Most business owners and individuals face mounting tax burdens without proper strategic planning. The average American pays 22% of their income in federal taxes alone, yet many miss significant savings opportunities.

We at Sager CPA see clients reduce their tax liability by 15-30% through professional tax planning services for individuals. The right provider makes the difference between reactive filing and proactive wealth preservation.

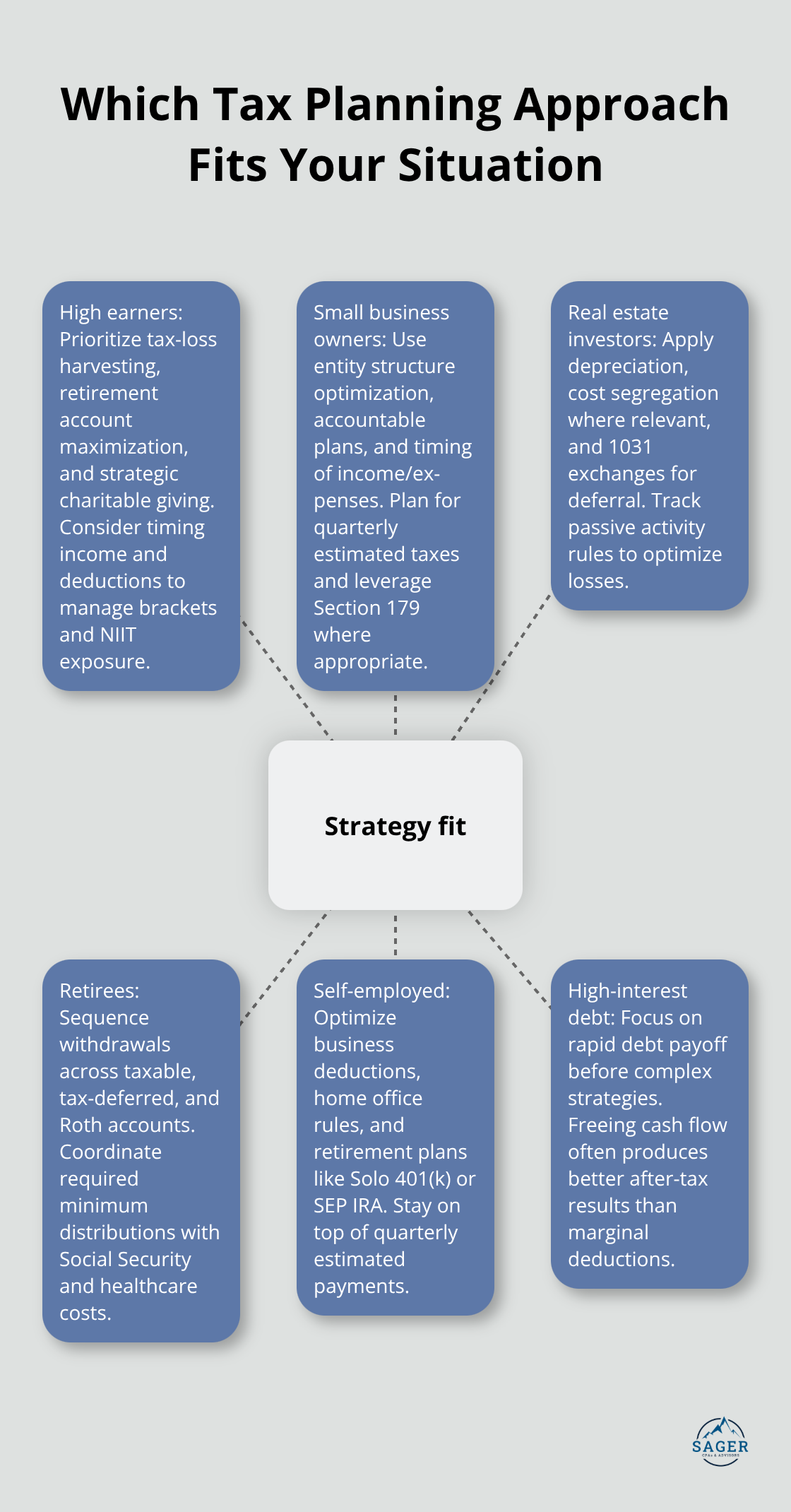

Your income level, asset portfolio, and cash flow patterns shape which tax planning approach works best. High earners above $200,000 annually need aggressive strategies like tax-loss harvesting and retirement account maximization. Small business owners with fluctuating income require different tactics than W-2 employees who receive steady paychecks. The IRS reports that taxpayers who earn over $100,000 face audit rates, which makes proper documentation and planning essential.

