High W2 income earners face unique tax challenges that require strategic planning. At Sager CPA, we’ve helped numerous professionals navigate the complexities of high W2 income tax strategies.

This blog post will explore effective methods to optimize your tax position, from maximizing deductions to leveraging retirement accounts. We’ll provide actionable insights to help you keep more of your hard-earned money while staying compliant with tax laws.

At Sager CPA, we often work with clients who fall into the high W2 income bracket. The IRS doesn’t provide an official definition, but individuals earning more than $400,000 annually typically qualify as high-income earners.

The U.S. uses a progressive tax system, which increases tax rates as income rises. For 2025, the highest federal income tax bracket stands at 37% for individuals with taxable income over $578,125 (single filers) or $693,750 (married filing jointly). This system can push a larger portion of high earners’ income into higher tax brackets.

High W2 income earners face specific tax challenges:

To address these challenges, high W2 income earners should consider the following strategies:

Given the complexities of tax planning for high W2 income earners, professional guidance becomes invaluable. A qualified tax advisor (like those at Sager CPA) can help you navigate these challenges and develop a personalized tax strategy that aligns with your financial goals.

High W2 income earners often overlook valuable deductions and credits. This chapter explores effective strategies to optimize your tax position.

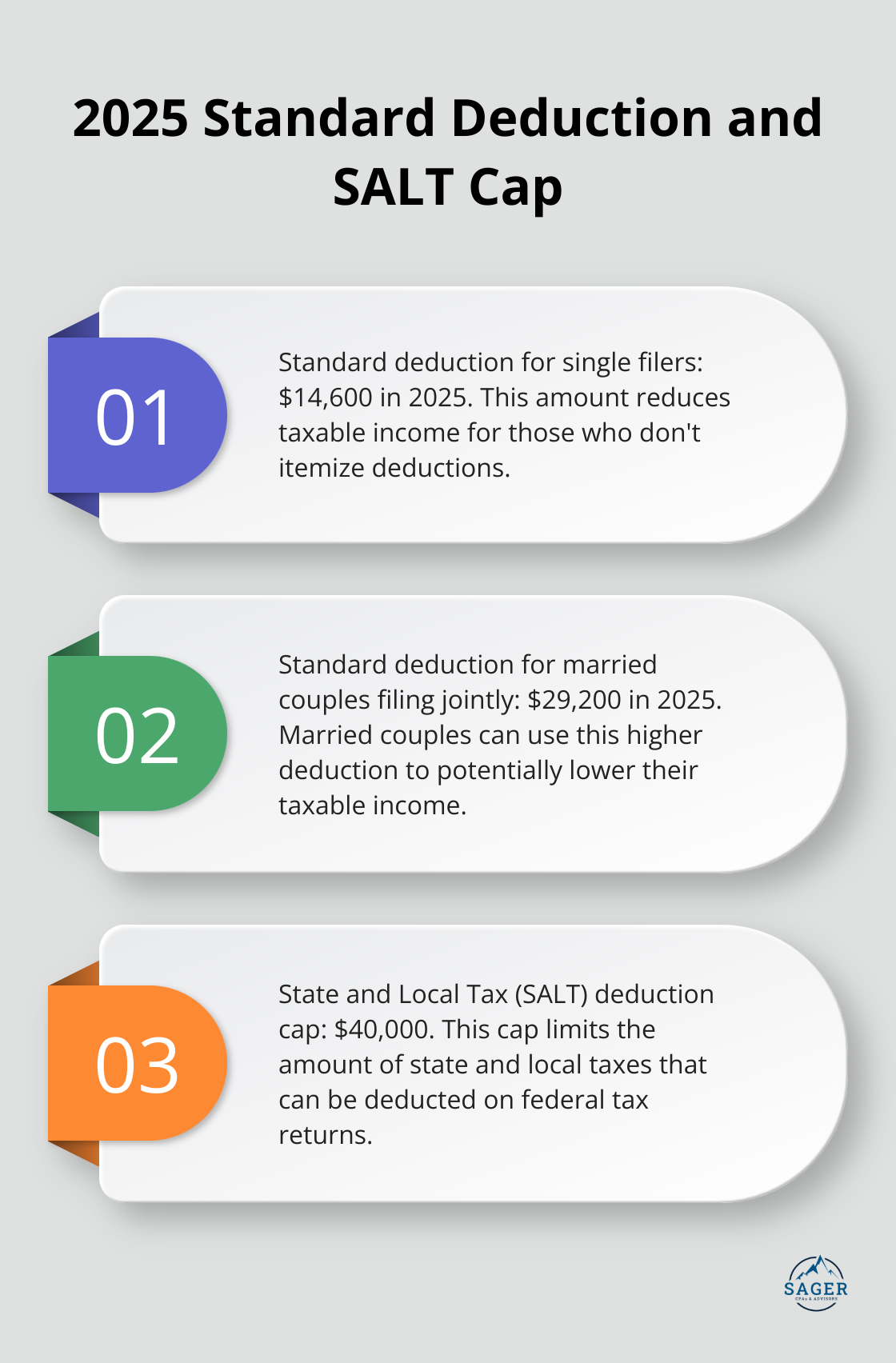

The standard deduction for 2025 is $14,600 for single filers and $29,200 for married couples filing jointly. However, high earners often benefit more from itemizing. Track your expenses throughout the year to ensure you don’t leave money on the table.

