Ultra high net worth families face complex tax challenges that require sophisticated planning strategies. Traditional approaches often fall short when managing substantial wealth across multiple jurisdictions and asset classes.

We at Sager CPA specialize in advanced ultra high net worth tax planning techniques that protect and preserve generational wealth. The right combination of estate planning, international structures, and succession strategies can save millions in taxes.

Ultra high net worth individuals need aggressive tax strategies that extend far beyond conventional planning. The lifetime gift and estate tax exclusion reaches $13.99 million per individual in 2025, which creates substantial opportunities. Grantor retained annuity trusts allow families to transfer appreciation beyond the Section 7520 rate while they retain income streams. Qualified personal residence trusts remove primary residences from taxable estates while owners continue to live there. Sales to intentionally defective grantor trusts freeze estate values while they transfer future growth to beneficiaries tax-free.

Dynasty trusts in states without rule against perpetuities create perpetual wealth transfer vehicles. Nevada and Delaware offer particularly favorable trust laws with no state income tax on trust income. Family limited partnerships provide valuation discounts for transferred interests while general partners maintain control. Charitable lead annuity trusts generate substantial gift tax deductions while remainder interests pass to heirs. These vehicles maximize annual exclusion gifts of $18,000 per beneficiary while they leverage generation-skipping transfer tax exemptions.

