S Corporation tax strategies can significantly impact your business’s financial health. At Sager CPA, we’ve seen firsthand how optimizing these strategies can lead to substantial savings and growth opportunities.

This guide will walk you through key tactics to maximize your S Corporation’s tax benefits while avoiding common pitfalls. We’ll cover everything from salary optimization to leveraging retirement plans for tax advantages.

S Corporations represent a unique business structure that offers significant tax advantages to small businesses. An S Corporation is a regular corporation that has elected to be taxed under Subchapter S of the Internal Revenue Code. This election allows the corporation to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

S Corporations must meet specific criteria to maintain their status. They can have no more than 100 shareholders, and these shareholders must be U.S. citizens or residents. Additionally, S Corporations can only issue one class of stock. These restrictions keep S Corporations relatively small and simple in structure.

One of the most attractive features of S Corporations is the avoidance of double taxation. Unlike C Corporations, where profits face taxation at both the corporate and individual levels, S Corporation profits only incur taxes once at the individual shareholder level. This can result in substantial tax savings for business owners.

The tax benefits of S Corporation status can be significant. Shareholders can receive income from the corporation in two ways: salary and distributions. While salary is subject to payroll taxes, distributions are not. This allows S Corporation owners to potentially reduce their overall tax burden by carefully balancing their salary and distribution mix.

S Corporations make up about 73.3% of all corporations in the United States (as of 2015). This popularity stems largely from the tax advantages they offer.

When compared to other business structures, S Corporations often come out ahead in terms of tax benefits. Sole proprietorships and partnerships, while simple to set up, expose owners to unlimited personal liability and self-employment taxes on all business income. Limited Liability Companies (LLCs) offer liability protection but don’t provide the same level of tax flexibility as S Corporations.

C Corporations, while offering the strongest liability protection, face the issue of double taxation.

The right structure can lead to substantial tax savings. This example illustrates the potential financial impact of choosing the appropriate business structure.

As we move forward, we’ll explore specific strategies to optimize the tax benefits of S Corporations, starting with how to balance salary and distributions effectively.

S Corporation owners can significantly reduce their tax burden by strategically balancing salary and distributions. A common tactic involves forming an S corporation and using it to pay yourself a combination of wages and distributions. The IRS mandates that S Corporation owners who work in the business must receive a reasonable salary. However, additional profits can be taken as distributions, which are not subject to payroll taxes.

For instance, if an S Corporation generates $200,000 in profit, the owner might set a salary of $100,000 and take the remaining $100,000 as a distribution. This approach could result in substantial payroll tax savings compared to taking the entire $200,000 as salary.

It’s important to note that the salary must be reasonable to avoid IRS scrutiny. The definition of reasonable varies by industry and job function, but it should generally align with what you would pay someone else to perform your role.

