W2 employees often believe they have limited options for reducing their tax burden. This misconception costs thousands of workers significant money each year.

We at Sager CPA have identified multiple tax saving strategies for W2 employees that can substantially lower your annual tax liability. From maximizing retirement contributions to strategic deduction timing, these proven methods work within the current tax code.

The Tax Cuts and Jobs Act of 2017 changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses, eliminating most itemized deductions for W2 employees. However, several powerful above-the-line deductions remain available that directly reduce your adjusted gross income. These deductions include student loan interest up to $2,500 annually, traditional IRA contributions up to $7,000 for 2024 (or $8,000 if you’re 50 or older), educator expenses up to $300, and HSA contributions. Above-the-line deductions work regardless of whether you itemize or take the standard deduction, which makes them more valuable than itemized deductions for most W2 employees.

For 2024, the standard deduction stands at $14,600 for single filers and $29,200 for married couples who file jointly. Some taxpayers choose to itemize their deductions if their allowable itemized deductions total is greater than their standard deduction. You should only itemize if your total deductions exceed these standard amounts. The primary itemizable expenses for W2 employees include mortgage interest, state and local taxes up to $10,000, charitable contributions, and medical expenses that exceed 7.5% of adjusted gross income. Most W2 employees save more money when they claim the standard deduction and focus on above-the-line deductions instead.

W2 employees cannot deduct home office expenses, unreimbursed business expenses, or professional dues since 2018. The IRS eliminated these deductions entirely for employees. Work-related travel, meals, and equipment purchases no longer qualify for deductions unless your employer reimburses you through an accountable plan. These changes force W2 employees to shift their tax strategy away from work-related expense deductions.

