A solid business financial plan serves as your roadmap to sustainable growth and profitability. Without proper financial planning, 82% of small businesses fail due to cash flow problems.

We at Sager CPA have guided hundreds of businesses through the financial planning process. This step-by-step guide will show you how to build a comprehensive financial plan that drives real results.

A business financial plan consists of three core documents that determine your company’s survival: income statement, balance sheet, and cash flow projection. The income statement tracks revenue minus expenses over specific periods, while your balance sheet shows assets, liabilities, and equity at any given moment. Your cash flow projection forecasts money movement for the next 12 months, which prevents the cash flow crises that kill 82% of businesses.

Your income statement reveals net profit or loss over specific periods and details costs, revenue, and overall financial performance. The balance sheet outlines your business’s financial position through assets, liabilities, and shareholder equity at a single point in time. Cash flow projections indicate how much cash flows in and out of your business, which provides insight into liquidity and operational efficiency.

Personnel plans help you evaluate workforce requirements and costs, which aligns staff with business growth and financial health. Break-even analysis determines the sales volume needed to cover fixed and variable expenses (this guides your price strategies). Business ratios measure financial health through metrics like net profit margin and return on equity.

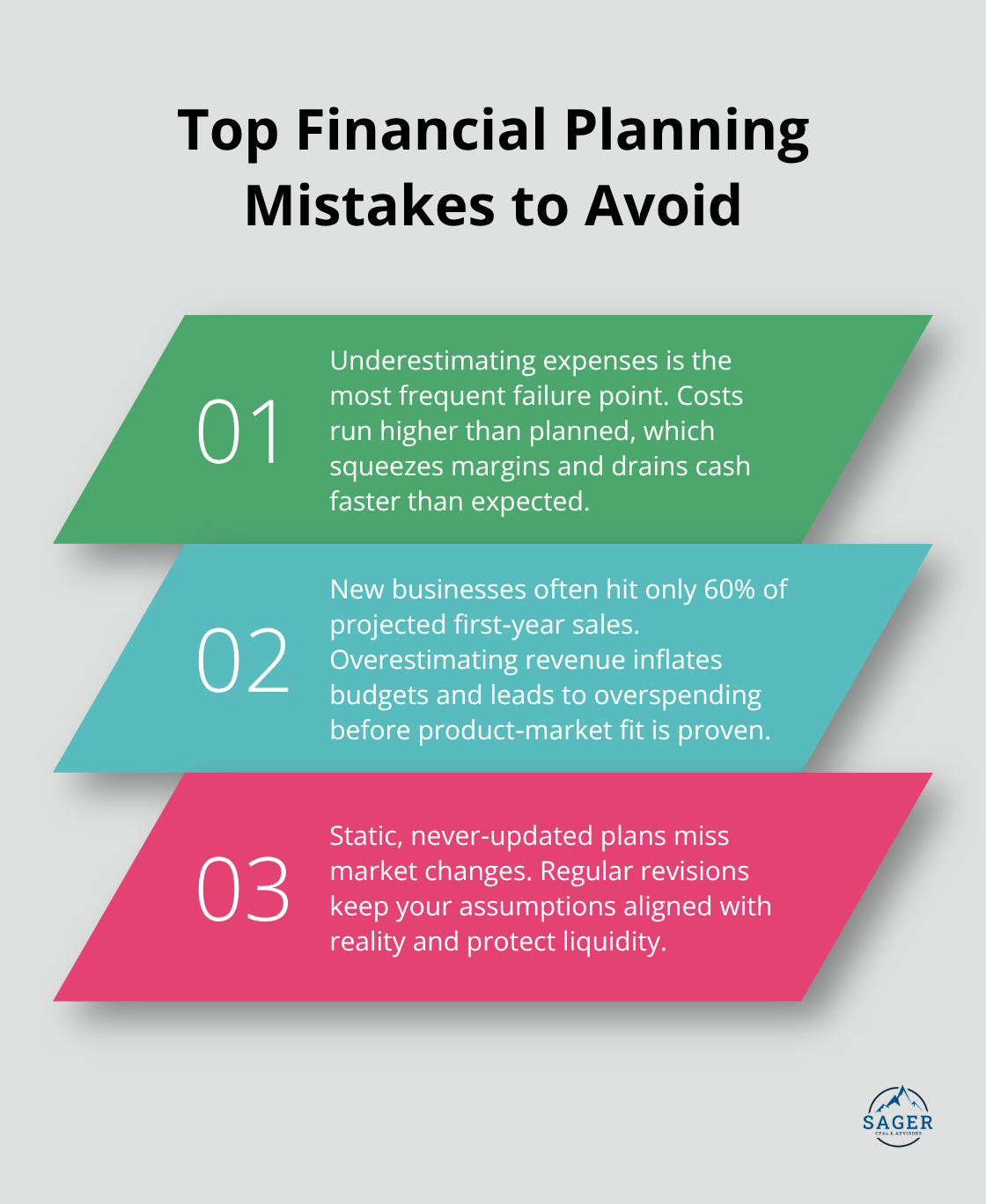

Most businesses fail at financial planning because they underestimate expenses. New businesses typically achieve only 60% of projected sales in year one, which makes overestimated revenue the second fatal error. The third mistake involves static plans that never receive updates.

