Most taxpayers leave money on the table by missing strategic opportunities throughout the year. The difference between reactive tax filing and proactive planning can save thousands annually.

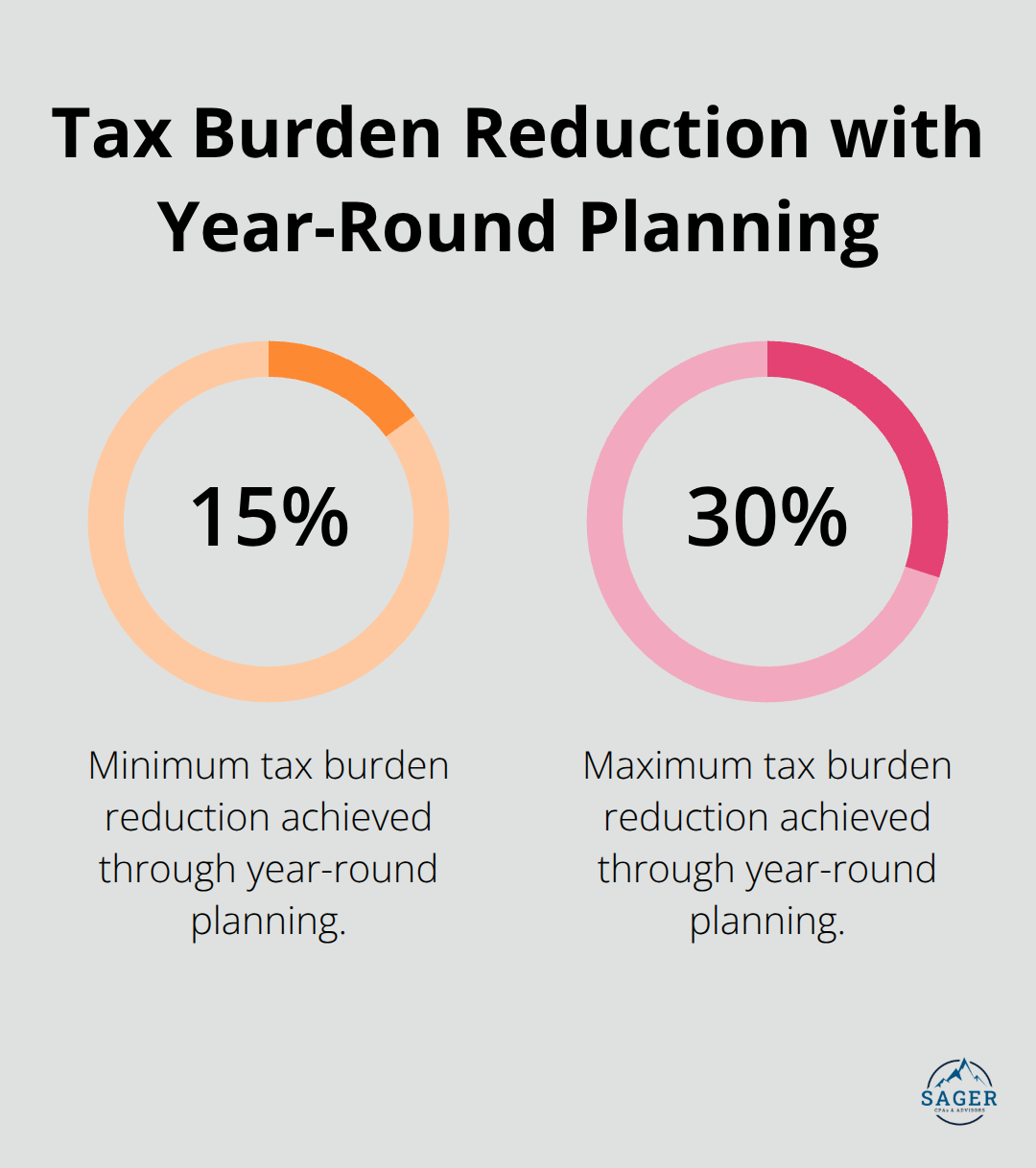

Effective personal tax strategies include maximizing deductions, optimizing retirement contributions, and timing income strategically. We at Sager CPA see clients reduce their tax burden by 15-30% when they implement year-round planning approaches.