Real estate investors need depreciation strategies and 1031 exchanges, while retirees focus on withdrawal sequences from different account types. Self-employed individuals must navigate quarterly estimated payments and business expense optimization. Your debt-to-income ratio also matters-those who carry high-interest debt should prioritize debt reduction over complex tax strategies.

Tax planning serves multiple financial goals beyond reduction of current-year liability. Some clients prioritize wealth transfer to heirs, which requires estate planning integration. Others focus on retirement income optimization through Roth conversions and tax-deferred growth strategies. Business owners often target cash flow improvement through strategic timing of income and expenses.

Research shows that 90% of taxpayers use tax preparers or software, with over 50% paying significant fees for professional services. Your timeline matters too-short-term goals like home purchases require different strategies than long-term wealth accumulation. Consider whether you want steady tax savings each year or prefer larger benefits concentrated in specific years.

Simple tax situations need basic preparation services, while complex scenarios demand comprehensive planning expertise. Single filers with W-2 income and standard deductions rarely benefit from extensive planning. However, multi-state income, rental properties, or business ownership creates complexity that requires specialized knowledge. The Tax Foundation reports that Americans spend 8.9 billion hours annually on tax compliance (with business owners who average 40 hours per year).

Once you understand your specific needs and objectives, the next step involves identification of the key features that separate exceptional tax planning services from basic preparation providers.