Strategic charitable giving can reduce your tax burden significantly. Consider bunching donations into a single tax year to exceed the standard deduction threshold. Donor-advised funds (DAFs) allow you to make a large charitable contribution in one year and distribute the funds over time, providing an immediate tax deduction while spreading out the actual giving.

Mortgage interest on loans up to $750,000 is deductible for homes purchased after December 15, 2017 (for homes bought before this date, you can deduct interest on up to $1 million in mortgage debt). Consider refinancing to a lower rate to increase your deductible interest payments.

State and local tax (SALT) deductions are capped at $40,000. The law increases this cap and the $500,000 income threshold by 1% each year from 2026 through 2029, with the cap reset to $10,000 from 2030. Some states have implemented workarounds. For instance, some allow pass-through entities to pay state income taxes at the entity level, potentially bypassing the SALT cap. Check if your state offers such options.

If you pursue further education or have dependents in college, don’t overlook education-related tax benefits. The Lifetime Learning Credit offers up to $2,000 per tax return for qualified education expenses. While this credit phases out for high earners, it’s worth checking if you’re eligible.

Tax laws change frequently, and strategies that work one year might not be optimal the next. Regular consultations with a tax professional can help you adapt your approach as your financial situation evolves. As we move forward, let’s explore how retirement planning and tax-advantaged accounts can further optimize your tax strategy.

The 401(k) plan serves as a powerful tool for high W2 income earners to reduce their tax burden. In 2025, individuals can contribute up to $23,500 to their 401(k), with an additional $7,500 catch-up contribution for those 50 and older. This strategy can lower taxable income by up to $31,000 for those 50 or older, potentially saving thousands in taxes each year.

Some employers offer after-tax 401(k) contributions, which allow for even greater savings. The total 401(k) contribution limit (including employer contributions) reaches $69,000 in 2025. If your plan permits, you can contribute after-tax dollars up to this limit and then convert them to a Roth 401(k) or roll them into a Roth IRA, effectively bypassing income limits on Roth contributions.

High earners often find themselves ineligible for direct Roth IRA contributions due to income limits. The backdoor Roth IRA strategy offers a solution. This involves making a non-deductible contribution to a traditional IRA and then immediately converting it to a Roth IRA. While this strategy doesn’t provide an immediate tax deduction, it allows your money to grow tax-free and be withdrawn tax-free in retirement.

The pro-rata rule plays a significant role when executing this strategy. If you have other traditional IRA balances, a portion of your conversion may become taxable. A tax professional can help you navigate this complex area and avoid unexpected tax consequences.

HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2025, individuals can contribute up to $4,300, and families can contribute up to $8,550. Those 55 and older can make an additional $1,000 catch-up contribution.

HSAs can function as retirement accounts. If you can afford to pay medical expenses out of pocket, you can let your HSA grow and use it as a supplemental retirement account after age 65. At this point, you can withdraw funds for any purpose without penalty (though you’ll pay income tax on non-medical withdrawals).

Some employers offer non-qualified deferred compensation (NQDC) plans, which allow you to postpone receiving a portion of your income until a later date (typically retirement). This can effectively reduce your current taxable income and potentially receive the deferred income in a lower tax bracket during retirement.

NQDC plans come with risks. Unlike qualified plans like 401(k)s, the money in an NQDC plan isn’t protected from the company’s creditors. You must carefully consider your employer’s financial stability and your own financial needs before participating in such a plan.

High W2 income tax strategies require a comprehensive approach. You can reduce your tax burden and build long-term wealth through deductions, credits, and tax-advantaged accounts. Professional guidance proves essential in navigating the complex and ever-changing landscape of tax laws.

Tax planning extends beyond a single year and sets the stage for long-term financial success. It allows you to allocate more resources towards your financial goals, such as early retirement or funding your children’s education. Sager CPA specializes in developing personalized tax strategies for high W2 income earners.

Our team of experts will help you minimize your tax burden while maximizing your financial potential. We turn tax planning from a daunting task into a powerful tool for building and preserving wealth. Take a proactive, informed approach to tax optimization and secure your financial future.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.