Small businesses face mounting tax pressures as rates climb and deductions shrink. Smart tax planning can save thousands annually through strategic timing and proper documentation.

We at Sager CPA have identified ten proven tax savings for small business owners that work in 2025’s current tax environment. These actionable strategies range from retirement contributions to equipment purchases, each designed to reduce your tax burden legally and effectively.

Pass-through business owners can deduct up to 20% of qualified business income through Section 199A, potentially saving thousands annually. The deduction phases out for single taxpayers earning over $191,950 and married couples filing jointly over $383,900 in 2025. Service businesses face additional restrictions above these thresholds, which makes income management essential for maximum benefits. Qualified business income excludes investment income, reasonable compensation from S-corporations, and guaranteed payments from partnerships. Business owners must calculate their taxable income before the QBI deduction to determine eligibility and optimize their tax strategy.

Strategic planning around the wage and property tests becomes essential for businesses that exceed income thresholds. The deduction cannot exceed 50% of W-2 wages paid by the business or 25% of wages plus 2.5% of qualified property basis (whichever is greater). Manufacturing businesses often benefit more than service providers due to higher equipment investments and wage requirements. Equipment purchases before year-end can increase the qualified property basis and expand deduction limits for the following year. Track both wage payments and asset acquisitions quarterly to optimize the 199A calculation and position your business for additional equipment-related tax benefits.

Equipment purchases made before December 31, 2025 qualify for 60% bonus depreciation under current tax law, down from 100% in previous years but still substantial for tax planning. Manufacturing equipment, office furniture, computers, and vehicles used primarily for business qualify for this accelerated write-off. The remaining 40% follows regular MACRS schedules over the asset’s useful life. Smart business owners combine this 60% bonus depreciation with Section 179 expensing, which allows immediate deduction of up to $1,000,000 in equipment costs for 2025. This dual strategy works particularly well for purchases between $50,000 and $200,000, where bonus depreciation handles most costs and Section 179 covers the remainder.

December equipment acquisitions create immediate tax benefits worth thousands more than January purchases. A $100,000 piece of manufacturing equipment purchased in December 2025 generates a $60,000 deduction for the current tax year, while the same purchase in January 2026 provides no current-year benefit.

The number 100% seems to be not appropriate for this chart. Please use a different chart type. Construction companies and manufacturers see the biggest impact from strategic year-end equipment timing because their asset purchases typically exceed amounts where bonus depreciation creates maximum value (especially for heavy machinery and specialized tools). Finalize equipment orders by mid-December to account for delivery delays and proper installation before year-end. This strategic approach to equipment acquisition sets the foundation for another powerful retirement savings strategy that can further reduce your 2025 tax burden.

Solo 401k plans allow self-employed business owners to contribute up to $70,000 annually in 2025, which combines employee deferrals of $23,500 with employer contributions of up to 25% of compensation. High-income consultants, freelancers, and single-owner businesses benefit most because they can shelter significantly more income than traditional IRAs or SEP-IRAs. The IRS permits loans up to $50,000 from Solo 401k accounts, which provides emergency access without penalties that other retirement accounts don’t offer. Setup costs run between $500-2,000 annually, but tax savings typically exceed fees within the first year for businesses that earn over $75,000.

SEP-IRAs require identical contribution percentages for all employees, which makes them unsuitable for businesses with staff, while Solo 401k plans work exclusively for owner-only businesses. Automatic contribution systems through payroll services like Gusto or ADP maximize deferrals and prevent missed deadlines that reduce annual limits. December 31st marks the deadline for employee deferrals, but employer contributions can continue until the business tax return deadline (including extensions). Fidelity and Charles Schwab offer low-cost Solo 401k options with minimal maintenance requirements and online management tools.

Establish Solo 401k accounts by November to allow processing time and avoid year-end administrative delays that could limit 2025 contributions. This retirement strategy works hand-in-hand with smart tax strategies that many business owners overlook when they use vehicles for business purposes.