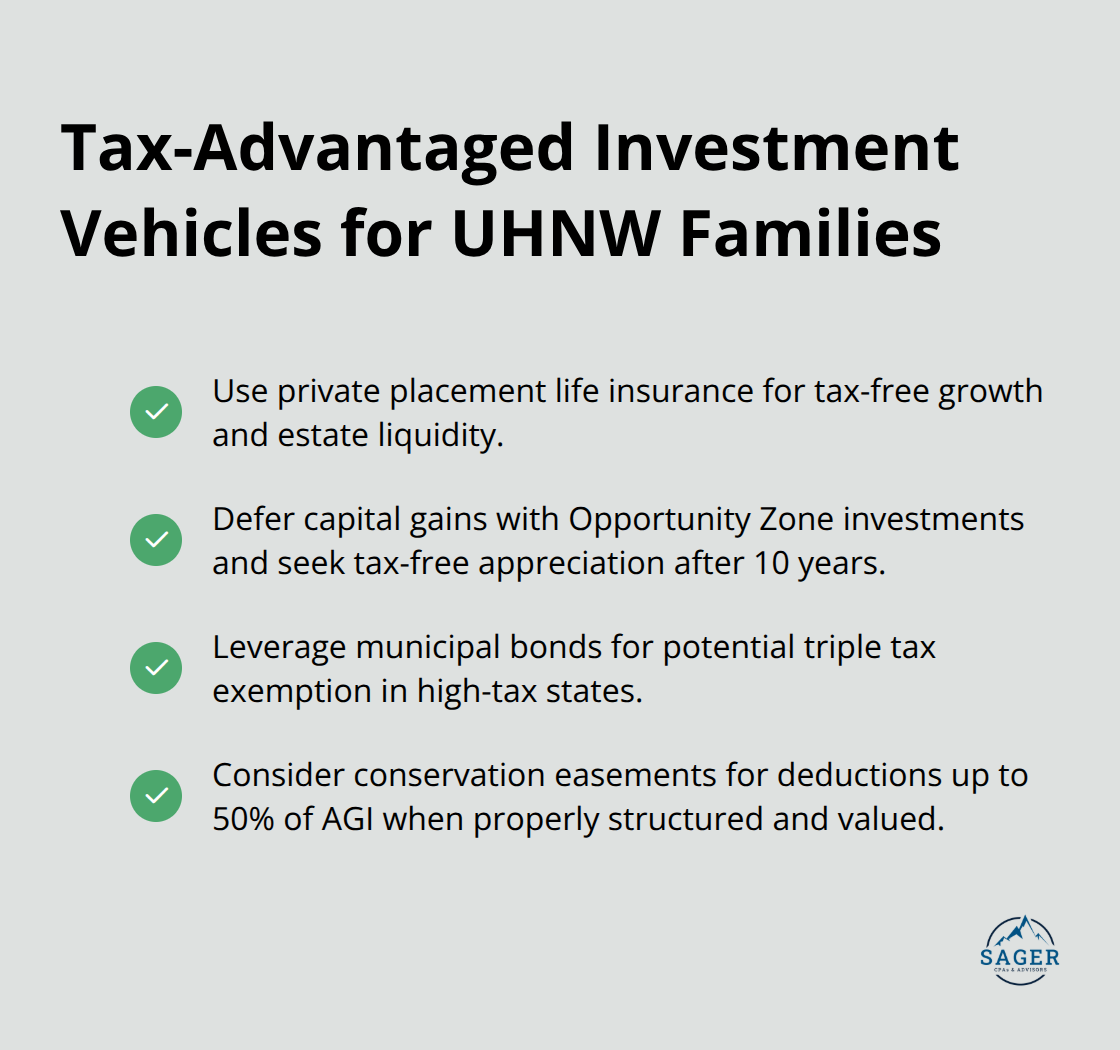

Private placement life insurance offers tax-free growth and death benefits while it provides liquidity for estate taxes. Opportunity zone investments defer capital gains until 2026 and eliminate taxes on appreciation held over ten years. Municipal bonds from high-tax states provide triple tax exemption for residents. Conservation easements on qualified properties generate income tax deductions up to 50% of adjusted gross income annually (when properly structured and valued).

Foreign tax credit optimization becomes essential when families hold assets across multiple jurisdictions. Treaty benefits can reduce withholding taxes on international investments while proper entity structures minimize global tax exposure. These international considerations require careful coordination with domestic strategies to avoid conflicts and maximize overall tax efficiency.

Ultra high net worth families with international assets face exponential tax complexity that demands sophisticated cross-border strategies. The Foreign Account Tax Compliance Act requires reporting of foreign financial accounts that exceed $10,000, while Form 8938 mandates disclosure of specified foreign financial assets when total values exceed $50,000 for single filers or $100,000 for joint filers. Foreign tax credits offset U.S. tax liability dollar-for-dollar on income already taxed abroad, but strategic timing and sourcing rules determine maximum benefits. Tax treaties with multiple countries reduce withholding rates on dividends, interest, and royalties, with rates often dropping from 30% to 15% or lower under treaty protection.

Controlled foreign corporations in low-tax jurisdictions like Singapore or Ireland defer U.S. taxation on active business income while passive investment income faces immediate Subpart F inclusion. Pre-immigration planning through foreign grantor trusts allows wealthy individuals to accumulate assets offshore before they establish U.S. tax residency, potentially saving millions in future U.S. taxes. Cook Islands asset protection trusts offer superior creditor protection with self-settled spendthrift provisions while they maintain beneficial ownership rights. Foreign partnerships achieve tax transparency while they provide operational flexibility across multiple jurisdictions.

