Tax season can be stressful, but it doesn’t have to be. With the right strategies, you can significantly reduce your tax burden and keep more money in your pocket.

At Sager CPA, we’ve compiled the best tax saving strategies to help you maximize your returns and minimize your liabilities. Whether you’re an individual or a business owner, understanding these tactics can lead to substantial savings.

Tax deductions reduce your taxable income. If you earn $50,000 and claim $10,000 in deductions, you’ll only pay taxes on $40,000. Common deductions for individuals include mortgage interest, state and local taxes, and charitable contributions. Businesses often deduct operating expenses, employee wages, and equipment depreciation.

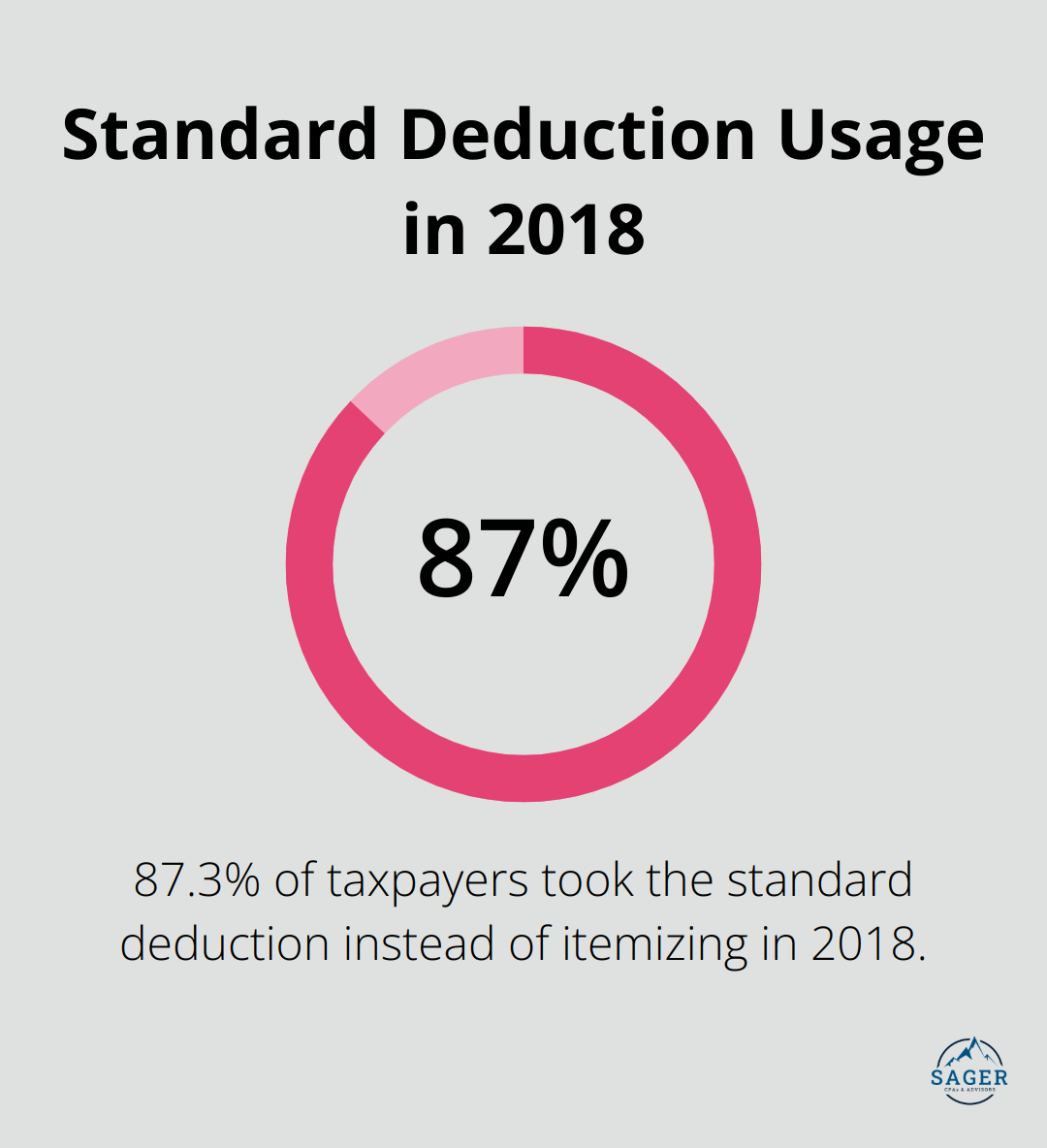

About 87.3% of taxpayers took the standard deduction in 2018 instead of itemizing.

For 2024, the standard deduction stands at $14,600 for single filers and $29,200 for married couples filing jointly (a significant increase from previous years).