Tax preparation happens after the year ends when your financial decisions are locked in stone. Tax planning occurs throughout the year when you still have power to influence your tax liability. The IRS provides year-round planning guidance to help taxpayers organize their tax records and make filing season less stressful.

You can move income between tax years to dramatically impact your tax bill. If you expect lower rates next year, defer bonuses or consulting income to December 31st or later. Conversely, accelerate income when you anticipate higher future rates.

Medical expenses work differently – bunch them into one year to exceed the 7.5% of adjusted gross income threshold. The standard deduction for 2025 reaches $15,750 for single filers and $31,500 for married couples filing jointly (making timing strategies even more valuable).

Tax credits provide dollar-for-dollar reductions while deductions lower your taxable income. The Child Tax Credit offers up to $2,000 per qualifying child, while the American Opportunity Tax Credit provides $2,500 for education expenses.

Mortgage interest, charitable contributions, and state taxes remain powerful deductions. You can contribute $7,000 to traditional IRAs or $23,500 to 401(k) plans in 2025 to reduce current-year taxes.

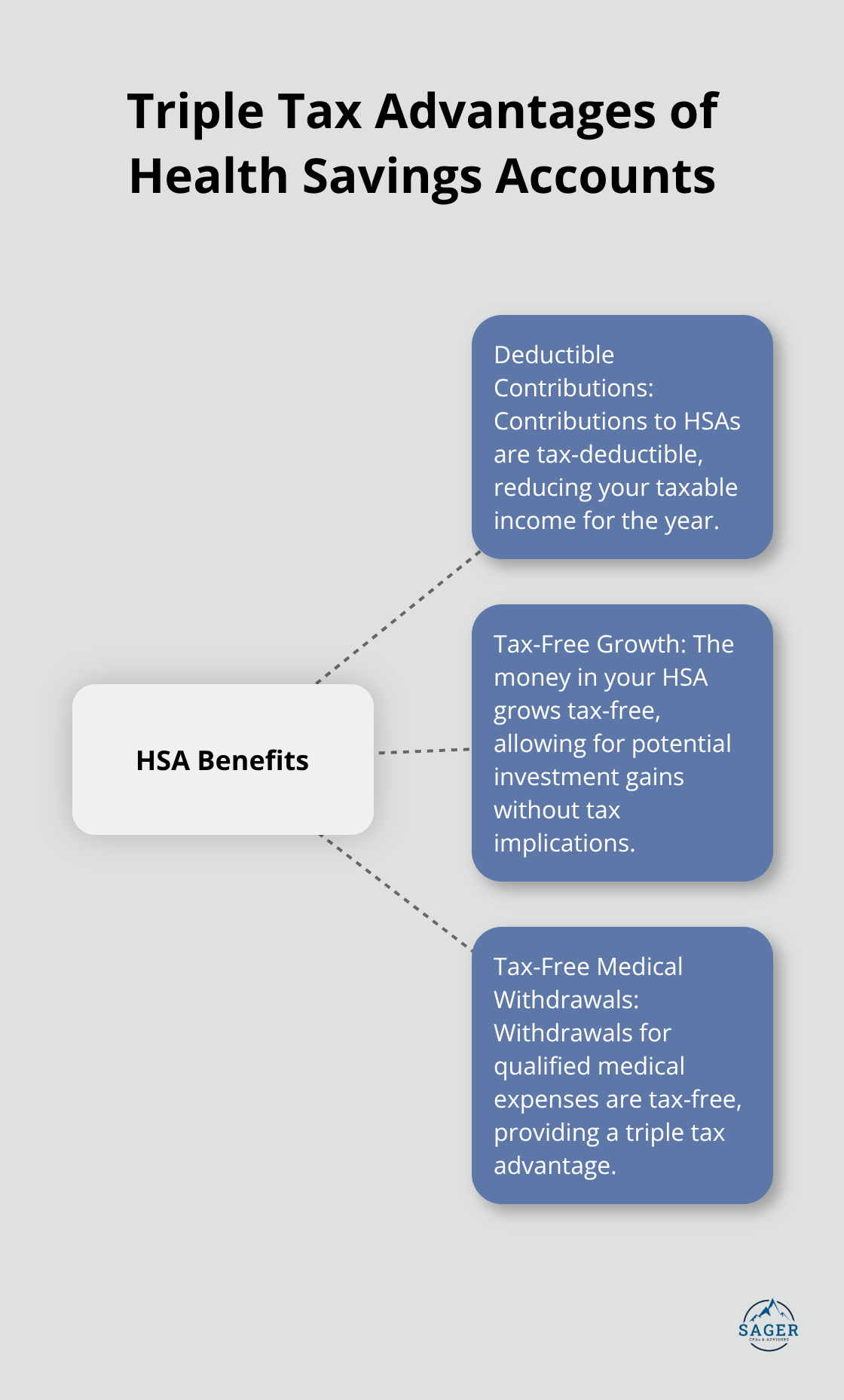

Health Savings Accounts allow $4,300 in tax-free contributions for individuals, creating triple tax advantages through deductible contributions, tax-free growth, and tax-free medical withdrawals. These accounts offer unmatched flexibility for both current medical expenses and future healthcare costs.

The next phase involves advanced techniques that go beyond basic deduction strategies to create substantial long-term tax savings.

Strategic retirement contributions create the foundation for aggressive tax reduction. The 2025 contribution limits reach $23,500 for 401(k) plans, with catch-up contributions that add another $11,250 for those over 50. Traditional IRA contributions allow $7,000 annually and create immediate tax deductions. Roth conversions work best during low-income years when you can move traditional IRA funds to Roth accounts at reduced tax rates. The key lies in balance between current deductions and future tax-free growth.

