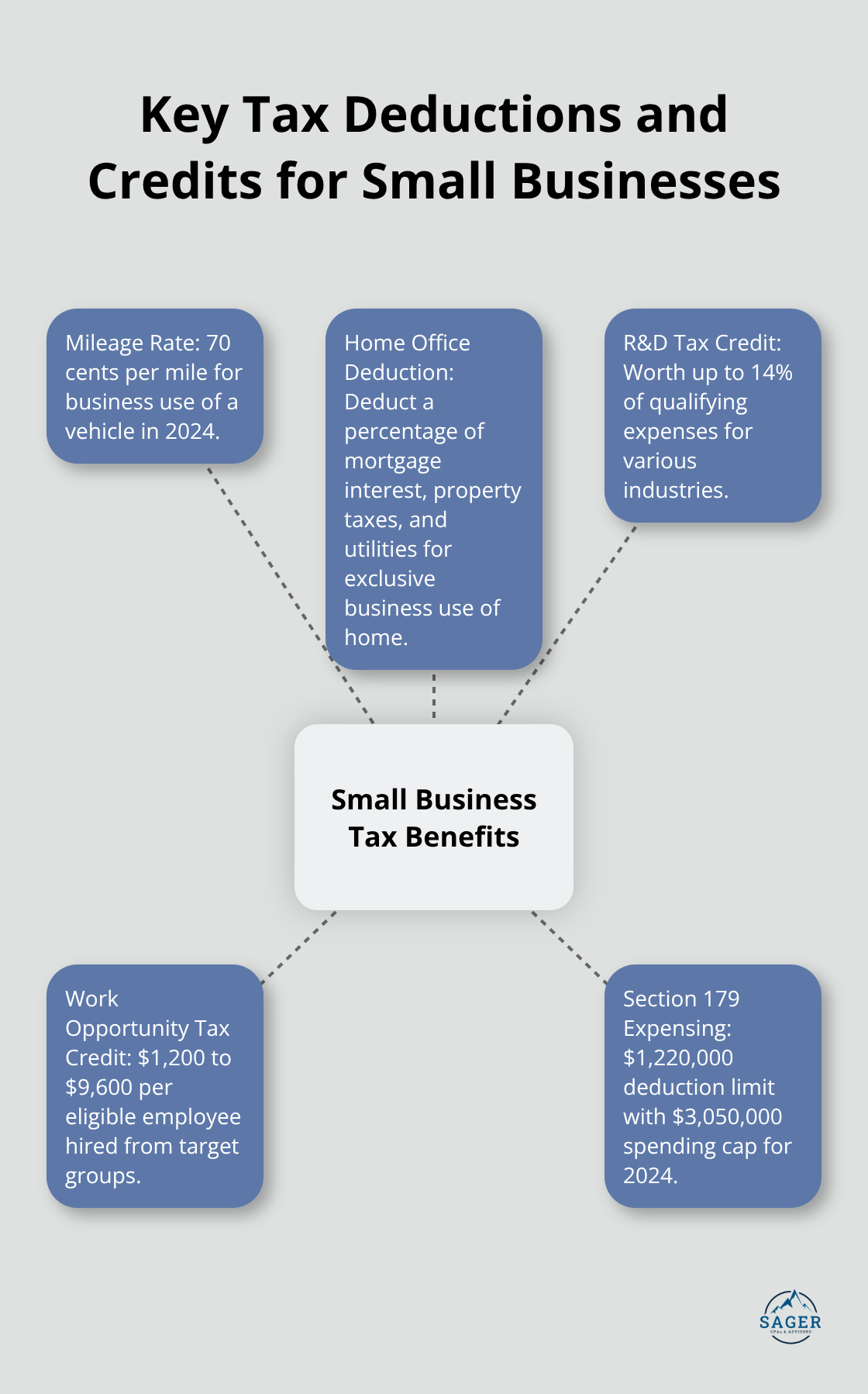

The IRS allows deductions for ordinary and necessary business expenses. These include office supplies, business travel, and professional development costs. In 2024, the standard mileage rate for business use of a vehicle is 70 cents per mile. This increase can add up quickly for businesses with high mileage.

Home office deductions present another opportunity for tax savings. If you use a portion of your home exclusively for business, you may deduct a percentage of your mortgage interest, property taxes, and utilities. The IRS reports that only 3.4 million taxpayers claimed the home office deduction in 2022, despite the rise in remote work.