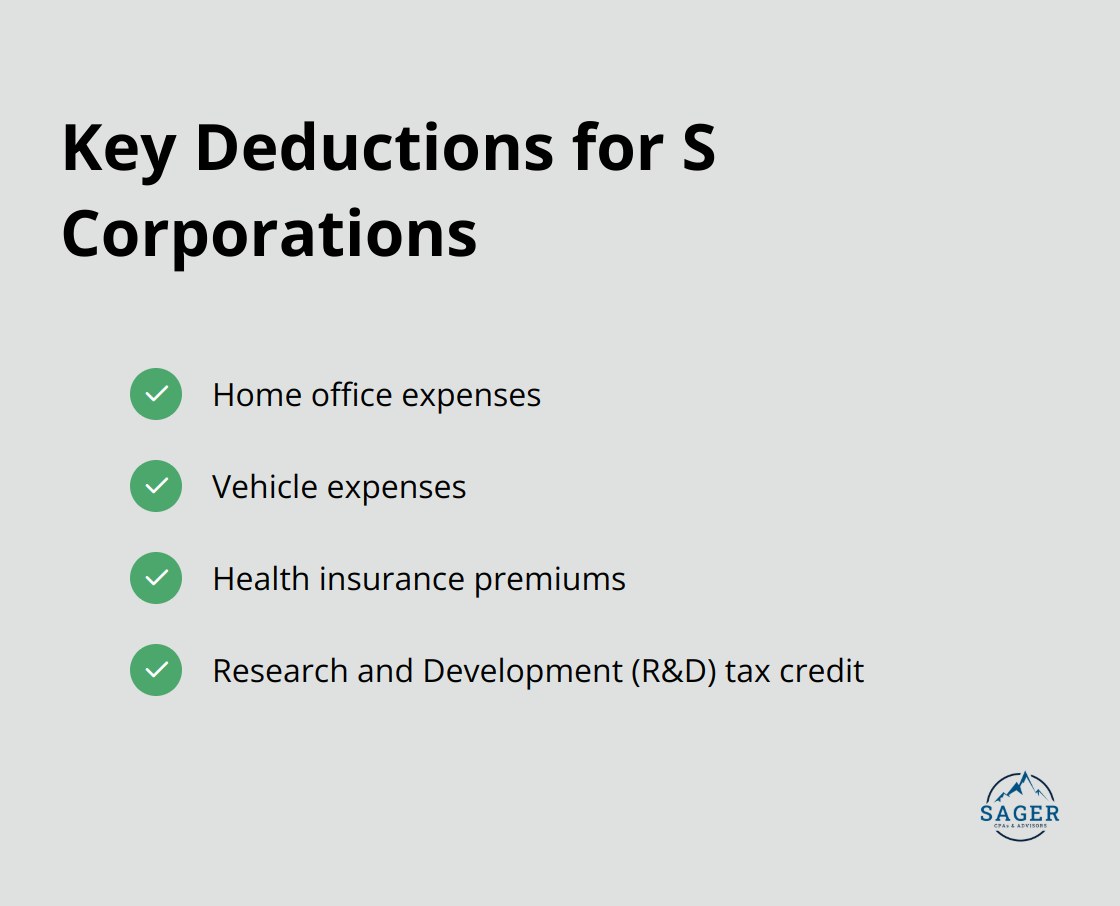

S Corporations can access numerous deductions and credits to reduce their tax liability. Some often-overlooked deductions include:

Timing plays a critical role in tax planning for S Corporations. Key considerations include understanding your tax bracket, the difference between tax deductions and tax credits, and deciding between taking the standard deduction or itemizing. Owners can strategically time their income recognition and expense payments to minimize tax liability.

This strategy requires careful planning and forecasting. Professional guidance (such as that provided by Sager CPA) can help project future income and expenses, allowing for more effective tax planning.

S Corporations can establish retirement plans that offer significant tax advantages. Options like 401(k)s, SEP IRAs, or SIMPLE IRAs allow the business to make tax-deductible contributions on behalf of employees (including owner-employees). These contributions reduce the company’s taxable income while providing a valuable benefit to employees.

For 2023, S Corporations can contribute up to $61,000 towards retirement plans, offering substantial asset-building opportunities and tax savings.

S Corporations can offer various fringe benefits to employees (including owner-employees) that are tax-deductible for the business and tax-free for the recipient. These may include:

By strategically implementing these benefits, S Corporations can reduce their tax burden while providing valuable perks to employees.

As we move forward, it’s essential to understand that while these strategies can lead to significant tax savings, they must be implemented carefully and in compliance with IRS regulations. In the next section, we’ll explore common pitfalls that S Corporations should avoid to maintain their tax benefits and stay compliant with IRS rules.