Tax-loss harvesting transforms portfolio losses into tax savings throughout the year. You can offset capital gains with losses and reduce taxable income up to $3,000 annually beyond gains. The wash-sale rule prevents repurchase of identical securities within 30 days, but similar ETFs or mutual funds provide workarounds. Direct indexing allows loss harvesting on individual stocks while it maintains market exposure. Investment firms report that systematic harvesting provides tax benefits from the sale of securities that have declined in value.

Health Savings Accounts deliver unmatched tax efficiency through deductible contributions, tax-free growth, and tax-free medical withdrawals. The $4,300 individual limit for 2025 rises to $5,300 for those over 55. HSA funds roll over indefinitely and make them powerful retirement vehicles after age 65 (when non-medical withdrawals face only income tax). Fidelity research shows HSA balances can cover 15% of retirement healthcare costs when maximized consistently. Smart HSA users pay current medical expenses out-of-pocket and preserve account growth for decades.

These advanced techniques require consistent application and careful monitoring to maximize their effectiveness. The next phase focuses on year-round implementation systems that turn these strategies into automatic wealth-building habits.

Quarterly estimated tax payments prevent the IRS underpayment penalty that currently reaches 8% annually. The IRS requires payments when you owe $1,000 or more in taxes beyond withholding. Calculate estimates with Form 1040ES and pay by January 15, April 15, June 15, and September 15. Most taxpayers underpay first quarter estimates after year-end bonuses or investment gains create unexpected income.

The safe harbor rule protects you when payments equal 100% of last year’s tax liability (or 110% for high earners with adjusted gross income exceeding $150,000). This rule provides certainty even when current year income fluctuates significantly. Smart taxpayers use automatic bank transfers to meet quarterly deadlines consistently.

Cloud-based systems like QuickBooks Online or FreshBooks automatically categorize business expenses and track mileage for tax deductions. Bank integration eliminates manual data entry while receipt apps like Expensify capture documentation instantly. The IRS accepts digital records but requires backup systems when technology fails.

Maintain records for three years minimum, though seven years protects against income underreporting claims. Business owners need permanent records for asset purchases and depreciation schedules that span multiple tax years. Digital storage costs less than physical filing systems and provides instant access during audits.