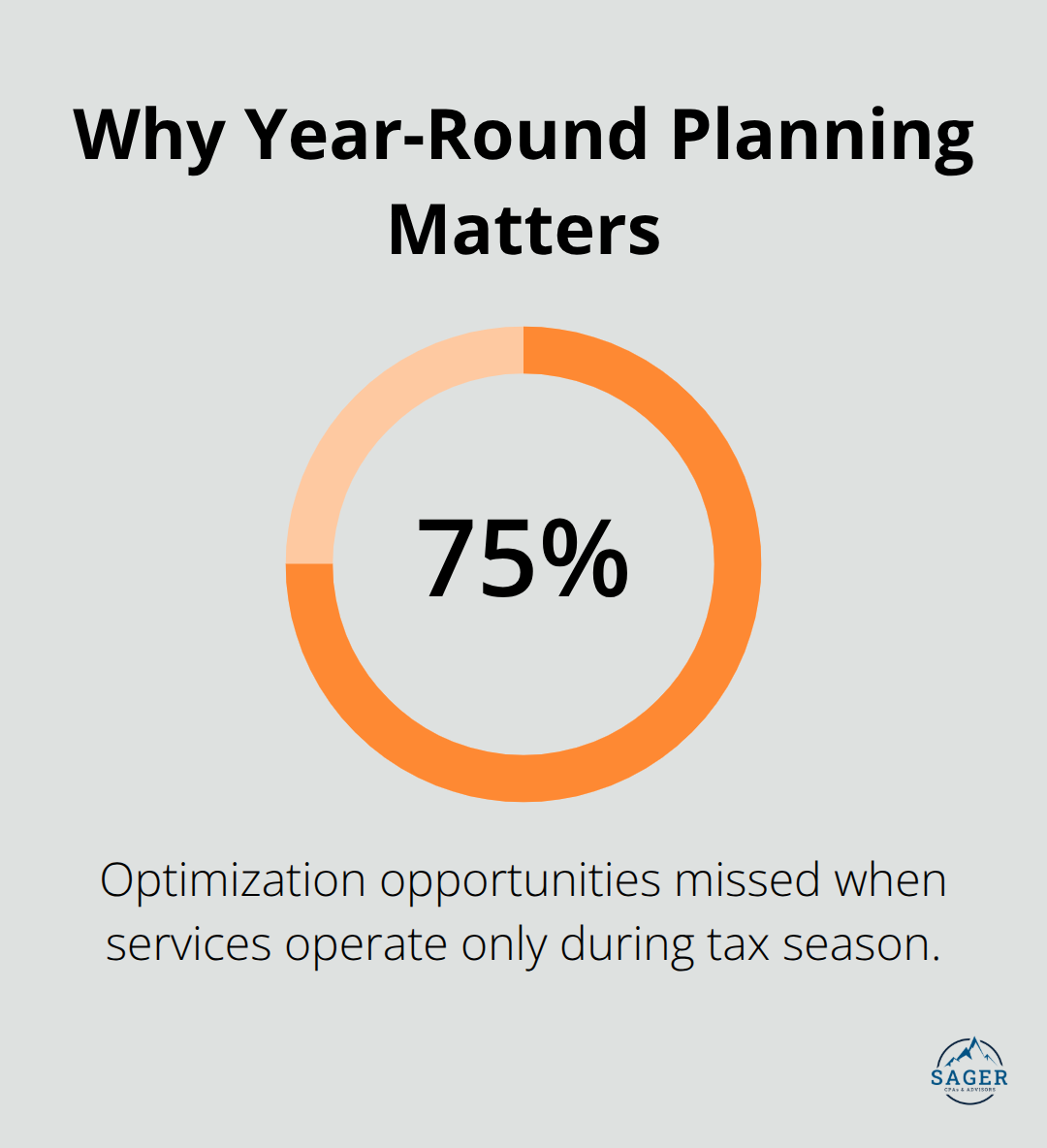

Tax services that operate only during tax season miss 75% of optimization opportunities. The National Association of Tax Professionals reports that year-round planners provide expertise in the latest tax laws, guiding clients in areas such as deductions, capital loss utilization, and retirement account optimization. Effective providers monitor tax law changes throughout the year and adjust strategies accordingly.

They track your income patterns, recommend optimal timing for major purchases, and coordinate retirement contributions before deadlines. Services that offer quarterly check-ins and proactive communication prevent costly missed opportunities. Look for providers who schedule regular strategy sessions and send timely reminders about tax-saving actions.

Generic tax services cost clients money through missed deductions and inefficient strategies. Medical professionals need different approaches than real estate investors or tech entrepreneurs. The IRS maintains statistics on tax professionals with current preparer tax identification numbers, tracking individuals issued PTINs since 2010.

Manufacturing business owners require cost segregation studies and Section 179 depreciation expertise that general practitioners often overlook. Restaurant owners need inventory management strategies that retail businesses don’t require. Ask potential providers about their client concentration in your industry and request examples of industry-specific strategies they’ve implemented.

Top-tier tax services extend far beyond annual return preparation. They provide estate planning coordination, retirement account optimization, and business structure analysis. These providers maintain relationships with specialized software vendors and participate in continuing education programs focused on your sector (which keeps them current on regulatory changes that impact your specific business model).

The most valuable services anticipate challenges before they affect your bottom line and offer integrated solutions that address multiple financial objectives simultaneously. This comprehensive approach becomes essential when evaluating potential service providers and their qualifications.

The IRS requires all paid tax preparers to hold a Preparer Tax Identification Number, but this basic requirement reveals nothing about expertise. Certified Public Accountants represent the highest qualification level, requiring 150 college credit hours, passing the CPA exam, and completing annual continuing education. Enrolled Agents earn IRS authorization through comprehensive testing or five years of IRS employment experience. The latest NASBA numbers reveal that over 665,600 CPAs are actively working in the U.S., making them a valuable but limited resource.