Tax credits directly reduce your tax bill, making them even more valuable than deductions. The Research and Development (R&D) Tax Credit is a prime example. This credit isn’t limited to tech companies; businesses in manufacturing, software, and even agriculture may qualify. The credit can be worth up to 14% of qualifying expenses.

For retail and restaurant owners, the Work Opportunity Tax Credit (WOTC) can provide significant savings. This credit rewards hiring individuals from certain target groups (such as veterans or long-term unemployment recipients). The credit can range from $1,200 to $9,600 per eligible employee, depending on the hire.

Timing plays a key role in tax planning. If you operate on a cash basis, consider accelerating expenses into the current year and deferring income to the next. This strategy can lower your current year’s taxable income. For example, if you plan a major equipment purchase, making it before year-end could allow you to take advantage of Section 179 expensing.

Section 179 allows businesses to deduct the full purchase price of qualifying equipment bought or financed during the tax year. For 2024, the deduction limit is $1,220,000, with a spending cap of $3,050,000. This can significantly reduce your taxable income if you plan substantial equipment investments.

On the income side, try to delay sending invoices until late December. This pushes the income into the next tax year, potentially lowering your current year’s tax burden. However, avoid artificially manipulating your income, as this could raise red flags with the IRS.

Tax planning isn’t a one-size-fits-all approach. Your specific situation may benefit from strategies not mentioned here. That’s why working with experienced tax professionals who can tailor a plan to your unique business needs is important. As we move forward, we’ll explore how to prepare the essential documentation needed for effective tax planning and filing.

Create a digital filing system for all your financial records. Establish a centralized filing system using shared network drives and naming conventions for electronic records, and central file cabinets for paper documents. The IRS accepts digital copies, so scan and categorize receipts, invoices, and bank statements. Use cloud-based accounting software to automate this process.

Implement a consistent naming convention for your files. For example, “Date_VendorName_Amount.pdf” allows for quick searching and sorting. Set reminders to review and organize these documents monthly, instead of waiting until year-end.

Your profit and loss (P&L) statement provides valuable tax planning opportunities. Review it line by line, comparing it to the previous year. Look for unusual spikes or dips in expenses or income. These could indicate areas where you can optimize for tax purposes or spot potential audit triggers.

Pay special attention to your revenue streams. If you’ve diversified your income sources, ensure each is properly categorized. This is critical for accurate reporting and identifying which deductions apply to each income type.

Gather all necessary information for your employees and contractors well before the January 31 deadline for W-2 and 1099 forms. This includes:

For contractors, ensure you have signed W-9 forms on file. The IRS can impose penalties of up to $130 per form for late or incorrect 1099 filings in 2025.

Create a checklist of required forms based on your business type and employee structure. This might include Forms 940, 941, or 1120 for corporations. Having this information ready streamlines the filing process and reduces the risk of errors.

Don’t wait until tax season to start organizing your documents. Implement a year-round strategy to keep your records up-to-date. This approach will save you time and stress when it’s time to file your taxes.

Try to set aside time each week (or at least monthly) to update your financial records. This regular maintenance will help you spot trends in your business finances and make more informed decisions throughout the year.

Use technology to your advantage when managing tax documents. Many accounting services offer features that automatically categorize expenses and generate financial reports. These tools can significantly reduce the time you spend on manual data entry and organization.

Consider using a document scanning app on your smartphone to capture receipts and invoices on the go. This practice ensures you don’t lose important documents and makes it easier to maintain accurate records throughout the year.

Year-end tax planning for small business owners requires careful consideration and strategic decision-making. Timing plays a critical role in maximizing tax benefits and potentially reducing your tax liability. Professional guidance can help you navigate complex tax regulations and identify opportunities for savings that align with your business goals.

We at Sager CPA specialize in providing tailored financial management and tax planning services for businesses. Our expert team can help you develop a comprehensive strategy that optimizes your tax position and supports your long-term financial success. Early preparation allows you to make informed decisions and implement effective strategies before the year-end deadline.

A proactive approach to tax planning can transform tax season from a stressful obligation into an opportunity for financial optimization. The strategies you implement now will set the foundation for your business’s financial stability and growth in the coming years. Take action today to secure your business’s financial future and minimize your tax burden.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.