Tax credits directly lower your tax bill dollar-for-dollar. A $1,000 tax credit decreases your tax liability by $1,000, regardless of your income or tax bracket. This makes credits generally more valuable than deductions.

Popular tax credits include:

To maximize your tax savings, you must identify all the deductions and credits you qualify for. This requires knowledge of recent tax law changes and their application to your specific situation.

Recent modifications have expanded the Child Tax Credit and introduced new clean energy credits. These changes can significantly impact your tax liability. Tax professionals stay current with these updates to ensure their clients don’t miss potential savings.

Self-employed individuals and small business owners often have more opportunities for deductions. Meticulous tracking of business expenses throughout the year can lead to substantial tax savings. This includes everything from home office expenses to vehicle use for business purposes.

Tax planning shouldn’t be a once-a-year activity. Ongoing awareness of your financial situation and potential tax implications helps you make decisions that optimize your tax position. This proactive approach is key to maximizing your tax savings and achieving your financial goals.

Now that we understand the basics of tax deductions and credits, let’s explore some smart tax planning strategies that can help you further reduce your tax burden.

Strategic tax planning is a year-round endeavor that can significantly reduce your tax burden. We’ve identified several powerful strategies that can help you keep more money in your pockets.

One of the most effective ways to manage your tax liability is through strategic timing of income and expenses. With a combination of tax deductions, tax credits, and contribution strategies, you can reduce your tax bill by reducing your taxable income.

Accelerate deductible expenses into the current tax year to reduce your taxable income. This might involve prepaying property taxes, making an extra mortgage payment, or purchasing necessary business equipment before year-end.

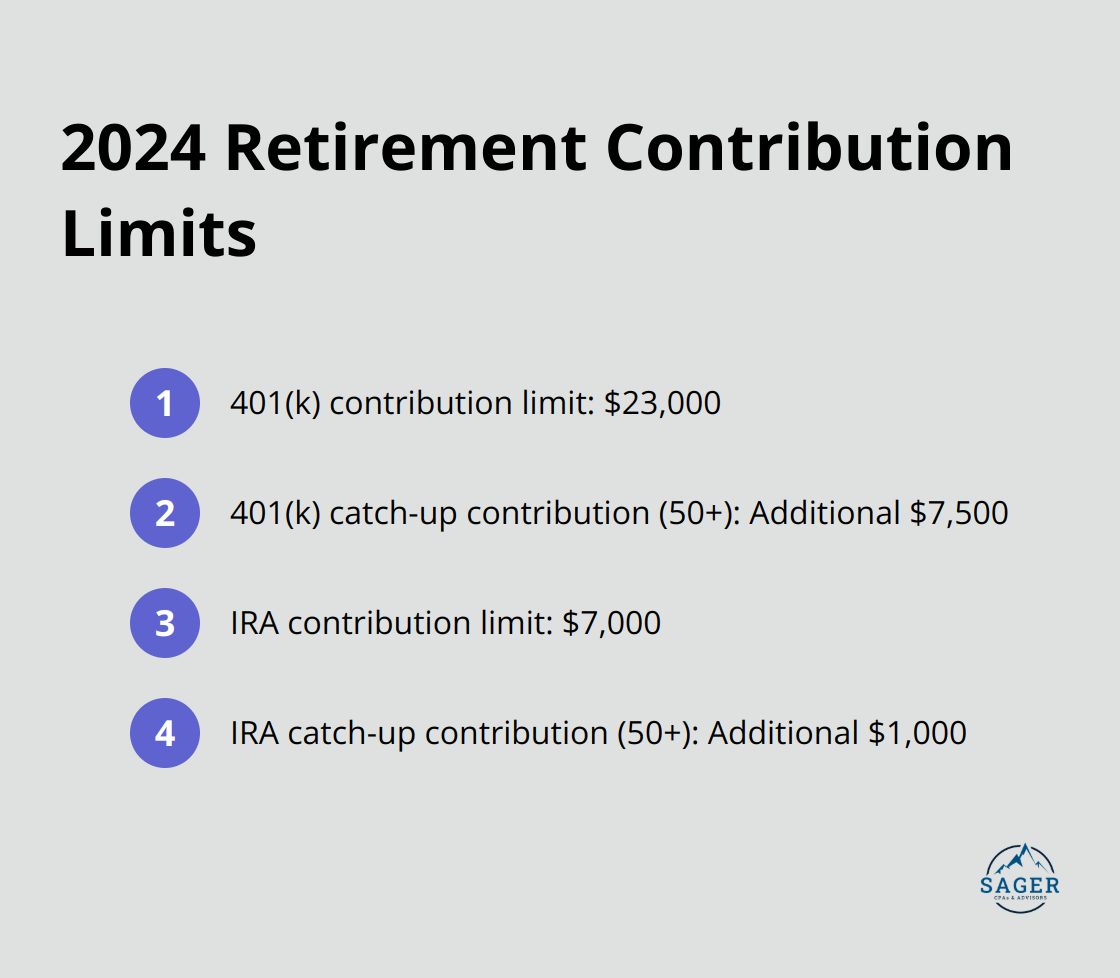

Contributions to retirement accounts are one of the most powerful tax-saving tools available. In 2024, you can contribute up to $23,000 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). These contributions reduce your taxable income dollar-for-dollar.

