At Sager CPA, we know that proactive tax strategies can make a big difference in your financial health.

Tax planning isn’t just for big corporations or the wealthy. It’s a smart move for everyone who wants to keep more of their hard-earned money.

In this post, we’ll show you how to implement effective tax strategies that can help you save money and avoid surprises when tax season rolls around.

Proactive tax planning is a strategic approach to manage finances with the goal of minimizing tax burden. It involves making informed decisions throughout the year, not just during tax season. This approach anticipates potential tax implications of financial choices and takes action before the end of the tax year.

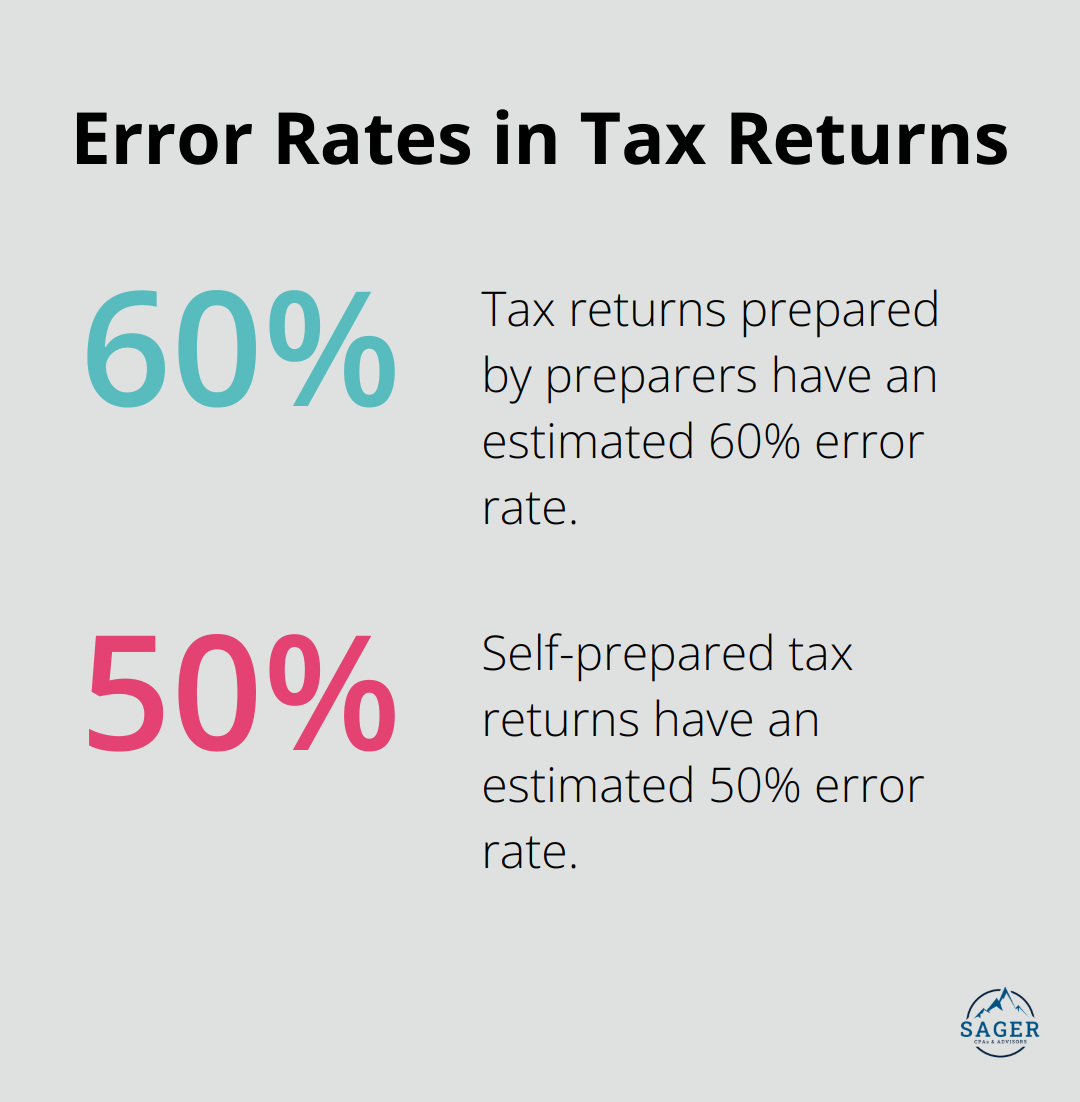

Proactive tax planning can lead to significant savings. A study by the Government Accountability Office reveals that tax returns prepared by preparers had a higher estimated percent of errors-60 percent-than self-prepared returns-50 percent. This statistic underscores the importance of professional guidance and forward-thinking strategies.

