Self-employed individuals, freelancers, and business owners face a tax reality that W-2 employees don’t: making quarterly payments to the IRS throughout the year.

Missing these deadlines can result in penalties that add up quickly. We at Sager CPA created this quarterly tax estimates guide to help you navigate payment calculations, deadlines, and strategies that keep you compliant while managing cash flow effectively.

Quarterly tax estimates are prepayments that taxpayers make to the IRS four times per year to cover income without automatic tax withholding. The IRS requires these payments because the tax system operates on a pay-as-you-go basis. Taxpayers must pay taxes as they earn income rather than wait until they file their returns.

Self-employed individuals, freelancers, independent contractors, business owners, and anyone who receives significant investment income must make these payments. The requirement kicks in when taxpayers expect to owe $1,000 or more in taxes after they subtract withholdings and credits. Corporations face the same requirement but with a $500 threshold instead. Traditional employees with proper withholding typically don’t need to make estimated payments.

The four quarterly payment deadlines for 2025 are April 15, June 16, September 15, and January 15, 2026. These dates shift when they fall on weekends or holidays (moving to the next business day). The payment periods don’t align with calendar quarters, which trips up many taxpayers.

The first quarter covers January through March, but the second quarter only spans April and May, while the third quarter includes June through August. Farmers and fishermen get special treatment, making just one payment by January 15 if at least two-thirds of their gross income comes from these activities.

