At Sager CPA, we know that accounting for small businesses can be overwhelming. Many entrepreneurs struggle to manage their finances while focusing on growing their company.

This guide will provide you with practical tips to streamline your accounting processes and improve your financial management. We’ll cover essential bookkeeping practices, cash flow management, and how to leverage technology for your small business accounting needs.

Small business owners must maintain a clear distinction between personal and business finances. Open a dedicated business bank account and use it exclusively for business transactions. This separation simplifies your bookkeeping process and provides a clearer picture of your business’s financial health. It’s also essential for tax purposes and can protect your personal assets in case of legal issues.

Small businesses typically choose between two main accounting methods: cash basis and accrual basis. The cash basis method records income when you receive payment and expenses when you pay bills. It’s simpler and often preferred by small businesses with straightforward finances. The accrual basis method records income when it’s earned and expenses when they’re incurred, regardless of when money changes hands. While more complex, it provides a more accurate view of your financial position over time.

A well-structured chart of accounts organizes your financial information effectively. Break down your accounts into the five main categories: Assets, Liabilities, Equity, Revenue, and Expenses. This list categorizes all financial transactions, making it easier to generate accurate financial statements and analyze your business’s performance. Tailor your chart of accounts to your specific business needs, ensuring it’s detailed enough to provide insights but not so complex that it becomes unmanageable.

Accurate tracking of all income and expenses is essential for small business success. Implement a system to record every transaction, no matter how small. This might involve using accounting software, maintaining spreadsheets, or working with a professional bookkeeper. Regular reconciliation of your accounts ensures that your records match your bank statements, catching any discrepancies early.

While these practices are important, they can be time-consuming. If you find yourself overwhelmed, consider seeking professional help. Professional tax preparers help taxpayers ensure their tax returns are filed accurately and on time, helping you avoid costly fines. Expert accounting services can ensure your books remain accurate and up-to-date, allowing you to focus on growing your business.

As we move forward, let’s explore how effective cash flow management can further strengthen your small business’s financial foundation.

Cash flow management forms the foundation of any small business’s financial health. Let’s explore practical strategies to maintain a robust and steady cash flow for your company.

Creating a cash flow projection helps you anticipate future financial needs. Learn how to create one with examples and mistakes to avoid from industry experts. Use a free template as a guide to get started. This practice allows you to identify potential cash shortages before they occur, enabling you to take preemptive action.

Efficient invoicing maintains healthy cash flow. Personalize your invoice and send invoices promptly. Set clear payment terms and use unique invoice numbers. Keep records to support your invoice. Consider offering early payment discounts to encourage prompt payments. Use automated reminders for overdue invoices to reduce late payments.

The timing of incoming and outgoing cash is critical. Try to collect receivables faster than you pay your bills. Negotiate longer payment terms with suppliers while offering competitive terms to your customers. Consider using electronic payment methods to speed up collections. For payables, schedule payments strategically to maintain a buffer in your account without risking late fees.

Even with solid cash flow management, you may need additional funds at times. A line of credit can provide a safety net during lean periods. Short-term loans can help bridge temporary gaps. However, use these options judiciously. Before taking on debt, analyze your cash flow projections to ensure you can manage repayments comfortably.

Effective cash flow management requires constant attention and adjustment. Implement these strategies to navigate the financial ups and downs of running a small business. If you struggle with cash flow management, don’t hesitate to seek professional help (Sager CPA specializes in helping small businesses optimize their financial processes for long-term success).

As we move forward, let’s explore how technology can further enhance your small business accounting practices and streamline your financial management processes.

Technology transforms financial management for small businesses. We’ll explore how to use tech tools to enhance your accounting practices.