Planning ahead allows you to identify opportunities to reduce taxable income, maximize deductions, and take advantage of available credits.

Many people believe tax planning is only for the wealthy or large corporations (a common misconception). In reality, proactive tax planning can benefit anyone who earns income, regardless of their financial status. Another myth suggests that tax planning is only necessary during tax season. However, the most effective tax strategies are implemented throughout the year.

Effective tax planning is an ongoing process. It requires regular reviews of your financial situation and adjustments based on changes in your life or in tax laws. For example, if you expect a significant increase in income, you might consider accelerating deductions into the current year or deferring income to the next year.

Tax planning software and mobile expense tracking apps can be valuable tools in your proactive tax strategy. These technologies allow for deeper analysis of tax scenarios and ensure that all potential deductions are captured efficiently. For instance, Rydoo is an AI-powered expense management solution trusted by over 1 million users. However, while these tools are helpful, they should not replace professional advice.

Proactive tax planning is not about avoiding taxes, but about making smart financial decisions that align with your goals while minimizing your tax liability. It’s about taking control of your financial future and ensuring that you’re not paying more in taxes than you legally owe. As we move forward, let’s explore the key strategies that can help you implement an effective proactive tax plan.

At Sager CPA, we understand the impact of well-timed financial decisions. Strategic income timing can significantly reduce your tax burden. The current tax code offers several ways to reduce your tax burden, such as maximizing tax-advantaged retirement accounts and health savings accounts. If you anticipate a lower tax bracket next year, consider deferring some of this year’s income. Self-employed individuals or business owners might delay billing for work completed near year-end. Employees could request their employer to postpone a year-end bonus to January.