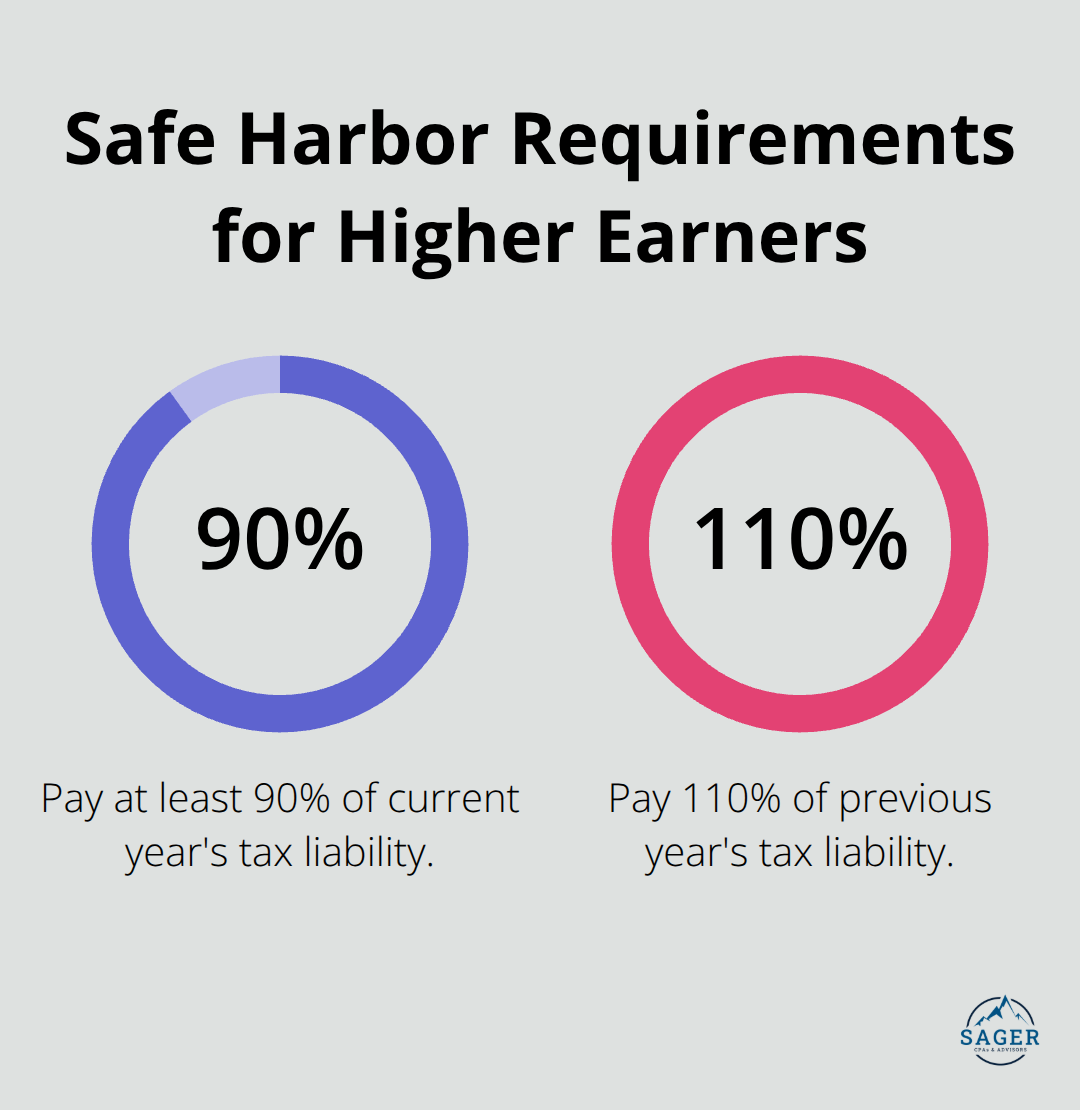

Missing quarterly payments triggers underpayment penalties that the IRS calculates at approximately 8% annually as of 2024. The penalty applies separately to each missed quarter, so late payments compound quickly. Taxpayers can avoid penalties when they pay at least 90% of their current year’s tax liability or 100% of last year’s tax liability through estimated payments and withholdings. High earners with adjusted gross income that exceeds $150,000 must pay 110% of their previous year’s tax to qualify for the safe harbor rule.

The annualized income installment method offers relief for taxpayers with uneven income throughout the year. This method allows lower payments during slow periods, which helps businesses with seasonal fluctuations manage their cash flow more effectively while they calculate their true tax obligations.

The most reliable method for quarterly payment calculations starts with your previous year’s tax return. Take the total tax you owed last year and divide it by four. This approach works well for taxpayers with stable income patterns. Higher earners with adjusted gross income that exceeds $150,000 must pay at least 90% of the tax shown on the return for the taxable year or 100% of the tax shown on the return for the prior year, whichever amount is less, to meet safe harbor requirements. The IRS accepts this method even if your current year income increases significantly, which protects you from underpayment penalties.

Form 1040ES provides worksheets that walk through current year calculations step by step. The form asks for estimated income, deductions, and tax liability, then subtracts expected withholdings to determine quarterly payment amounts. Download the current year version from the IRS website since tax brackets and standard deductions change annually. The worksheet accounts for self-employment tax at 15.3% on net earnings, which catches many new business owners off guard. Complete the entire worksheet rather than guess at numbers, since underestimation by more than 10% triggers penalties that compound quarterly.

Income fluctuations require payment adjustments to avoid overpayment or underpayment of taxes. Increase your next quarterly payment by the additional tax owed when income jumps unexpectedly from a large contract or investment gain. The annualized income method works better for seasonal businesses or irregular income patterns. This method calculates tax based on actual income earned each quarter rather than spread annual estimates evenly.

You aren’t required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount, so don’t file Form 2210 unless you want to use the annualized method and potentially reduce penalties when income varies significantly throughout the year. Track income monthly to spot trends early and adjust the following quarter’s payment accordingly (this prevents both overpayment and underpayment issues). Most taxpayers benefit from quarterly reviews of their income projections, especially those with variable revenue streams or multiple income sources.

The calculation methods above help you determine payment amounts, but the next step involves actually submitting these payments to the IRS through various available channels.