For IRAs, the contribution limit for 2024 is $7,000 (with an extra $1,000 catch-up contribution for those 50 and above). While traditional IRA contributions may be tax-deductible depending on your income and whether you’re covered by an employer plan, Roth IRA contributions grow tax-free.

Health Savings Accounts (HSAs) offer a triple tax advantage. HSAs and health care FSAs can both help you save for qualified medical expenses. HSAs may offer higher contribution limits and allow you to carry funds over from year to year.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, making them an excellent vehicle for long-term tax savings and healthcare cost management.

Charitable donations not only support causes you care about but can also provide significant tax benefits. For those who itemize deductions, charitable contributions can directly reduce taxable income. In 2024, you can deduct charitable cash contributions up to 60% of your adjusted gross income.

Consider donating appreciated stocks or mutual funds held for more than a year. You’ll avoid capital gains tax on the appreciation and can deduct the full fair market value of the donation.

For those aged 70½ or older, Qualified Charitable Distributions (QCDs) allow you to transfer up to $105,000 directly from your IRA to a qualified charity. This counts towards your Required Minimum Distribution (RMD) but isn’t included in your taxable income.

Implementing these strategies requires careful planning and consideration of your unique financial situation. While these tactics can lead to substantial tax savings, it’s important to consult with a tax professional to ensure they align with your overall financial goals and comply with current tax laws. A qualified CPA can help you navigate the complexities of tax planning and develop a strategy tailored to your specific needs.

Tax planning involves complex and ever-changing rules. While DIY tax software simplifies filing returns, it often lacks comprehensive tax strategy capabilities. A partnership with a tax professional, particularly a Certified Public Accountant (CPA), can significantly improve your financial health.

CPAs offer extensive knowledge and experience. They maintain up-to-date information on the latest tax laws, regulations, and strategies. This ensures you don’t miss potential savings. For example, the Tax Cuts and Jobs Act of 2017 introduced numerous changes that affect both individuals and businesses. A CPA can help you navigate these changes and optimize your tax position.

Every financial situation requires a unique approach. Generic solutions often result in missed opportunities. A CPA will invest time to understand your specific circumstances, goals, and risk tolerance. They then create a personalized tax strategy that aligns with your overall financial plan.

For high-income earners, a CPA might suggest strategies like backdoor Roth IRA contributions or tax-loss harvesting to minimize tax burden. Business owners might receive advice on the most tax-efficient business structure or industry-specific deductions they might have overlooked.

Many taxpayers mistakenly treat tax planning as an annual event. Effective tax planning requires regular attention and adjustments. A CPA provides year-round support, helping you make informed decisions throughout the year that can significantly impact your tax liability.

They might advise you on the tax implications of selling a property, starting a side business, or making large charitable donations. Consideration of these factors in real-time allows you to make choices that optimize your tax position before it becomes too late to make changes.

The cost of working with a tax professional often pales in comparison to the potential savings and peace of mind they provide. If you want to maximize your tax savings and ensure compliance with complex tax laws, a partnership with a qualified CPA could prove to be one of your smartest financial decisions.

A proactive approach to tax planning can lead to substantial savings and help avoid unpleasant surprises during tax season. CPAs offer broader financial and advisory services tailored to long-term financial health, working with clients throughout the year and providing regular check-ins and updates. This ensures that financial decisions always consider tax implications.

Maximizing tax savings requires a strategic approach and deep understanding of the tax code. We explored some of the best tax saving strategies, including leveraging deductions and credits, timing income and expenses, and maximizing retirement contributions. These tactics can significantly reduce your tax burden when applied correctly.

Proactive tax planning is a year-round endeavor that leads to substantial financial benefits. Staying informed about tax law changes and evaluating financial decisions through a tax-conscious lens allows you to make choices that optimize your tax position and support long-term financial goals.

Professional guidance becomes invaluable when navigating the complex world of taxation. Sager CPA and Advisors offers expert financial management and tax planning services tailored for individuals and businesses. Our team provides precise accounting, strategic advisory services, and comprehensive tax planning to help reduce tax liabilities and enhance financial clarity (while staying up-to-date with the latest tax laws and regulations).

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.