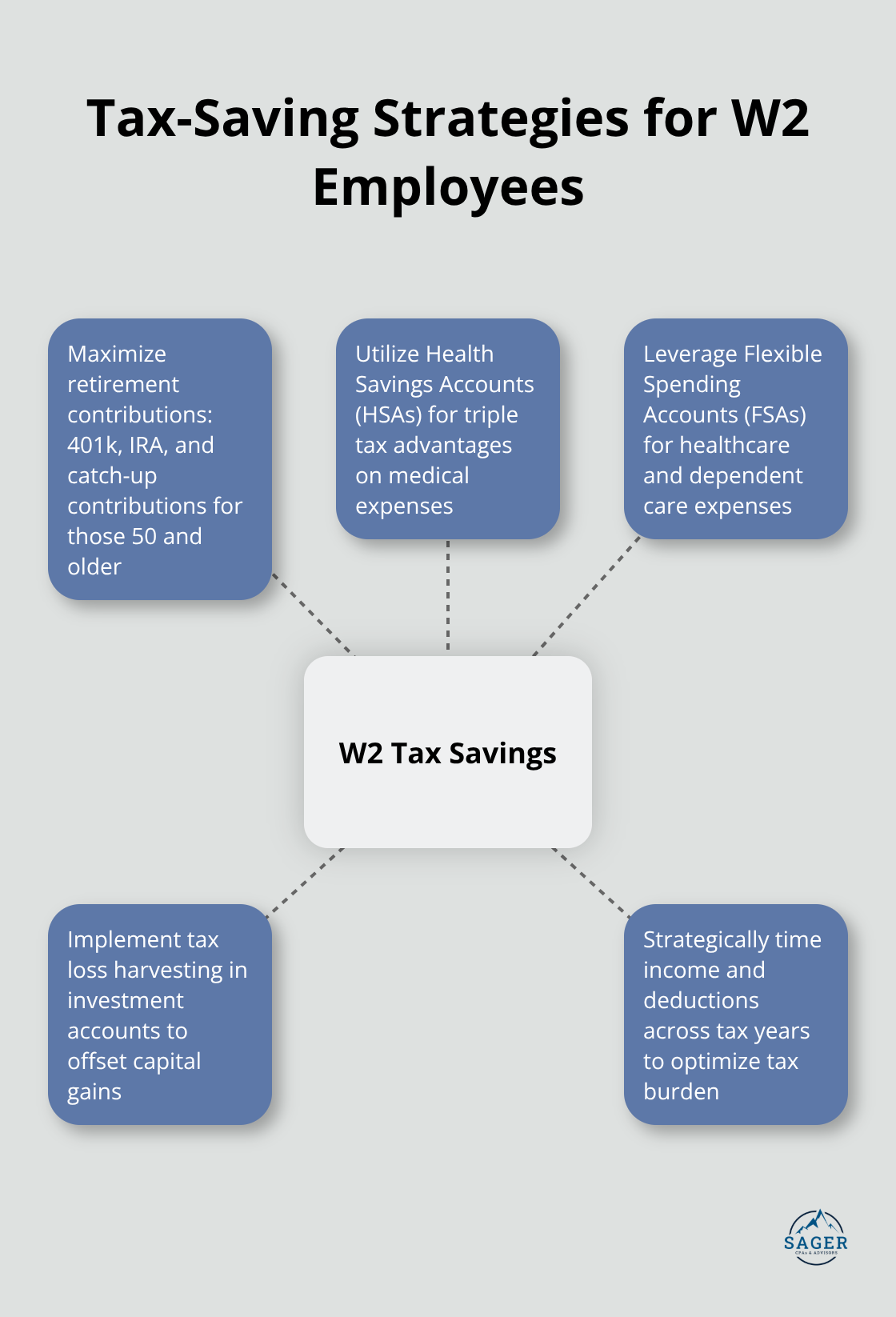

The elimination of these deductions means W2 employees must look elsewhere for tax savings. Retirement account contributions offer the most significant tax reduction opportunities for employees who want to lower their current tax burden while building wealth for the future.

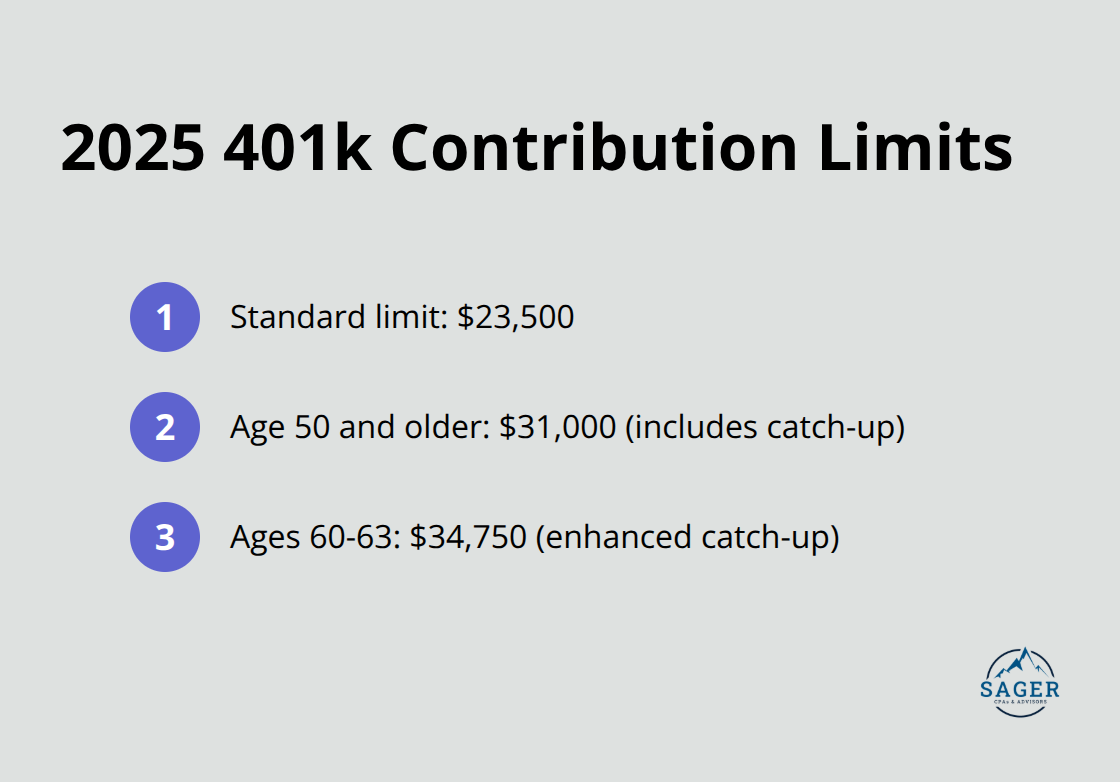

The 2025 401k contribution limit reaches $23,500, with catch-up contributions that allow those 50 and older to contribute $31,000 total. Workers between ages 60-63 can contribute up to $34,750 through enhanced catch-up provisions. Your employer match represents free money that reduces your taxable income immediately.