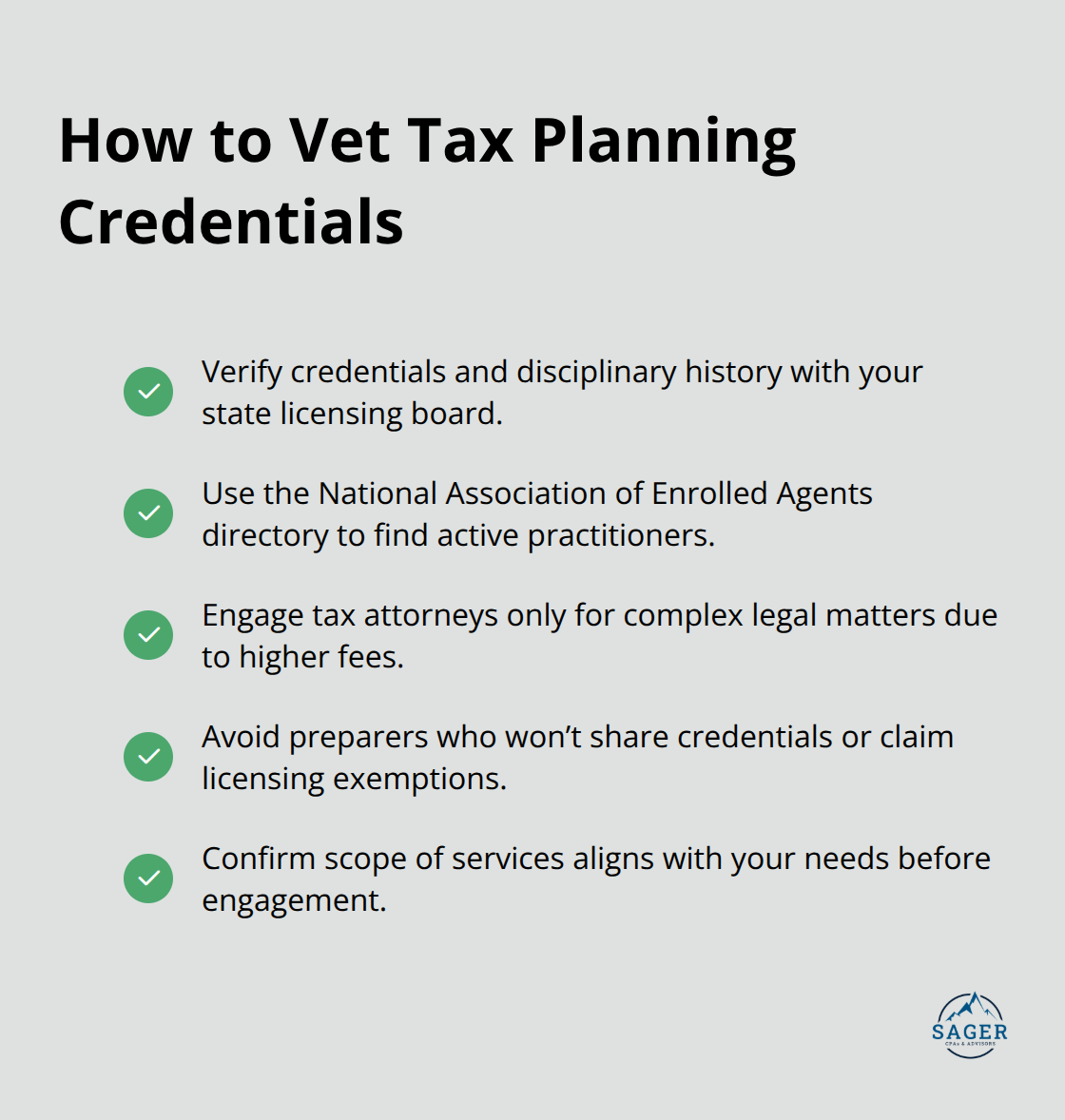

Check state licensing boards to verify credentials and disciplinary history. The National Association of Enrolled Agents maintains a directory of active practitioners. Tax attorneys offer specialized legal expertise but typically charge premium rates for complex cases. Avoid preparers who refuse to provide credentials or claim exemptions from licensing requirements.

Request specific examples of tax savings achieved for clients in similar situations. Quality providers share anonymized case studies that show measurable results without revealing confidential information. The National Society of Accountants found that professional preparation costs average $273 for itemized returns, but savings often exceed fees by substantial margins.

Ask about client retention rates and industry specialization. Providers who serve your sector for multiple years understand nuanced deductions and compliance requirements. Request references from long-term clients who face similar tax challenges. Avoid services that cannot demonstrate relevant experience or refuse to provide client testimonials.

Fee-based pricing models align provider interests with client outcomes better than percentage-based refund fees. Fixed annual fees for comprehensive planning typically range from $2,500 to $15,000 depending on complexity. Hourly rates vary from $150 to $400 based on credentials and location (with the key being understanding what services each fee structure includes and excludes).

Compare total annual costs including preparation, planning, and consultation time. Some providers offer unlimited consultations while others charge separately for advice. Request detailed fee schedules and identify potential additional charges before engagement. Quality providers explain their pricing transparently and justify costs through demonstrated expertise and results.

Tax planning services for individuals work best when you match your financial complexity with provider expertise. Focus on credentials like CPA or EA certifications, industry experience, and year-round availability rather than seasonal preparers. Fee transparency and demonstrated client results matter more than low initial costs.

Professional tax planning delivers measurable value through strategic timing, missed deduction recovery, and proactive law change adaptation. The average taxpayer saves 15-30% on annual liability through proper planning versus basic preparation. Complex situations that involve business ownership, real estate, or high income levels benefit most from specialized expertise (particularly when providers understand your specific industry challenges).

Start your search when you define your specific needs and timeline. Verify credentials through state boards and professional associations. We at Sager CPA provide comprehensive tax planning and advisory services tailored for individuals and businesses.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.