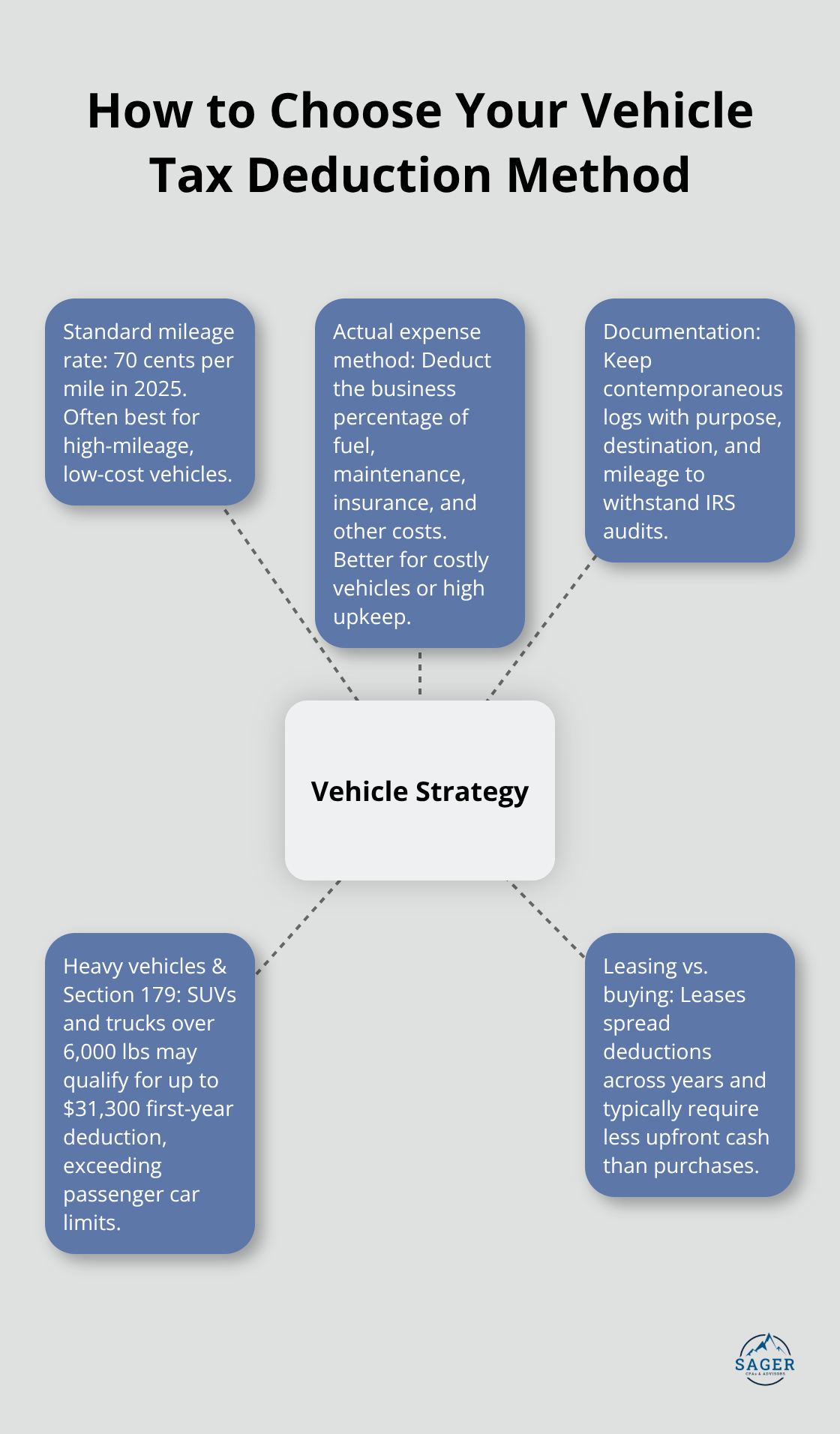

Business owners who drive for work can choose between the standard mileage rate of 70 cents per mile in 2025 or the actual expense method, which deducts the business percentage of total vehicle costs. The actual expense method typically benefits owners of expensive vehicles or those with high maintenance costs, while the standard mileage rate works better for reliable, fuel-efficient cars driven extensively for business. Mixed-use vehicles require meticulous records of business versus personal miles, and the IRS expects contemporaneous documentation that shows the business purpose, destination, and mileage for each trip. Apps like MileIQ or QuickBooks automatically track this data through GPS, which eliminates the manual logbook burden that causes many business owners to lose valuable deductions.

Business vehicle purchases create immediate tax advantages through Section 179 deductions up to $31,300 for SUVs and trucks over 6,000 pounds, while leased vehicles generate consistent monthly deductions based on business use percentage. Heavy pickup trucks and large SUVs qualify for the full Section 179 deduction without the luxury vehicle limits that restrict passenger cars to $12,200 in first-year depreciation (December purchases maximize current-year deductions). Leased vehicles spread costs evenly across multiple tax years and often require lower upfront cash compared to purchases. Track every business mile from January 1st because the IRS audits vehicle deductions frequently, and missing documentation can disqualify the entire deduction for the year.