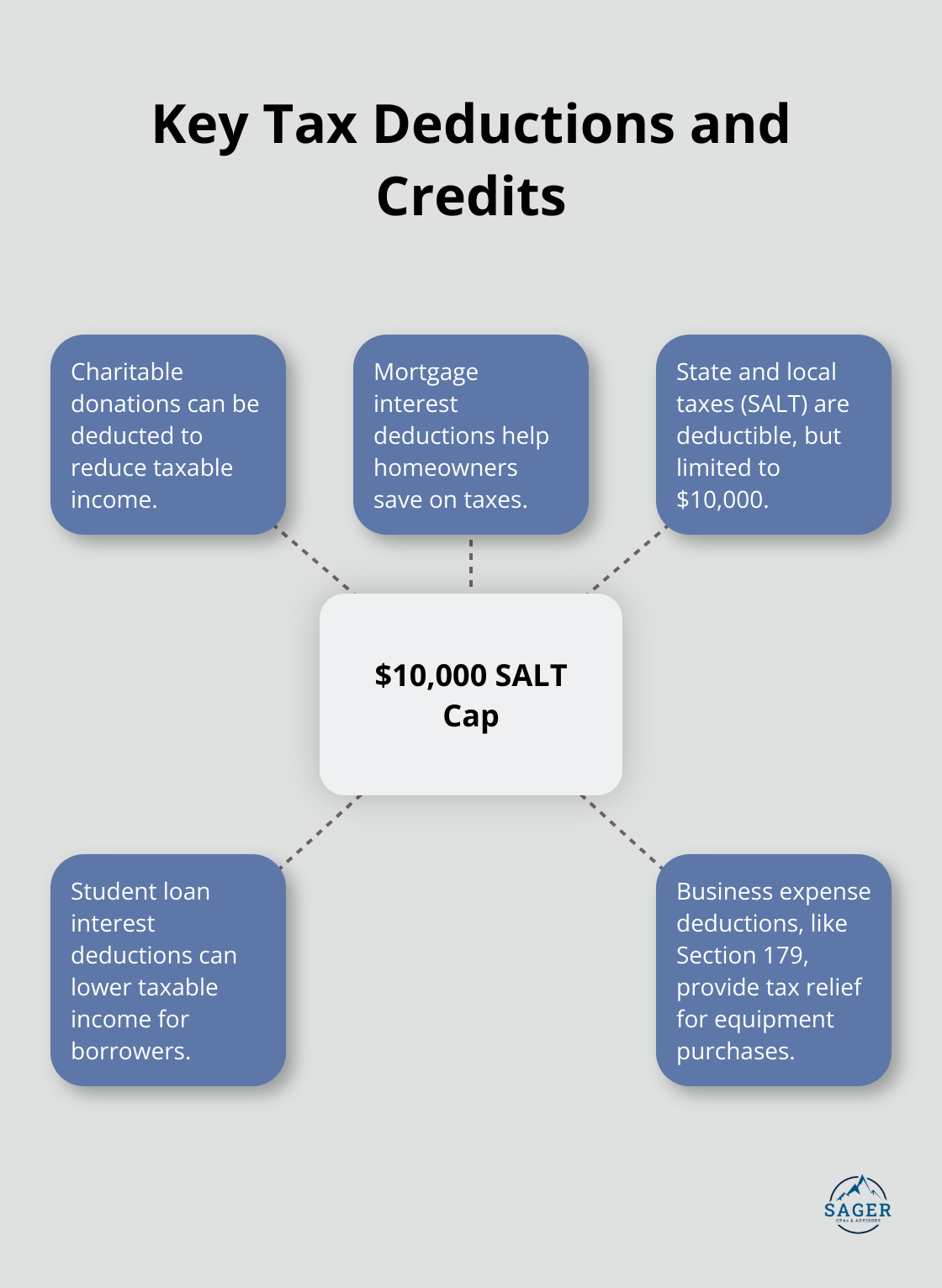

While the standard deduction has increased, itemizing can still benefit many taxpayers. Maintain detailed records of potentially deductible expenses throughout the year. This includes charitable donations, mortgage interest, and state and local taxes (SALT), although SALT deductions currently have a $10,000 cap.

Don’t overlook often-missed deductions like student loan interest or educator expenses. For businesses, Section 179 deductions for equipment purchases can provide substantial tax relief.

Smart investment strategies can dramatically reduce your tax liability. Consider tax-loss harvesting, which involves selling underperforming investments to offset capital gains.

For retirement accounts, try to maximize your contributions to tax-advantaged accounts like 401(k)s and IRAs. These contributions reduce your taxable income for the year.

Roth conversions can also serve as a powerful tool, especially in years when your income is lower. Converting a traditional IRA to a Roth IRA when account values are low can reduce your tax bill and lock in future tax-free growth.

As we move forward, it’s essential to understand how to implement these strategies effectively. The next section will guide you through the practical steps to put these powerful tax-saving techniques into action.

Set a schedule for quarterly financial reviews. These reviews will help you track your income, expenses, and investments, providing a clear picture of your tax situation throughout the year. During these check-ups, assess your progress towards tax-saving goals and identify areas for adjustment.

If you notice higher-than-expected income in Q2, consider increasing your 401(k) contributions to reduce taxable income. Similarly, if you’ve incurred unexpected medical expenses, start collecting receipts for potential itemized deductions.