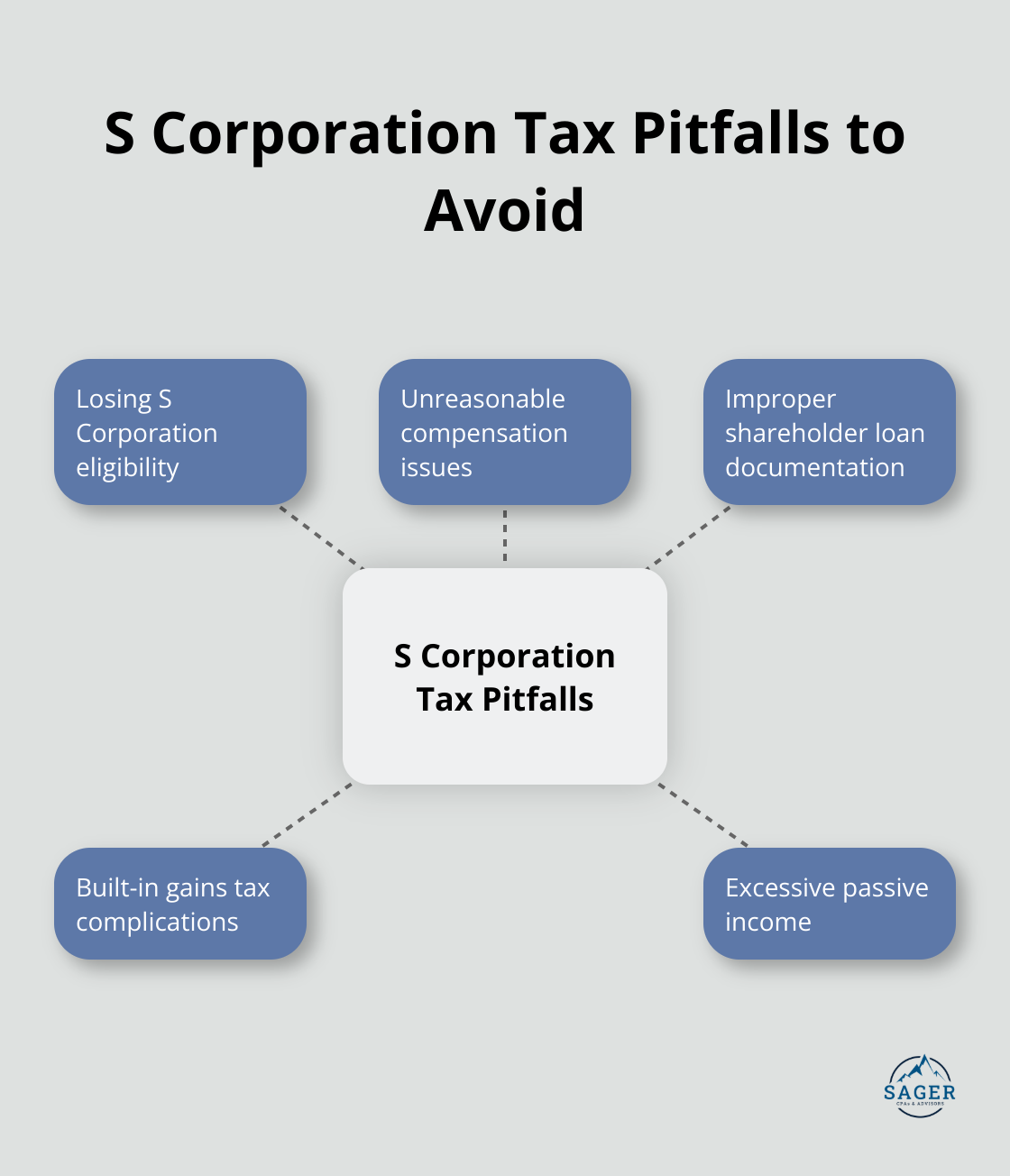

S Corporations must adhere to strict IRS rules about shareholder eligibility. Only individuals, certain trusts, and estates can hold shares. The addition of a corporate or partnership shareholder will result in immediate loss of S Corporation status.

To prevent this, S Corporations should implement a shareholder agreement that restricts stock transfers. This agreement must require all shareholders to obtain approval before selling or transferring their shares. Annual reviews of the shareholder list will ensure continued compliance.

The IRS scrutinizes S Corporation owner salaries closely. Subchapter S corporations should treat payments for services to officers as wages and not as distributions of cash and property or loans to shareholders. Paying yourself too little and taking most profits as distributions might trigger an audit.

S Corporation owners should research comparable salaries in their industry and location. The Bureau of Labor Statistics offers comprehensive wage data to justify compensation. Owners must document their salary decision-making process, including factors such as experience, duties, and time commitment.

Shareholder loans can benefit S Corporations, but they require proper documentation to avoid tax issues. The IRS might reclassify poorly documented loans as distributions, leading to unexpected tax liabilities.

S Corporations should create formal loan agreements for all shareholder loans. These agreements must include repayment terms, interest rates, and collateral (if applicable). Treat these loans like any other business transaction, with regular payments and accurate bookkeeping.

S Corporations that were previously C Corporations may face built-in gains tax on appreciated assets. This tax applies to gains recognized within five years of the S election on assets held when the election was made.

S Corporations should consider delaying the sale of appreciated assets until after the five-year period if possible. If a sale must occur within this timeframe, factor the additional tax into the decision-making process. Accurate valuation of assets at the time of conversion will minimize this tax burden.

S Corporations with excessive passive income (such as rent, royalties, or investment income) risk losing their S status. A second approach to avoiding termination under the passive income rules is to tailor the corporation’s operations so that the 25% passive income limit is not exceeded.

S Corporations must monitor their passive income closely. If approaching the limit, they should consider strategies to increase active business income or reduce passive income sources. This might involve restructuring certain income streams or diversifying business activities.

S Corporation tax strategies can significantly reduce tax burdens and promote financial growth for businesses. These strategies include balancing salary and distributions, maximizing deductions and credits, and leveraging retirement plans. Professional guidance proves invaluable in navigating complex tax laws and regulations to optimize these strategies effectively.

Sager CPA specializes in developing and executing effective tax strategies tailored to S Corporations’ unique needs. Our team of experts provides the insights and support necessary to maximize tax benefits while ensuring compliance with IRS rules. We offer expert financial management and tax planning services for individuals and businesses.

The long-term benefits of optimized tax planning for S Corporations extend beyond immediate savings. A well-executed tax strategy can improve cash flow, facilitate business growth, and provide a competitive edge in your industry. Don’t leave money on the table – start optimizing your S Corporation tax strategies today.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.