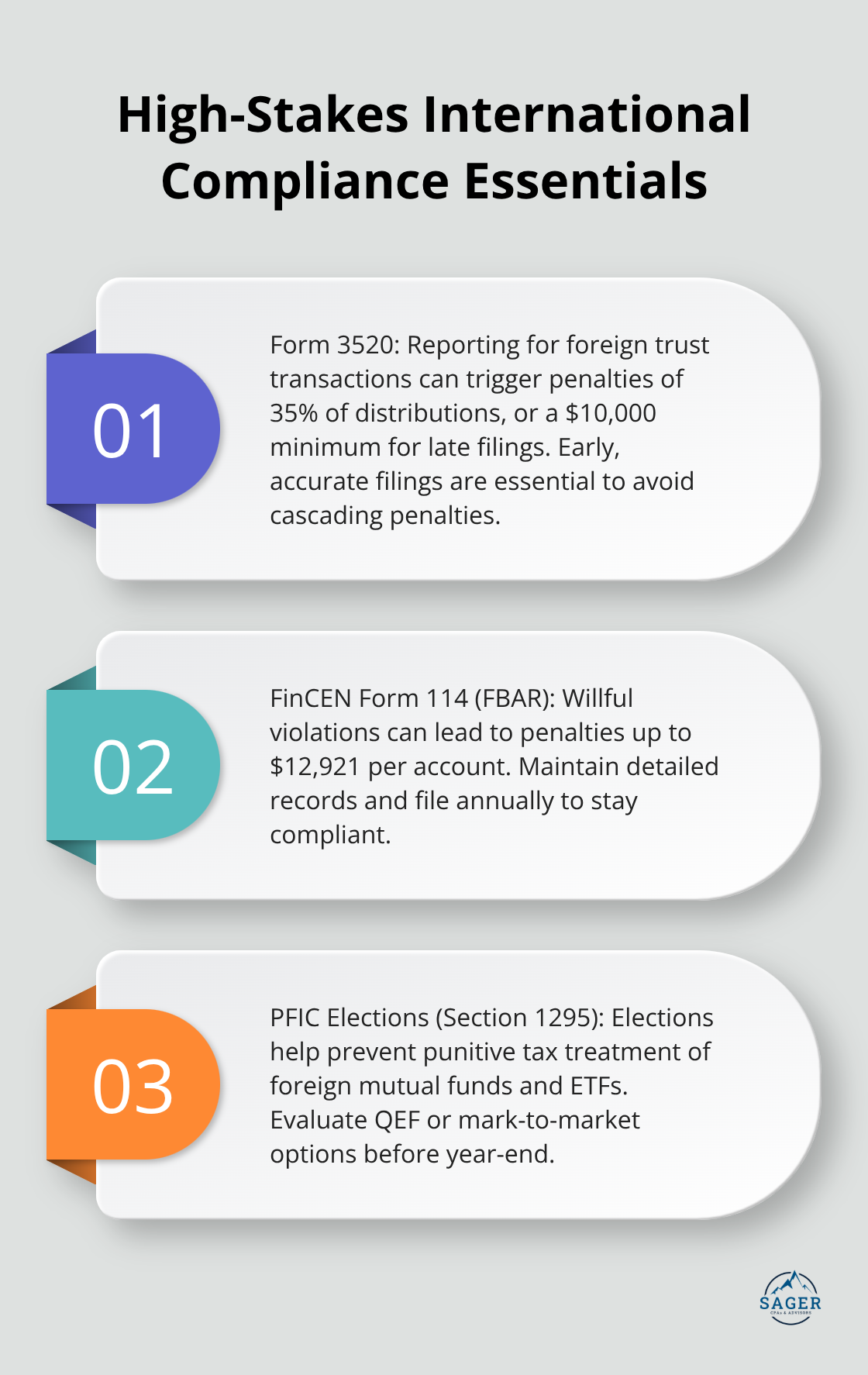

Form 3520 reporting for foreign trust transactions carries penalties of 35% of trust distributions (or $10,000 minimum for late filings). FinCEN Form 114 for foreign bank account reporting imposes penalties up to $12,921 per account for willful violations. Passive foreign investment company elections under Section 1295 prevent punitive tax treatment on foreign mutual funds and ETFs.

Professional tax planning services become non-negotiable given the severe penalties and complex intersection of domestic and international tax law that can destroy wealth through compliance failures.

Tax treaty networks provide substantial opportunities for withholding tax reduction when families structure investments properly. Double taxation agreements eliminate duplicate taxation while they preserve foreign tax credit benefits for U.S. taxpayers. Income sourcing rules determine which jurisdiction has primary taxation rights, and strategic entity placement maximizes treaty benefits. These international structures require careful coordination with domestic wealth transfer strategies to create comprehensive tax efficiency across all family assets and business interests.

Generation-skipping transfer tax strategies become mandatory when family wealth exceeds $13.99 million per individual in 2025. The generation-skipping transfer tax exemption matches the federal estate tax exemption at $13.99 million, but proper allocation requires immediate action before transfers occur. Direct skips to grandchildren trigger both gift tax and generation-skipping transfer tax without proper exemption allocation.

Dynasty trusts in perpetuity jurisdictions like South Dakota and Nevada maximize generation-skipping transfer tax exemptions while they avoid state income taxes indefinitely. Charitable lead grantor trusts provide gift tax deductions up to 60% of adjusted gross income while remainder interests pass to skip persons tax-free.

Private family foundations require minimum annual distributions of 5% but offer perpetual tax deductions and generation-skipping benefits when properly structured. These foundations create lasting philanthropic legacies while they reduce estate tax exposure across multiple generations. Grantor retained income trusts freeze asset values at transfer while all appreciation passes to beneficiaries free of additional transfer taxes.