Tesla took 18 years to become profitable, while most businesses expect profitability within two years. This shows how unrealistic initial projections destroy companies. Lower fixed costs reduce risk since they provide more flexibility when revenue drops unexpectedly.

Update your financial plan monthly during the first year, then quarterly once operations stabilize. Create your annual financial plan at the start of each fiscal year and involve finance, HR, sales, and operations departments. Compare actual performance against projections every 30 days to catch problems early.

Most successful businesses create three scenarios: best case, worst case, and most likely case. They adjust monthly based on real data rather than stick to outdated assumptions. This approach prepares you for the step-by-step process that transforms these fundamentals into actionable financial strategies.

Start by collecting your bank statements, credit card statements, and accounting records from the past 12 months. Download transaction data directly from your financial institutions rather than rely on manual entry, which undermines business productivity according to QuickBooks research.

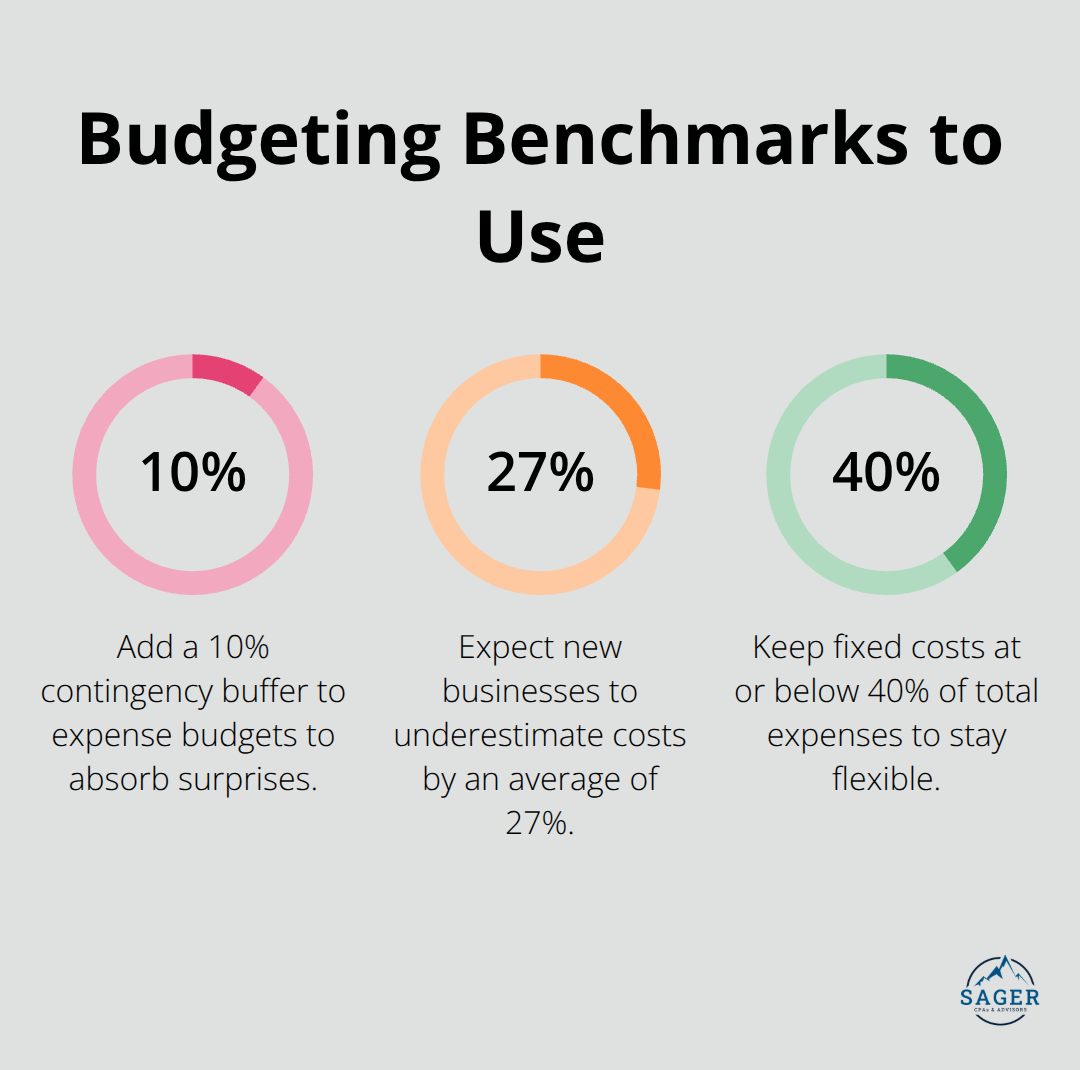

Export your sales data from your point-of-sale system or e-commerce platform, then organize expenses into fixed costs like rent and payroll versus variable costs like advertising and materials. Fixed costs should represent no more than 40% of total expenses to maintain flexibility during revenue fluctuations.