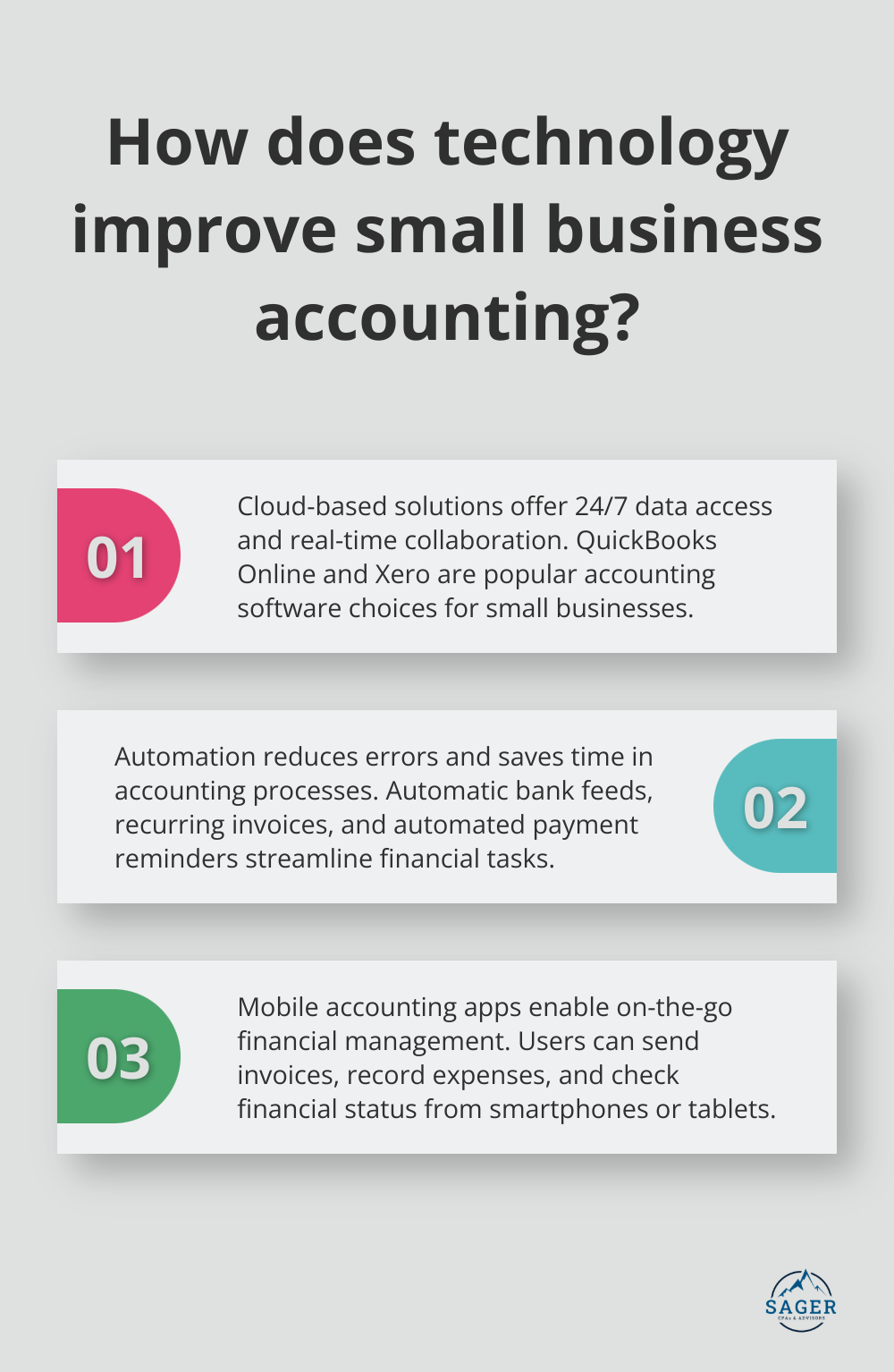

The right accounting software can revolutionize your financial management. Look for solutions that fit your industry and business size. QuickBooks Online and Xero stand out as popular choices, each with distinct advantages. QuickBooks excels in detailed reporting and integrations, while Xero offers a user-friendly interface and robust inventory management. Consider your specific needs (such as multi-currency support or project tracking) when you make your decision.

Cloud-based accounting solutions provide unmatched flexibility and accessibility. These platforms allow you to access your financial data from any location, at any time. Cloud accounting software simplifies accounting for small businesses, offering real-time data, automation, enhanced security, and scalability. This proves particularly valuable for businesses with remote teams or those who need real-time collaboration with their accountants. Cloud solutions also offer automatic backups and updates, which ensure your data remains secure and your software stays current.

Automation reduces errors and saves time in accounting processes. Many modern accounting platforms feature automatic bank feeds, which import and categorize transactions directly from your bank account. You can set up recurring invoices for regular clients to streamline your billing process. Use automated reminders for overdue payments to improve cash flow without constant manual follow-ups.

Integrate your accounting software with other business tools to create a seamless workflow. Connect your point-of-sale system, e-commerce platform, or customer relationship management (CRM) software to your accounting solution. Integrated accounting systems offer benefits such as improved efficiency, real-time data synchronization, and enhanced decision-making capabilities.

Mobile accounting apps allow you to manage your finances on the go. You can send invoices, record expenses, and check your financial status from your smartphone or tablet. This mobility proves especially useful for businesses with field operations or frequent travel requirements.

Effective accounting practices form the backbone of small business success. You can gain better control over your finances and make informed decisions for your company’s future. The right accounting software, cloud-based solutions, and automation tools will significantly streamline your financial management, save time, and reduce errors.

Accounting for the small business involves more than keeping books in order. It provides clarity and insights necessary for strategic business decisions, growth opportunities, and financial challenges. You should regularly review and adjust your practices as your business grows and evolves.

Professional help can navigate complex financial situations and ensure compliance with tax regulations. At Sager CPA, we offer expert financial management and tax planning services tailored for small businesses. Our team can help you develop strategies for long-term growth and turn your accounting into a powerful tool for business success.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.