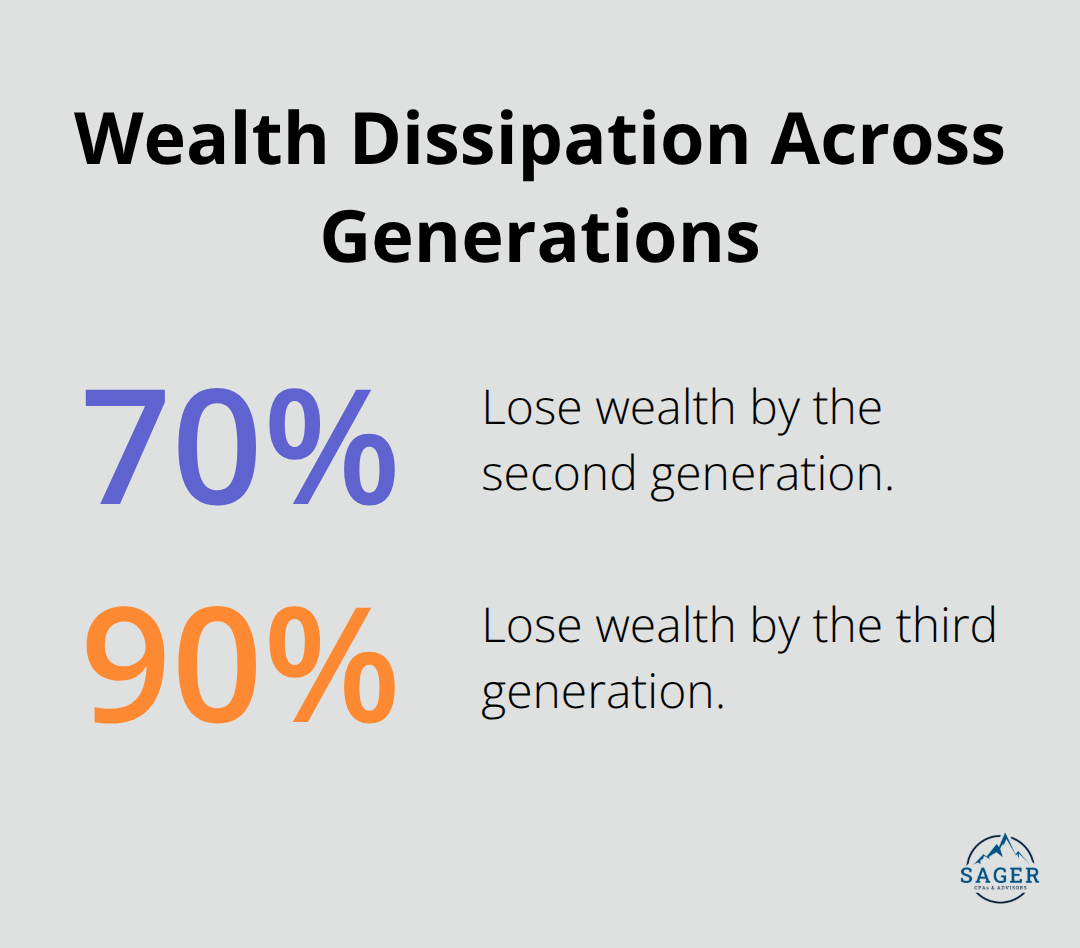

Donor-advised funds accept non-cash assets like private company shares and real estate while they provide immediate tax deductions at fair market value. Charitable remainder trusts defer capital gains taxes on appreciated assets while they generate income streams for beneficiaries (up to 20 years or life). Studies show 70% of wealthy families lose their wealth by the second generation and 90% by the third, which makes structured philanthropy essential for wealth preservation education.

Business succession through employee stock ownership plans provides tax deferral on sale proceeds when sellers reinvest in qualified securities within 12 months. Management buyouts funded through seller financing create installment sale treatment while buyers leverage cash flow for acquisition costs. Family Limited Partnerships enable wealth transfer to heirs while shielding them from high estate taxes. These wealth transfer mechanisms require coordination with international structures to prevent treaty conflicts and maximize global tax efficiency across all family assets.

Ultra high net worth tax planning demands immediate action due to complex current tax laws and potential future changes. The $13.99 million lifetime exemption in 2025 creates a narrow window for wealth transfer strategies before potential legislative modifications occur. Families who delay implementation risk the loss of millions in tax savings through missed opportunities in generation-skipping transfers and estate planning techniques.

Professional coordination becomes essential when families manage international assets, trust structures, and business succession plans. Tax attorneys, estate planners, and investment advisors must work together to prevent conflicts between domestic and international strategies. The severe penalties for compliance failures with foreign reporting requirements (up to $12,921 per account for willful violations) can destroy wealth faster than poor investment decisions.

We at Sager CPA provide comprehensive tax planning services that coordinate all aspects of ultra high net worth financial management. Our strategic approach reduces tax liabilities through customized action plans that address estate planning, international structures, and succession strategies. Time-sensitive opportunities in 2025 require immediate professional guidance to maximize wealth preservation across generations.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.