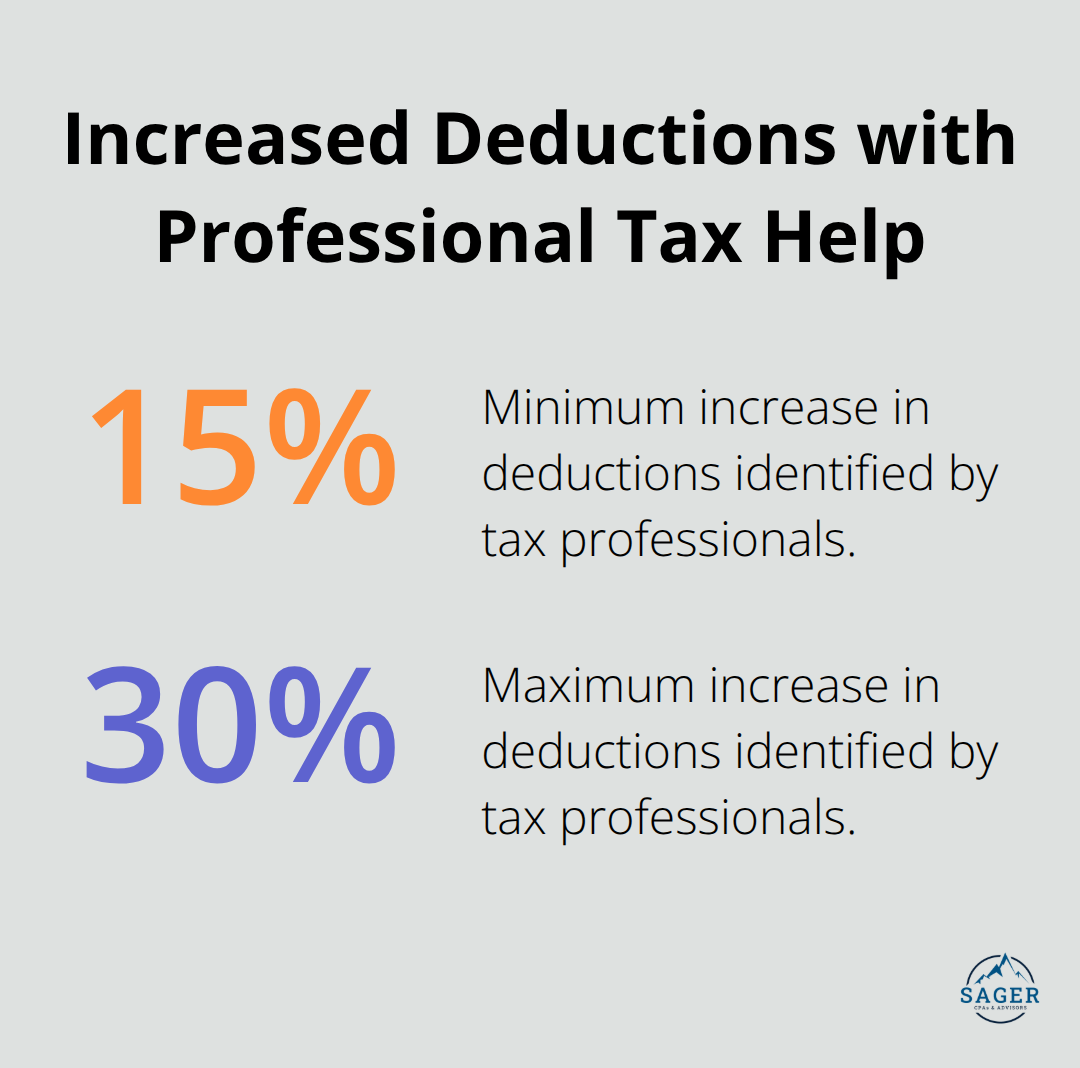

Tax professionals identify deductions worth 15-30% more than self-prepared returns according to the National Society of Accountants. Enrolled agents, CPAs, and tax attorneys each offer different expertise levels for complex situations. The average professional fee of $300-500 pays for itself through increased refunds or reduced liabilities.

Choose professionals who provide year-round advice rather than seasonal preparation services. Thomson Reuters Institute reports that 95% of tax professionals believe clients want advisory services beyond basic compliance work. Proactive advisors help clients adjust strategies throughout the year based on income changes and new opportunities.

Effective personal tax strategies include retirement account maximization, tax-loss harvesting, and year-round planning systems. Proactive approaches save taxpayers 15-30% annually compared to reactive filing methods. Strategic timing and advanced techniques transform tax outcomes when applied consistently throughout the year.

Success demands quarterly payments, digital record systems, and professional guidance beyond seasonal preparation. Health Savings Accounts deliver triple tax benefits while strategic income timing optimizes liability across multiple years (creating substantial long-term savings). Complex situations require expertise that self-preparation cannot match.

We at Sager CPA deliver comprehensive tax planning services through customized strategies and proactive partnerships. Start these strategies immediately rather than wait for year-end deadlines. Schedule a consultation with Sager CPA to create your personalized tax strategy and transform your financial outcomes through expert guidance.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.