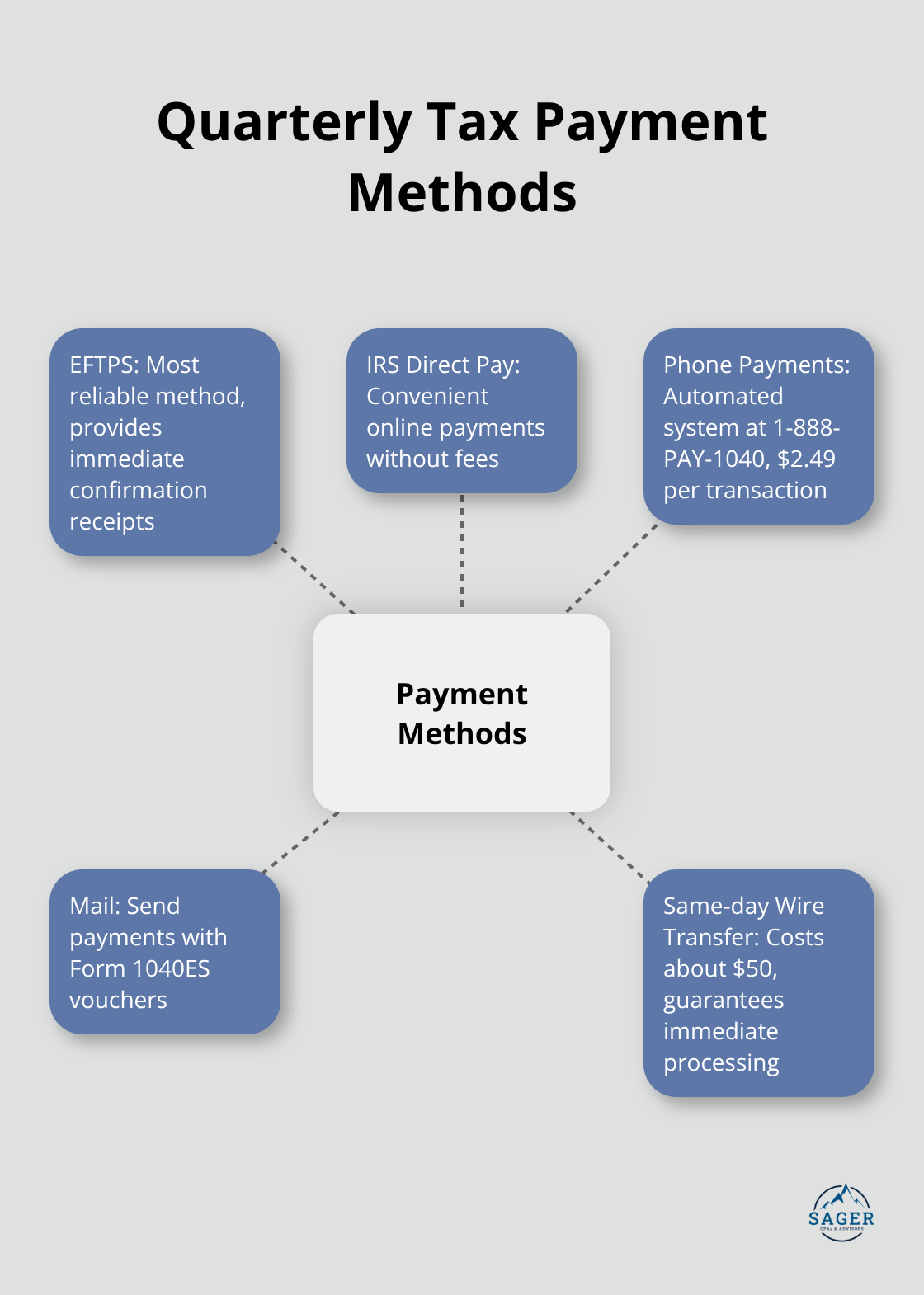

The Electronic Federal Tax Payment System (EFTPS) stands as the most reliable method for quarterly payment submission. This IRS system processes payments and provides immediate confirmation receipts that serve as proof of payment. EFTPS eliminates mail delays and processing errors that can trigger late payment penalties. The system requires enrollment that can take up to five business days to process, but prevents penalties that apply to missed payments.

Online payments through IRS Direct Pay offer convenience for taxpayers who prefer not to enroll in EFTPS. The system accepts bank transfers directly from accounts without fees. Phone payments through the automated system at 1-888-PAY-1040 cost $2.49 per transaction but provide same-day processing. Mail payments with Form 1040ES vouchers work but require postmarks by the due date to avoid penalties. Same-day wire transfers cost approximately $50 but guarantee immediate processing for last-minute payments.

Keep digital copies of all payment confirmations, bank statements that show withdrawals, and Form 1040ES vouchers for each quarter. The IRS requires taxpayers to maintain records for at least three years after they file their returns. Store payment confirmations with the date, amount, and confirmation number in a dedicated tax folder. Print EFTPS receipts immediately after payment since the system only retains transaction history for 16 months (this limited retention period catches many taxpayers off guard).

Record each payment amount on a spreadsheet with the due date and actual payment date to track compliance patterns. Create separate columns for payment method, confirmation numbers, and any penalty calculations. This system helps identify payment trends and prevents duplicate submissions. Most accounting software packages include quarterly tax payment modules that automate these records and generate reports for tax preparation.

Overpayments automatically apply to the next quarter unless you request a refund through Form 843 within three years. Underpayments require immediate correction through additional payments plus penalty calculations that compound until resolved. The IRS applies payments to the earliest unpaid quarter first, which affects penalty calculations for subsequent periods. Contact the IRS immediately when payment processing errors occur (such as incorrect amounts or missed deadlines) to minimize penalty accumulation.

Quarterly tax estimates represent a fundamental obligation for self-employed individuals and business owners who expect to owe $1,000 or more in taxes. The April 15, June 16, September 15, and January 15 deadlines require consistent attention throughout the year. Penalties compound at approximately 8% annually when taxpayers miss these payments, which makes compliance both a legal requirement and a financial necessity.

Current estimated payments provide significant cash flow advantages when taxpayers spread tax obligations across four manageable installments rather than face a large bill at year-end. This approach prevents penalty accumulation and helps businesses maintain steady financial operations. Form 1040ES and the Electronic Federal Tax Payment System streamline the calculation and submission process (when taxpayers use them correctly).

Complex income patterns, significant business changes, or uncertainty about payment calculations signal the need for professional guidance. We at Sager CPA help clients navigate quarterly payment requirements while we develop strategies to reduce overall tax liabilities. Our quarterly tax estimates guide approach includes proactive tax planning that supports long-term financial stability for individuals and businesses.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.