Always contribute enough to capture the full employer match before you consider other investment options. Pre-tax 401k contributions reduce your current year taxable income dollar-for-dollar, which makes them more valuable than most other tax strategies available to W2 employees.

Traditional IRAs offer immediate tax deductions up to $7,000 annually (or $8,000 for those over 50 in 2025). High earners face income phase-outs for Roth IRA contributions, with single filers who lose eligibility between $150,000-$165,000 in 2025.

The backdoor Roth IRA strategy allows high earners to convert traditional IRA contributions to Roth accounts, which bypasses income limits entirely. Traditional IRAs make sense when you expect lower tax rates in retirement, while Roth IRAs benefit those who anticipate higher future tax brackets.

HSAs provide triple tax advantages that surpass retirement accounts for tax efficiency. Contributions reduce current taxable income, funds grow tax-free, and qualified medical withdrawals remain tax-free forever. The 2024 HSA contribution limits allow $4,150 for individuals and $8,300 for families.

After age 65, HSA withdrawals for non-medical expenses face ordinary income tax rates without penalties (similar to traditional IRAs). HSAs require high-deductible health plans but offer unmatched tax benefits when you use them strategically for both current medical expenses and retirement healthcare costs.

These retirement and health account strategies form the foundation of tax reduction for W2 employees. However, additional specialized accounts and investment techniques can further reduce your tax burden throughout the year.

Flexible spending accounts represent one of the most underutilized tax reduction tools for W2 employees. Healthcare FSAs allow you to contribute up to $3,300 in 2025 with pre-tax dollars, which reduces your taxable income while you cover medical expenses like copays, prescriptions, and dental work. Dependent care FSAs accept up to $5,000 annually for childcare expenses, which saves high earners up to $1,850 in federal taxes plus state tax savings.

The IRS requires you to use FSA funds within the plan year, though many employers offer a $640 carryover or 2.5-month grace period. You must plan your contributions carefully since unused funds typically expire at year-end.

Tax loss harvesting in taxable investment accounts offsets capital gains with realized losses, which reduces your tax liability on investment profits. You can harvest up to $3,000 in net capital losses annually to offset ordinary income, with excess losses that carry forward indefinitely to future tax years.

The wash sale rule prohibits repurchasing identical securities within 30 days, but you can maintain market exposure through similar investments like broad market ETFs. This strategy works best when you review your portfolio quarterly and act on loss opportunities before year-end.

Strategic timing of income and deductions across tax years provides additional tax savings opportunities for W2 employees. December bonus payments can be deferred to January if you expect lower tax rates in the following year, while you accelerate deductible expenses like property taxes or charitable contributions into high-income years to maximize their value.

Medical expense timing becomes important when you approach the 7.5% adjusted gross income threshold for itemized deductions. You can bunch charitable contributions into alternating years through donor-advised funds, which allows you to exceed the standard deduction threshold periodically while you maintain consistent patterns of charitable support.

Track your year-to-date tax situation quarterly to identify optimal timing opportunities before December 31st deadlines eliminate your flexibility. Professional tax planning strategies can help you maximize these opportunities and identify additional deductions specific to your situation.

W2 employees have more tax saving strategies for W2 employees available than most people realize. Contributions to 401k accounts up to $23,500 annually provide the largest immediate tax reduction, while HSAs offer triple tax advantages that surpass other retirement accounts. Above-the-line deductions like traditional IRA contributions and student loan interest work regardless of whether you itemize or take the standard deduction.

Flexible spending accounts for healthcare and dependent care expenses create additional pre-tax savings opportunities. Tax loss harvesting in investment accounts offsets capital gains while strategic timing of income and deductions across tax years optimizes your overall tax burden. Year-round tax planning beats last-minute December scrambling when you review your tax situation quarterly to identify opportunities before deadlines eliminate your flexibility.

Complex situations require professional guidance when high earners face Roth IRA phase-outs (income limits between $150,000-$165,000 for single filers in 2025), employees with significant investment portfolios, or those who consider major financial changes. We at Sager CPA provide comprehensive tax planning services that identify personalized strategies and reduce long-term tax liabilities through proactive planning. Our team develops customized action plans that help W2 employees maximize their tax savings throughout the year.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.