This vehicle strategy pairs perfectly with another frequently overlooked deduction that can significantly reduce your tax burden through strategic tax planning.

Employee meals at company offices qualify for 100% deduction under current IRS rules when the business owner or an employee is present and meals are from restaurants, while business meals with clients remain at 50% deductibility. The distinction matters significantly for tax planning because companies that spend $10,000 annually on employee meals save $2,100 more in taxes compared to client entertainment at the same cost level. Office catering, team lunches during meetings, and meals during overtime work all qualify for full deduction. Document the business purpose, attendees, and costs for every meal expense because IRS audits focus heavily on meal deductions due to frequent abuse. Apps like Receipt Bank or QuickBooks capture meal receipts instantly and categorize them properly for tax preparation.

December represents the optimal time for tax-deductible business events because expenses count toward the current tax year while they provide team building benefits before year-end. Holiday parties, client appreciation events, and year-end team dinners create immediate deductions when you properly document them with business purposes and attendee lists (restaurant meals with clients require contemporaneous notes that show business topics discussed). Company-wide events need guest lists and agendas to support deductions. Schedule major business events well before year-end to process payments and documentation within the tax year. Smart meal planning creates thousands in additional deductions while it supports legitimate business relationship development and employee morale initiatives, which sets the stage for another powerful tax strategy that involves the strategic timing of income and expenses.

Cash-basis taxpayers control when income and expenses hit their tax returns through strategic decisions that can save thousands annually. December invoices can wait until January 2026 to defer income recognition, while prepaid January 2026 expenses in December 2025 accelerate deductions into the current tax year. Service businesses benefit most from income deferral because they can delay client bills until after year-end, while retailers and manufacturers face limited flexibility due to automatic income recognition from sales. Professional service firms like consultants, attorneys, and architects routinely defer December bills to manage tax brackets and optimize cash flow. The strategy works particularly well when business owners expect lower tax rates in 2026 or need to smooth income across multiple years to avoid higher marginal brackets.

Accelerate deductible expenses like equipment maintenance, office supplies, insurance premiums, and professional fees into December 2025 to maximize current-year write-offs. Prepaid expenses qualify for deduction under IRS rules (which means 2026 rent, insurance, or service contracts paid before December 31st create valuable tax benefits). Coordinate these strategies with quarterly estimated tax payments because dramatic income shifts can trigger underpayment penalties if not properly managed through adjusted payments. Calculate the tax impact before implementation because some businesses save more money through consistent quarterly payments rather than dramatic year-end adjustments that complicate cash flow management. This strategic timing of income and expenses pairs perfectly with health savings accounts that provide triple tax advantages for self-employed business owners.

Self-employed business owners can contribute up to $4,550 for individual coverage or $8,550 for family coverage to Health Savings Accounts in 2025. These contributions create immediate above-the-line tax deductions that reduce adjusted gross income dollar-for-dollar. The IRS requires high-deductible health plans with minimum deductibles of $1,650 for individuals to qualify for HSA eligibility. Contributions reduce current-year taxes, grow tax-free through investments, and withdraw tax-free for qualified medical expenses (which creates a triple tax advantage that no other account type offers). December contributions count toward the current tax year, but the deadline extends to April 15th of the following year for maximum flexibility.

Strategic medical expense plans maximize HSA benefits because funds never expire and can accumulate for decades while they earn investment returns through stock and bond portfolios offered by providers like Fidelity or HSA Bank. Self-employed individuals can deduct 100% of their health insurance premiums as a separate above-the-line deduction, then use HSA funds for out-of-pocket costs like deductibles, copays, and prescription medications. Pay routine medical expenses from regular accounts while you leave HSA funds invested for future healthcare costs or retirement, since withdrawals become penalty-free for any purpose after age 65.

Track all medical receipts throughout the year because you can reimburse yourself from HSA funds years later as long as the expense occurred after the HSA was established. Dental work, vision care, and over-the-counter medications qualify for tax-free HSA distributions when properly documented with receipts. This health savings strategy works perfectly with employee benefit programs that can further reduce your business tax burden through strategic tax planning structures.