Collect all financial documents from the past year and categorize transactions by type and frequency. Sort expenses into operational categories such as marketing, utilities, inventory, and professional services. Document payment terms for all vendors and customers since these directly impact cash flow timing.

Create spreadsheets that track monthly revenue patterns and identify seasonal trends. Most businesses experience 20-30% revenue variation between peak and slow months. Record all recurring expenses with exact payment dates to predict future cash needs accurately.

Calculate your current monthly burn rate by dividing total expenses by revenue over six months. Businesses with burn rates exceeding 80% of revenue face immediate cash flow danger. Review your debt-to-equity ratio and current ratio to assess financial stability.

Examine your gross profit margins by product line or service category. Healthy margins typically range from 50-70% for service businesses and 20-40% for retail operations. Identify which revenue streams generate the highest returns and which drain resources.

Set revenue growth targets based on industry benchmarks rather than wishful thinking. SaaS companies are expected to grow 19.38% annually, while retail businesses average 3-5% growth. Create three financial scenarios with conservative projections showing 70% of optimistic targets.

Project monthly sales for 18 months using historical data and seasonal patterns. Most lenders require three-year sales forecasts, so extend projections using industry growth rates from sources like IBISWorld. Factor in market conditions and competitive pressures when setting targets.

Build monthly cash flow projections showing exact dates when money enters and exits your business. Include payment terms since B2B customers average 31-day payment cycles while retail generates immediate cash. Account for seasonal variations by analyzing the past two years of monthly sales data.

Track accounts receivable aging and set credit limits to prevent cash flow gaps. Monitor your cash conversion cycle, which should stay below 30 days for healthy operations (longer cycles tie up working capital and strain liquidity).

Build expense budgets with 10% contingency buffers since new businesses underestimate costs by an average of 27%. Separate fixed costs from variable costs to understand your break-even point and operational flexibility. Update projections weekly during your first year, then monthly once patterns stabilize.

These financial foundations prepare you for the tools and resources that will streamline your planning process and improve accuracy.

QuickBooks dominates small business financial planning with 80% market share, but specialized tools deliver better results. Prophix automates complex forecasts and streamlines planning processes compared to spreadsheets. Anaplan handles enterprise-level scenarios with real-time collaboration features that eliminate version control problems. Fathom connects directly to accounting software and generates automated financial reports within minutes rather than hours.

Google Sheets offers free budget templates that work for businesses under $500K annual revenue, while Microsoft 365 provides more advanced financial management templates with built-in formulas. SCORE delivers free business plan templates and cash flow calculators that guide startups through initial planning phases.

Professional financial planning software cuts preparation time from weeks to days. Prophix users report faster budget cycles and more accurate forecasts compared to Excel-based systems. Anaplan processes scenario models in real-time, which allows you to test multiple growth assumptions simultaneously. These platforms sync with accounting systems to eliminate manual data entry errors that plague small business financial plans.

Engage financial advisors before major business decisions rather than after problems emerge. Revenue growth above 50% annually creates cash flow complexity that requires professional guidance. Businesses that seek loans above $100K need CPA-prepared financial statements since banks have strict lending practices for self-prepared financials. Tax planning becomes necessary when profits exceed $75K annually due to strategic deduction opportunities (this threshold triggers significant tax implications).

Monitor debt-to-equity ratios monthly since ratios above 2:1 signal overleveraging that restricts growth capital. Track accounts receivable turnover every 30 days because declining turnover indicates collection problems that threaten cash flow. Days sales outstanding should stay below 45 days for B2B companies and under 15 days for retail operations. Working capital ratios below 1.2 indicate immediate liquidity danger that requires emergency funding or expense cuts.

Gross profit margin should stay above 50% for service businesses, current ratio must exceed 1.5 for healthy liquidity, and cash conversion cycle should remain under 30 days to prevent working capital strain (these benchmarks separate thriving businesses from struggling ones).

A comprehensive business financial plan transforms guesswork into strategic decision-making. Companies with formal financial plans grow 30% faster than those without structured processes. Your business financial plan becomes the foundation for securing funding, managing cash flow, and scaling operations sustainably.

Implementation starts with monthly monitoring during your first year, then quarterly reviews once operations stabilize. Update projections based on actual performance rather than outdated assumptions. Track key metrics like debt-to-equity ratios, cash conversion cycles, and gross profit margins to maintain financial health.

Professional support accelerates your success and prevents costly mistakes while identifying growth opportunities. We at Sager CPA specialize in strategic business advisory services and comprehensive financial planning that reduces tax liabilities while enhancing financial clarity (our proactive approach helps businesses make informed decisions through regular communication and customized action plans). Schedule a consultation with Sager CPA to create a personalized financial strategy that drives long-term stability and growth.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.