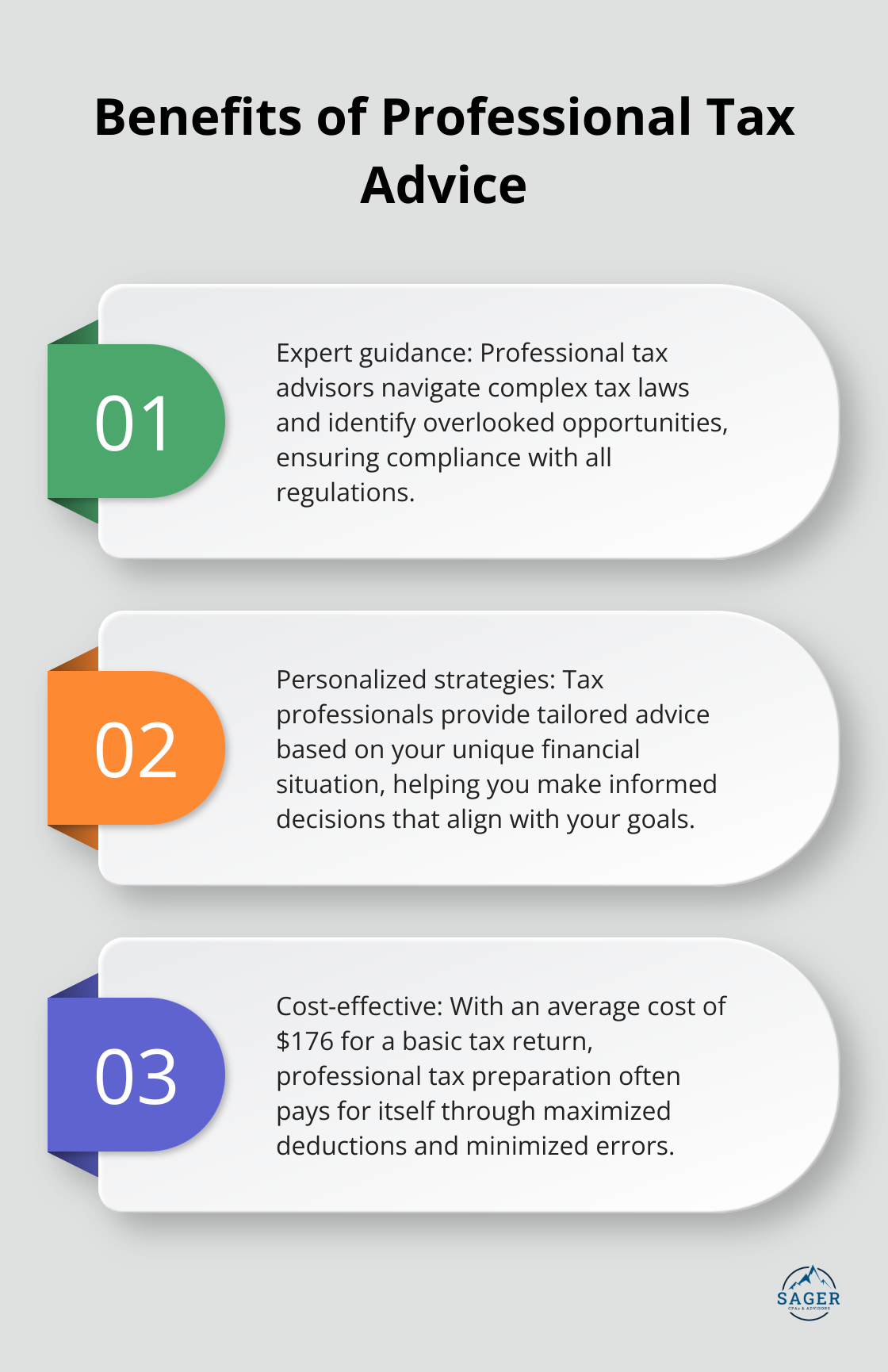

While DIY tax software has its place, personalized advice from a tax professional often yields better results. Professional tax preparation for a Form 1040 and state return with no itemized deductions costs an average of $176.

Tax laws are complex and ever-changing. A skilled tax advisor can help you navigate these complexities, identify overlooked opportunities, and ensure compliance with all regulations. They can also provide valuable insights into how potential life changes (such as starting a business or buying a home) might impact your tax situation.

Tax laws change frequently, and these changes can significantly impact your tax strategy. Make it a habit to stay informed about tax law updates. The IRS website serves as a reliable source for the latest tax information. You can also subscribe to tax-focused newsletters or follow reputable tax professionals on social media for timely updates.

The Tax Cuts and Jobs Act of 2017, for example, brought significant changes to the tax code, including reducing individual tax rates and nearly doubling the standard deduction. This change alone altered the tax strategy for millions of Americans. Staying informed about such changes allows you to adjust your strategy proactively.

Technology can be a valuable tool in your tax planning arsenal, although it shouldn’t replace professional advice. Tax planning software can help you run different scenarios and see how various decisions might impact your tax liability. You could use software to compare the tax implications of selling a stock this year versus next year.

Expense tracking apps can also prove incredibly useful. These apps allow you to categorize expenses in real-time, making it easier to identify potential deductions throughout the year. This can particularly benefit self-employed individuals or small business owners who need to track business expenses meticulously.

Try to implement tax strategies consistently throughout the year, rather than scrambling at the last minute. This approach allows you to take advantage of opportunities as they arise and make informed decisions that align with your overall financial goals.

For instance, if you’re considering charitable donations, plan these throughout the year rather than waiting until December. This approach not only helps you budget more effectively but also ensures you have proper documentation for tax purposes.

Proactive tax strategies benefit everyone, not just the wealthy. These strategies reduce tax burdens, increase savings, and secure financial futures. We explored various approaches to control your tax situation, from strategic income timing to optimizing investment accounts.

Tax planning requires continuous attention and adjustments. It involves staying informed about tax law changes and making decisions based on your unique circumstances. Technology can assist, but professional guidance remains invaluable for navigating complex tax laws and identifying opportunities.

Don’t leave your financial future to chance. Take action today by implementing proactive tax strategies and seeking expert advice. Sager CPA specializes in providing tailored financial management and tax planning services. Our team can help you develop a customized strategy to minimize your tax liability while supporting your long-term financial goals.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.