Dependent care assistance programs allow businesses to provide up to $5,000 annually per employee for childcare expenses, which reduces both employer and employee payroll taxes while it creates tax-free benefits for workers. The IRS permits employers to deduct these payments as business expenses while employees receive assistance without income tax consequences. Educational assistance benefits work similarly, with employers able to provide up to $5,250 per employee annually for tuition, books, and training costs that qualify as tax-free employee income. These programs require formal written plans and non-discrimination policies, but the tax savings typically exceed administrative costs within the first year. Companies with 10 employees that provide maximum dependent care benefits save approximately $3,825 annually in FICA taxes alone, while employees save their marginal tax rate on received benefits.

Flexible spending accounts reduce payroll taxes for both employers and employees when they allow pre-tax contributions up to $3,300 annually for healthcare expenses and $5,000 for dependent care costs in 2025. Employers save 7.65% on FICA taxes for every dollar employees contribute to FSAs, while employees reduce their taxable income and save their marginal tax rate plus FICA taxes. Third-party administrators like WageWorks or TASC handle FSA management for annual fees between $2-8 per employee per month, which makes these programs cost-effective for businesses with five or more workers.

Setup requires 60-90 days before implementation, so businesses that plan 2025 programs need to act immediately to meet January 1st effective dates (this timing constraint makes immediate action essential for maximum tax benefits). Smart business owners combine these employee benefit strategies with research and development tax credits that can further reduce their overall tax burden through innovation investments.

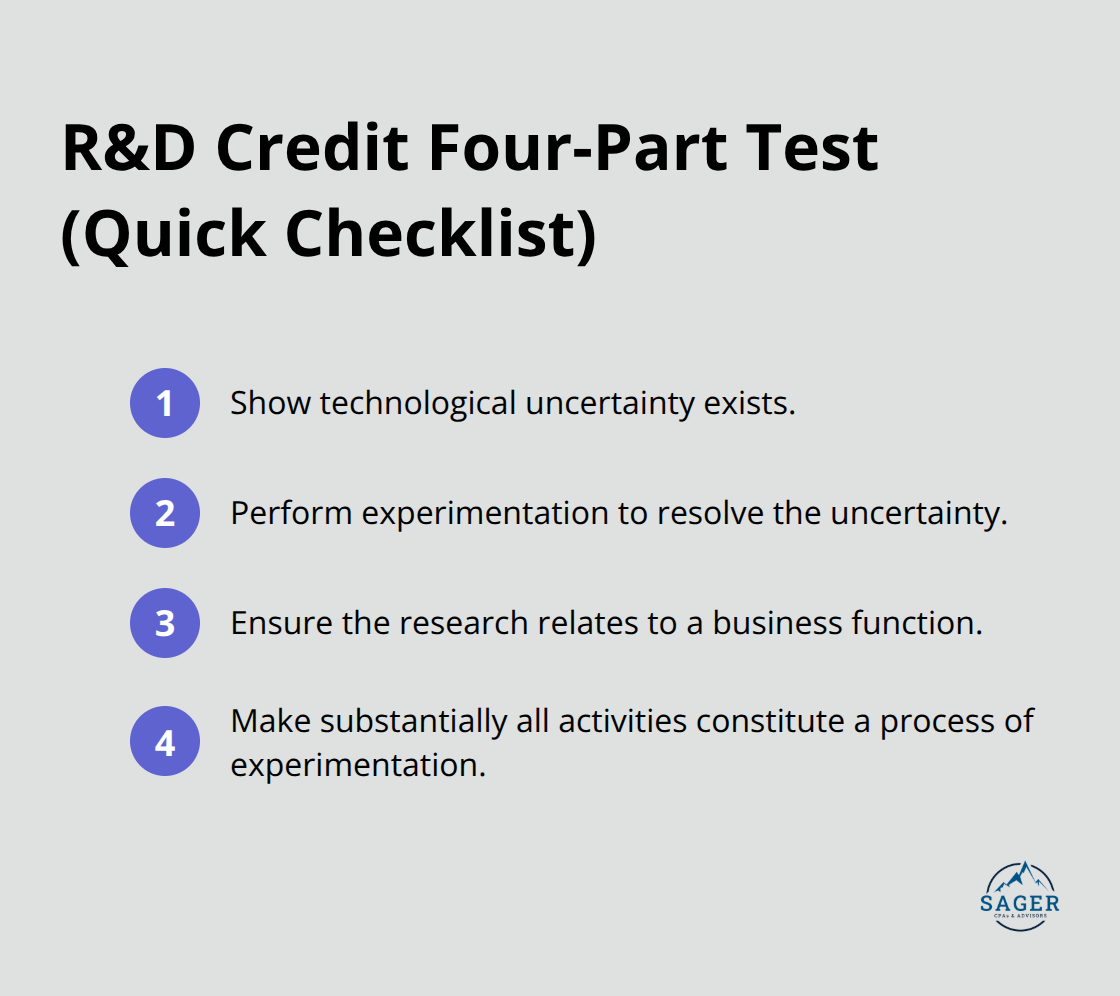

The federal R&D tax credit allows businesses to claim qualified research expenses, which includes software development, product improvements, and process innovations that many business owners overlook. Manufacturing companies that develop new production methods, software firms that create applications, and even restaurants that test new recipes can qualify for these credits. The IRS defines qualified research as activities that eliminate uncertainty through experimentation, which covers everything from beta testing software features to improved manufacturing efficiency through trial-and-error processes. Companies must document the four-part test: technological uncertainty exists, experimentation occurs to resolve uncertainty, research relates to a business function, and substantially all activities constitute experimentation. Proper documentation requires detailed records of employee time, contractor costs, and supply expenses directly related to innovation activities.

State R&D credits often exceed federal benefits and can be claimed simultaneously, with states like California that offer 24% credits and New York that provides up to 9% for qualified expenses. Small businesses with gross receipts under $5 million during the prior three years can claim R&D credits against payroll taxes up to $500,000 annually through IRS Section 41 (which provides immediate cash flow benefits rather than income tax reductions). Track all innovation-related costs throughout the year because missed documentation eliminates credit eligibility, and the IRS frequently audits R&D claims due to their substantial value. Calculate both federal and state opportunities before year-end to optimize credit claims and coordinate with other tax strategies for maximum benefit. This innovation-focused approach works hand-in-hand with business entity restructures that can fundamentally transform your tax obligations and create additional savings opportunities.

S-Corporation elections for existing LLCs generate self-employment tax savings for businesses that earn over $60,000 in profit. LLC members pay self-employment taxes on all business income, while S-Corporation owners pay FICA taxes only on reasonable salaries and receive profits as distributions exempt from self-employment taxes. The IRS requires S-Corporation owners to pay themselves reasonable compensation based on industry standards, but profits above salary levels avoid the 15.3% self-employment tax burden. Professional service businesses like consultants, attorneys, and accountants see the largest savings because their high profit margins create substantial distribution income that escapes self-employment taxes. Single-member LLCs that elect S-Corporation status must establish payroll systems and file quarterly employment tax returns, but tax savings typically exceed administrative costs within the first year.

Entity conversion affects multiple tax years and requires careful coordination with business cycles and cash flow needs. December 31st represents the deadline for S-Corporation elections that take effect for the current tax year, while January elections apply to the following year and miss current-year savings opportunities. C-Corporations face double taxation on profits and dividends, which makes them unsuitable for most small businesses unless they plan to retain significant earnings for future expansion or qualify for Section 1202 qualified small business stock benefits. Calculate the break-even point where S-Corporation savings exceed administrative costs (this typically occurs around $40,000-50,000 in annual business profit depending on state requirements and payroll fees). These entity structure decisions work best when combined with proper quarterly tax planning and professional guidance to avoid penalties and maximize benefits throughout the year.

These ten strategies represent proven tax savings for small business opportunities that work in 2025’s current environment. Implementation requires careful timing and meticulous documentation to withstand IRS scrutiny and maximize benefits. The IRS expects accurate records and proper business purposes for every deduction claimed.

Quarterly estimated tax payments demand immediate attention because underpayment penalties accumulate daily and can eliminate savings from these strategies. Calculate payments based on current year projections rather than prior year safe harbors when you implement multiple tax reduction techniques simultaneously. Professional guidance becomes essential when you combine multiple strategies because interactions between deductions, credits, and entity structures create complex tax implications (year-end planning consultations should occur by November to allow implementation time for equipment purchases and entity elections).

Record-keeping systems must capture every receipt, mileage log, and business purpose documentation because the IRS audits small businesses at higher rates than large corporations. Digital tools like QuickBooks or Receipt Bank automate much of this process and create audit-ready documentation that supports claimed deductions. We at Sager CPA help business owners coordinate these strategies with their specific situations and long-term financial goals.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.